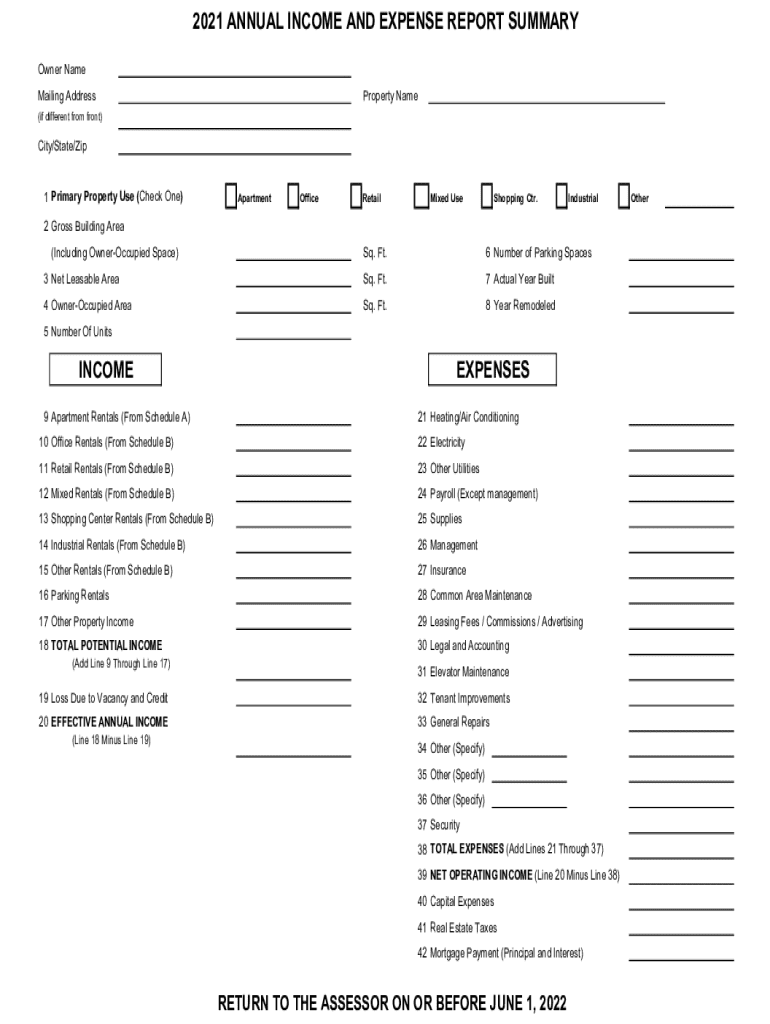

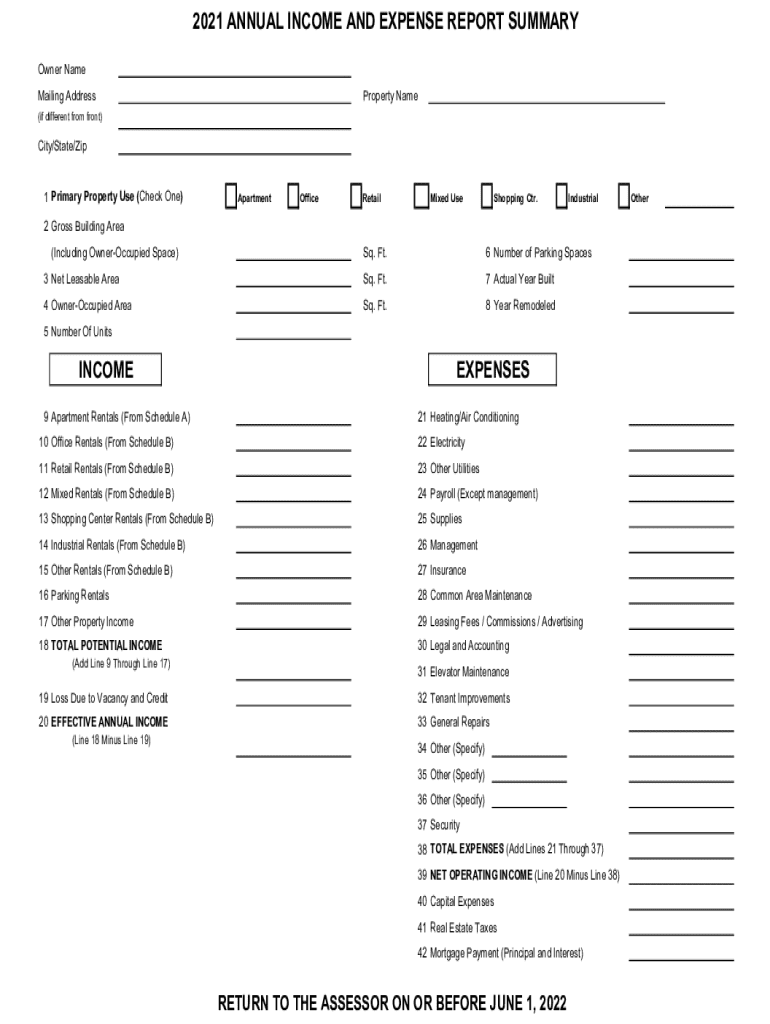

Get the free 2021 Annual Income and Expense Report Summary

Get, Create, Make and Sign 2021 annual income and

Editing 2021 annual income and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2021 annual income and

How to fill out 2021 annual income and

Who needs 2021 annual income and?

A comprehensive guide to 2021 annual income and form

Understanding 2021 annual income reports

Annual income refers to the total amount of money earned by an individual or household over the course of a year. This includes wages from employment, freelance earnings, investment income, and other revenue sources. Accurate reporting of this income is crucial not only for compliance with tax regulations but also for personal financial management. Misreporting can lead to potential legal issues and financial penalties.

Different types of income include earned income (wages, salary, commissions) and unearned income (interest, dividends, capital gains). Both categories contribute to an individual's overall financial profile. It’s essential to understand these distinctions to ensure proper reporting on your tax forms. Underreporting income can result in back taxes owed and penalties from the IRS, underscoring the importance of meticulous and accurate income documentation.

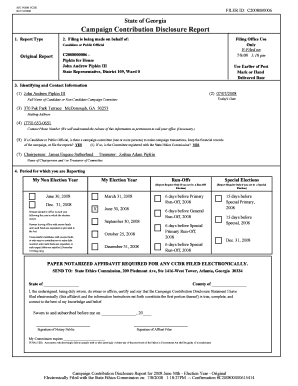

Navigating the necessary forms

When it comes to reporting your 2021 annual income, several essential forms are required. The primary form for individuals is IRS Form 1040, which serves as the Individual Income Tax Return. It provides a comprehensive view of your income, deductions, and tax liabilities.

Additionally, W-2 Forms are critical for employees—they outline wages and taxes withheld by employers. For freelancers or contractors, 1099 Forms report miscellaneous income earned outside traditional employment. Obtaining these forms can easily be done through the IRS website, directly from your employer, or various online sources. Ensuring you have these documents in hand simplifies the filing process.

Filling out your annual income forms

To successfully complete IRS Form 1040, follow a step-by-step approach. Start with gathering necessary financial documents, including your W-2 and 1099 Forms. These documents contain key information needed for accurate reporting of your income.

Next, determine your filing status (single, married filing jointly, head of household, etc.) as this affects your tax calculations. As you enter your income sources on the form, be meticulous. It's crucial to include all applicable figures, as omitting income can lead to issues with the IRS. Proper supporting documentation must be kept to validate claims and deductions.

Pay attention to common mistakes, such as numerical errors or misclassifying income types. Each field must be filled out accurately to avoid complications. Double-check your entries against your documentation to ensure everything aligns perfectly.

