Get the free Disaster Assistance Loans Application Form

Get, Create, Make and Sign disaster assistance loans application

Editing disaster assistance loans application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out disaster assistance loans application

How to fill out disaster assistance loans application

Who needs disaster assistance loans application?

Disaster Assistance Loans Application Form: Your Comprehensive Guide

Overview of disaster assistance loans

Disaster assistance loans are financial resources provided to individuals and businesses affected by natural disasters. Their primary purpose is to help with the recovery process, allowing victims to rebuild their homes, repair damages, and restore their livelihoods. Financial support plays a critical role in helping communities rebound and regain stability after catastrophic events.

These loans are crucial because they offer low-interest financing to cover those expenses that aren’t fully covered by insurance or other forms of aid. Eligibility for disaster assistance loans generally includes criteria such as the extent of the damage suffered, income levels, and the nature of the disaster.

Who can apply for a disaster loan?

A variety of entities can apply for disaster assistance loans, including individuals, businesses, and non-profit organizations. Each of these categories has specific eligibility requirements.

Generally, applicants must demonstrate that they have been adversely affected by a declared disaster, and they must show proof of their financial situation.

Understanding the different types of disaster loans

Disaster assistance loans are categorized into various types, each tailored to address specific needs following a disaster.

Understanding these loan types is essential, as they each have distinct application procedures and eligibility criteria.

Disaster declarations: Why they matter

A disaster declaration by local, state, or federal authorities is necessary for accessing disaster assistance programs. Such a declaration confirms the severity of the disaster and establishes the grounds for available aid.

To verify if your area has been declared eligible for disaster assistance, you can visit the Federal Emergency Management Agency (FEMA) website. Understanding the timing and details of these declarations helps ensure you submit your application within the required timeframe.

Step-by-step guide to accessing the disaster assistance loans application form

The process for applying for a disaster assistance loan can feel daunting, but it can be simplified with the following steps:

Each of these steps is critical for ensuring a complete and successful application.

