Get the free 990

Get, Create, Make and Sign 990

How to edit 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 990

How to fill out 990

Who needs 990?

990 Form: Comprehensive How-to Guide

Understanding Form 990

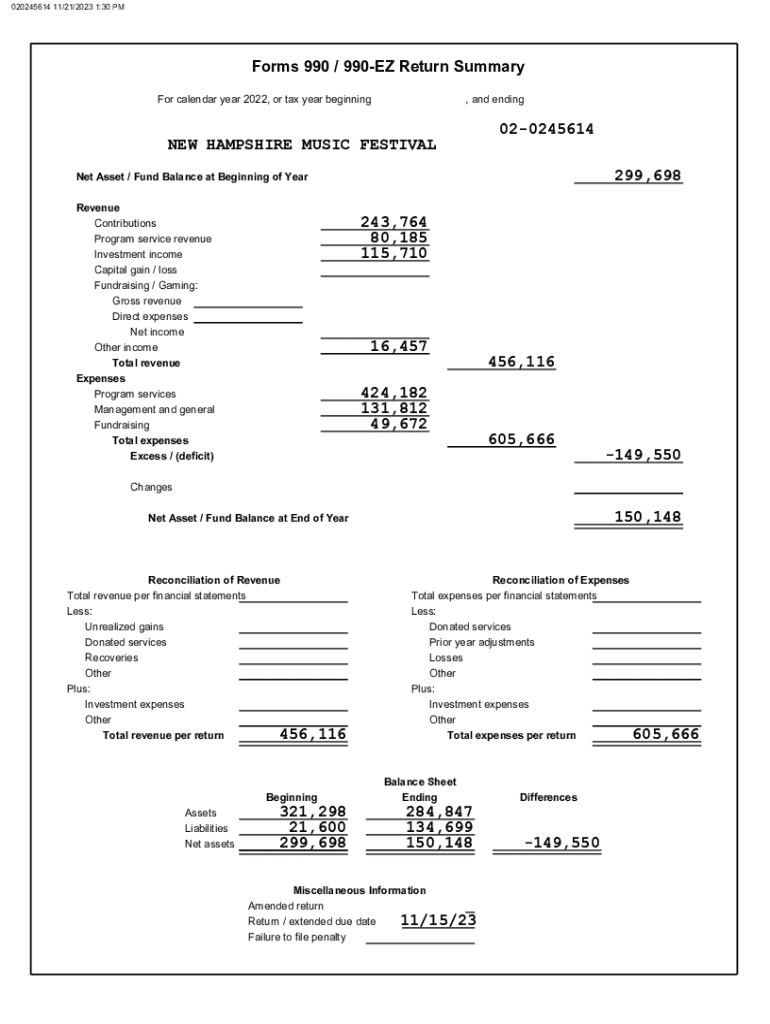

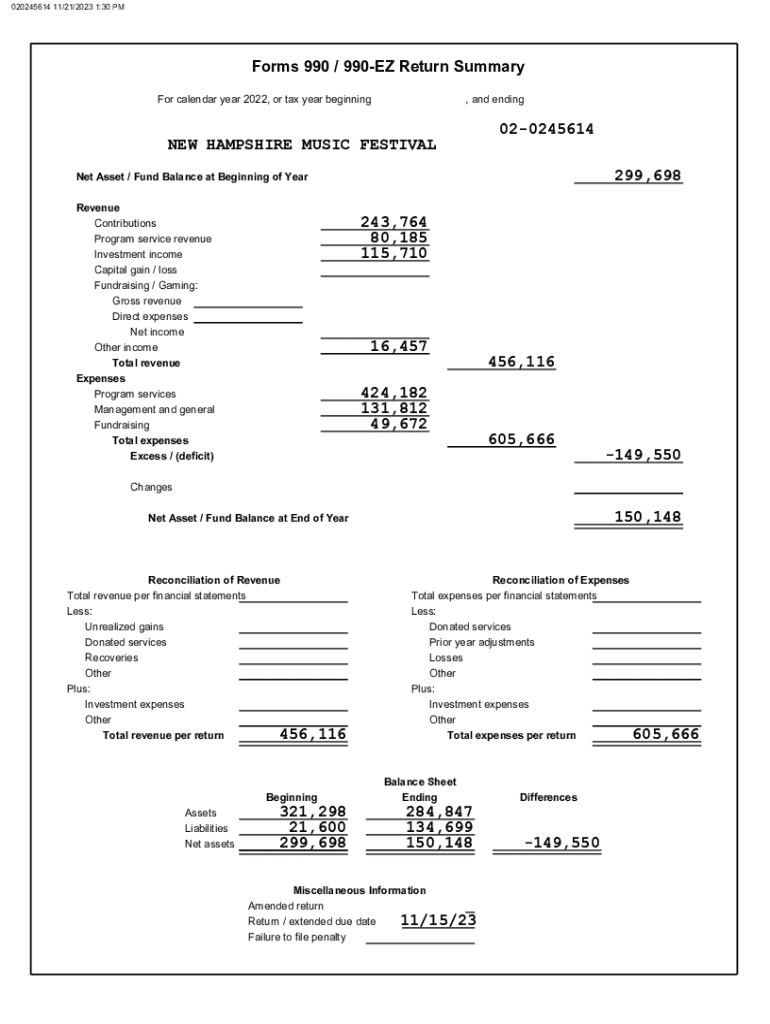

Form 990 is a critical document for tax-exempt organizations, including nonprofits, charities, and other similar entities. Its primary purpose is to provide the Internal Revenue Service (IRS) with financial and operational information about these organizations. The transparent reporting of this data helps to ensure accountability and fosters public trust in the nonprofit sector.

