Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Understanding Form 990: A Comprehensive Guide for Nonprofits

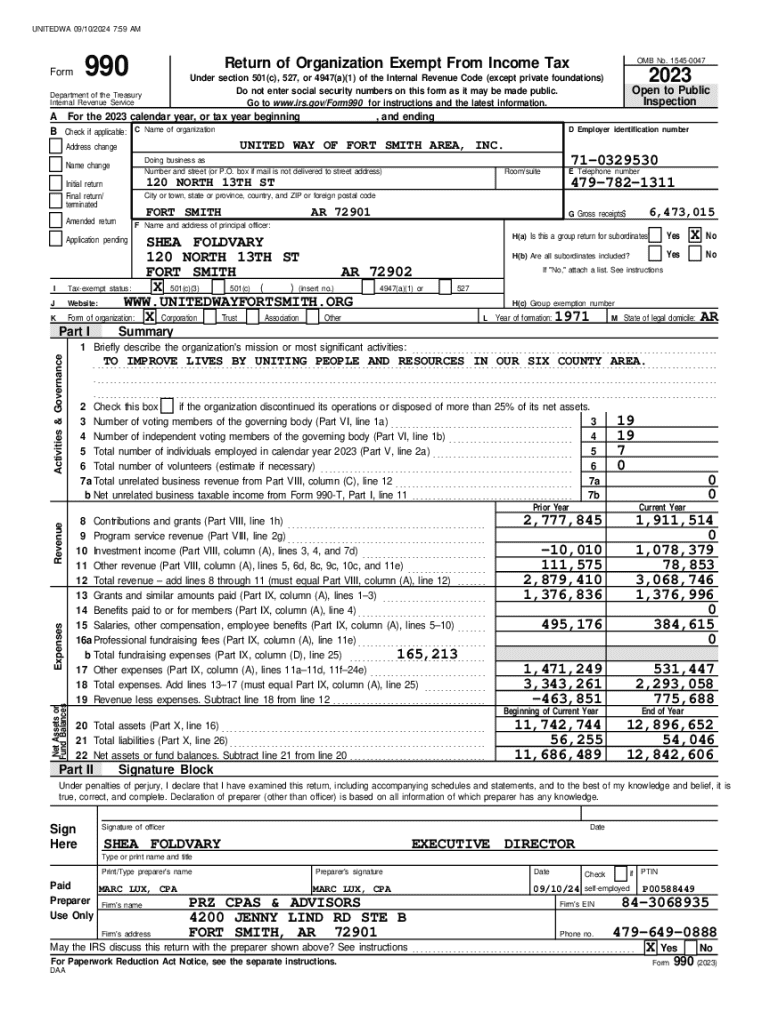

Understanding Form 990: An overview

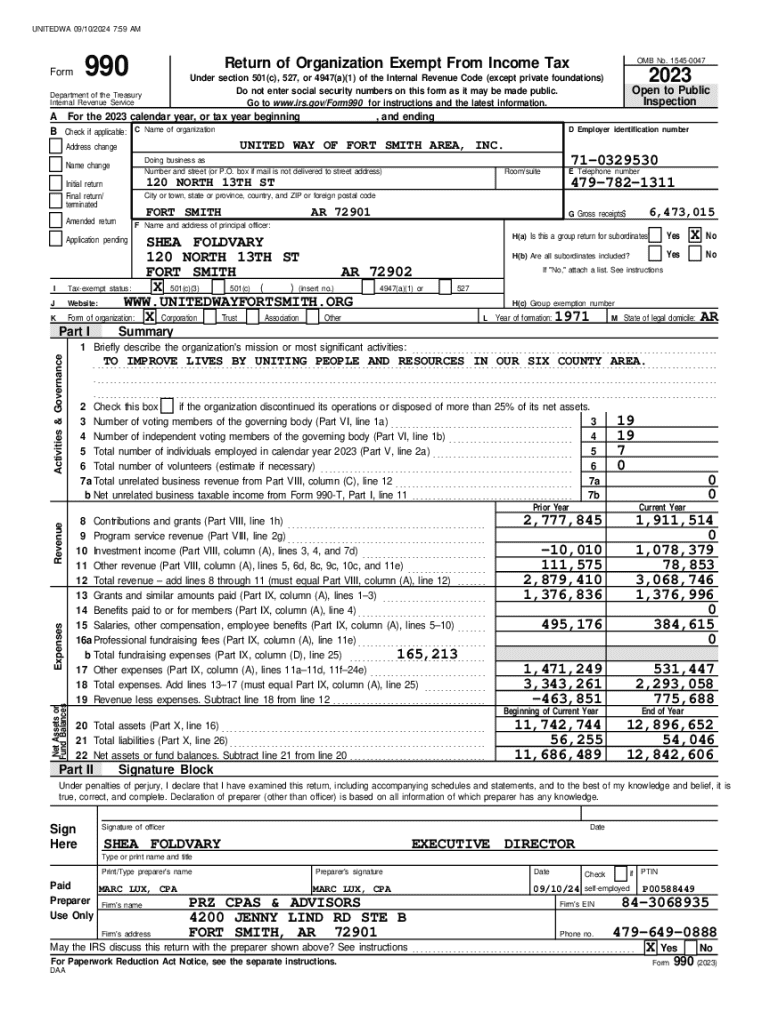

Form 990 is a critical document required by the Internal Revenue Service (IRS) for tax-exempt organizations in the United States. Its primary purpose is to provide transparency by reporting financial information, governance, and program accomplishments of nonprofits. The form showcases how organizations operate, their funding sources, expenses, and compliance with federal tax regulations.