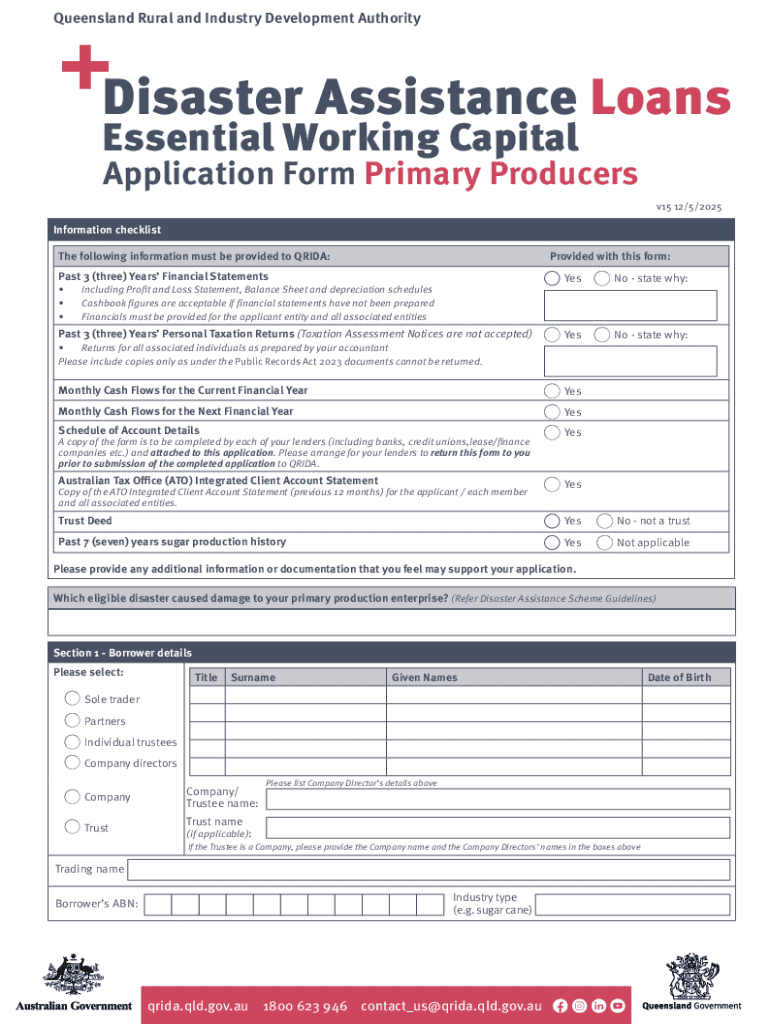

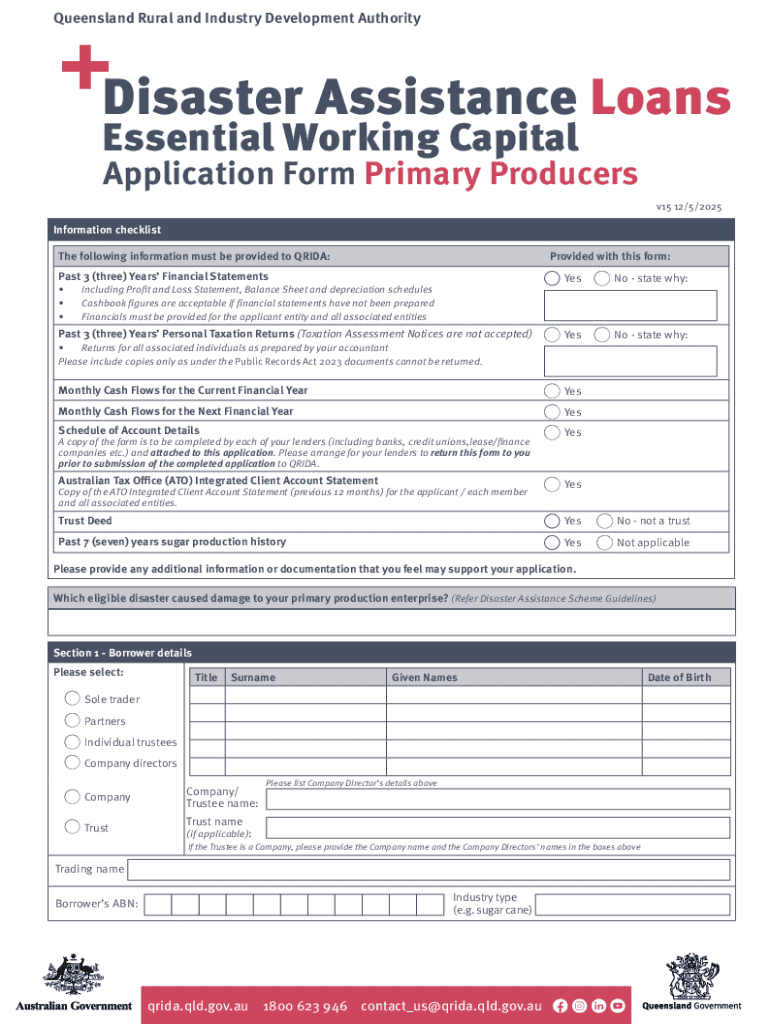

Detailed instructions for filling out the application

When completing the application form, it's essential to navigate each section carefully. Start with personal and contact information, followed by the specifics of the disaster, such as the date and nature of the damage. Ensure accuracy in financial figures and provide a clear narrative of your circumstances.

Common mistakes to avoid include providing outdated or incorrect documentation and failing to sign the application. Take the time to review all entries to ensure clarity and completeness.

Submitting your application

Once you’ve completed the application, submit it through the online platform. Be sure to save a confirmation of your submission for your records. If you prefer, alternative submission methods may be available, such as mailing in a hard copy.

After submission, expect a timeline outlining when you will receive communication regarding your application status. Stay informed and prepared to provide any additional information if requested.

Tracking your application status

After submitting your disaster assistance loans application form, tracking your application status becomes crucial. Regularly check the portal or contact customer support to confirm the progress of your application.

Understand that delays may occur due to high application volumes or incomplete information. Being proactive and responsive to any requests for documentation will help expedite the review process.

Managing your disaster loan post-approval

Once approved for a disaster loan, it is essential to manage your funds wisely. Understand the loan terms, such as interest rates, repayment schedules, and any conditions attached to the loan.

Implementing robust financial management strategies, such as budgeting for loan repayments and keeping track of expenditures related to disaster recovery, will ease the process of managing your disaster assistance loans.

Additional support and resources

Various resources are available to assist applicants through the disaster loan application process. FEMA provides comprehensive support through its website and customer service channels.

Language and accessibility options

The disaster assistance loans application form is designed to be accessible to all applicants. Translation services may be available for non-English speakers. Additionally, online platforms are often equipped with features to assist individuals with disabilities.

It’s essential to inquire about available language options and accessibility features while accessing the application to ensure no potential applicant is left behind.

About this document

This guide aims to provide a comprehensive overview of the disaster assistance loans application form, detailing every aspect, from eligibility to submission processes. It serves to empower users with the knowledge needed to navigate their application successfully.

Feedback and inquiries are encouraged to improve the guidance offered and ensure applicants are well informed.

Footer navigation

For further support, quick links to related forms and other resource pages can typically be found at the bottom of the application site. Utilizing social media channels may also enhance the support you receive.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send disaster assistance loans application for eSignature?

How do I make changes in disaster assistance loans application?

How do I edit disaster assistance loans application in Chrome?

What is disaster assistance loans application?

Who is required to file disaster assistance loans application?

How to fill out disaster assistance loans application?

What is the purpose of disaster assistance loans application?

What information must be reported on disaster assistance loans application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.