Get the free R-1070

Get, Create, Make and Sign r-1070

Editing r-1070 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out r-1070

How to fill out r-1070

Who needs r-1070?

Your Complete Guide to the R-1070 Form

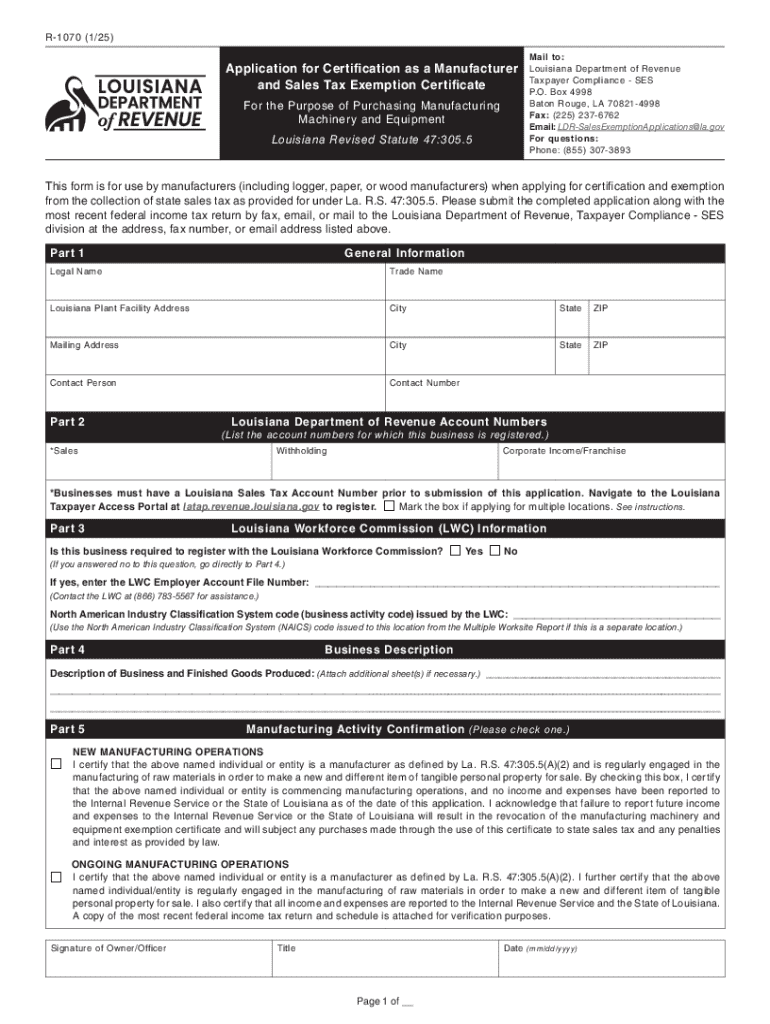

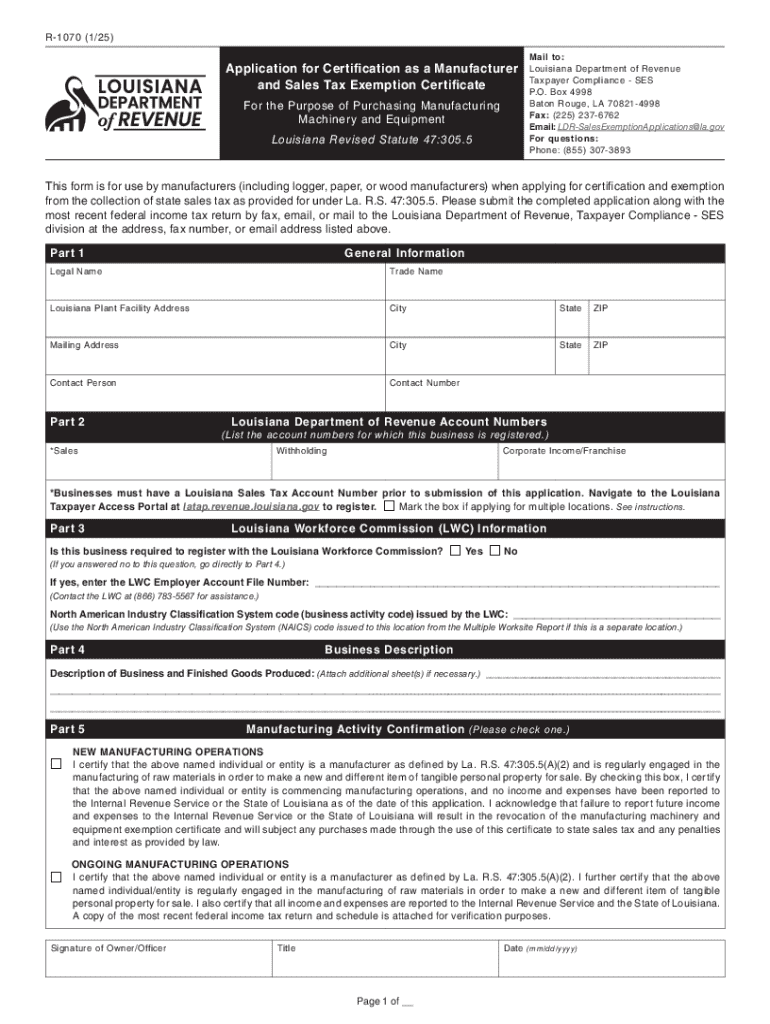

Overview of the R-1070 Form

The R-1070 form serves a critical function in the landscape of manufacturing in Louisiana. Designed specifically for manufacturers seeking tax incentives, this form helps streamline the process of claiming tax exclusions on various capital expenditures. Understanding its purpose is essential for any manufacturing entity to maximize its financial advantages.