Various types of organizations must file Form 990, including 501(c)(3) charities, private foundations, and certain other tax-exempt entities. The importance of Form 990 cannot be overstated as it plays a vital role in maintaining trust between nonprofits and their donors, enabling public accountability while assisting in the safeguarding of tax-exempt status.

The structure and components of Form 990

Form 990 is structured into several sections, each serving a unique purpose. Understanding each part is essential for accurate completion.

Additionally, some schedules must accompany Form 990, providing deeper insights into specific areas of operation. For instance, Schedule A confirms the public charity status, Schedule B reports contributions received, and Schedule C covers political campaign and lobbying activities, establishing a foundation for transparent communication with the public.

Filing requirements for Form 990

Not every nonprofit is obliged to file Form 990. Organizations must consider income thresholds, which dictate the specific forms required based on financial performance. For example, organizations with gross receipts under $50,000 may qualify to file Form 990-N, also known as the e-Postcard.

Understanding the filing deadlines and potential extensions is equally crucial. Generally, Form 990 is due on the 15th day of the 5th month after the end of the organization's fiscal year. For those unable to meet this deadline, an extension can be requested. Organizations should be diligent about ensuring they file on time to maintain their tax-exempt status.

Penalties for non-compliance

Organizations that fail to file Form 990 on time can face significant financial penalties. The IRS imposes fines, which can accumulate if the organization does not file for multiple years. In severe cases, failure to file may result in the revocation of tax-exempt status, which complicates fundraising efforts and diminishes public trust.

It's crucial for nonprofits to understand the importance of compliance with the filing of Form 990 to avoid these penalties. Establishing a systematic approach to filing, with clear reminders and checks in place, can help mitigate risks associated with late or incomplete submissions.

Public inspection regulations

Form 990 is a vital tool for public transparency, and there are strict regulations governing public access to this form. Each nonprofit organization is required to make its Form 990 available for public inspection within 30 days of request. This means that donors, grantors, and the general public can access organizations’ fiscal information to ensure that their contributions are used effectively.

Transparency serves as a trust-building mechanism between donors and the nonprofit sector. Accessing Form 990 records can be done through the IRS website or various charity watchdog organizations that compile these reports, enhancing the ability to evaluate potential donations or partnerships.

Historical context of Form 990

The evolution of Form 990 has been significant since its introduction, with the form undergoing key changes to promote greater transparency and accountability. Early iterations of the form were less comprehensive, focusing primarily on basic financial data. However, over the years, the form has expanded to include detailed schedules addressing governance, salaries, and volunteer efforts.

This evolution has shaped the way nonprofits operate, emphasizing the importance of detailed record-keeping and the disclosure of extensive financial activities. Enhanced reporting through Form 990 has encouraged nonprofits to adhere to stricter financial and ethical guidelines, ultimately benefiting the entire sector.

Utilizing Form 990 for charity evaluation research

Researchers and analysts can leverage Form 990 data to evaluate nonprofit organizations effectively. The form contains valuable information regarding financial health, program effectiveness, and governance structures. Financial health indicators, such as revenue sources, expense allocation, and net assets, are critical in assessing an organization's operational stability.

Case studies showcase the utility of Form 990 data, showcasing organizations that have improved through insights gleaned from analyzing their reporting. Understanding trends in funding, program accomplishments, and financial management strategies helps organizations make informed decisions that align with mission objectives.

Variants of Form 990

Not all nonprofits are required to file the full Form 990. Depending on the size and type of organization, there are different variants available: Form 990-EZ and Form 990-N. Organizations with gross receipts under $200,000 and total assets under $500,000 can file Form 990-EZ, while the smallest entities with gross receipts of $50,000 or less use Form 990-N.

Understanding when to use each variant is essential for compliance. Filing the correct form helps demonstrate an organization's commitment to transparency while ensuring alignment with IRS requirements.

Filing modalities

When it comes to filing Form 990, organizations can choose between digital submission and paper filing. Electronic filing is preferred due to its efficiency and quicker processing times by the IRS. For those opting for eFiling, following the official IRS guidelines ensures compliance.

Ensuring compliance during submission involves thorough double-checking of entries and ensuring all required schedules are completed as necessary.

Best practices for completing Form 990

Completing Form 990 accurately is crucial for maintaining credibility and compliance. Here are some best practices to consider:

Using tools like pdfFiller can facilitate the process, allowing for seamless form completion, including functionalities for editing, signing, and collaborating with team members.

Collaborating on Form 990 with your team

Collaboration is vital when preparing Form 990, especially for larger organizations with multiple contributors. Platforms like pdfFiller enhance collaboration through integrated tools.

Managing document versions to track changes helps maintain clarity throughout the preparation process, reducing confusion.

Frequently asked questions about Form 990

Many organizations have questions regarding Form 990. Here are some of the most frequently asked queries:

Additional considerations for Form 990

Beyond federal filing, organizations must consider state reporting requirements. Many states have their own rules regarding the transparency of nonprofit organizations and may require separate filings, which highlights the importance of being aware of both federal and state regulations.

Furthermore, Form 990 significantly influences grant applications and funding opportunities, as many foundations evaluate potential grantees based on their transparency and financial reporting. A well-prepared Form 990 builds credibility and can be advantageous in securing essential funds.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 990?

How do I make edits in form 990 without leaving Chrome?

How can I fill out form 990 on an iOS device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.