Get the free Form 10-k

Get, Create, Make and Sign form 10-k

How to edit form 10-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-k

How to fill out form 10-k

Who needs form 10-k?

A comprehensive guide to Form 10-K: What every investor needs to know

Understanding Form 10-K

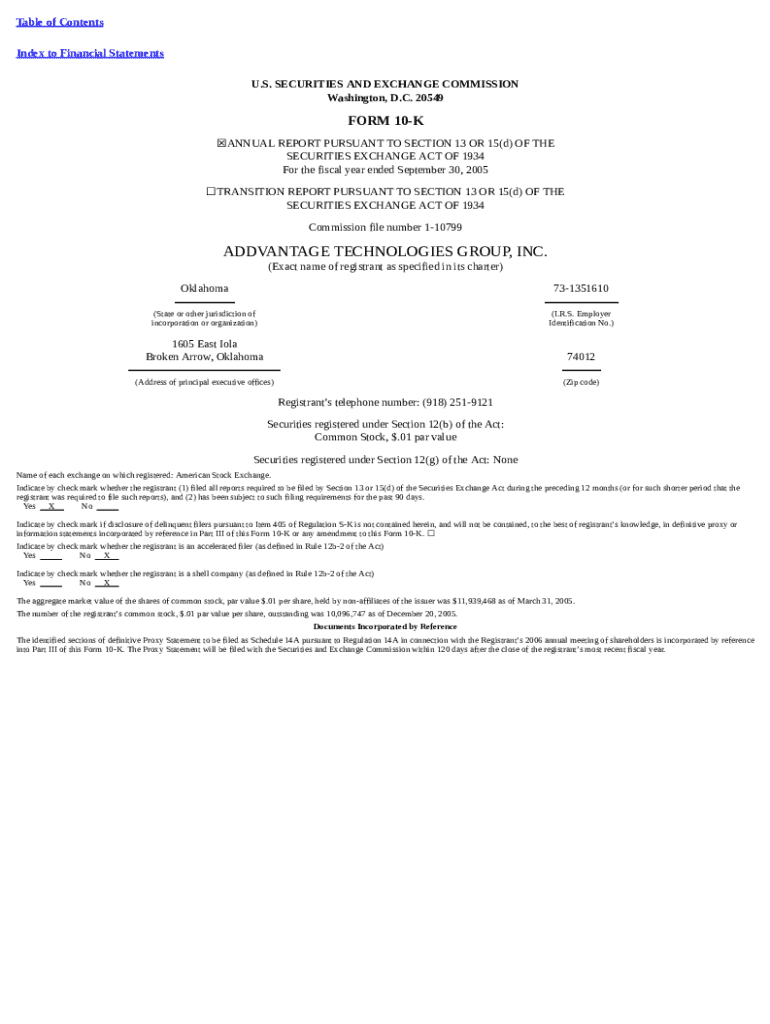

Form 10-K is an annual report that publicly traded companies in the United States are required to file with the Securities and Exchange Commission (SEC). This document provides a comprehensive overview of a company's financial performance, operational strategy, and risk factors over the past fiscal year. The primary purpose of Form 10-K is to disclose vital information to shareholders and potential investors, ensuring transparency in the market.

For investors and stakeholders, the Form 10-K serves as a crucial resource for making informed decisions. Unlike quarterly reports, known as Form 10-Q, the 10-K offers more extensive detail, making it a key reference document for evaluating a company's long-term stability and growth prospects.

Contents of Form 10-K

Form 10-K consists of several mandated sections that provide detailed insights into various aspects of the company. Each section is designed to facilitate a comprehensive understanding of its business and the environment in which it operates. Below is an itemized breakdown of these sections:

Additionally, many companies include forward-looking statements to provide insights into future performance and strategy. These disclosures are essential for investors anticipating changes in the company’s trajectory.

Filing deadlines for Form 10-K

Public companies must adhere to specific filing deadlines for Form 10-K based on their size and filing status. Generally, larger companies designated as 'accelerated filers' must file within 60 days after the end of their fiscal year, while 'non-accelerated filers' have 90 days. Compliance with these regulations is crucial as the SEC closely monitors submission periods.

Not meeting the filing deadline can result in significant repercussions, such as penalties and reputational damage. Furthermore, failure to file timely may restrict a company’s ability to raise capital or impact stock prices negatively.

Five percent ownership disclosure

Under SEC regulations, individuals or entities that acquire more than 5% ownership in a public company must file a Schedule 13D or 13G. This requirement aims to promote transparency about who has substantial influence over the company, thereby protecting the interests of shareholders and maintaining equitable governance.

Companies must accurately disclose changes in significant ownership through timely filings. Misreporting or delays in these disclosures may lead to regulatory scrutiny and potential legal consequences.

Managing your Form 10-K filings with pdfFiller

pdfFiller provides an exceptional platform for creating and managing your Form 10-K filings efficiently. Users can leverage interactive tools to generate the necessary documents directly within the application, ensuring all entries are compliant with SEC requirements.

With its cloud-based document management system, pdfFiller ensures that users can access and manage their filings from anywhere, making it easier to collaborate across teams.

How to find Form 10-Ks

Finding Form 10-K filings is straightforward through several reliable resources. A prime source is the SEC’s EDGAR database, which is a comprehensive repository of all publicly traded companies' filings. Investors can easily access a company’s 10-K filings by searching for the company’s name or ticker symbol.

For historical Form 10-Ks, investors can also explore third-party financial analysis websites that aggregate this data, enhancing the ease of research.

Related forms and filings

In addition to Form 10-K, several other SEC filings are relevant for investors looking to analyze a company’s financial health comprehensively. Notably, Form 10-Q provides quarterly financial updates, while Form 8-K is used for reporting unforeseen events that may affect the company.

Moreover, Form S-1 serves as an essential registration statement for new securities. Understanding these forms not only complements the Form 10-K insights but also allows for a more holistic view of a company's reporting landscape.

Key highlights in a Form 10-K

Investors should focus on specific elements within Form 10-K that can significantly impact investment decisions. The Management's Discussion and Analysis (MD&A) section is particularly critical, as it provides updates on the company’s financial results, including any strategies affecting future performance.

Additionally, understanding the risk factors outlined can provide deeper insights into potential challenges the company may face. Such information can prove invaluable when evaluating the viability of investing in or continuing to hold shares of the company.

Common questions about Form 10-K

For first-time filers, common inquiries arise regarding the appropriate filing process and requirements. One of the most frequent questions pertains to which sections are mandatory and how to accurately report items. To efficiently navigate these queries, companies should consult the SEC's guidance on Form 10-K.

Moreover, understanding the nuances in reporting can significantly aid in maintaining compliance and averting complications during the review.

Resources and tools for filing Form 10-K

Utilizing tools designed for document preparation, such as pdfFiller, can simplify the Form 10-K filing process. These resources not only assist in creating accurate filings but also facilitate the tracking of changes and required revisions. Keeping records and relevant documentation is crucial for audits or future references.

Additionally, seeking legal and compliance resources pertinent to Form 10-K is advisable. This step ensures adherence to all filing regulations and contributes to a smoother reporting process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form 10-k?

Can I sign the form 10-k electronically in Chrome?

Can I create an eSignature for the form 10-k in Gmail?

What is form 10-k?

Who is required to file form 10-k?

How to fill out form 10-k?

What is the purpose of form 10-k?

What information must be reported on form 10-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.