Organizations required to file Form 990 include all tax-exempt entities under IRC Section 501(c)(3) or similar designations. This includes charities, educational institutions, and social service organizations, which are necessary to notify the IRS about their financial activities on an annual basis. Understanding key definitions related to Form 990, such as 'exempt organization' and 'gross receipts,' is crucial for compliance and accurate reporting.

Filing requirements for Form 990

To remain compliant, entities must meet annual filing obligations based on their financial activities. Organizations with gross receipts typically exceeding $200,000, or total assets exceeding $500,000, are required to file the complete Form 990. Smaller organizations might qualify to file the abbreviated Form 990-EZ or the simplest e-Postcard Form 990-N, based on their income levels.

Filing deadlines are essential for avoiding penalties. Form 990 is due on the 15th day of the 5th month after the organization's fiscal year ends. Therefore, for organizations operating on a calendar year, the deadline is May 15. Extensions can be requested using Form 8868, allowing an additional six months to compile and file the necessary documentation.

Components of Form 990

Form 990 is divided into multiple sections that report comprehensive information about an organization's financial health and activities. Part I summarizes the financial status, while Part II details the activities and sources of income. This provides a snapshot of total revenue and expenses.

Organizations that do not exceed the specified income thresholds may file Form 990-EZ or Form 990-N instead. Each version has different requirements, simplifying the process for smaller entities. Supplementary schedules may also be necessary to provide additional disclosures pertinent to various activities or financial situations.

How to fill out Form 990 effectively

Filling out Form 990 can seem daunting, but following a structured approach can simplify the process. Begin by gathering all necessary documentation, including financial statements, receipts, and information related to program services. Utilizing a detailed step-by-step approach will ensure accuracy in reporting.

A tipsheet can be invaluable for this process, highlighting the importance of clarity and ensuring the financial information aligns seamlessly with your mission statement, thus providing a holistic view of the organization.

Electronic filing options

Today, eFiling has become the preferred method for submitting Form 990 due to its convenience and speed. Filing electronically not only speeds up the submission process but also reduces the risk of errors. While paper submission is still an option, it lacks the advantages of immediate confirmation and quicker processing.

There are various software tools that specialize in completing Form 990, providing intuitive interfaces and built-in error checks, which can be beneficial for those unfamiliar with tax reporting. Moreover, the IRS e-File system is designed to facilitate a smooth user experience, ensuring easy navigation and submission.

Understanding penalties for incorrect filing

Organizations can face significant penalties for failing to file Form 990 correctly or on time. The IRS imposes fines that can accumulate quickly, particularly for late submissions, emphasizing the need for adherence to deadlines and rigorous reporting standards. Maintaining accurate records can help mitigate risks associated with errors or inaccuracies on the form.

Proactive measures such as maintaining a well-organized filing schedule with reminders can aid organizations in complying with IRS expectations, thus securing their tax-exempt status.

Fiduciary responsibilities associated with Form 990

Filing Form 990 involves fiduciary responsibilities that extend to individuals in leadership roles within the organization. This includes board members, executive directors, and financial officers, all of whom must ensure accurate and timely filings to uphold the organization’s integrity.

Understanding these responsibilities is crucial for safeguarding both the organization's assets and its credibility in the nonprofit community.

Public inspection regulations

Form 990 filings are publicly accessible documents, fostering transparency in the nonprofit sector. This accessibility allows donors, researchers, and the general public to evaluate the financial activities of tax-exempt organizations. Key pieces of information available through Form 990 include revenue sources, expenditures, and information regarding board members.

Understanding how to navigate these public records enhances transparency and accountability in the nonprofit sector, instilling confidence among stakeholders.

Using Form 990 for charity evaluation research

Form 990 serves as a vital resource for analyzing the financial health of nonprofits. Scholars, researchers, and potential donors utilize the data contained in these forms to gauge the effectiveness and efficiency of various organizations. Key metrics derived from Form 990 data help assess operational performance, including the ratio of program expenses to total expenses.

Accessing and interpreting these metrics enables stakeholders to make informed decisions regarding charitable contributions and support, ultimately enhancing the effectiveness of philanthropy.

Best practices for Form 990 preparation

Preparation for Form 990 should begin well in advance to ease the filing process. Organizing documents early, including financial statements, program descriptions, and governance information, helps streamline the completion of Form 990. Consistency in record-keeping is essential for maintaining accurate and comprehensive financial reports.

Employing these best practices not only mitigates risk but also enhances the overall quality of information reported on Form 990.

How to read and interpret Form 990 data

Reading and interpreting Form 990 data require careful attention to detail, as the information contained can paint a comprehensive picture of an organization’s financial health. Financial statements within Form 990, including balance sheets and statements of activities, reveal essential insights into the revenue generation and spending patterns of the nonprofit.

Analyzing these components assists stakeholders in making informed assessments about an organization's sustainability and impact over time.

Real-world examples and case studies

Real-world scenarios often highlight the challenges nonprofits face in filing Form 990 accurately. For example, an organization that mistakenly reported inflated income could face major penalties and potential loss of tax-exempt status. Learning from such cases can provide valuable lessons that inform best practices for future filings.

These examples can serve as cautionary tales and practical guides for organizations aiming to navigate the complexities of Form 990 filings effectively.

Further resources for Form 990 filers

As the filing of Form 990 can be intricate, several organizations and resources offer guidance throughout the process. Institutions like the National Council of Nonprofits provide educational materials, while online workshops and webinars can enhance understanding of Form 990 criteria and requirements.

Leveraging these resources can not only aid in accurate filing but also enhance the overall operational effectiveness of nonprofits, ensuring they maximize their impact.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 990 in Gmail?

How can I edit 990 on a smartphone?

How do I complete 990 on an iOS device?

What is 990?

Who is required to file 990?

How to fill out 990?

What is the purpose of 990?

What information must be reported on 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.