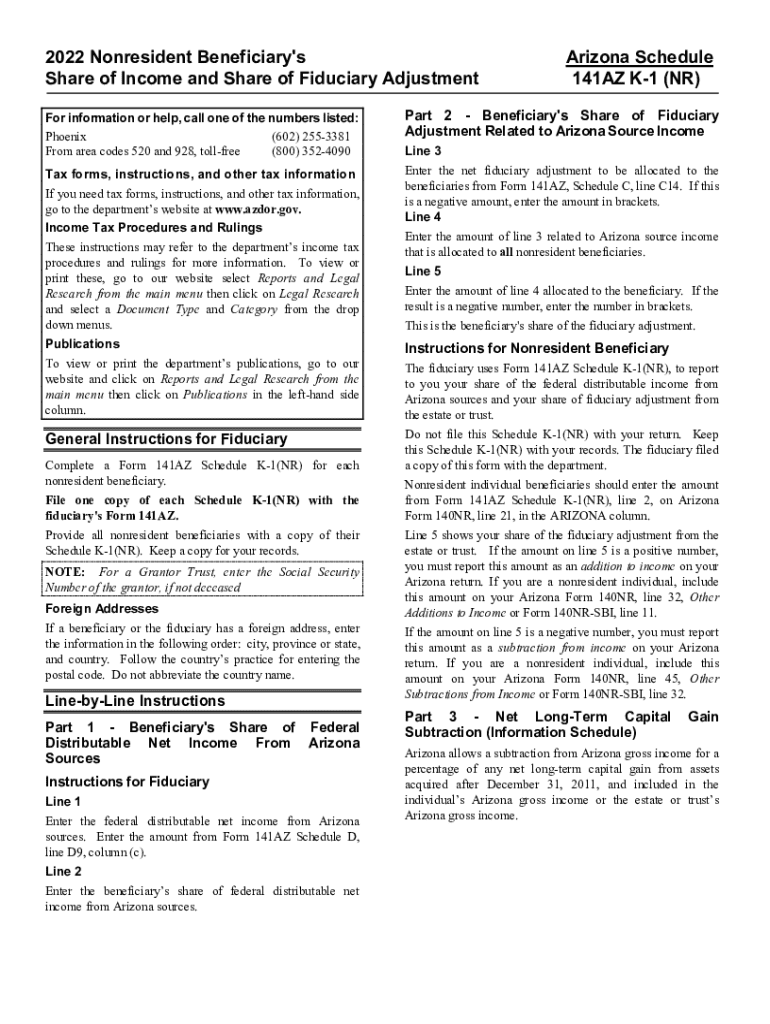

Get the free Arizona Schedule 141az K-1 (nr)

Get, Create, Make and Sign arizona schedule 141az k-1

Editing arizona schedule 141az k-1 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out arizona schedule 141az k-1

How to fill out arizona schedule 141az k-1

Who needs arizona schedule 141az k-1?

A comprehensive guide to the Arizona Schedule 141AZ K-1 Form

Overview of Arizona Schedule 141AZ K-1 Form

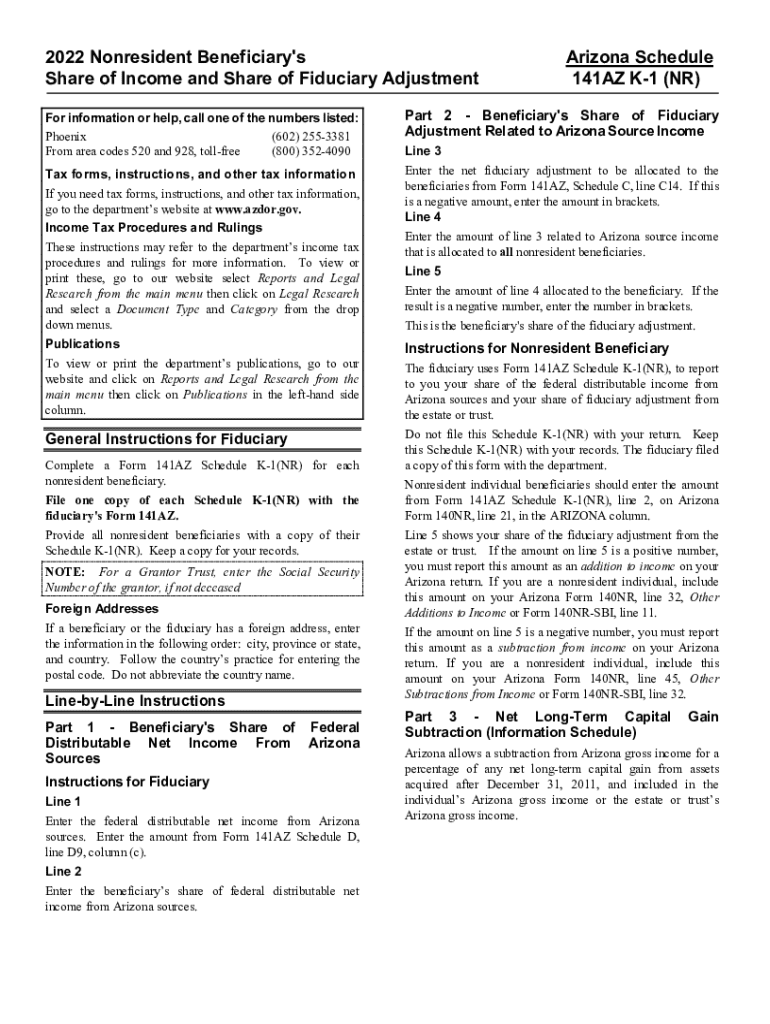

The Arizona Schedule 141AZ K-1 Form is an essential document utilized in the state of Arizona for reporting income, deductions, and credits from partnerships and S corporations to their individual partners or shareholders. It is a counterpart to the federal Schedule K-1 but tailored to meet Arizona's specific tax regulations. Understanding the role and details of this form is crucial for accurate tax filings in Arizona.

