Get the free Central Depository Settlement (cds) Account Opening Pack

Get, Create, Make and Sign central depository settlement cds

How to edit central depository settlement cds online

Uncompromising security for your PDF editing and eSignature needs

How to fill out central depository settlement cds

How to fill out central depository settlement cds

Who needs central depository settlement cds?

Central Depository Settlement (CDS) Form: A Comprehensive How-to Guide

Understanding central depository settlement (CDS)

Central Depository Systems provide a critical infrastructure for the securities market, enabling the electronic registration, custody, and settlement of securities. By facilitating the transfer of ownership through digital means, CDS significantly reduces risks associated with physical exchanges of documents and stabilizes market efficiency.

The importance of Central Depository Systems in financial markets cannot be overstated. They enhance transparency, decrease settlement times, and increase market access for both investors and institutions. Without a robust depository system, the execution of financial transactions would be mired in inefficiencies and operational risks.

Key players in these operations include Depository Participants (DPs), who are entities that facilitate the opening and maintenance of accounts for investors, and Regulatory Bodies which oversee the functioning and compliance of the depository system to protect investors and ensure fair practices.

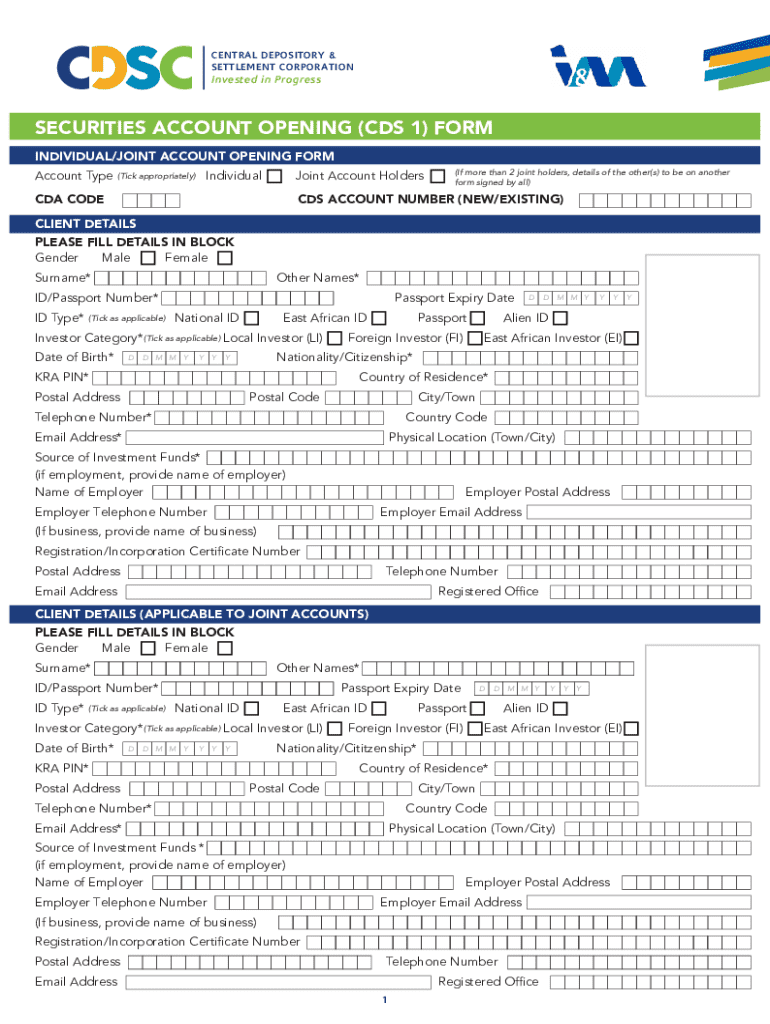

The central depository settlement (CDS) form

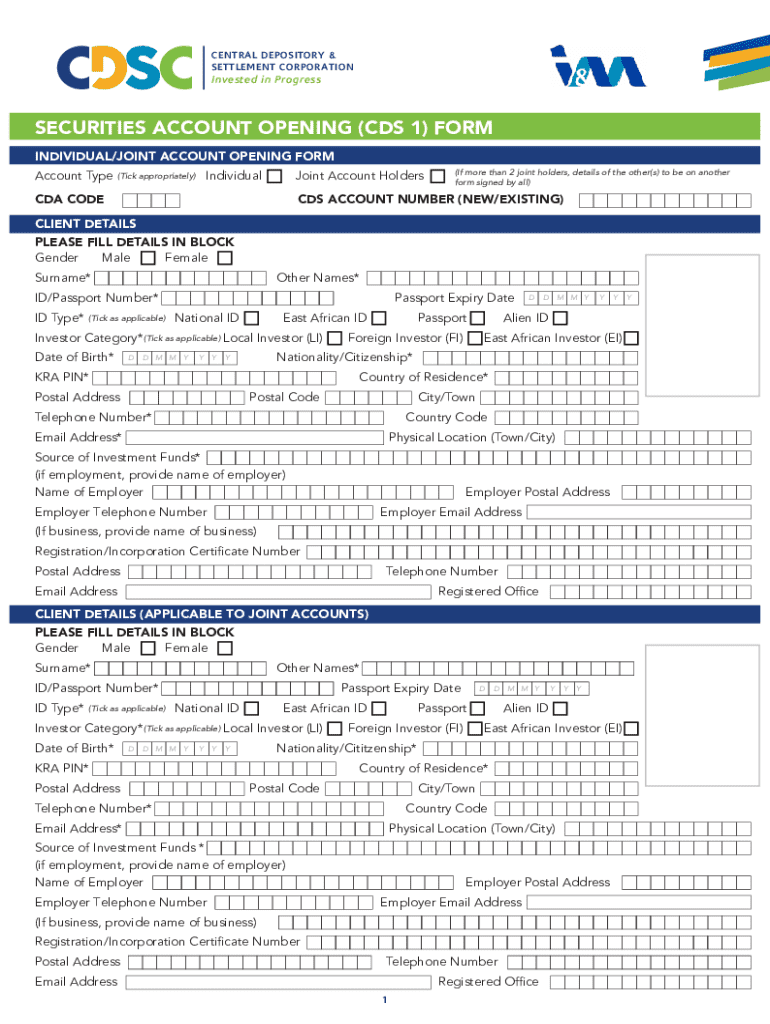

The Central Depository Settlement (CDS) Form is essential for investors looking to engage with the depository system. This form is crucial for documenting ownership claims and facilitating the settlement process of securities transactions. The accuracy and completeness of the information provided in this form directly impact the efficiency and reliability of financial operations.

Investors, whether individuals or institutions, find the CDS Form instrumental in simplifying their investment journey. It streamlines the process of settling trades and ensures that rightful ownership of securities is transferred seamlessly.

