A Comprehensive Guide to the Attachment Minority Business Form

Understanding the Attachment Minority Business Form

The Attachment D Minority Business Form plays a critical role for businesses seeking recognition as minority-owned. It provides a structured way for companies to demonstrate their eligibility for programs and opportunities aimed at empowering minorities in the business landscape.

The form is part of a certification process recognized by various institutions.

It is essential for accessing contracts, grants, and support specifically designated for minority businesses.

Proper completion of the form helps convey the legitimacy and operational capabilities of the business.

By grasping the importance of the Attachment D Minority Business Form, businesses can navigate their growth strategies with confidence, ensuring they tap into available resources and networks.

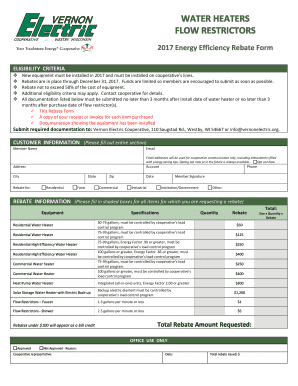

Eligibility criteria for filling out the form

To fill out the Attachment D Minority Business Form, applicants need to understand who qualifies as a minority business. Typically, a business is classified as minority-owned if it is at least 51% owned, operated, and controlled by individuals from recognized minority groups, which include African Americans, Hispanic Americans, Native Americans, Asian-Pacific Americans, and Subcontinent Asian Americans.

Ownership must be verifiable through documentation.

Sole proprietors must provide personal identification along with their business registration details.

Common misconceptions often arise concerning the ethnicity or scope of ownership; applicants should be precise in documentation.

It's crucial for applicants to gather all necessary documentation, including business licenses, tax registrations, and any relevant racial or ethnic identity certifications, to support their claims.

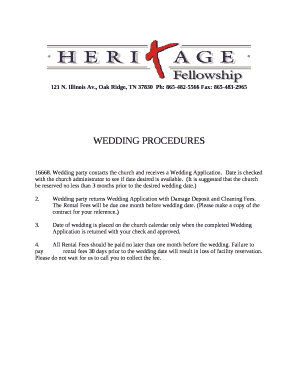

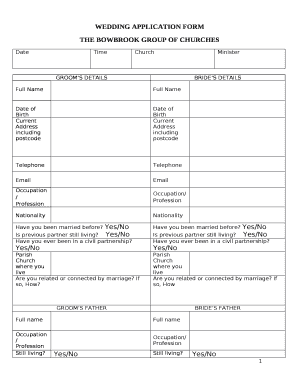

Step-by-step guide to completing the Attachment form

Completing the Attachment D Minority Business Form involves a systematic approach to accurately filling out all required sections. Initially, applicants should gather personal information, including the names and addresses of the owners, and ensure they are ready to define the business structure and ownership percentages.

Gather all personal information, including identification numbers.

Clearly outline the business structure—whether it is a sole proprietorship, partnership, or corporation.

Be prepared to specify ownership information; indicate the percentage of ownership held by minority individuals.

Next, navigate through each section of the form. It's crucial to read instructions carefully and provide accurate data to avoid common pitfalls such as misreported income or incomplete ownership declarations.

Follow each instruction closely for each section.

Utilize checkboxes effectively to indicate necessary items.

Review entries for typos or misrepresentation before finalizing.

Avoiding common mistakes such as incomplete sections, failures to sign, or improperly dated entries can streamline the approval process for your form submission.

Editing and customizing your form

After submission, applicants may find they need to edit their Attachment D Minority Business Form. Knowing how to make changes effectively can save time and effort. It is essential to ensure that any modifications are well-documented and justifiable.

Use pdfFiller tools for easy editing and updates to submitted forms.

Always maintain a record of original and altered documents to ensure clear communication.

Collaborate with team members to ensure all changes reflect the most current operations of the business.

Utilizing these tools can significantly enhance the efficiency of document management, enabling businesses to respond promptly to any regulatory or procedural inquiries.

E-signing the Attachment Minority Business Form

The inclusion of e-signatures has transformed the way businesses handle important documents like the Attachment D Minority Business Form. E-signatures not only facilitate a swift completion process but also enhance the security of signatories.

E-signatures provide legal validity, equivalent to traditional signatures in most jurisdictions.

Using tools like pdfFiller simplifies the signing process, making it accessible for all parties involved.

Ensure all signatories are present and informed about their commitments before signing.

Employing e-signature technology can expedite the approval process, allowing businesses to move forward with their applications and secure vital contracts more efficiently.

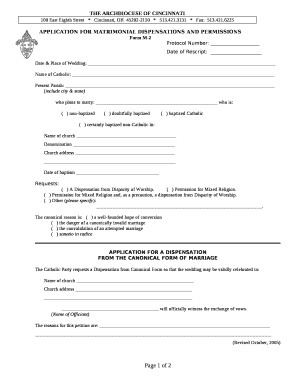

Submission process for the Attachment form

Once the Attachment D Minority Business Form is complete and signed, understanding the submission process is essential in ensuring it reaches the right department. Generally, forms can be submitted either via email, online platforms, or in person, depending on the organization overseeing the certification.

Verify which submission methods are accepted for your form.

Follow instructions explicitly regarding the format and additional documents if necessary.

Be prepared for a follow-up process, which may involve additional documentation requests or clarifications.

After submission, applicants should monitor their application status diligently, as timelines for review can vary based on workload and regulatory requirements.

Managing your minority business certification

Post-submission, managing the status of your minority business certification is vital. Applicants should understand how to track their application status effectively. Regular check-ins can help ensure you stay informed about any additional requirements or deadlines.

Keep records of all submitted documents and correspondence with certifying bodies.

Renew your certification on time, usually required annually or bi-annually, based on state requirements.

Regularly update any changes in business structure, ownership, or contact information to maintain certification validity.

Staying proactive in managing documentation helps avoid lapses in certification status, which can hinder access to important resources.

Leveraging your certification for business growth

Obtaining minority business certification through the Attachment D form opens doors to vast resources and networking opportunities designed to support minority-owned enterprises. This certification not only acts as a badge of credibility but can also facilitate access to contracts reserved for minority businesses.

Explore grant opportunities specifically aimed at minority-owned businesses to help fund your projects.

Engage in networking events that can introduce you to other minority entrepreneurs and potential partners.

Maximize participation in government contracts and programs designed to uplift minority businesses.

Adopting best practices for taking advantage of these resources can significantly enhance your business growth trajectory.

Interactive tools for document management

Choosing pdfFiller can elevate how you manage important documents from creation to submission. With powerful features designed to streamline business processes, it offers scalable solutions for documentation.

The platform provides customizable templates for various business needs, including the Attachment D form.

Users can benefit from real-time collaboration tools, allowing multiple team members to work on documents simultaneously.

pdfFiller's user-friendly interface simplifies document tracking and management, ensuring that users are always aware of their form statuses.

These interactive tools not only boost productivity but also enhance the accuracy and reliability of business documentation.

FAQs about the Attachment Minority Business Form

As applicants navigate through the process of completing the Attachment D Minority Business Form, questions inevitably arise. Common inquiries often revolve around eligibility requirements, processing times, and legal ramifications of the form.

What documentation is necessary for submission of the Attachment D form?

How long does it typically take for my application to be processed?

Are e-signatures legally valid for all submissions?

Addressing these questions early on can help decrease stress throughout the application process, allowing applicants to focus on their core business activities.