Get the free pdffiller

Get, Create, Make and Sign pdffiller form

How to edit pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out michigan lady bird deed

Who needs michigan lady bird deed?

A Comprehensive Guide to the Michigan Lady Bird Deed Form

Understanding the Michigan Lady Bird Deed

A Michigan Lady Bird Deed, also known as an enhanced life estate deed, allows the property owner, or grantor, to retain control of their property during their lifetime while designating beneficiaries who will receive the property upon their death. This legal instrument serves a pivotal role in estate planning, particularly for individuals seeking to avoid probate and retain flexibility in managing their property. Widely recognized for its unique benefits, the Lady Bird Deed permits the grantor to maintain complete authority over the property, including the right to sell, transfer, or leverage it as they see fit.

Designed to simplify the transfer of property to heirs, the Lady Bird Deed is particularly advantageous for homeowners who want to ensure their assets pass seamlessly without court intervention. It is especially useful for parents who wish to transfer their home to their children while retaining the authority to live in and manage the property until their passing.

Key features of a Lady Bird Deed

The unique characteristics of a Michigan Lady Bird Deed set it apart from traditional deeds and estate planning tools. One key feature is the enhanced life estate, which means that the grantor holds a life estate in the property, allowing them to live there without interference while also having the power to alter the deed or sell the property. This flexibility is a significant advantage over more restrictive life estate deeds, where any changes require the consent of the remainder beneficiaries.

In addition to the enhanced life estate, a crucial element of the Lady Bird Deed is the unrestricted power granted to the grantor. This means the homeowner can conduct transactions involving the property independently of the beneficiaries, ensuring total control until their death.

How the Michigan Lady Bird Deed works

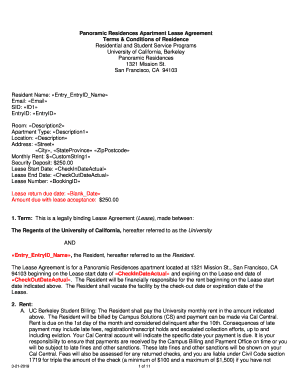

Creating a Michigan Lady Bird Deed involves several key steps. First, the grantor must complete the deed form, clearly stating their intentions regarding the property, including the names of beneficiaries who will inherit the property. This process requires providing precise details such as the legal description of the property, the full names of the grantor and the grantees, and an indication of whether the grantor retains the right to sell or encumber the property during their lifetime.

Once the deed is completed, it must be signed by the grantor and witnessed by two individuals who are not beneficiaries. Notarization may also be required to ensure the deed is legally binding. After the required signatures and witness statements are in place, the completed deed should be recorded at the local county register of deeds office.

Tax implications and benefits

Using a Michigan Lady Bird Deed can have favorable tax implications for both the grantor and the beneficiaries. For property tax purposes, properties transferred through a Lady Bird Deed may retain their current taxable value, circumventing the usual tax reassessment that occurs upon transfer of ownership. This aspect can result in substantial savings for beneficiaries who inherit the property.

Moreover, when the property is passed on through a Lady Bird Deed, it effectively receives a step-up in basis, which is beneficial concerning capital gains tax. This means that if the beneficiaries decide to sell the property after inheriting it, they may only be liable for taxes on any appreciation in value that occurs after they inherit the property, potentially saving them significant amounts.

Advantages of using a Michigan Lady Bird Deed

One of the primary advantages of using a Michigan Lady Bird Deed is the flexibility it affords in estate planning. Unlike traditional life estate deeds, which restrict the grantor’s ability to alter their estate plan, the Lady Bird Deed provides the freedom to make changes without needing approval from beneficiaries. This adaptability enables homeowners to react to changing circumstances, such as financial needs or familial relationships, without impacting their estate planning.

In contrast to survivorship deeds, which require joint ownership with right of survivorship, Lady Bird Deeds allow property transfers without complicating ownership rights during the grantor's lifetime. This feature is particularly appealing for individuals who want to maintain complete control of their property while providing for a smooth succession.

Retaining control and avoiding probate

One of the standout benefits of the Michigan Lady Bird Deed is the ability to retain control of the property while avoiding probate court proceedings. During the grantor’s lifetime, they maintain complete authority over the property, using it, selling it, or even disposing of it as they desire. This level of control is a remarkable advantage over other estate planning tools, including trusts and standard life estates, as it eliminates the confusion and potential disputes that can arise with property ownership.

Moreover, upon the grantor’s death, the property automatically transfers to the designated beneficiaries without the need for a will or probate proceedings. This direct transfer minimizes the stress on surviving family members and significantly reduces the costs associated with the probate process, allowing beneficiaries to inherit the property without delays or additional court fees.

Legal considerations and signing requirements

To ensure a Michigan Lady Bird Deed is valid, certain legal requirements must be met. The deed must be signed by the grantor in front of two witnesses, neither of whom can be named as beneficiaries. This compliance with witnessing requirements is critical for the deed’s enforceability, thereby safeguarding the grantor’s intentions regarding property transfer.

Additionally, notarization may be required in some jurisdictions to further authenticate the deed. Once the deed is signed and notarized, it is crucial to record it with the appropriate county office to inform the public of the change in ownership and protect the grantor’s intentions.

Understanding recording practices

After creating and signing the Lady Bird Deed, recording it at the local county register of deeds is essential. This practice formally documents the change in property ownership and provides legal protection to the grantor’s intentions. The recording process typically incurs a fee, which varies by county, and should be completed promptly to ensure that the deed is effective. Most counties maintain specific deadlines and procedures for recording, so it is advisable for grantors to check with their local offices to avoid potential complications.