There are primarily two types of CDS Forms: Individual Investor Forms and Institutional Investor Forms. Individual Forms cater to single investors, while Institutional Forms are designed for corporate entities, making the process adaptable to various investor needs.

Preparing to complete the CDS form

Before filling out the CDS Form, investors must gather necessary documentation to ensure that the process is smooth and efficient. Typically, this includes identification documents, proof of residency, and any previous investment records that may be relevant.

Key information required from the investor includes personal details such as name, address, contact information, and any relevant organizational details in the case of institutional investors. Understanding specific terms related to CDS is equally important, as it can greatly clarify the process.

Step-by-step guide to filling out the CDS form

Now that you have prepared the necessary documentation, let's delve into the actual process of filling out the CDS Form. It consists of several distinct sections, each requiring careful attention.

In the Personal Information Section, provide your name, address, and contact information. This section is crucial as it verifies your identity and ensures communications are directed appropriately.

Next, the Account Information section requires you to select the type of account you’re opening—be it Individual, Joint, or Corporate. It’s essential to choose accurately based on your investment needs.

For the Investment Details step, specify the types of investments and their corresponding quantities. This section typically includes stock symbols, investment amounts, and any preferences for investment types.

After filling out the form, signing and verifying are the next steps. Signing the form indicates your agreement to the terms, while verification is necessary to ensure authenticity. Finally, submission can be done via online channels or in person, depending on the regulations applicable in your jurisdiction.

