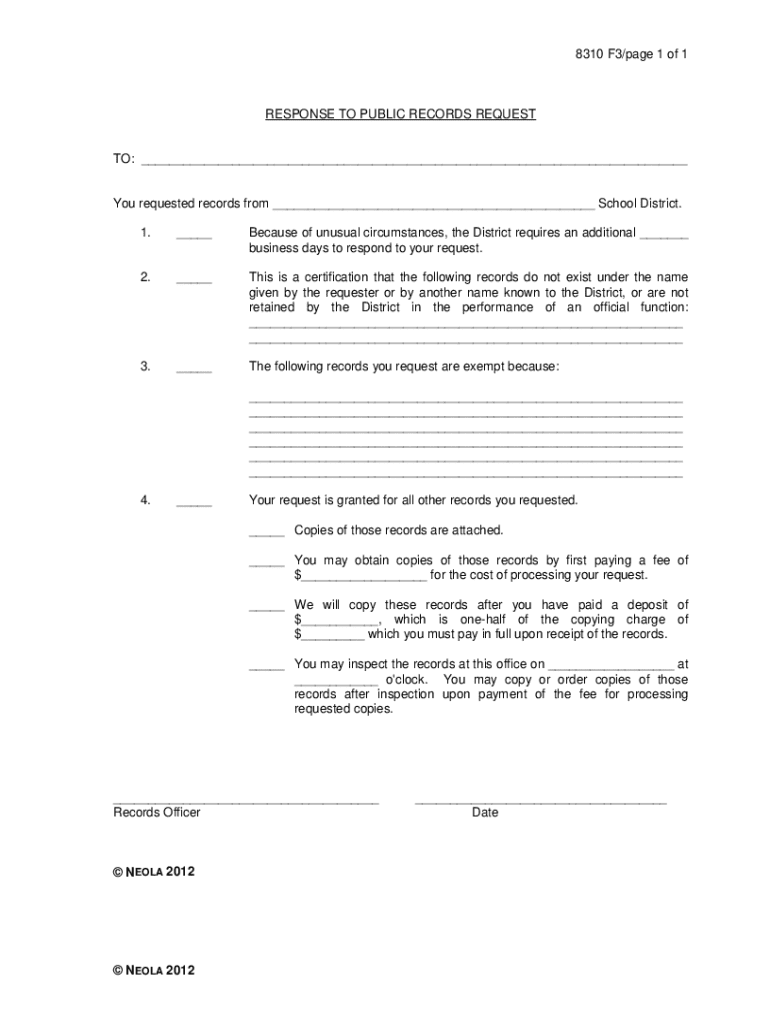

Get the free 8310 F3

Get, Create, Make and Sign 8310 f3

Editing 8310 f3 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 8310 f3

How to fill out 8310 f3

Who needs 8310 f3?

Comprehensive Guide to the 8310 F3 Form

Understanding the 8310 F3 Form

The 8310 F3 form serves distinct purposes across various domains, primarily within financial and tax contexts. Its significance lies in facilitating accurate data reporting and compliance with applicable regulations, making it essential for both individuals and businesses. Whether as a means of reporting income, declaring liabilities, or verifying financial stability, this form plays a critical role in transparency and accountability.

Commonly, the 8310 F3 form is utilized during tax filings, grant applications, or any scenario that requires a legitimate financial declaration. It’s vital for certified accountants, tax professionals, and entrepreneurs who engage with government agencies or financial institutions to ensure compliance and avoid penalties.

Who needs to use the 8310 F3 Form?

The target audience for the 8310 F3 form encompasses a diverse group, including individuals filing tax returns, small business owners, and financial advisors. Each of these groups has specific situations that require the submission of this form, either as part of their annual tax preparation or for obtaining loans and grants.

Getting started with the 8310 F3 Form

Accessing the 8310 F3 form has been simplified in today's digital environment. Users can conveniently download the form directly from relevant government websites or utilize resources such as pdfFiller for a straightforward experience. The pdfFiller platform enables you to access various templates, including the 8310 F3 form, enhancing ease of use.

When preparing to fill out the 8310 F3 form, understanding the required information is crucial. Typically, individuals and businesses must provide personal identification, financial data, and relevant documentation that supports their claims. This may include income statements, previous tax returns, and business licenses, which reinforce both accuracy and legitimacy.

Step-by-step guide to filling out the 8310 F3 Form

Breaking down the form into sections helps streamline the filling process. First, the Personal Information Section requires accurate personal details. This includes full names, addresses, and identification numbers. Accuracy is essential here to prevent delays or rejections of the submission.

Next, the Financial Information Section covers a comprehensive account of your income and expenses. This section may include various calculations to determine net income or liabilities. It's advisable to double-check any figures you enter to maintain integrity throughout the document.

Finally, the Signature and Certification Section emphasizes the importance of electronic signatures. Using pdfFiller, you can easily add a legally binding eSignature, ensuring that your submission is not only compliant but also secure.

Tips for error-free completion

To ensure the 8310 F3 form is completed without errors, avoiding common pitfalls is crucial. One primary consideration is ensuring that all sections are filled out completely. Omitting a small detail can lead to complications. Additionally, regularly reviewing entries before submission is recommended; it helps verify the accuracy of the information provided.

