Get the free Dr 729

Get, Create, Make and Sign dr 729

Editing dr 729 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dr 729

How to fill out dr 729

Who needs dr 729?

A Comprehensive Guide to the dr 729 Form

Understanding the dr 729 form

The dr 729 form is an essential document frequently used in various legal and governmental procedures. Its primary purpose is to provide a standard method for submitting essential data to relevant authorities, ensuring compliance and proper record-keeping. The form serves not only as a channel for information exchange but also plays a crucial role in processing requests or applications.

The importance of the dr 729 form is evident in contexts like tax filings, permits, and specific regulatory requirements. Failure to properly complete or submit this form can lead to delays or penalties, emphasizing the necessity for accurate and timely completion.

Who needs the dr 729 form?

Various individuals and organizations may require the dr 729 form. This includes business owners seeking permits, individuals applying for government assistance programs, and legal professionals handling documentation for clients. Typical scenarios where the form is applicable range from filing taxes to submitting documentation for regulatory compliance.

Understanding when and how to use the dr 729 form is crucial for anyone involved in legal proceedings or compliance-related activities. Whether you represent a business or are submitting personal information, this form must be managed properly to ensure successful outcomes.

Navigating the dr 729 form

Obtaining the dr 729 form can be accomplished through several methods. Users can access the form online for quick and convenient completion. Many official government websites provide downloadable PDF versions for users, while pdfFiller also offers direct access to fill and manage the form online.

For those who prefer an in-person approach, local government offices may have hard copies available. It's essential to select a trusted source to ensure you’re obtaining the most recent version of the form.

