Get the free Annual Governance and Accountability Return 2024/25

Get, Create, Make and Sign annual governance and accountability

Editing annual governance and accountability online

Uncompromising security for your PDF editing and eSignature needs

How to fill out annual governance and accountability

How to fill out annual governance and accountability

Who needs annual governance and accountability?

Your Comprehensive Guide to the Annual Governance and Accountability Form

Understanding the Annual Governance and Accountability Form

The Annual Governance and Accountability Form (AGAF) is a critical document for organizations, particularly in the nonprofit sector, serving as a comprehensive report on governance and financial accountability. This form ensures that organizations remain transparent in their operations, providing detailed insights into their financial health, governance structures, and the outcomes of their initiatives. The AGAF not only represents an organization's compliance with legal requirements but also acts as a trust-building tool among stakeholders, including donors, members, and the general public.

The importance of the AGAF cannot be overstated. It serves as a report card, indicating how well the organization has adhered to its missions and goals. By completing the AGAF, boards and trustees can reflect on their accountability to stakeholders. Furthermore, timely completion of the AGAF guarantees that organizations remain eligible for funding and support from potential partners and grants.

Preparing to fill out the AGAF

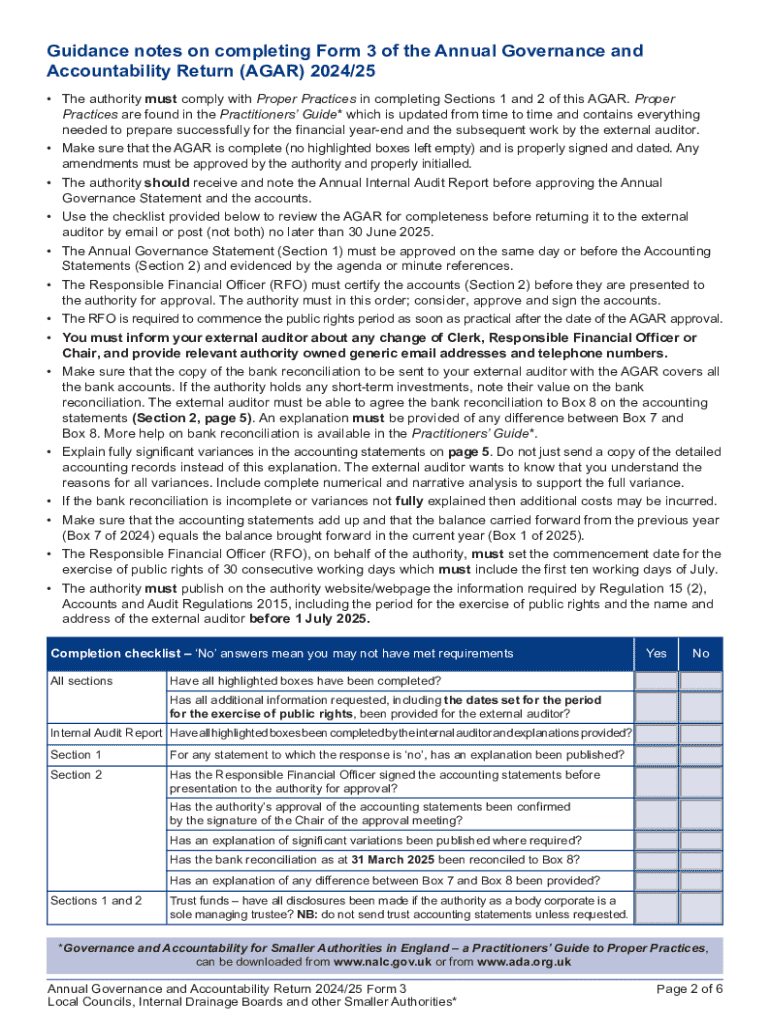

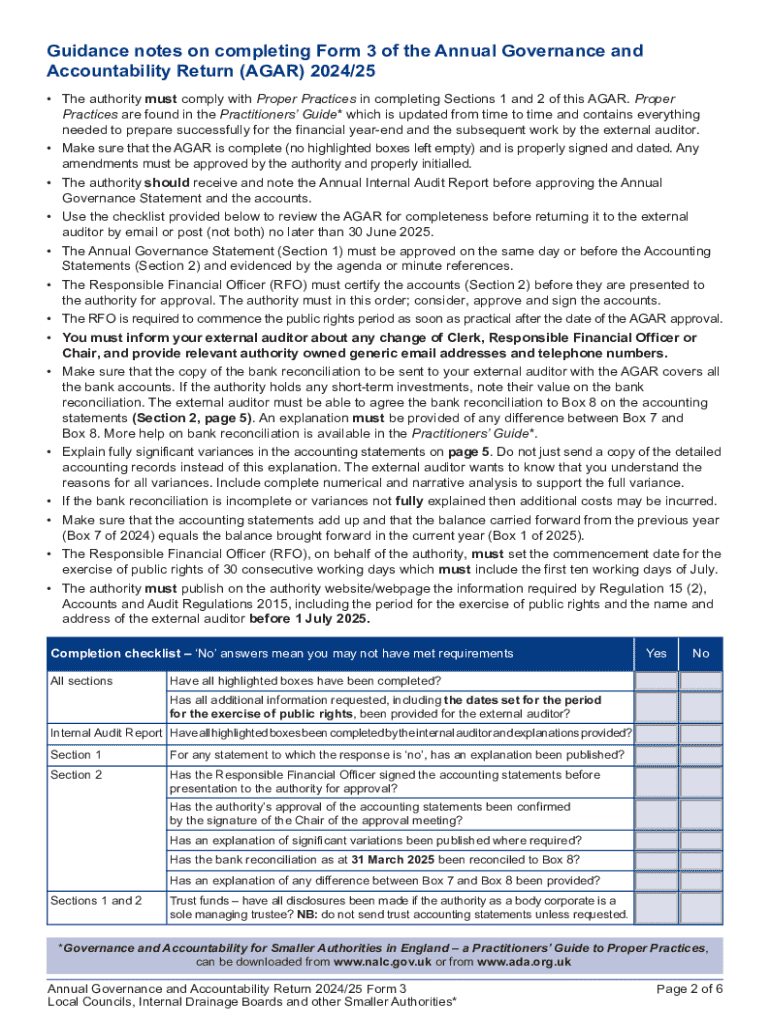

Before you begin filling out the AGAF, it’s essential to gather all necessary documents and information. This helps in ensuring accuracy and completeness in reporting. Key documents needed include financial records such as income statements, balance sheets, meeting minutes from board meetings, and any prior AGAF submissions if applicable. A pre-filing checklist can also be beneficial to ensure that you are not missing any critical information.

Understanding the eligibility and requirements for filling out the AGAF is crucial. Not everyone is required to submit the AGAF; typically, it is mandated for charities and nonprofits operating in the public interest. Misconceptions abound, and it’s vital to clarify who is affected. Organizations with annual income below a set threshold might have different reporting requirements. Confirm the eligibility criteria to avoid unnecessary complications.

Step-by-step guide to completing the AGAF

Completing the AGAF involves systematic execution of each section. The first section requires basic organizational details, including the name, registered address, and contact information of your organization. This information should be entered accurately to avoid delays or complications during processing.

The second section addresses financial information, where you input all relevant income and expenditures for the fiscal year. Utilizing financial statements is crucial for accurate reporting. Move on to the third section to outline governance details: this should include insights into your board members and other governing bodies—who they are, their roles, and how they contribute to governance.

In the fourth section, you will document the outcomes and achievements of your organization. This can include statistical measures of success, personal testimonials from beneficiaries, and any other quantifiable impacts of your work. Providing concrete examples can significantly enhance the perception of accountability.

Interactive tools for AGAF completion

Utilizing pdfFiller’s online editor can significantly streamline the AGAF completion process. The platform offers features that not only allow you to fill out but also edit and electronically sign the document, making it accessible from anywhere. The interactive editor supports easy adjustments, ensuring that the information is up-to-date and accurate. Furthermore, when changes are necessary, the tool allows for swift revisits to your completed document.