For manufacturers, the importance of the R-1070 form cannot be overstated. This form allows businesses to benefit from state tax exclusions that can significantly reduce tax liabilities, encouraging reinvestment back into their companies. The eligibility criteria established for the R-1070 form typically include being classified as a manufacturer and engaging in qualifying manufacturing activities.

Detailed instructions for completing the R-1070 form

Completing the R-1070 form accurately is crucial to avoid any delays or issues with tax benefits. The form consists of multiple sections, each requiring specific information from applicants.

Section 1: Applicant Information

In the first section, you will provide your name, contact information, and other pertinent details. Ensure that the information is current and accurately reflects your business. Common mistakes include typos in contact details and incorrect naming conventions.

Section 2: Business Information

The second section focuses on your business details. You'll need to include your business name, address, registration information, and the type of entity. Make sure you have your business documentation readily available to corroborate the accuracy of the information you provide.

Section 3: Manufacturing Activities

Here, you need to outline the specific manufacturing activities your business engages in. This is critical as only certain activities qualify for tax exclusions. Ensure you also attach the necessary documentation that supports your claims, such as project plans, invoices, or relevant permits.

Section 4: Certification Declaration

The final section requires a certification declaration. Understanding this statement is vital, as it confirms the accuracy of the information you’ve submitted. Make sure to check the signatory requirements to confirm that the appropriate person signs the document to avoid invalid submissions.

Interactive tools available on pdfFiller

pdfFiller enhances the experience of filling out the R-1070 form with its user-friendly interface and interactive tools. One of the standout features is the fillable PDF capabilities, which allow users to complete the form electronically.

Further, pdfFiller offers step-by-step guided assistance, making it easier for users to understand each section's requirements. Teams can also collaborate on the document in real-time, ensuring that multiple stakeholders can review and provide input seamlessly.

Editing and customizing the R-1070 form

Editing pre-filled information is straightforward with pdfFiller. Users can easily change incorrect fields, thus ensuring all details are accurate, which is pivotal when dealing with tax forms. Adding additional notes or attachments can provide context for your submission, enhancing clarity.

Besides, pdfFiller allows formatting and styling options, helping you to present your information clearly. Utilize these options to make your R-1070 form not only correct but also visually appealing.

Signing the R-1070 form

After filling out the R-1070 form, the next step is signing it. pdfFiller provides various eSignature options that make the process quick and easy. Whether you prefer to draw your signature on a touchscreen or upload an image of your signature, pdfFiller accommodates your preference.

It's essential to note that eSignatures are legally recognized in Louisiana. Therefore, adding your signature electronically is valid and binding. Follow these simple steps to add your signature to the document within pdfFiller.

Submitting your R-1070 form

Once the form is completed and signed, the submission process can begin. You have several options for submitting your R-1070 form, whether online or offline. Online submission is often faster and allows for instant confirmation of receipt.

Key deadlines are crucial; be aware of timeframes to ensure you submit your form on time to avoid missing out on tax benefits. After submission, you can expect to receive a confirmation and possibly some follow-up communication if further information is required.

Troubleshooting common issues

While submitting the R-1070 form, you might encounter issues ranging from technical glitches to questions about eligibility. Identifying frequently encountered problems can save you time and effort. Common problems include miswritten information that leads to delays or submissions not being found in the system.

If you encounter issues, don't hesitate to contact customer support or state agencies for assistance. Utilizing pdfFiller’s support resources can also help clarify any questions you may have.

Related documents and forms

It's beneficial to be aware of related documents and forms associated with tax exclusions for manufacturers. These may include applications for sales tax exemption certificates or local tax forms for manufacturers. Keeping organized records of submissions is crucial for future reference and possible audits.

Engaging with additional resources for tax compliance can also keep your business informed and prepared for any changes in legislation that may impact your manufacturing operations.

Additional tips for manufacturers

Effective document management is paramount for manufacturers, particularly when dealing with forms like the R-1070. Employing strategies for ongoing compliance can mitigate risks associated with missed deadlines or documentation errors. Keeping an organized filing system will also ease the burden of information retrieval during audits.

Leveraging pdfFiller for future documentation needs can streamline your processes significantly. It not only facilitates filling out forms but also aids in managing various other documents efficiently.

Next steps after filing the R-1070 form

Once you’ve filed your R-1070 form, it's wise to consider potential audit scenarios. It's not uncommon for manufacturers claiming tax exclusions to be audited, and being prepared can save a lot of stress. Keeping all documentation related to your submission organized can be incredibly beneficial.

Additionally, tracking the application status after submission is essential. Most state departments provide a method for you to check the progress of your application, ensuring you remain informed. Stay proactive in preparing for future tax requirements, as regulations can frequently change.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my r-1070 directly from Gmail?

How do I edit r-1070 online?

How can I fill out r-1070 on an iOS device?

What is r-1070?

Who is required to file r-1070?

How to fill out r-1070?

What is the purpose of r-1070?

What information must be reported on r-1070?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.