Get the free Mortgage Gifted Deposit Form

Get, Create, Make and Sign mortgage gifted deposit form

How to edit mortgage gifted deposit form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mortgage gifted deposit form

How to fill out mortgage gifted deposit form

Who needs mortgage gifted deposit form?

Mortgage Gifted Deposit Form: A How-to Guide

Understanding the mortgage gifted deposit

A mortgage gifted deposit is a sum of money given by a family member or friend to help a homebuyer secure a mortgage. It typically accounts for part of the down payment needed to purchase a property. Gifted deposits can play a crucial role in enabling first-time buyers or those without substantial savings to enter the housing market.

In the mortgage process, this type of deposit is particularly valuable as it can improve the borrower's financial situation, potentially leading to better loan terms and lower interest rates. Common scenarios for utilizing a gifted deposit include first-time home purchases or assisting young adults in buying their first home. To use a gifted deposit, both the donor and the recipient must meet certain eligibility requirements, including proof of relationship and documentation of the gifted amount.

Roles and responsibilities

The donor of a gifted deposit plays a vital role in the mortgage process. To facilitate a smooth transaction, the donor must provide specific documentation, such as a gifted deposit letter stating that the funds are a gift without repayment expectations. This document must reflect the donor's relationship to the recipient and the amount given.

Financially, the donor should consider potential tax implications for large gifts, as these might affect their financial status or require them to file specific tax forms. For the recipient, open communication with the donor is essential. By discussing the intent of the gift, the recipient can better navigate lender requirements and ensure all parties are aligned on the terms of the contribution to the home purchase.