Utilizing pdfFiller to manage your income forms

pdfFiller is a comprehensive tool for managing your income forms, simplifying the editing and submission process. Users can easily edit PDFs, add signatures, collaborate with team members, and securely store their documents in a cloud environment. This accessibility makes it easy to retrieve important tax forms whenever needed.

Using pdfFiller's capabilities, you can convert a standard Form 1040 into an editable document. The platform allows users to upload forms, make necessary adjustments, and save changes efficiently.

For example, to upload, edit, and save Form 1040 in pdfFiller, log into your account, select the form, and utilize the editing tools to make all necessary changes. This process streamlines income reporting and enhances organization.

Calculating your taxes: A step-by-step guide

Understanding how to calculate your taxable income is vital for accurate reporting. Begin by adding your total annual income sources, then subtract any applicable deductions. Deductions can be broadly categorized into standard and itemized deductions. Most taxpayers choose the standard deduction, which simplifies the process.

Tax credits, which directly reduce your tax liability, should also be taken into account. There are various types of credits available based on specific circumstances, such as education expenses or child care costs. Utilizing these effectively can significantly lessen your overall tax burden.

Consider the following example: If your total income is $60,000 and you qualify for a standard deduction of $12,400, your taxable income reduces to $47,600. If you apply a tax credit of $1,000, your final liability decreases, leading to substantial savings.

Common questions about 2021 annual income reporting

Many questions arise surrounding the intricacies of annual income reporting. For instance, what do you do if changes to your income occur after filing? Generally, you can amend your return using Form 1040-X. It's also vital to report rental income or earnings from gig economy work accurately; keep thorough records to substantiate these amounts.

Late filing can result in penalties, emphasizing the significance of timely submissions. It's advisable to file as early as possible to avoid these repercussions and to maintain compliance with tax regulations. Resources, including IRS publications and tax preparation guides, can provide further assistance.

Staying compliant with tax regulations

Keeping organized records is a fundamental aspect of staying compliant with tax regulations. Individuals should maintain copies of income documents for several years, as the IRS may audit returns up to three years after they have been filed. A digital and physical filing system can help ensure that all documents are stored safely and are easily accessible whenever needed.

Best practices for documenting your annual income include routinely updating records and using financial management software throughout the year. This allows for a comprehensive view of your financial status, ensuring no income source goes unreported come tax time.

Looking ahead: Preparing for future income reporting

Preparation for the upcoming year begins by establishing a systematic approach to financial documentation. Organizing your expenses and income monthly can prevent a last-minute rush and will prepare you for accurate reporting when the time comes.

Consider utilizing pdfFiller for year-round management of tax-related documents. Its online platform allows for easy tracking and filing of necessary forms as they arise, promoting a more streamlined tax preparation process. Staying informed on potential changes in tax law is also significant to ensure compliance in future filings.

Additional support and resources

For personalized advice and assistance, connecting with tax professionals can provide invaluable insights. Local resources, such as community tax centers, also offer free or low-cost assistance to those in need. Remaining informed about updates or changes to tax laws through official government websites ensures compliance and accurate reporting.

In addition, pdfFiller offers user support through FAQs, chat assistance, and instructional videos to help users navigate the platform effectively. This resource proves beneficial for anyone from individuals to teams managing documents collaboratively.

Conclusion

Accurate annual income reporting is crucial for both compliance with tax regulations and the individual's financial health. Tools like pdfFiller enhance the ease of document management, editing, and submission, making the process simpler for users. By utilizing the resources outlined and keeping organized, taxpayers can confidently navigate their income reporting obligations, ensuring compliance and minimizing stress come tax season.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in 2021 annual income and without leaving Chrome?

How do I fill out 2021 annual income and using my mobile device?

How do I complete 2021 annual income and on an Android device?

What is annual income and?

Who is required to file annual income and?

How to fill out annual income and?

What is the purpose of annual income and?

What information must be reported on annual income and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.