Creating your Michigan Lady Bird Deed

Creating a Michigan Lady Bird Deed involves carefully completing a specific form designed to capture essential details. Users should ensure they have the legal description of the property and the names of all parties involved. The form will typically require fields for the grantor's name, contact information, and the names of the beneficiaries, commonly family members or heirs. Accuracy is critical, so reviewing the completed form for errors is essential before signing.

Common mistakes to avoid include leaving blank fields, misidentifying the property, or failing to include necessary signatures. To streamline the process, leveraging digital platforms like pdfFiller can simplify the document creation experience. With its user-friendly interface, pdfFiller enables you to fill out, edit, and sign forms directly online, ensuring a seamless experience from start to finish.

Using pdfFiller for document creation

pdfFiller stands out as a powerful tool for creating, editing, and managing legal documents like the Michigan Lady Bird Deed. The platform features an array of templates that simplify the process of filling out forms. Users can easily pick a Lady Bird Deed template, fill in the necessary information, and make edits as required to reflect their needs accurately.

This platform also offers convenient eSignature capabilities, allowing users to sign digitally. By providing cloud-based storage, pdfFiller empowers individuals to access their documents from anywhere, streamlining collaboration with family members or legal counsel during the estate planning process.

Related forms and documentation

Other than the Michigan Lady Bird Deed, several alternative forms and documentation may be relevant in estate planning. For example, a warranty deed provides assurances to the grantee regarding the title’s validity, while a living trust offers a way to manage assets during life and ensure transfer upon death. Selecting the right form depends on individual circumstances and estate planning goals, making it vital for property owners to consult with legal professionals.

In addition to deeds and trusts, individuals may also consider employing a simple will as part of their estate planning strategy. Wills are essential for outlining personal wishes and distributing assets and can work in conjunction with deeds like the Lady Bird for a comprehensive estate plan.

Resources for legal and estate planning

To navigate the complexities of estate planning and documentation like the Michigan Lady Bird Deed, accessing appropriate resources can prove invaluable. Local legal counsel specializing in estate planning can provide tailored advice and assist in document preparation. Additionally, online platforms such as pdfFiller offer tools and templates that simplify the process and enhance understanding of legal documents. Ever-evolving laws and regulations necessitate updated knowledge, making continual research essential for effective estate planning.

Insights on the use of Lady Bird deeds

Examining the Michigan Lady Bird Deed’s functionality provides critical insights into its advantages compared to other estate planning tools. For instance, while living trusts offer benefits in avoiding probate, they can be complex and require significant upkeep. Lady Bird Deeds, conversely, allow property owners to retain control during their retention and facilitate seamless transfers upon death without the expenses and formalities associated with a trust.

Misunderstandings often arise surrounding the implications of Lady Bird Deeds, particularly in relation to asset protection. While these deeds are an excellent tool for succession planning, they do not shield assets from creditors during the grantor’s lifetime. Thus, individuals must carefully evaluate their needs and risks when deciding if a Lady Bird Deed is the appropriate choice.

Interactive tools for document management

pdfFiller empowers users through its document management tools, transforming the approach to creating and handling legal papers like the Michigan Lady Bird Deed. The platform’s collaborative features enable family members or legal advisors to work together on documents in real-time, streamlining the review and approval process. By including eSigning capabilities, pdfFiller allows users to finalize agreements promptly without requiring physical meetings.

From creation to management, pdfFiller offers a comprehensive lifecycle for documents. Users can initiate a Lady Bird Deed, share it with stakeholders for input, receive feedback, and store the finalized document securely in the cloud, ensuring that critical information is accessible from anywhere.

Frequently asked questions

Many individuals considering a Michigan Lady Bird Deed have questions regarding its practical application and legal standing. Common queries include whether it can be revoked, how it impacts Medicaid eligibility, and what steps are necessary for proper execution. Understanding these aspects is crucial for making informed decisions about using this tool in estate planning.

To clarify, a Lady Bird Deed can be revoked by the grantor at any time, allowing for increased flexibility. Regarding Medicaid, while the property may be subject to estate recovery, this depends on the circumstances and timing of the transfer. Consulting with an attorney is advised to ensure a comprehensive strategy regarding eligibility and asset management.

Additional insights and case studies

Illustrating the practical application of Lady Bird Deeds through real-life scenarios can enrich understanding. For example, consider a couple who used a Lady Bird Deed to transfer their home to their children while retaining the right to live there until their deaths. This arrangement allowed them to avoid probate, simplify the process for their children, and maintain peace of mind regarding their property.

These case studies reveal the potential challenges and considerations for future users. One family learned the importance of understanding the property’s future tax implications as they inherited it without incurring unnecessary costs. Overall, these insights not only highlight practical advantages but also recognize the complexities surrounding estate planning with a Lady Bird Deed.

Summary of essential points

In summary, the Michigan Lady Bird Deed presents a flexible and efficient tool for individuals looking to streamline their estate planning. Key features include the ability to retain control over property, facilitate direct transfers upon death, and avoid the costs and complications of probate. By understanding the mechanics, advantages, and legal considerations associated with this deed, individuals can make informed choices that best suit their specific situations.

Ultimately, as individuals explore their estate planning options, integrating a Michigan Lady Bird Deed into their strategy may provide essential peace of mind, ensuring their property is managed and passed on according to their wishes while minimizing burdens on their loved ones.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit pdffiller form from Google Drive?

Can I sign the pdffiller form electronically in Chrome?

How do I complete pdffiller form on an Android device?

What is michigan lady bird deed?

Who is required to file michigan lady bird deed?

How to fill out michigan lady bird deed?

What is the purpose of michigan lady bird deed?

What information must be reported on michigan lady bird deed?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.