Get the free Employer Identification Numbers Registry

Get, Create, Make and Sign employer identification numbers registry

How to edit employer identification numbers registry online

Uncompromising security for your PDF editing and eSignature needs

How to fill out employer identification numbers registry

How to fill out employer identification numbers registry

Who needs employer identification numbers registry?

Employer Identification Numbers Registry Form - How-to Guide

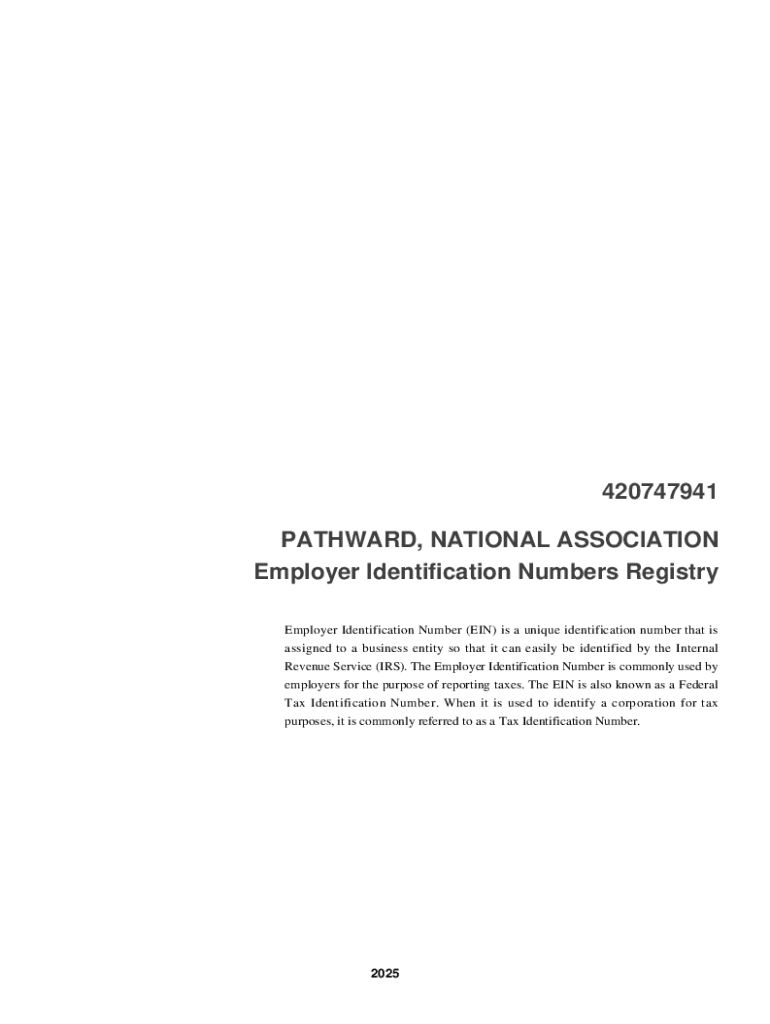

Understanding Employer Identification Numbers (EIN)

An Employer Identification Number (EIN) is a unique nine-digit identifier assigned by the IRS to businesses for tax purposes. It functions similarly to a Social Security Number (SSN) for individuals but is specifically tailored for identifying business entities. Without an EIN, businesses can face significant hurdles, particularly relating to their tax responsibilities.

The importance of an EIN cannot be overstated; it not only allows companies to manage their federal taxes but also enables them to open business bank accounts and apply for loans. Additionally, different types of businesses—including corporations, partnerships, and non-profits—are legally required to obtain an EIN, especially if they plan on hiring employees.

It's crucial to understand the distinctions between EINs, Tax Identification Numbers (TINs), and state Tax ID Numbers. An EIN is a specific type of TIN that is required for businesses, while TINs can refer to various forms of identification used for tax purposes, including SSNs.

How to obtain an EIN

Acquiring an EIN is a straightforward process that involves several key steps to ensure compliance and accuracy. By following this guide, you can navigate the application process effectively.