Editing and managing the 8310 F3 Form

Once the initial draft of the 8310 F3 form is completed, utilizing pdfFiller’s editing tools can elevate your document's accuracy. The platform offers robust editing capabilities that make adjusting any component of the form not only easy but efficient. You can add or remove sections, modify text, and adjust layouts as needed, ensuring that your final submission meets all necessary specifications.

Furthermore, collaboration is a significant aspect of managing your 8310 F3 form. With pdfFiller, you can share your form seamlessly with colleagues or advisors for feedback. This feature is particularly beneficial when you’re working on a complex financial statement that might require insights from other professionals.

Signing the 8310 F3 Form

Understanding electronic signature requirements for the 8310 F3 form is essential. eSignatures are legally recognized and offer a secure method of signing documents. pdfFiller ensures that your signature complies with legal standards while also maintaining the security necessary for financial documents.

Completing the signing process is straightforward on pdfFiller. You can navigate through the signing options available and pick the one that best suits your needs. Additionally, options for additional authentication or witnessing can be accommodated if required by your specific situation.

Submitting the 8310 F3 Form

Proper submission of the 8310 F3 form is crucial for ensuring that your information is processed correctly. Depending on your situation, this may involve submitting the form directly to different authorities or organizations, such as the IRS or your banking institution. Each entity may have specific procedures, so it's vital to follow those to avoid any complications.

Additionally, using pdfFiller streamlines the submission process. The platform provides numerous options for submission, including directly emailing the form or printing it out for mailing. Tracking your submission through pdfFiller’s tools is also recommended, as it helps you maintain awareness of its status.

Troubleshooting common issues with the 8310 F3 Form

Encountering issues while filling out the 8310 F3 form is commonplace, especially for those unfamiliar with its requirements. Frequently asked questions can clarify common concerns regarding form requirements, completion, and submission processes. Gathering insights into these areas can simplify your experience.

In case of technical difficulties, pdfFiller provides customer support tailored to address common challenges users may face. The platform’s help center is equipped with resources and assistance options that can guide you toward resolving issues quickly.

Additional tools and features of pdfFiller for form management

Beyond the specific capabilities for the 8310 F3 form, pdfFiller offers comprehensive document management solutions. Users can effectively organize, edit, and manage a variety of documents, resulting in improved productivity. The platform not only enhances form completion but also provides robust support for collaborative efforts.

Utilizing pdfFiller for the 8310 F3 form carries various benefits, including fast access from any device, secure data handling, and easy collaboration features. Users have shared favorable experiences demonstrating how the platform improves workflows and document management processes, showcasing its effectiveness in diverse situations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete 8310 f3 online?

How can I fill out 8310 f3 on an iOS device?

How do I fill out 8310 f3 on an Android device?

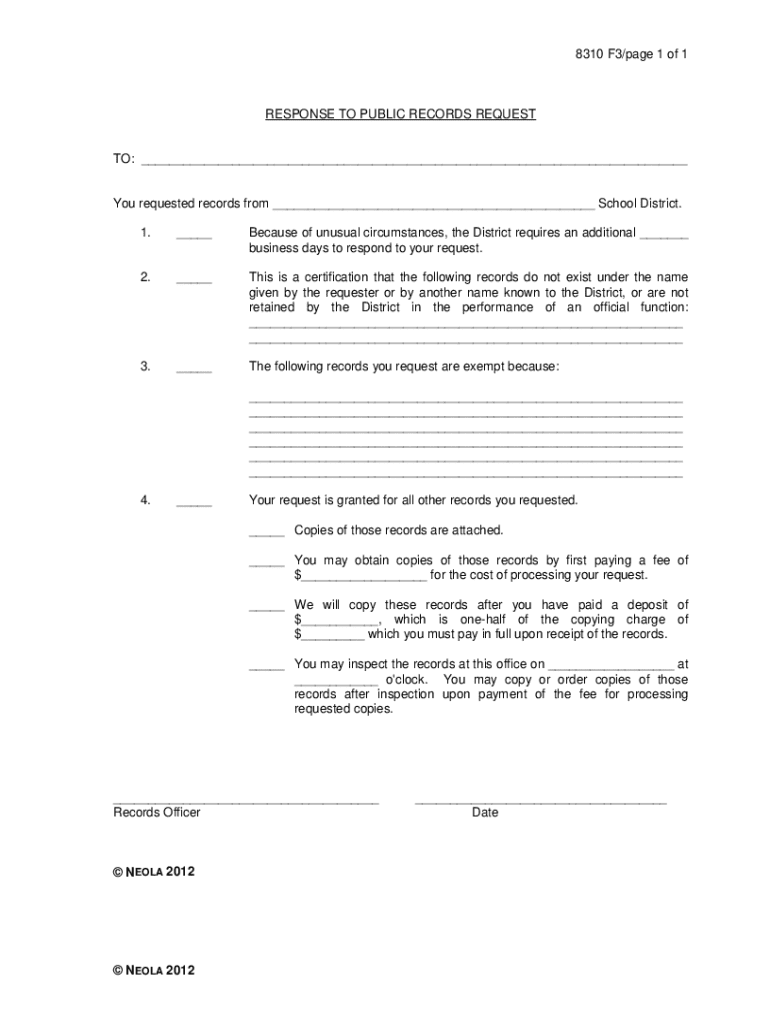

What is 8310 f3?

Who is required to file 8310 f3?

How to fill out 8310 f3?

What is the purpose of 8310 f3?

What information must be reported on 8310 f3?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.