Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990: A Comprehensive How-to Guide

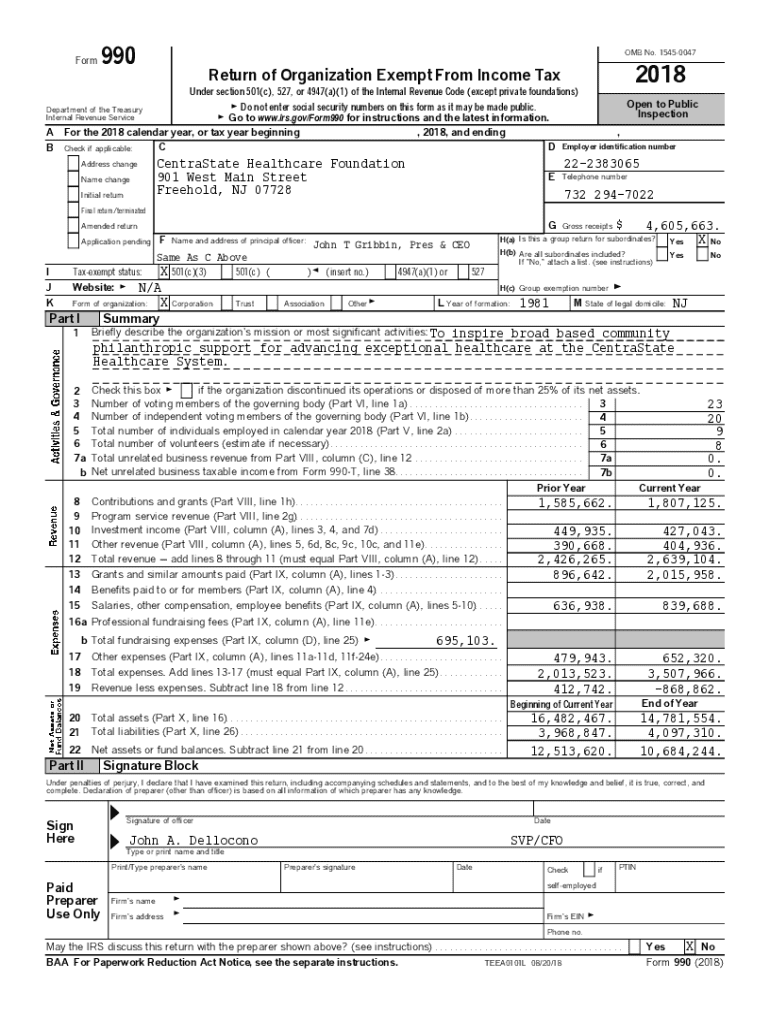

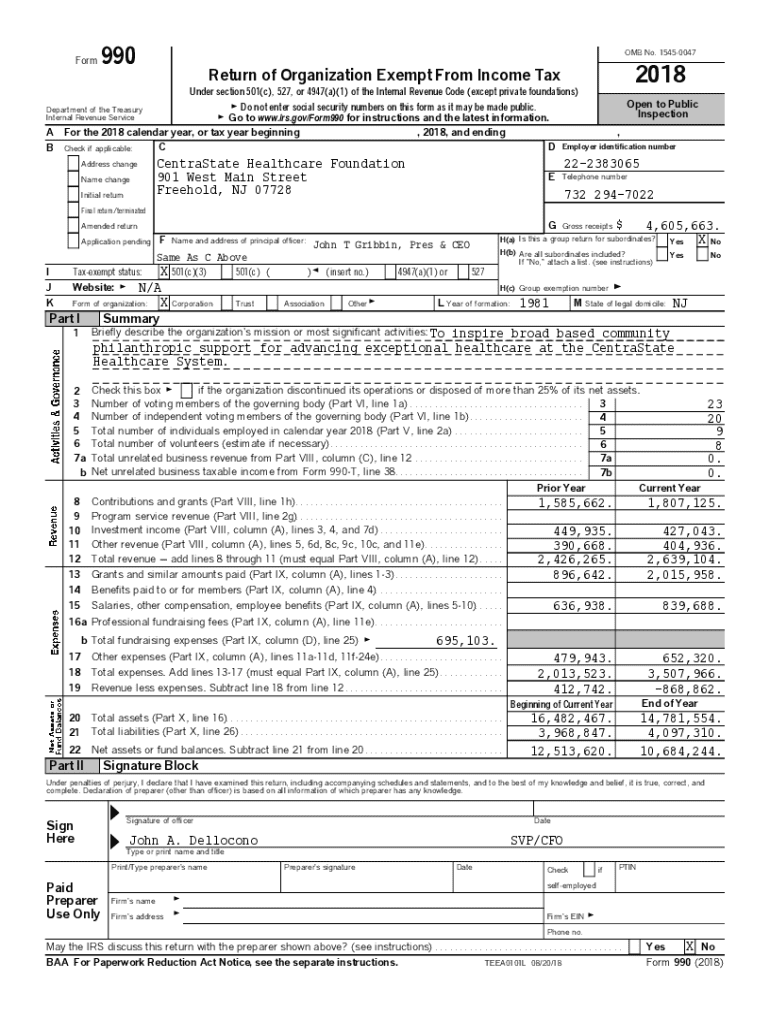

Understanding Form 990

Form 990 is a crucial document filed annually by tax-exempt organizations in the United States to report their financial information to the IRS. The primary purpose of this form is to ensure transparency and accountability within the nonprofit sector. It allows the government, as well as the public, to review an organization's financial health and operational effectiveness, thus playing a significant role in promoting good governance.

Organizations required to file Form 990 typically include charities, foundations, and other nonprofit entities that are exempt from federal income tax. Different types of organizations have distinct filing requirements based on their size and activities, with large organizations needing to file the full Form 990, while smaller entities may be eligible to file the simplified Form 990-EZ. Understanding which form to file is essential for compliance and maintaining tax-exempt status.

Content and structure of Form 990

Understanding the structure of Form 990 is vital for effective completion. This multifaceted document is divided into several sections, detailing different aspects of the organization’s financial status and activities. Key sections include income, expenses, and balance sheets, which provide a comprehensive overview of the organization’s revenue sources, operational costs, and net assets.

In addition to the main sections, Form 990 includes important schedules that support the primary data. These schedules cover special topics such as compensation for highest-paid employees, fundraising activities, and grant allocations. Completing these schedules accurately ensures a full disclosure of the organization’s operational practices.

Filing requirements and timing

Form 990 is typically due on the 15th day of the 5th month after the end of the organization’s fiscal year. For most organizations operating on a calendar year, this means the due date would be May 15. Organizations can apply for an extension, allowing them to file as late as November 15, provided the appropriate form is filed on time.

