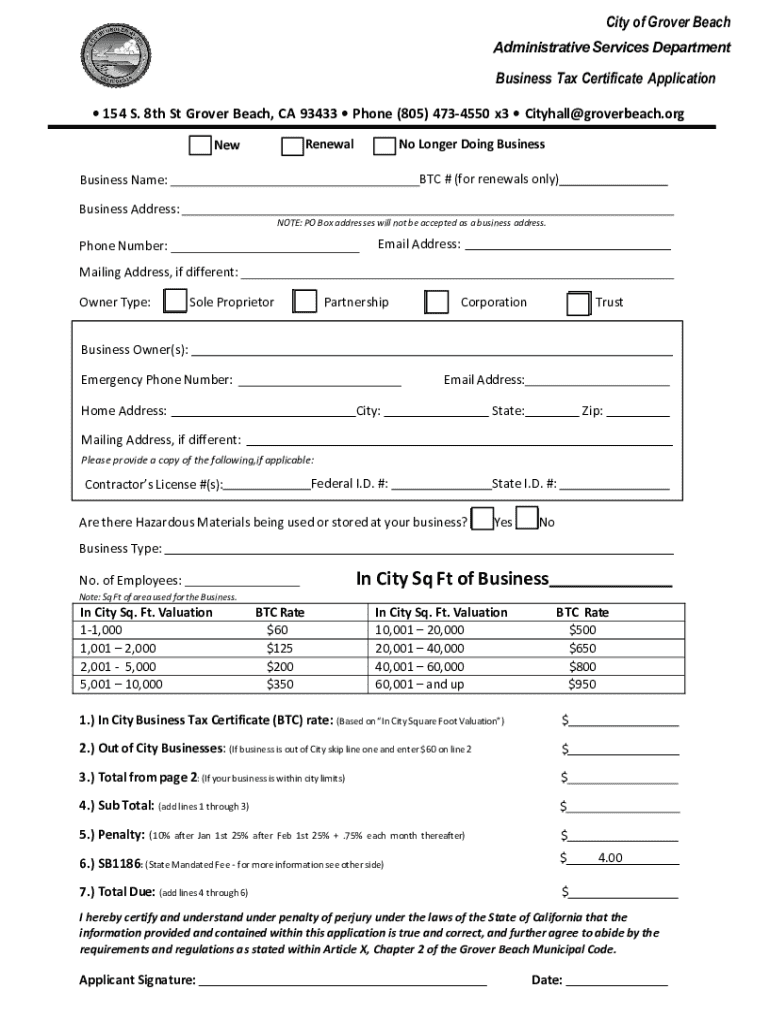

Get the free Business Tax Certificate Application

Get, Create, Make and Sign business tax certificate application

How to edit business tax certificate application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business tax certificate application

How to fill out business tax certificate application

Who needs business tax certificate application?

Comprehensive Guide to Business Tax Certificate Application Form

Overview of business tax certificate

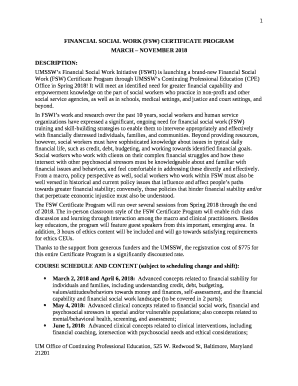

A business tax certificate, often termed a business license or permit, is an official document issued by local government entities. Its primary purpose is to validate that a business meets regulatory requirements, tax obligations, and operational guidelines. For businesses, possessing a business tax certificate is not just a legal formality; it serves as a testament to credibility and adherence to local laws.

In many jurisdictions, the possession of a business tax certificate is mandatory for operations. It assists local governments in monitoring businesses for compliance and taxation, thereby ensuring that businesses contribute to community services and infrastructure.

Eligibility criteria for obtaining a business tax certificate

Qualifications for obtaining a business tax certificate vary widely based on the type of business, geographic location, and local laws. Various factors should be considered to determine eligibility.

For instance, certain business types may have dedicated regulatory frameworks requiring additional permits or licenses, such as health permits for food-related establishments. Additionally, revenue thresholds can determine if a tax certificate is necessary. Some municipalities exempt businesses from obtaining a certificate if their annual income remains below a specified level. Finally, understanding the specific regulations in your area is crucial; rules can differ significantly from one region to another.

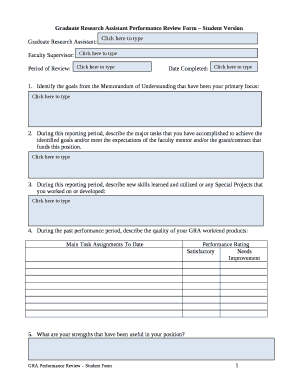

Detailed breakdown of the application process

The process of applying for a business tax certificate entails several key steps to ensure a seamless experience. Below, we outline a step-by-step guide.