Collaboration is also made easy with pdfFiller. Involving team members in the filling-out process can enhance accuracy and clarity of information. Sharing the document is straightforward, and best practices for collecting feedback should include clear communication about areas requiring team input. Establish designated roles to streamline the process further.

Common challenges and troubleshooting tips

Errors in the AGAF can lead to delays or rejections, so it’s helpful to be aware of common pitfalls when completing your submission. Typical mistakes include misreporting financial data, incomplete sections, and failure to provide supporting documents. To avoid these errors, consider having a second pair of eyes review the completed AGAF before submission.

In the event your AGAF is rejected or queried, understanding the response process is essential. You may receive an inquiry for clarification; responding promptly and clearly can often resolve any issues. Keeping communications with the governing body professional and straightforward will foster a positive resolution.

Important dates and deadlines for AGAF submission

Timelines for AGAF filing can vary depending on the jurisdiction, typically aligning with the end of the fiscal year. Organizations must be aware of specific deadlines to ensure compliance. Missing submission dates can lead to penalties or loss of funding opportunities. Setting reminders using online tools or calendar apps can ensure you stay on track.

The consequences of late submission are serious; failing to file on time can jeopardize the organization’s status, affecting everything from public trust to funding eligibility. Being proactive about deadlines is a best practice every organization should implement.

Tips for maintaining compliance and accountability

Post-submission, organizations should maintain copies of their AGAF and related documents securely. Keeping track of documents is crucial in case changes occur after the submission; you may need to refer back to prior data or clarify any discrepancies that arise.

Implementing ongoing governance practices, including diligent record-keeping and regular meetings, builds an atmosphere of accountability. Best practices suggest that transparency should be a core operational value for your organization. This fosters trust and supports the long-term sustainability of your mission.

More information and support

For organizations seeking assistance with the AGAF, various resources are available. Numerous downloadable guides provide detailed insights into the AGAF process, enhancing understanding for first-time filers. Furthermore, seeking professional support from consultants or legal advisors can provide tailored assistance to ensure compliance.

Engaging with community discussions can also be invaluable. Forums and online groups allow organizations to share experiences and insights, providing peer support in navigating the complexities of the AGAF. This community can serve as a knowledge base for troubleshooting, helping organizations learn from one another’s experiences.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out annual governance and accountability using my mobile device?

How do I complete annual governance and accountability on an iOS device?

Can I edit annual governance and accountability on an Android device?

What is annual governance and accountability?

Who is required to file annual governance and accountability?

How to fill out annual governance and accountability?

What is the purpose of annual governance and accountability?

What information must be reported on annual governance and accountability?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.