Organizations must choose their filing method carefully. They can file Form 990 via paper or electronically. E-filing is often recommended because it's generally faster and provides immediate confirmation of successful submission. Additionally, organizations designated for audit must ensure compliance with regulations, potentially necessitating an independent audit to accompany their Form 990 filing.

Completing Form 990

Completing Form 990 can be daunting, but breaking it down into manageable steps simplifies the process. Begin gathering pertinent financial documents, such as your organization’s financial statements, board meeting minutes, and records of donations. Each section should be completed methodically—start with basic organizational information, then move on to income, expenses, and finally, the balance sheet.

Common challenges arise during the completion process. Ensure you double-check figures and descriptions to minimize discrepancies. Additionally, nonprofit organizations often face confusion regarding definitions and reporting periods. Utilizing interactive tools, like pdfFiller, can streamline the editing and signing process, helping organizations stay organized throughout their filing journey.

Penalties for non-compliance

Organizations that fail to file Form 990 by the deadline, or who submit inaccurate information, may face significant penalties. The IRS imposes fines that can accumulate quickly, leading to potentially crippling financial obligations for nonprofits operating on limited budgets. Moreover, chronic non-compliance can jeopardize the organization's tax-exempt status, which could impair its ability to operate effectively.

To avoid these outcomes, organizations should establish a clear filing plan, implementing monthly check-ins leading up to the deadline. Additionally, incorporate a review system where knowledgeable board members are brought in to verify the data being reported, thus ensuring compliance and mitigating risks associated with inaccuracy.