Preparation before application

Before filling out the application, gather all necessary information and documentation. This includes the legal name of the business entity, the type of entity (e.g., LLC, corporation), and the names and addresses of the owners or partners involved. Identifying the responsible party, a person designated to handle tax matters, is also crucial in this preparation phase.

Completing the EIN application form

To find the EIN application form, visit the IRS website or utilize platforms like pdfFiller, which facilitate easy access and filing. When completing the form, be meticulous. Common sections include the business structure, reason for applying, and the date of establishment.

Submitting the application

You have several options for submitting your EIN application. The quickest method is to apply online through the IRS website, where you typically receive your EIN immediately. Alternatively, applications can be submitted via fax or mail; however, these methods may take longer, usually between 4-6 weeks.

Managing and utilizing your EIN

Once you have your EIN, it's vital to manage and utilize it appropriately. Accessing your EIN can be done through your IRS account or by reviewing the original letter received during application. To keep your EIN secure, take steps such as limiting access to it, storing it in a secure location, and never sharing it unnecessarily.

Your EIN will be required in numerous scenarios, such as opening a business bank account or filing both federal and state taxes. Proper application of your EIN ensures compliance with tax regulations, allowing your business to operate without any unnecessary friction.

Changing or deactivating your EIN

There are specific circumstances that might prompt the need to change your EIN, such as a significant change in business structure or ownership. If your business's ownership changes due to incorporation or reformation, applying for a new EIN is required.

Should you need to change your EIN, the process involves submitting Form 8822-B to the IRS. If you no longer need your EIN due to business closure or dissolution, ensure that you notify the IRS to officially deactivate it, preventing any potential tax issues down the line.

Troubleshooting common EIN issues

Encounters with EIN issues can range from receiving an EIN you didn’t request to making errors on the forms. If you mistakenly receive an EIN, contact the IRS immediately to clarify the situation. In cases of errors, Form 4419 can be submitted to request corrections.

Handling EIN verification issues

Sometimes, verification from the IRS can become problematic. For issues regarding EIN verification, ensure you have all pertinent documents ready and directly reach out to the IRS for assistance.

Resources and tools for EIN management

Effective management of your EIN can be simplified through various interactive tools available online, including those offered by pdfFiller. The platform can help in the creation, editing, and signing of EIN-related documents and forms.

Additionally, the IRS website provides ample resources for EIN inquiries, complete with FAQs and guidelines. Understanding the intricacies of EIN management can play a significant role in the seamless operation of your business.

EIN FAQs

Clarifying common questions about EIN can save business owners time and prevent costly mistakes. For instance, many wonder about the difference between a federal EIN and a state EIN; the former is required by the IRS for federal tax purposes, while the latter may be required by state authorities.

Business owners also frequently inquire if they will ever need to change their EIN. Yes, particularly if their business structure changes significantly. To look up your EIN, check the documents you received upon registration, or access your IRS account.

Related business topics

In understanding the larger picture of business management, it's important to familiarize oneself with various business types and setups. Knowing how to efficiently manage business documents is key. Tools like pdfFiller streamline the process of document creation and management, making it easier to stay organized.

Entrepreneurs should also be well-versed in the essentials of starting their own business, which includes everything from legal regulations to financial planning. Collaborative capabilities within document management can ensure that teams are always aligned and effective.

Start creating and managing your documents with pdfFiller

pdfFiller empowers users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based platform. As businesses handle various forms and applications, having a reliable document management system is imperative.

From financial documentation needs to EIN forms, pdfFiller allows users to not just create, but also efficiently manage, store, and retrieve essential business documents, ensuring that all your business needs are met.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send employer identification numbers registry for eSignature?

Where do I find employer identification numbers registry?

How can I edit employer identification numbers registry on a smartphone?

What is employer identification numbers registry?

Who is required to file employer identification numbers registry?

How to fill out employer identification numbers registry?

What is the purpose of employer identification numbers registry?

What information must be reported on employer identification numbers registry?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.