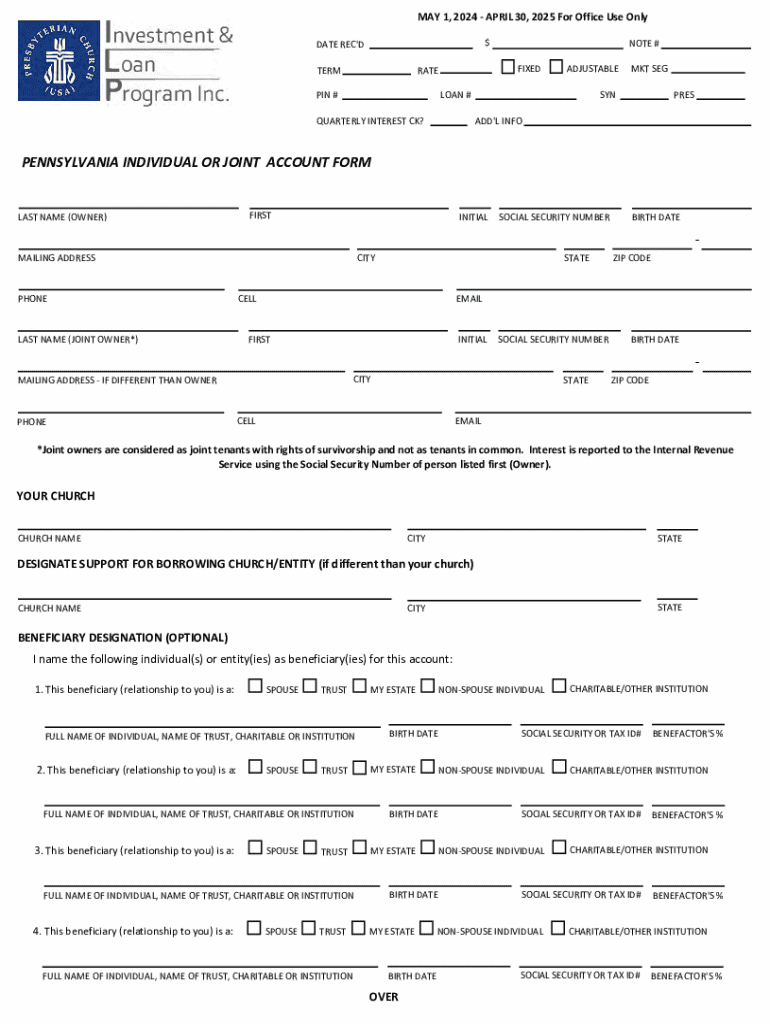

Get the free MAY 1, 2024 - APRIL 30, 2025 For Office Use Only

Get, Create, Make and Sign may 1 2024

How to edit may 1 2024 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out may 1 2024

How to fill out may 1 2024

Who needs may 1 2024?

Everything You Need to Know About the May 1, 2024 Form

Understanding the May 1, 2024 form

The May 1, 2024 form is a critical document required for individuals and organizations alike. Understanding its purpose is essential for timely compliance with regulatory or administrative requirements, which often include tax filings, grant applications, or organizational audits. This form helps streamline the data collection processes and ensure that all necessary information is compiled accurately for official assessment.

Purpose of the form

The primary purpose of the May 1, 2024 form is to collect essential financial and personal information that may influence decision-making processes within various industries. For example, educational institutions might require this for scholarship eligibility, while non-profits might use it as part of their grant application process. Completing this form accurately ensures that stakeholders have access to the information needed for their decisions.

Who needs to complete the form?

Various demographics are impacted by the necessity of the May 1, 2024 form. Individuals applying for financial aid, businesses seeking grants, and organizations updating their tax information will all need to fill out this form. Specifically, educational institutions, non-profit organizations, and for-profit companies operating within certain regulated sectors will find this form especially relevant.

Important deadlines

To ensure compliance, it is crucial to be aware of the deadlines associated with the May 1, 2024 form. Submissions typically need to be finalized by May 1; however, preparatory work such as gathering documents should begin well in advance, ideally several weeks prior to the deadline to avoid last-minute complications.

Key components of the May 1, 2024 form

Understanding the key components of the May 1, 2024 form will help you navigate the process more smoothly. Each section of the form serves a distinct purpose and must be completed accurately to ensure successful submission.

