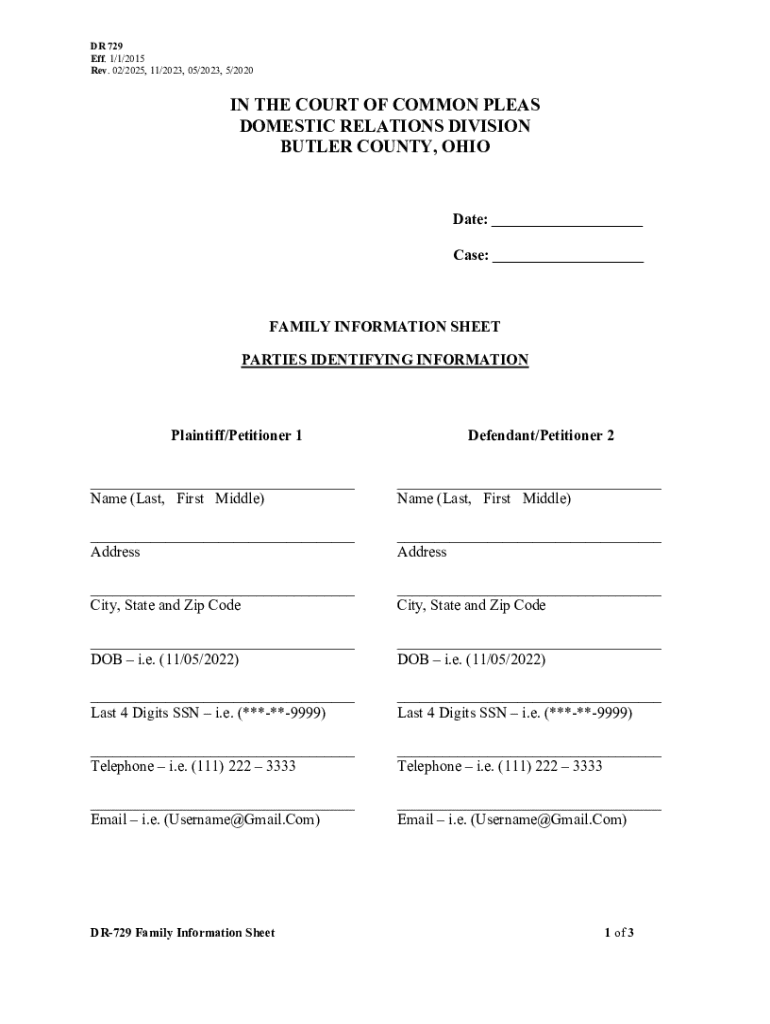

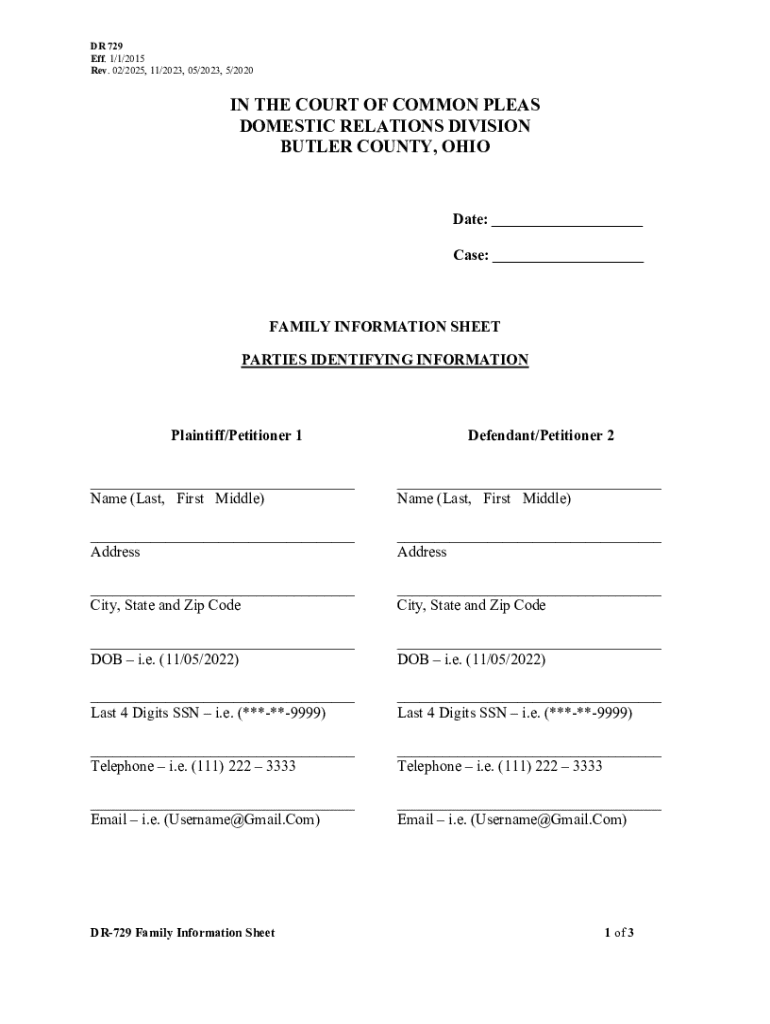

Get the free Dr 729

Get, Create, Make and Sign dr 729

How to edit dr 729 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dr 729

How to fill out dr 729

Who needs dr 729?

Your Complete Guide to the DR 729 Form

Understanding the DR 729 form

The DR 729 form serves a critical role in various administrative and legal processes. Primarily, it is utilized to report and document transactions related to property ownership, ensuring that any transfer of title is recorded accurately. This form helps in maintaining a transparent record of ownership changes, which is essential for legal purposes. For individuals or organizations involved in real estate transactions, the DR 729 form is indispensable in facilitating lawful ownership transfer and safeguarding against future disputes.