Reporting personal income in Arizona can be a complex process, making the Schedule K-1 vital for individuals involved in partnerships or S corporations. Unlike the federal version, which serves a broader audience, the Arizona K-1 has unique features that align with state tax requirements, emphasizing income sourced within Arizona.

Eligibility criteria for using Arizona Schedule 141AZ K-1

Eligibility to file the Arizona Schedule 141AZ K-1 revolves around the nature of the entity and its structure. Generally, individuals involved in partnerships, S corporations, estates, and trusts are required to file this form. It's vital for taxpayers to understand their obligations to avoid future compliance issues.

Partnerships are typically the most common entities required to complete the K-1 form, as they operate under a pass-through taxation structure. S corporations must also file this document, ensuring that each shareholder receives a report of their share of the corporation's income, gains, losses, deductions, and credits. Additionally, estates and trusts that generate taxable income may need to disclose income distributions to beneficiaries through K-1.

Detailed instruction for completing the Arizona Schedule 141AZ K-1

Completing the Arizona Schedule 141AZ K-1 requires careful attention to detail. The first step involves collecting all the necessary documentation to ensure accuracy. This includes prior year tax returns, the entity’s operating agreement, and financial statements. Accurate tax identification numbers for both the entity and its members are critical in this stage.

Once the required information is gathered, you can begin filling out the form. The completion process typically involves multiple sections, starting with partner or shareholder identification, followed by allocations of income, losses, deductions, and credits. Each section must accurately reflect the financial transactions of the entity to avoid discrepancies.

Being aware of common pitfalls, such as misreporting income or overlooking deductions, is essential for a smooth filing process. Finally, review the completed form thoroughly to verify its accuracy, ensuring that all figures align with the entity's financials and prepare for submission.

Filing process for Arizona Schedule 141AZ K-1

The filing process for the Arizona Schedule 141AZ K-1 is crucial, with specific deadlines that must be adhered to in order to avoid penalties. Typically, the form must be filed concurrently with Arizona Form 140 on or before the tax deadline, which is usually April 15th. However, for partnerships with fiscal years, the deadline may differ.

When it comes to submitting the K-1, individuals can choose between e-filing and traditional paper filing. E-filing is generally more efficient, allowing for quicker processing times and confirmation of receipt. Nonetheless, paper filing can still be relevant for those who prefer or are required to utilize traditional methods. Regardless of the chosen method, timely submission is essential to avoid incurring penalties associated with late filings.

Understanding related forms and additional requirements

Filing the Arizona Schedule 141AZ K-1 often necessitates awareness of other associated forms that may be required in conjunction with the K-1. One of the primary forms is Arizona Form 140, which serves as the main tax return for individuals. Additionally, Arizona Form 141 may be necessary for those seeking a more detailed reporting of their income.

It is crucial for filers to be familiar with the requirements associated with these forms, as well as any local documentation needed to support claims made on the K-1. Ensuring all relevant accompanying documents are included in the submission can significantly streamline the review process.

Handling errors and amendments

When working with the Arizona Schedule 141AZ K-1, common errors can arise that may necessitate corrections post-submission. Common mistakes include misreported amounts, incorrect entity identification, or missing information. If errors are detected, it’s critical to take immediate action to rectify the mistakes, typically through an amended filing.

Amending a previously filed K-1 involves submitting a new form that clearly indicates the corrections made. Keeping accurate records of both the original and amended forms is vital for personal reference and future audits. Following up with the Arizona Department of Revenue ensures that the changes are acknowledged.

Resources for assistance and additional support

Filing the Arizona Schedule 141AZ K-1 can be a daunting process, especially for first-time filers. Fortunately, there are numerous resources available to assist taxpayers in navigating the complexities of this form. Online tools, such as tax preparation software and guides, can streamline the process, ensuring that all necessary information is captured efficiently.

Furthermore, seeking assistance from professional services, such as certified tax advisors or accountants who specialize in Arizona taxes, can provide filers with expert guidance tailored to their unique situations. Communities and forums dedicated to tax advice can also be valuable resources for answering specific questions related to the Schedule 141AZ K-1.

Key takeaways for efficient management of Arizona Schedule 141AZ K-1

Filing the Arizona Schedule 141AZ K-1 requires attention to detail, adequate preparation, and knowledge of the surrounding requirements. By adhering to best practices, taxpayers can ensure not only compliance but also a smoother filing experience. Key strategies include maintaining accurate records, verifying all reported information for consistency, and staying updated on any changes to Arizona tax laws that may impact the filing process.

Incorporating tools such as the services offered by pdfFiller can enhance the ease of managing tax documents, facilitating smoother editing, signing, and collaboration. Staying proactive about tax changes will empower individual taxpayers and businesses alike to manage their filings effectively, leading to responsible tax practices and reduced risks of penalties.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my arizona schedule 141az k-1 in Gmail?

How do I fill out the arizona schedule 141az k-1 form on my smartphone?

How do I fill out arizona schedule 141az k-1 on an Android device?

What is arizona schedule 141az k-1?

Who is required to file arizona schedule 141az k-1?

How to fill out arizona schedule 141az k-1?

What is the purpose of arizona schedule 141az k-1?

What information must be reported on arizona schedule 141az k-1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.