Breakdown of sections

The May 1, 2024 form is divided into several key sections:

Required documents

Alongside the May 1, 2024 form, certain supporting documents are often required. Commonly requested documents include:

Common mistakes to avoid

Errors on the May 1, 2024 form can lead to processing delays or rejections. To prevent common issues, make sure to:

Step-by-step guide to completing the form

Completing the May 1, 2024 form doesn't have to be a daunting task. With proper preparation and access to useful tools like pdfFiller, you can streamline the process significantly.

Preparing your information

Before initiating the form, gather all necessary documents like tax returns and ID proofs. Having this information at your fingertips will save time and help you complete the form efficiently.

Completing the form online

Utilizing pdfFiller's platform allows you to fill out the May 1, 2024 form electronically, which can be incredibly convenient. The form is typically structured for easy navigation, and pdfFiller offers interactive features that guide you as you enter each piece of information.

Editing and reviewing your form

After completing the initial entries, it’s vital to review the form. With pdfFiller’s editing tools, you can easily modify any section if necessary. Consider utilizing the proofreading functions to identify potential errors.

eSigning the form

Adding your electronic signature to the May 1, 2024 form is quick and efficient through pdfFiller. Simply follow the intuitive prompts to place your signature in the designated area.

Submitting your form

Once you’ve reviewed all entries and added your signature, you can submit the form directly through the pdfFiller platform. Make sure to receive a confirmation of submission in order to maintain proper records.

Maintaining your documentation

After submitting the May 1, 2024 form, it's important to maintain thorough documentation related to the submission for future reference and compliance.

Storing your form safely

Make sure to store a copy of the submitted form securely. PdfFiller's cloud storage ensures that your documents are safe and accessible at all times, allowing you to retrieve them whenever needed.

Checking submission status

Keep track of your submission's status by checking the tracking feature available through pdfFiller. This will give you peace of mind and alert you to any required follow-ups.

Managing revisions and updates

If you discover that the May 1, 2024 form requires amendments after submission, you can utilize pdfFiller’s capabilities to edit and resubmit the form. This ensures you stay compliant and up-to-date.

Collaborating with others

Depending on your needs, you may need to collaborate with team members during the completion of the May 1, 2024 form.

Sharing the form with team members

PdfFiller provides features that simplify the sharing and collaboration process. You can easily invite team members to view or edit the form, ensuring that all relevant perspectives are considered.

Best practices for team collaboration

To maximize effectiveness while working with others, communicate clearly about roles and responsibilities. Setting expectations can facilitate smoother collaboration and enhance the quality of the final submission.

Understanding the impact of the May 1, 2024 form

Recognizing the broader implications of the May 1, 2024 form can provide additional motivation for completion.

How it affects individuals

For individuals, correctly completing the form can result in financial aid or opportunities that would not have been accessible otherwise. This can greatly impact education, job prospects, and financial stability.

Broader implications for organizations

Businesses and organizations may find that compliance with the May 1, 2024 form leads to better regulatory standing and access to essential funding. This can influence long-term strategies and operational dynamics.

Future changes to expect

As regulations evolve, it’s important to stay informed about possible updates related to the May 1, 2024 form. Engaging with the relevant authorities or following updates from pdfFiller can help you prepare for upcoming changes.

Troubleshooting common issues

While filling out the May 1, 2024 form through pdfFiller, you may encounter certain technical challenges.

Technical issues when using pdfFiller

Should you face any technical difficulties, pdfFiller’s user-friendly design allows for easy error correction. You may find solutions in the help section, which provides answers to frequent questions.

Contacting customer support

If issues persist, reaching out to customer support is a straightforward way to get assistance. Ensure that you provide as much detail as possible so they can assist you effectively.

Leveraging pdfFiller for enhanced document management

Utilizing pdfFiller extends beyond the May 1, 2024 form. This platform offers robust features that can significantly enhance your document management experience.

Beyond the May 1, 2024 form

From tax forms to various legal documents, pdfFiller provides a wide array of templates that cater to diverse needs. This ensures you can always find the necessary form without hassle.

Features to maximize your experience

Consider utilizing pdfFiller’s advanced tools, such as cloud storage, document sharing, and integration capabilities with other applications, to streamline your workflow and improve efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit may 1 2024 online?

Can I edit may 1 2024 on an Android device?

How do I complete may 1 2024 on an Android device?

What is May 1?

Who is required to file May 1?

How to fill out May 1?

What is the purpose of May 1?

What information must be reported on May 1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.