Get the free Schedule of Government Securities Selling Auctions

Get, Create, Make and Sign schedule of government securities

Editing schedule of government securities online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule of government securities

How to fill out schedule of government securities

Who needs schedule of government securities?

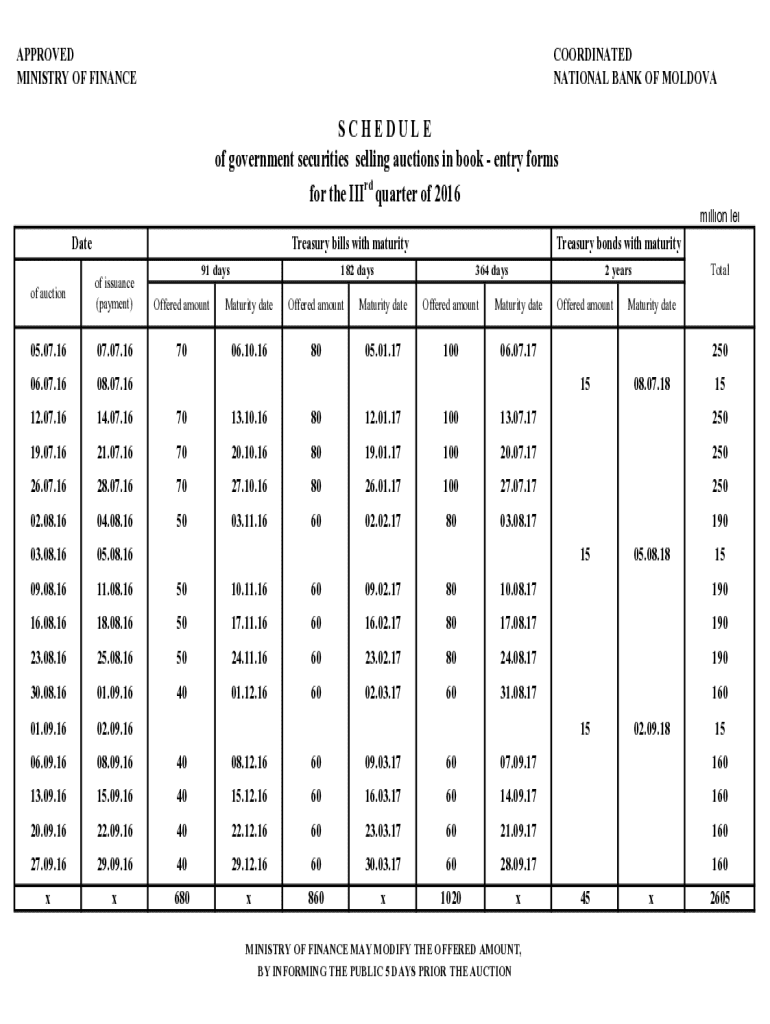

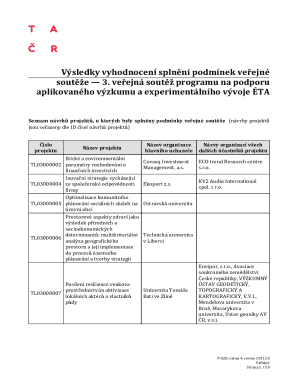

Understanding the Schedule of Government Securities Form

Understanding government securities

Government securities are debt instruments issued by a government to finance its expenditures and are considered one of the safest investments available. These securities function as a means for governments to borrow money from the public and are typically backed by the full faith and credit of the issuing government. Whether through foreign investments or domestic savings, government securities promote capital formation in the economy. Their importance in the financial markets cannot be overstated, as they help stabilize interest rates and provide an essential risk-free benchmark for other financial instruments.