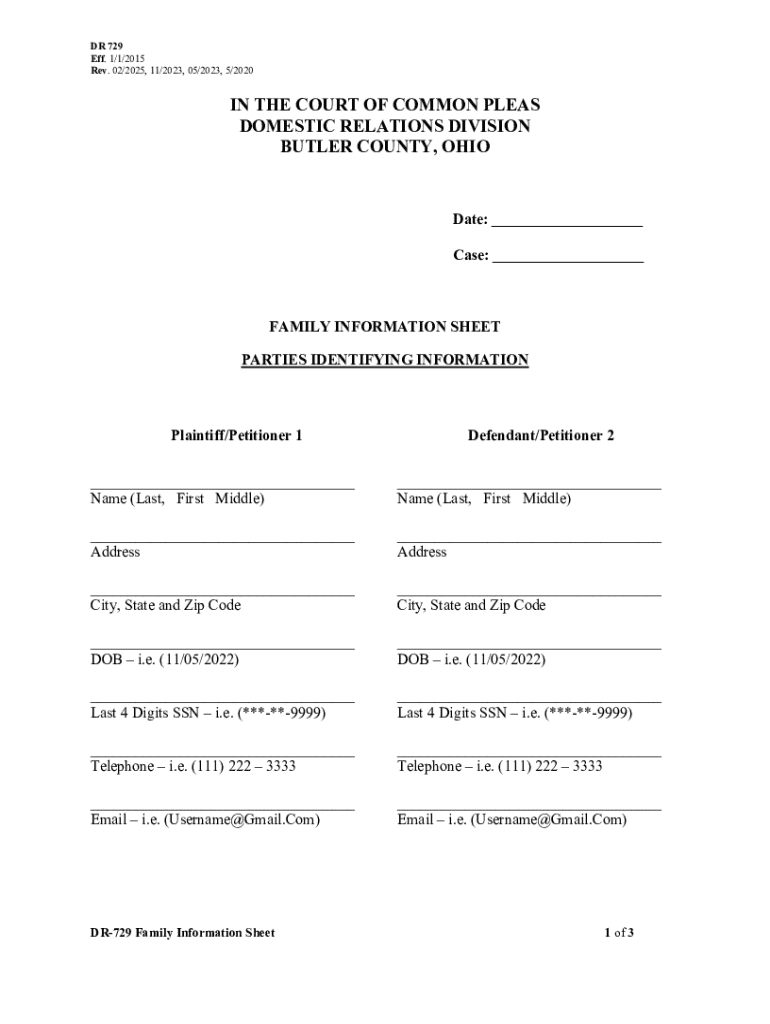

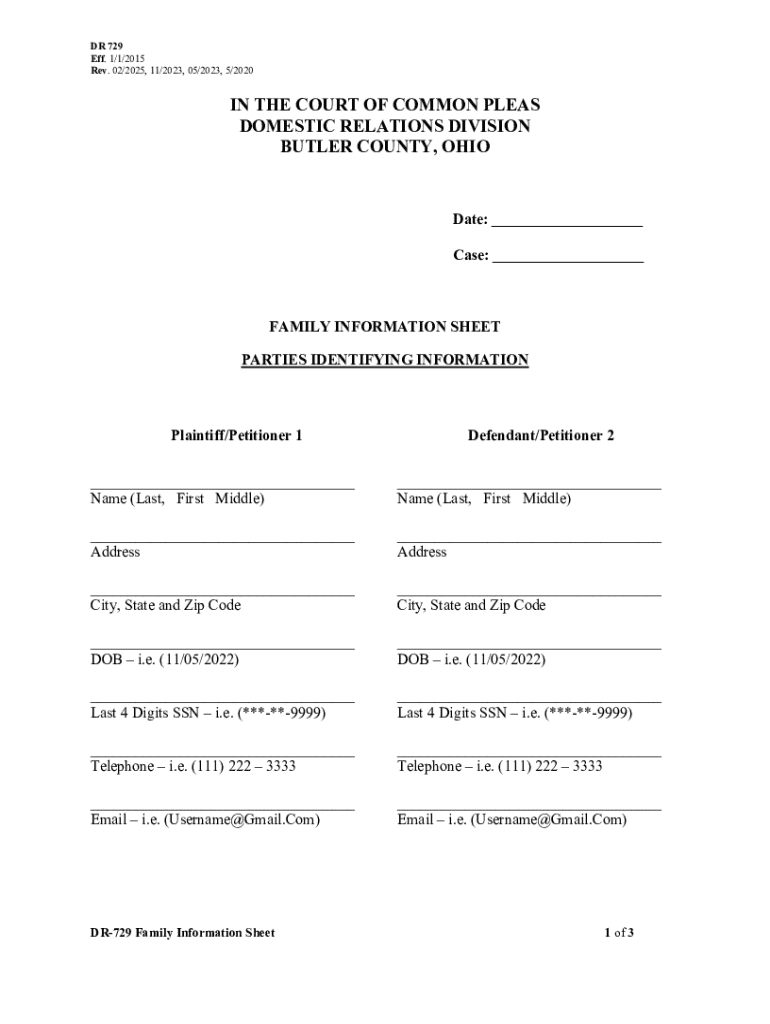

Format and structure of the dr 729 form

The dr 729 form is structured to guide users through essential sections, including personal information, purpose of the request, and any specific data fields that may be required. It typically includes sections for entering your name, contact details, and any pertinent identification numbers.

Important fields to complete may vary depending on the specific purpose of the form. Always review the form closely to ensure all necessary information is provided accurately.

Filling out the dr 729 form: step-by-step guide

Filling out the dr 729 form can be straightforward if approached methodically. Begin by reviewing the requirements to gather all necessary information beforehand. This includes your personal details, relevant identification, and supporting documentation.

With your documents in hand, proceed to complete the form section by section. For personal information, include your full name, address, and contact information. Ensure you fill out any specific data fields related to your request.

Once the form is completed, it's crucial to check for accuracy. Verify all entered information, as mistakes can lead to processing delays.

Editing and managing the dr 729 form

Using pdfFiller can significantly simplify managing the dr 729 form. The platform offers a cloud-based solution for editing, ensuring you can access your documents from anywhere. Upload the dr 729 form to pdfFiller to edit it quickly and efficiently.

The tools available on pdfFiller are user-friendly, with interactive features that facilitate document completion. You can utilize templates tailored to the dr 729 form and take advantage of auto-fill features that automatically populate your personal information.

eSigning the dr 729 form

After filling out the dr 729 form, consider the convenience of signing it digitally. pdfFiller allows you to add a digital signature with ease. Simply follow the prompts to create your signature and insert it where required.

Opting for eSigning has its advantages over traditional methods. Digital signatures are quicker, more secure, and allow for immediate document transmission, which is crucial for time-sensitive submissions.

Securing your signature involves following best practices, such as using strong passwords and enabling two-factor authentication where possible.

Submitting the dr 729 form

Submitting your completed dr 729 form is the final step. You have various options for submission, including online and physical submission methods. For online submissions, follow the instructions provided by the relevant authority’s website. If submitting by mail or in person, ensure you have the correct mailing address or office to avoid delays.

For tracking submission status, many agencies provide online resources to check your progress. Keep a record of your submission to reference in case of any inquiries.

Troubleshooting common issues

If your submission of the dr 729 form is rejected, understanding the common reasons can be helpful. Typical issues include incomplete information, misfiled forms, or missing signatures. Addressing these proactively can save you time and frustration.

Frequently asked questions regarding the dr 729 form often revolve around filling out specific sections or understanding submission procedures. These queries can help clarify processes and reduce anxiety about compliance.

Additional considerations

Understanding the legal implications associated with the dr 729 form is essential. Since the form often involves sensitive data, keeping abreast of the regulations and requirements is crucial to avoid potential legal ramifications.

Changes in the requirements for the dr 729 can occur, necessitating continued education on modifications and updates to ensure compliant submissions.

Utilizing pdfFiller for future document needs

Expanding your document management skills through pdfFiller extends beyond the dr 729 form. The platform support numerous document types, making it a highly versatile tool for users in various sectors.

Feature highlights include collaboration tools for team projects, cloud storage solutions to keep documents organized, and various templates to simplify the creation of new forms and documents.

User experiences with the dr 729 form

Real-life success stories illustrate the effectiveness of the dr 729 form when completed correctly. Users frequently share testimonials emphasizing the ease of use through platforms like pdfFiller, noting that guided assistance makes the process smoother.

However, challenges remain. Users often encounter pitfalls related to incomplete submissions or overlooked requirements. pdfFiller addresses these concerns by providing onboard tools that alert users to missed fields or errors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my dr 729 directly from Gmail?

How can I send dr 729 to be eSigned by others?

How do I edit dr 729 straight from my smartphone?

What is dr 729?

Who is required to file dr 729?

How to fill out dr 729?

What is the purpose of dr 729?

What information must be reported on dr 729?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.