Get the free Form 8-k

Get, Create, Make and Sign form 8-k

Editing form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

Understanding Form 8-K: A Comprehensive Guide

Understanding Form 8-K

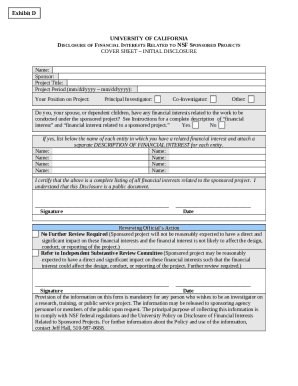

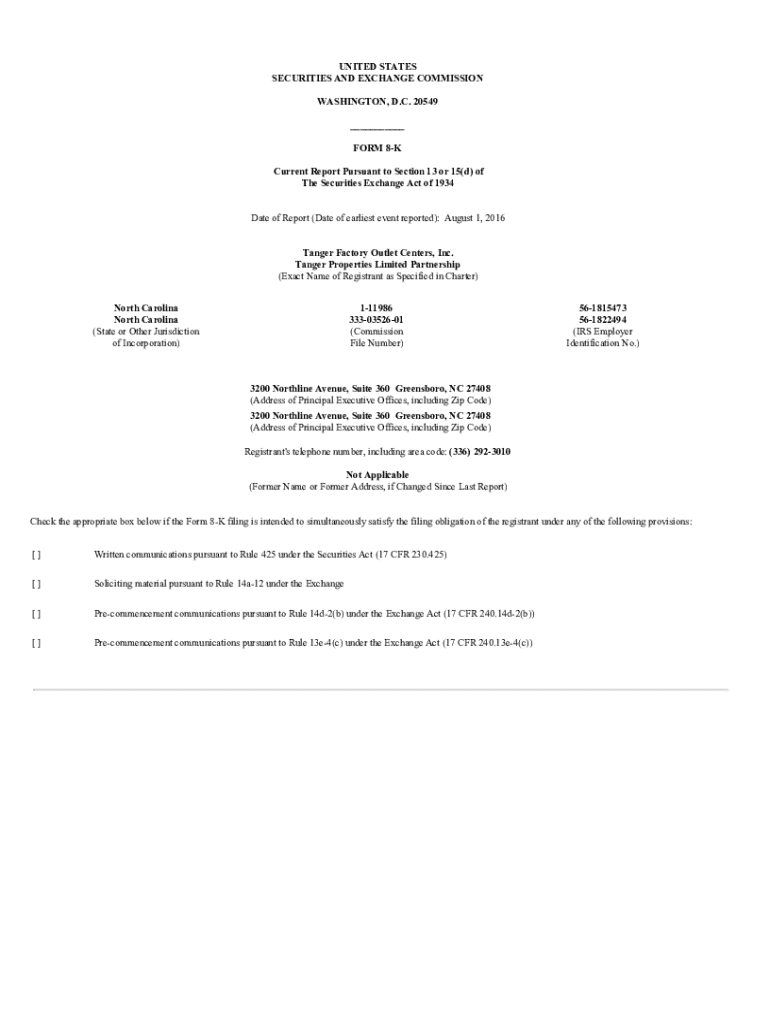

Form 8-K is a crucial reporting vehicle used by publicly traded companies to inform the Securities and Exchange Commission (SEC) and shareholders about significant corporate events. This form acts as a regulatory communication mechanism, ensuring timely reporting of key events that stakeholders need to be aware of.

The importance of Form 8-K in corporate governance cannot be overstated. By providing immediate disclosure of relevant events, it enhances transparency and maintains the integrity of the financial markets.

Legally, Form 8-K is governed by the SEC's rules under the Securities Exchange Act of 1934. Companies are required to follow strict guidelines when preparing and submitting this form, ensuring compliance with federal regulations.

When is Form 8-K required?

Form 8-K must be filed by companies in various situations. Significant corporate events that trigger the requirement to file include major mergers and acquisitions, changes in executive management, bankruptcy filings, and any other material changes that could affect stockholder decisions.

Timeliness of filing is critical. Companies generally have four business days to file Form 8-K following the occurrence of such events. Delays can lead to penalties, and failure to file correctly may result in increased scrutiny from regulators.

Key components of Form 8-K

Understanding the structure of Form 8-K is essential for accurate reporting. The form consists of various sections that require specific disclosures. Each section serves to inform stakeholders about different aspects of the event being reported.

Required disclosures in Form 8-K include financial information and governance changes, ensuring that investors have the necessary data to make informed decisions.

Reading and interpreting Form 8-K

Deciphering Form 8-K can be challenging due to its technical language. Investors and analysts should be aware of key indicators within the form to understand the implications of reported events.

A practical approach is to focus on disclosures that impact the company's financials, governance structure, and overall operations. Utilizing a step-by-step walkthrough will simplify the analysis of specific filings for clarity.

Benefits of using Form 8-K

The use of Form 8-K offers numerous benefits for companies and stakeholders alike. By enhancing transparency, it builds trust with investors, allowing them to react promptly to significant corporate changes.

Proactive communication during significant events not only reassures stakeholders but also enhances corporate governance practices, promoting accountability within organizations.

Historical context and trends

Form 8-K has evolved significantly since its introduction. Originally, the requirements were less stringent; however, increasing regulatory scrutiny has led to changes in how and when filings are made.

The evolution reflects a broader trend towards increased transparency and timeliness in corporate reporting, underscoring the importance of Form 8-K in today's marketplace.

Form 8-K items explained in detail

Each item in Form 8-K serves a distinct purpose and requires particular information. Here's a breakdown of significant sections:

FAQs about Form 8-K

With the complexities surrounding Form 8-K, businesses frequently encounter common queries. Understanding these can enhance compliance and reporting accuracy.

Interactive tools for Form 8-K management

pdfFiller offers cutting-edge tools that simplify the management of Form 8-K filings. Its user-friendly full suite provides access to templates and eSignature functionalities, streamlining the filling and submission process.

The platform includes collaborative editing features, allowing teams to work together efficiently on Form 8-K filings, all from a cloud-based solution.

Sector-specific insights

Different industries utilize Form 8-K for various purposes, tailoring disclosures based on sector-specific requirements. For instance, the tech sector may file reports based on rapid innovations, while healthcare organizations might focus on regulatory changes.

Understanding these sector trends is important for compliance strategies, as they can unveil emerging challenges and opportunities for improvements in corporate governance.

The future of Form 8-K

As market conditions evolve, so do regulatory demands for Form 8-K. Definitely, future updates may require more detailed disclosures or adjustments to reporting timeliness.

Moreover, technology continues to play a pivotal role in enhancing the Form 8-K process. With ongoing advancements, businesses may experience an anticipated shift in how disclosures are managed and presented.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 8-k directly from Gmail?

How do I edit form 8-k on an iOS device?

How do I complete form 8-k on an Android device?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.