Electronic vs. paper forms: pros and cons

When considering the process of filling out the CDS Form, individuals may opt for electronic or traditional paper forms. The advantages of using platforms like pdfFiller include easy access from any location and built-in tools for editing and signing documents electronically. This convenience is especially beneficial for on-the-go investors.

On the other hand, traditional paper forms come with their challenges. Potential delays in processing due to mail or physical submission issues, along with the risk of documents being misplaced, can complicate matters. Therefore, choosing an electronic solution generally leads to a more streamlined experience.

Common mistakes to avoid when filling out the CDS form

Even seasoned investors can make errors when completing the CDS Form. To avoid complications, be mindful of common pitfalls like providing incomplete information—double-check to ensure every section is properly filled.

Additionally, misunderstandings regarding what certain fields require can lead to unnecessary delays. It’s critical to review the guidelines accompanying the form and confirm your understanding before submission. Don’t forget to include all required attachments and documentation, as failing to do so may result in rejections or requests for further information.

Interactive tools and features on pdfFiller

Utilizing pdfFiller for completing the CDS Form offers several interactive features that enhance user experience. The platform allows you to upload the form directly, ensuring that access is quick and hassle-free. Editing tools on the platform provide functionalities such as adding text, signatures, and annotations seamlessly.

Collaboration features are particularly useful for teams. Team members can engage in real-time editing and leave comments for one another. Additionally, managing permissions for shared use ensures that sensitive information remains protected while still facilitating collaborative efforts.

Post-submission follow-up

After submitting the CDS Form, it’s important to know what to expect next. Processing timelines can vary, but most firms provide general estimates for how long it may take to finalize your application. Tracking your form status online can also add transparency to the process, allowing you to stay informed of any updates.

Maintaining your CDS account is equally crucial. Regularly accessing your account online enables you to keep your information updated and ensures that you are aware of any upcoming requirements or changes in regulations that might affect your investments.

FAQs about the central depository settlement (CDS) form

Addressing common questions surrounding the CDS Form can help demystify the process for many investors. Some frequently asked questions include inquiries about the specific information needed, timelines for processing, and troubleshooting issues related to submission or verification.

Providing clear answers to these questions not only assists new investors but also fosters a sense of confidence in navigating the world of financial investments. Understanding these FAQs enables investors to approach the process with clarity and assurance.

Corporate solutions with CDS forms

For businesses, the effective management of CDS Forms is critical. Corporations utilize these forms to streamline their securities management, ensuring compliance and governance in all transactions. Services offered to companies may include tailored processes for CDS Forms processing, further enhancing operational efficiency.

Emphasizing compliance and governance is essential in a corporate setting, where the stakes are typically higher. Maintaining transparency and adherence to regulatory frameworks safeguards corporate interests while reinforcing investor confidence.

Environmental considerations

As the world shifts towards more sustainable practices, document management also plays a part in these initiatives. Implementing electronic forms, such as the CDS Form via pdfFiller, reduces the carbon footprint associated with paper use and contributes to greener operations.

pdfFiller supports green initiatives in form handling by providing a fully digital solution, minimizing waste and promoting efficiency. By choosing electronic solutions, investors not only streamline their processes but also contribute positively to environmental sustainability.

Continuing education and resources: Bursa Academy

For those looking to deepen their understanding of the Central Depository Settlement processes, resources like Bursa Academy offer invaluable learning opportunities. Investors can access workshops and webinars focused on CDS and related topics, enhancing their financial literacy and investment strategies.

Engaging in continuous education provides investors with updated knowledge about changes in the market, regulations, and innovative financial products, ensuring they remain capable decision-makers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my central depository settlement cds in Gmail?

How do I make changes in central depository settlement cds?

Can I create an electronic signature for signing my central depository settlement cds in Gmail?

What is central depository settlement cds?

Who is required to file central depository settlement cds?

How to fill out central depository settlement cds?

What is the purpose of central depository settlement cds?

What information must be reported on central depository settlement cds?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.