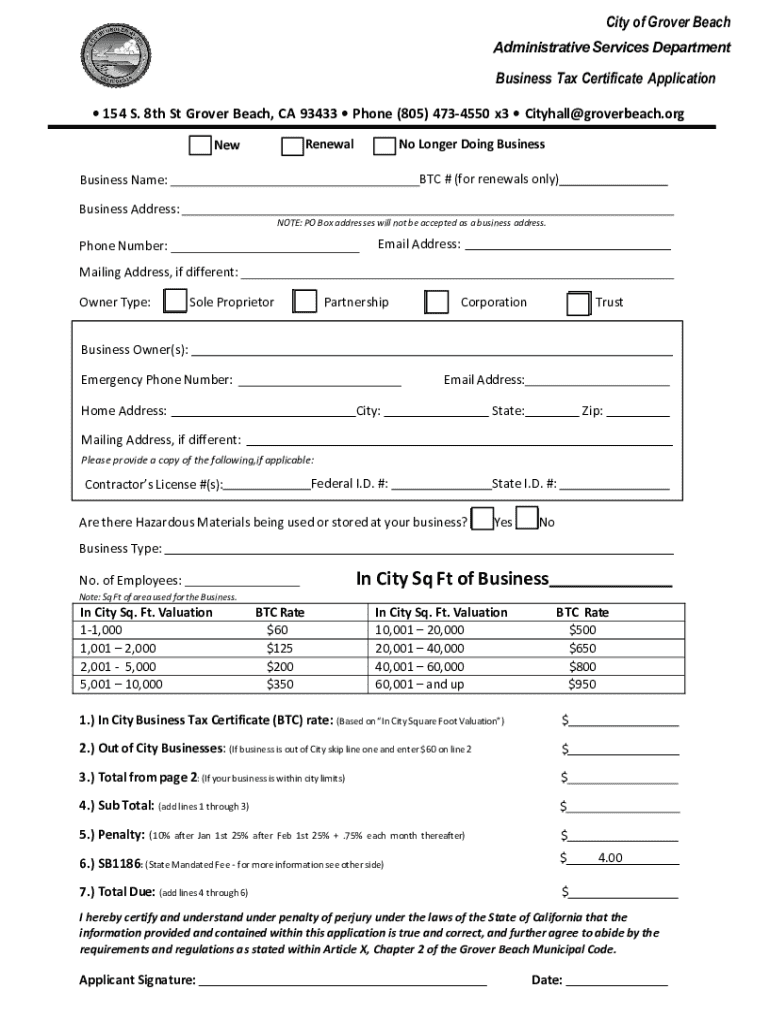

Payment of fees

Obtaining a business tax certificate usually involves several fees. These costs can vary by jurisdiction and specific business type, so it’s vital to be informed ahead of your application.

Typically, an initial application fee applies, which is often subject to renewal after a set period. This fee structure helps local governments cover the administrative costs associated with processing applications.

Payment methods may include options for online transactions, in-person payments, or mail-in checks, facilitating customer convenience based on preference.

Managing your business tax certificate

Once you have successfully obtained your business tax certificate, effective management of this document is critical for ongoing compliance. This includes keeping track of key dates such as renewal deadlines.

Renewals are often required annually or biannually. Documentation must be resubmitted, presenting proof of continued compliance with local business operating standards. Additionally, any amendments to business ownership, location, or structure require a formal update of the certificate to reflect changes.

Resources for assistance

For many business owners, navigating the intricacies of obtaining and managing their business tax certificate can be challenging. Fortunately, various resources are available to assist in this process.

Contacting your local tax office is often the most direct method of obtaining answers to specific inquiries related to your business tax certificate. Each office usually provides contact details and hours of operation on local government websites.

Leveraging pdfFiller for your application

Utilizing pdfFiller streamlines the application process for your business tax certificate significantly. The platform provides a wide array of tools to help in filling out and managing your documents.

With pdfFiller, you can effortlessly upload your existing documents, make the necessary edits, and fill out the application form online. This cloud-based platform enables users to access their forms from any device, ensuring you’re never without the necessary tools.

Best practices for maintaining compliance

Compliance with local tax laws is essential for business continuity. Staying informed about changes in regulations will help you avoid unnecessary conflicts with tax authorities.

Implementing sound record-keeping strategies not only enhances compliance but also strengthens your overall tax position. Digital solutions, such as invoicing software, can simplify the organization of essential documentation.

Additional considerations

While obtaining a business tax certificate is essential, the implications of non-compliance can be severe. Businesses operating without the proper certification may face fines, penalties, and even suspension of operations.

On a more positive note, being compliant opens doors to potential deductions related to the costs incurred during registration. Consulting with a tax professional can uncover valuable insights specific to your situation.

Testimonials and success stories

Many business owners have navigated the daunting process of obtaining their business tax certificate and come out successfully. Anecdotal insights convey strategies and practical tips that can be invaluable.

Case studies from entrepreneurs illustrate the challenges faced during their application but ultimately highlight the importance of persistence and comprehensive understanding of the requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the business tax certificate application in Gmail?

How do I complete business tax certificate application on an iOS device?

How do I complete business tax certificate application on an Android device?

What is business tax certificate application?

Who is required to file business tax certificate application?

How to fill out business tax certificate application?

What is the purpose of business tax certificate application?

What information must be reported on business tax certificate application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.