Understanding who should use the DR 729 form is equally important. The target audience primarily comprises individuals, families, and organizations such as real estate agencies or legal teams handling property transfers. Anyone involved in buying or selling property must familiarize themselves with this form to ensure compliance with local regulations and practices.

Accessing the DR 729 form

Locating the DR 729 form is straightforward, as it is available through several official channels. The easiest way to access it is via the state’s official government website, which often provides the latest forms in multiple formats, including PDF and DOCX. Additionally, platforms like pdfFiller offer direct links to the form, ensuring users can easily navigate to it.

To download the form, follow these simple steps: 1. Visit the designated authority's website or pdfFiller’s site. 2. Search for 'DR 729 form.' 3. Click on the download link, choosing your preferred file format. 4. If you're accessing it on mobile, ensure your device has a PDF reader installed to view the form correctly. This method ensures you can retrieve the form swiftly, regardless of your device.

Filling out the DR 729 form

Filling out the DR 729 form requires attention to detail, as every section plays a crucial role in documenting property transactions. The form typically includes sections for personal information, transaction details, and terms of the agreement. Each of these sections must be completed accurately to avoid any delays in processing your submission. A common pitfall is omitting required fields, so always double-check that every section is filled out completely.

To complete the form step-by-step, start with your personal information at the top, including your name, address, and contact details. Next, detail the transaction specifics, such as the property’s address and the nature of the transaction. Avoid ambiguities; clarity is critical. For example, if you’re transferring ownership, clearly state the previous owner's name and the new owner’s name. Examples of completed sections can help guide you, ensuring that your entries are formatted correctly and comprehensively.

Editing the DR 729 form

Editing the DR 729 form can be efficiently managed using pdfFiller. This platform provides various editing features that allow users to modify their forms seamlessly. You can upload the completed DR 729 form directly into pdfFiller, where it can be edited easily. Whether you need to make small changes to the text, add annotations, or modify the layout, pdfFiller offers a user-friendly interface tailored for such tasks.

Within pdfFiller, you have access to tools that allow for text editing, formatting, and adding comments or notes. For a customized experience, you can adjust layout elements, such as margins and font sizes, to fit personal preferences. Utilizing these tools can enhance the clarity and presentation of your DR 729 form, ensuring it meets all necessary standards.

Signing the DR 729 form

Signing the DR 729 form is a critical step, as it signifies acceptance of the terms outlined in the document. The legal implications of failing to sign or using an incorrect method can be significant, including potential delays or invalidation of the transaction. Users have the option of employing digital signatures through platforms like pdfFiller or opting for traditional handwritten signatures.

To eSign your DR 729 form using pdfFiller, simply navigate to the signing section within the platform. Follow the on-screen instructions, which typically involve inputting your signature, either by drawing it or uploading a scanned image. pdfFiller implements rigorous security measures to ensure your digital signature is both valid and secure, providing peace of mind as you complete your paperwork.

Submitting the DR 729 form

The submission of the DR 729 form can take several forms, including in-person delivery, online submission, or sending it via mail. Each method has its own set of instructions tailored to ensure compliance with local government regulations. When submitting in person, ensure you arrive prepared with all required documents. If opting for online submission, verify that you are using the correct portal as per your local authority’s guidelines.

Tracking your submission is equally important. Verify submission status by retaining any confirmation emails or receipts provided during the process. If issues arise, you can contact the appropriate office by phone or email for assistance, ensuring timely resolution of any potential problems.

Managing the DR 729 form after submission

After submitting the DR 729 form, it's essential to anticipate any follow-up requirements or responses. Depending on the nature of your submission, you may receive notifications or requests for additional information. Keeping a careful record of all documents related to your submission is vital, as it facilitates any necessary follow-ups or clarifications.

Storing your completed DR 729 form securely is equally important. Utilize pdfFiller’s cloud storage options for a convenient and secure method to keep your documents organized and accessible. This ensures that you can refer back to your documents whenever necessary while also safeguarding them from potential loss.

Additional support for the DR 729 form

For any further inquiries regarding the DR 729 form, users often turn to Frequently Asked Questions (FAQs) sections on relevant websites. This resource can answer numerous common queries, providing clarity on the form and its processes. From understanding submission guidelines to resolving specific issues, FAQs can serve as a valuable tool.

Additionally, contacting the necessary authorities for personalized assistance can provide further support. Many local government offices have dedicated contact numbers and email addresses, allowing users to reach out easily with any unique concerns or questions they may have regarding their submissions.

Continuous improvement with pdfFiller

pdfFiller isn’t just a solution for the DR 729 form; it can also cater to a wide array of document needs. Whether you’re handling tax forms, contracts, or any other paperwork, pdfFiller offers a versatile platform to streamline document management efficiently. This adaptability makes it an invaluable tool for individuals and teams looking to simplify their administrative processes.

Users have shared numerous success stories outlining how pdfFiller has transformed their approach to document handling. From increasing productivity to ensuring compliance with various forms, this platform has proven to be beneficial in enhancing organizational workflows. Regular usage of pdfFiller can help you adapt to any emerging paperwork requirements with ease and professionalism.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my dr 729 in Gmail?

How can I edit dr 729 on a smartphone?

How do I complete dr 729 on an Android device?

What is dr 729?

Who is required to file dr 729?

How to fill out dr 729?

What is the purpose of dr 729?

What information must be reported on dr 729?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.