Public inspection regulations

Form 990 is open to public inspection, allowing donors, stakeholders, and the general public to access the information disclosed within the form. Nonprofits are required by law to make their Form 990 filings available for inspection, which promotes accountability. This transparency helps foster a sense of trust between organizations and their constituencies.

Best practices recommend making this form readily accessible on your organization’s website and providing copies upon request. Furthermore, organizations should consider summarizing key findings or metrics from the Form 990 in their annual reports to ensure stakeholders understand the entity’s operational impacts fully.

Historical context of Form 990

Form 990 has evolved significantly since its inception, reflecting the changing landscape of nonprofit finance and regulation. Originally designed as a simplistic reporting tool, it has been developed into a comprehensive financial statement that requires detailed disclosures about an organization’s activities. Key changes included the introduction of additional schedules and updates to ensure compliance with current laws and regulations, making it more useful for stakeholders.

The role of Form 990 in nonprofit reporting cannot be underestimated. It serves as a critical tool for assuring the public and government that nonprofits are indeed fulfilling their mission and using donor funds responsibly. Through continuous improvements, the IRS aims to enhance the functionality of Form 990 to foster transparency and accountability within the nonprofit sector.

Using Form 990 for research and evaluation

The information contained within Form 990 is invaluable for researchers and evaluators in assessing nonprofit performance. By analyzing financial metrics, operational activities, and fundraising efficiency, stakeholders can gauge how effectively an organization meets its stated mission. This data can be vital for funding decisions and program evaluations.

Case studies demonstrate the impact of utilizing Form 990 data to drive decision-making. Research has shown that organizations reporting higher transparency levels often perform better financially and achieve greater levels of community trust. Therefore, both nonprofits and their supporters benefit from a commitment to thorough and accurate Form 990 reporting.

Fiduciary responsibilities and reporting

Nonprofit board members have fiduciary responsibilities related to Form 990 compliance. They must ensure that the information reported is accurate and represents a true depiction of the organization's financial status and activities. This obligation not only protects the organization but also upholds the confidence of stakeholders and the community at large.

The impact of Form 990 on governance is profound. Effective governance structures often incorporate rigorous review processes for financial documentation, including Form 990. Best practices suggest that boards should meet frequently to discuss financial reports and oversee compliance efforts, thereby bolstering the accountability of the organization.

Alternative forms and filings

Various forms exist within the Form 990 framework to cater to the needs of different nonprofit organizations. For example, Form 990-EZ is designed for smaller organizations with less complex financial situations, while Form 990-PF is intended for private foundations. Understanding which version of Form 990 to file is essential for compliance and keeping a nonprofit operating smoothly.

Fractions of organizations may qualify to file shorter versions of Form 990; therefore, familiarity with these alternatives ensures efficient compliance. Form 990-N, often called the e-Postcard, is another significant option for small organizations with minimal revenue.

Third-party sources for Form 990

Numerous resources and consulting firms specialize in assisting nonprofits with navigating the complexities of Form 990. These third-party sources can provide expertise on financial documentation, regulations, and best practices to enhance compliance efforts. Engaging a consultant or utilizing online platforms like pdfFiller can help streamline the Form 990 filing process and reduce organizational burdens.

Moreover, organizations can leverage services that facilitate the e-signature and editing of documents associated with Form 990. By adopting a cloud-based platform like pdfFiller, organizations can manage their paperwork more efficiently while ensuring compliance with a distinct focus on streamlined document management.

How to read and interpret Form 990

Reading and interpreting Form 990 can be quite informative when you know what to look for. Financial information on Form 990 typically outlines an organization’s revenue streams, expenditures, and net assets. Stakeholders should focus on metrics such as total revenue versus grants and contributions, net income, and program expenditures to understand an organization’s operational viability.

Utilizing the right terminology is also crucial in deciphering Form 990. The form is filled with terms and acronyms that can be perplexing for those unfamiliar with nonprofit reporting. Having a glossary handy can aid in clarifying difficult concepts, providing a clearer picture of the organization’s financial standing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 990 from Google Drive?

How can I get form 990?

How do I edit form 990 straight from my smartphone?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.