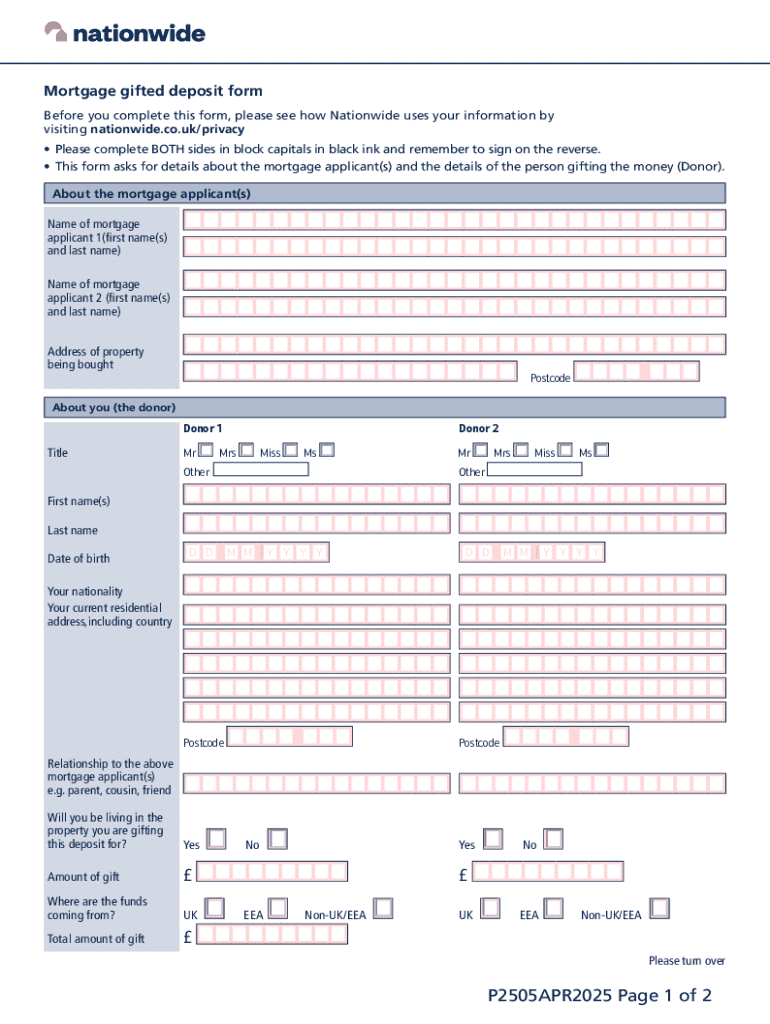

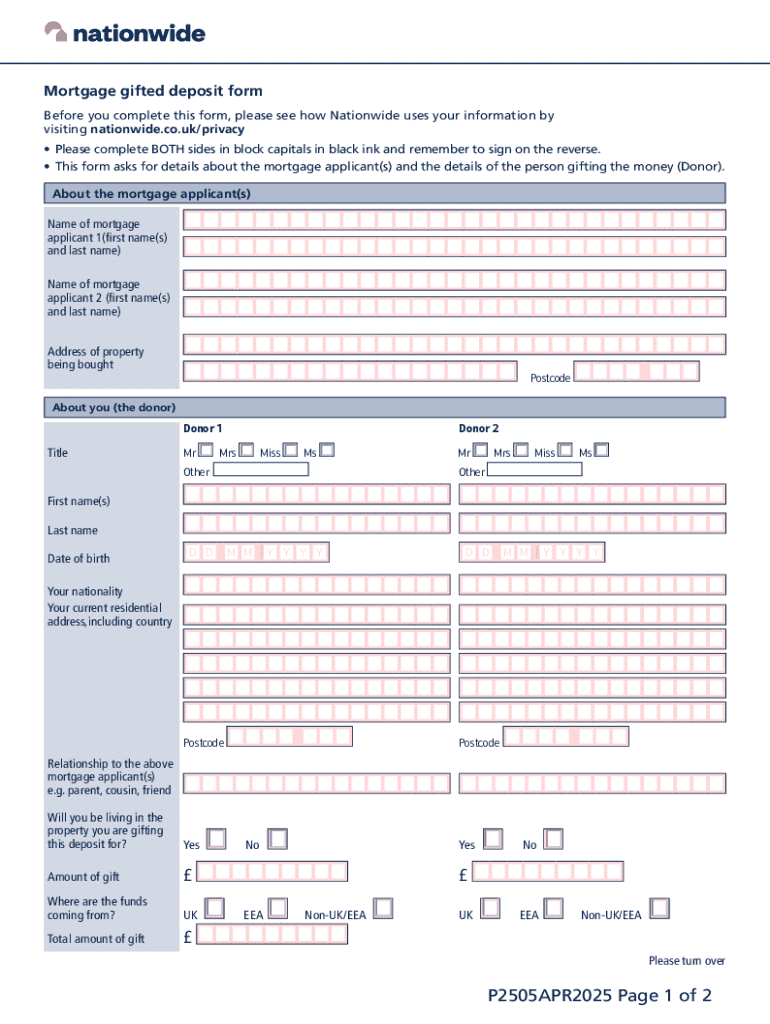

Document preparation: The mortgage gifted deposit form

The mortgage gifted deposit form serves as a formal acknowledgment of the financial gift provided by the donor. This document is significant in the mortgage application process, as lenders require it to safeguard against potential misunderstandings about the nature of the transfer. The key components of the form include the recipient's and donor's personal information, the amount gifted, and the relationship between both parties.

You can find the mortgage gifted deposit form through various financial institutions and real estate websites. To simplify this process, pdfFiller offers an easy option for direct download. Alternatively, the platform allows you to fill out the form online, which can save time and reduce errors during the completion process.

Step-by-step guide to filling out the form

Filling out the mortgage gifted deposit form requires careful attention to detail to ensure all information is accurately reported. Here’s a structured guide through the process:

Editing and customizing the form on pdfFiller

Using pdfFiller for form editing offers numerous benefits, including its user-friendly interface and cloud-based accessibility. To edit the mortgage gifted deposit form, users can follow these simple steps:

eSigning the mortgage gifted deposit form

eSigning the mortgage gifted deposit form is an essential step in ensuring the document's validity. The convenience of eSigning allows both parties to sign the document remotely, which is especially advantageous in today’s fast-paced environment. To use pdfFiller’s eSignature tools, users can follow a few straightforward steps.

First, upload the completed form onto the pdfFiller platform, then follow the prompts to add an electronic signature. It’s vital to check that the eSignature complies with relevant legal standards to ensure that both parties’ interests are protected and recognized.

Submitting the form to lenders

Once the mortgage gifted deposit form is completed and signed, the next step is submitting the form to lenders. Adhering to best practices during this step is crucial for a seamless approval process. First, double-check all forms and supporting documentation for accuracy before submission.

Understand that lenders may have specific requirements regarding how to submit this form — whether electronically or via physical mail. Additionally, if any further documentation is requested, respond promptly to avoid delays in the mortgage approval process.

Common mistakes to avoid

Filling out the mortgage gifted deposit form can seem straightforward but can lead to mistakes that may delay the process. Common errors include incomplete sections, inaccurate personal details, and absence of necessary signatures or notarization.

To ensure accuracy, it’s advisable to have a trusted third party review the completed form before submission. If a submission is rejected, communicate with the lender to understand the issues clearly, and promptly make any required amendments.

FAQs about mortgage gifted deposits and documentation

A variety of questions often accompanies the mortgage gifted deposit form, particularly from both recipients and donors. Common concerns include the implications of gifted deposits on qualifying for a mortgage and the potential tax ramifications for the donor. Understanding these factors is essential for all parties involved.

Further, lenders may have varying perspectives regarding the allowance and management of gifted deposits. Therefore, it is wise to consult directly with the lender to clarify specific rules and expectations.

Real-life case studies

Case studies of gifted deposit transactions can provide insight into how these gifts affect the home buying process. For example, one young couple received a gifted deposit from their parents, which allowed them to secure a home in a competitive market. By ensuring that all required steps and documentation were completed accurately, they successfully navigated the lender’s requirements.

Another case involved a donor who was uncertain about gifting a large sum. By consulting with a financial advisor, they understood the tax implications and felt comfortable proceeding. These examples illustrate how strategic use of the mortgage gifted deposit can facilitate homeownership, benefiting both recipients and donors.

Enhancing your document management

Utilizing pdfFiller's document management features can greatly simplify the process of handling mortgages and gifts. With tools designed for tracking document status, users can monitor progress throughout the mortgage application process. Moreover, the collaborative features that pdfFiller offers enable recipients to work closely with donors to ensure everything is properly managed.

Ensuring the security and privacy of these sensitive documents is paramount. Utilizing pdfFiller's secure storage solutions will give users peace of mind as they manage important financial forms and agreements.

Conclusion of the guide

Navigating the mortgage gifted deposit process can feel overwhelming, but understanding the vital steps — from completing the mortgage gifted deposit form to securing the necessary documentation — simplifies the journey. By leveraging resources like pdfFiller, entrants to the housing market can effectively manage their documents and enhance collaboration with donors.

Finally, utilizing a streamlined approach with pdfFiller promotes efficiency in managing documentation for gifted deposits and other critical financial documents, ensuring a smoother path toward homeownership.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my mortgage gifted deposit form in Gmail?

How can I send mortgage gifted deposit form for eSignature?

How can I fill out mortgage gifted deposit form on an iOS device?

What is mortgage gifted deposit form?

Who is required to file mortgage gifted deposit form?

How to fill out mortgage gifted deposit form?

What is the purpose of mortgage gifted deposit form?

What information must be reported on mortgage gifted deposit form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.