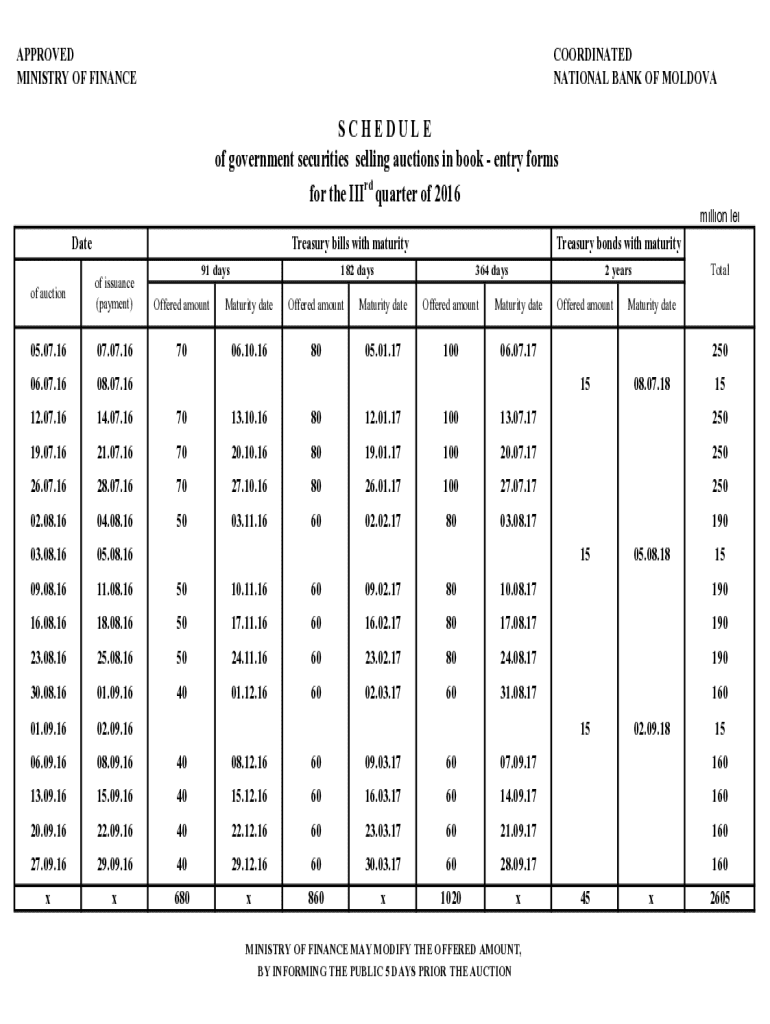

Government securities generally fall into three categories: Treasury Bills (T-Bills), Treasury Notes (T-Notes), and Treasury Bonds (T-Bonds). T-Bills are short-term securities maturing in one year or less, while T-Notes range from two to ten years. On the other hand, T-Bonds have longer maturities, typically exceeding ten years. Investors choose among these options based on their risk tolerance, investment horizon, and yield expectations.

The role of the schedule of government securities

The Schedule of Government Securities serves as a crucial tool for investors and financial institutions. This schedule outlines the details of upcoming issuances of government securities and offers significant insights into the government's borrowing activities. Understanding this schedule enables investors to plan their investment strategies effectively.

The significance of the schedule lies in its provision of key information, including auction dates, interest rates, and maturity profiles of different securities. This information helps both individual and institutional investors navigate the asset allocation process by identifying optimal entry points for investment. Tracking changes in these schedules can also provide insights into the government's fiscal policies and overall economic health.

How to access the schedule of government securities

To access the Schedule of Government Securities, you can find the official form through government financial websites or dedicated investment platforms. Here is a step-by-step guide to locating this essential document online.

It’s essential to stay updated with the most recent version of the schedule. PDFs are widely used, but check for any interactive formats as they might include real-time updating features.

Filling out the schedule of government securities form

Filling out the Schedule of Government Securities Form involves providing detailed personal and financial information. Required details often include your full name, address, Social Security number, and other identification to ensure clarity and security in processing your submission.

In addition to personal information, you may be asked to include specific financial details related to your investment levels and preferences. Accuracy is crucial for preventing delays or issues with your submission. To complete the form effectively, consider the following helpful tips:

Submitting the schedule of government securities form

When it comes to submitting the Schedule of Government Securities Form, you have multiple methods at your disposal. The online submission process is the most efficient, allowing for immediate processing and confirmation. However, if you prefer a more traditional approach, mail-in options are also available.

It's crucial to be mindful of important deadlines associated with your submission, which coincide with auction timelines. Investors should take note of critical dates to ensure they don’t miss out on opportunities to invest in government securities.

Managing your government securities

Once you have submitted your Schedule of Government Securities Form, it's critical to manage your investments effectively. This includes tracking your submission status and confirming receipt with the relevant authorities. Any issues can frequently be addressed through customer support or through direct communication with the treasury department.

Document management can be simplified with tools like pdfFiller, which allows you to edit and revise your submission even after it has been completed. Utilizing e-signatures enhances the security and compliance of your documents, ensuring that your interests are safeguarded throughout the process.

Interactive tools available

To enhance the user experience, pdfFiller offers various interactive tools for users dealing with the Schedule of Government Securities Form. These tools simplify the form completion process, turning what can be a tedious task into a streamlined activity. Templates are available that guide you through the necessary fields, ensuring you don’t overlook any crucial information.

Collaboration tools on pdfFiller allow teams to work together on submissions, ensuring accuracy and efficiency in document preparation. To further assist users, here are some frequently asked questions that address common concerns relating to the Schedule of Government Securities.

Related forms and legislation

It is important to understand the other legal documentation surrounding government securities. Several forms complement the Schedule of Government Securities Form, including forms related to purchase applications, sell orders, and transfer requests. Being familiar with these documents helps ensure that investors make well-informed decisions.

Moreover, relevant laws like the Government Securities Act outline the regulatory framework governing the issuance and management of securities, ensuring that investors’ rights are protected. For more detailed exploration, resources on these related legislations and financial information are indispensable.

Support and assistance

Navigating the complexities of government securities requires access to reliable support systems. Whether you have questions regarding the Schedule of Government Securities Form, face challenges with submissions, or seek clarification on securities, robust customer support options are available. Utilize resources like community forums or direct helplines provided by governmental financial institutions to address inquiries quickly.

Feedback on the form and process is invaluable in improving services. Users are encouraged to provide suggestions and comments to help evolve the framework surrounding government securities.

Keeping up with changes in government securities

Staying informed about changes in auction schedules and other relevant timelines is essential for investors actively participating in the government securities market. Subscription services and email alerts can provide timely notifications regarding updates on auctions, schedules, and new security releases.

Utilizing digital platforms effectively positions investors to capitalize on emerging opportunities and adapt quickly to shifts in the market landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send schedule of government securities for eSignature?

How can I edit schedule of government securities on a smartphone?

How do I fill out schedule of government securities using my mobile device?

What is schedule of government securities?

Who is required to file schedule of government securities?

How to fill out schedule of government securities?

What is the purpose of schedule of government securities?

What information must be reported on schedule of government securities?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.