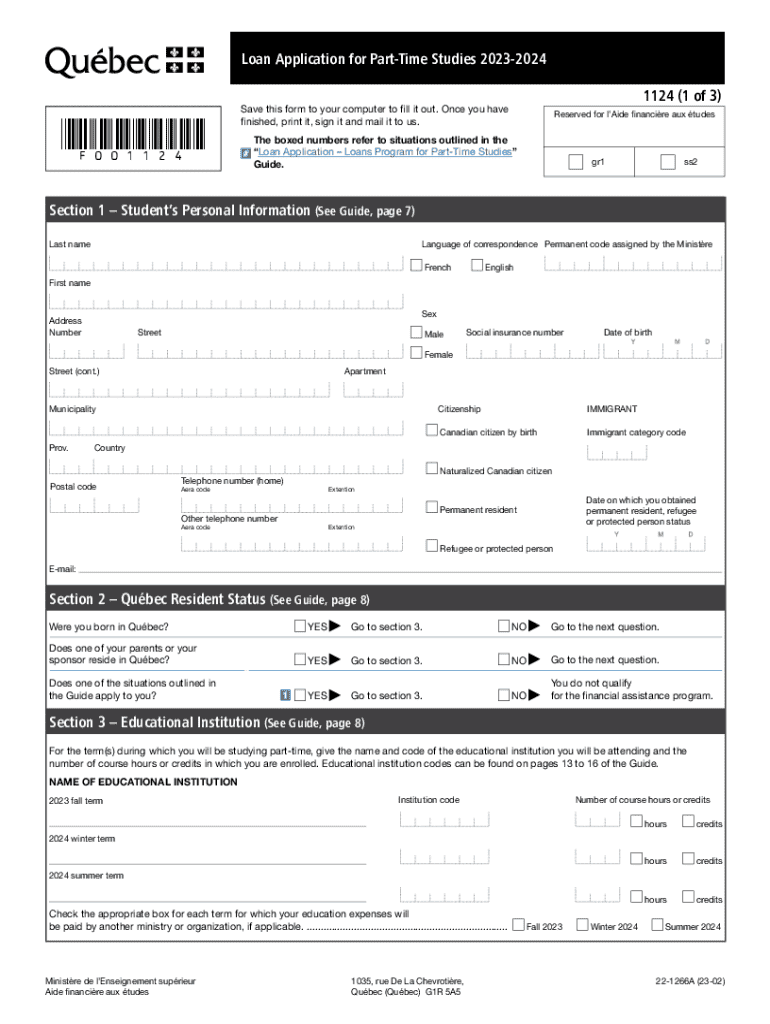

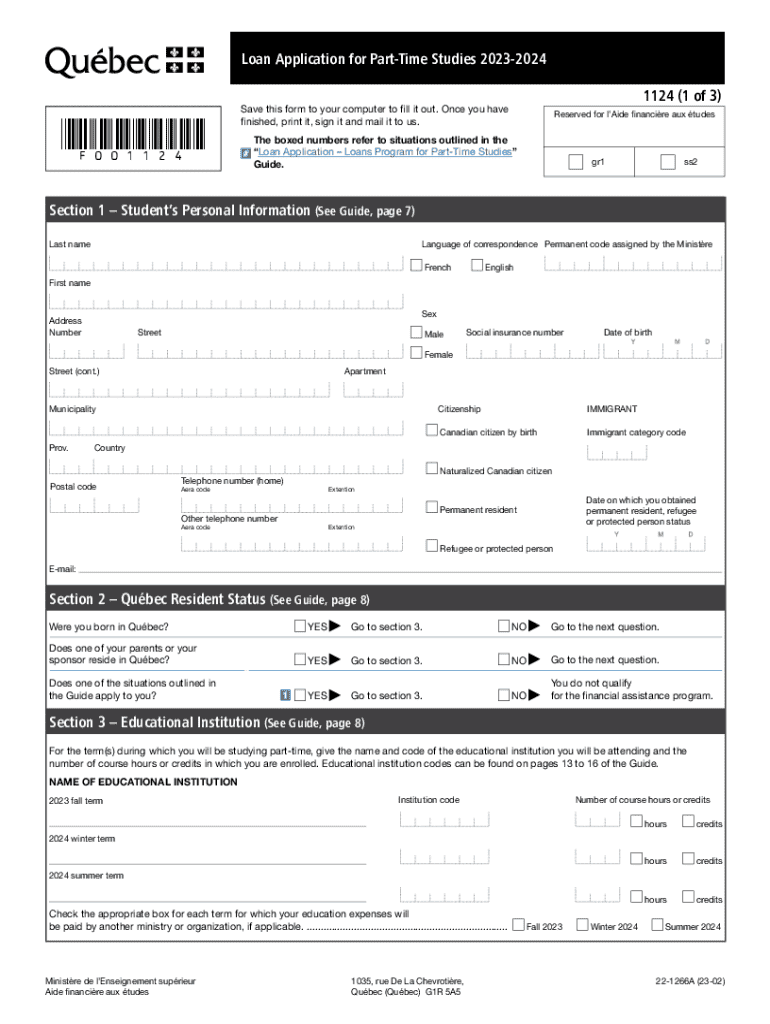

Get the free Loan Application for Part-time Studies 2023-2024

Get, Create, Make and Sign loan application for part-time

Editing loan application for part-time online

Uncompromising security for your PDF editing and eSignature needs

How to fill out loan application for part-time

How to fill out loan application for part-time

Who needs loan application for part-time?

Navigating the Loan Application for Part-Time Form: A Comprehensive Guide

Understanding the part-time loan application

Part-time students seeking financial assistance have access to various loan options designed specifically for their needs. These loans can help cover educational costs, from tuition to living expenses, reassuring students that they can balance work and education without excessive financial strain. Understanding the nuances of the part-time loan application process is crucial in ensuring you acquire the necessary funding without delays.

Eligibility criteria often vary among lenders. Typically, part-time students need to meet specific income thresholds and be enrolled in a qualifying course. Knowing these criteria ahead of time can streamline your application process.

Preparing your documentation

Before diving into the loan application for part-time form, it is essential to gather all necessary documentation. Lenders require proof of your identity and financial stability to process your loan efficiently. Having these documents on hand will save you time and ensure a smooth application experience.

Step-by-step guide to completing the loan application form

Filling out the loan application can be daunting, but with a clear plan, it becomes manageable. First, familiarize yourself with the online application portal; many lenders now provide a streamlined digital experience. This section will offer guidance on navigating these platforms efficiently.

Begin with your personal information section, ensuring accuracy to avoid hiccups later on. Follow this by detailing your financial situation, which typically involves reporting income sources and their amounts. Finally, don’t forget to fill in specifics about your course, including the institution's name, the degree pursued, and enrollment status.

Be aware of common errors, such as incomplete sections or mismatched documents, which could lead to rejection or delay.

Submitting your application

After completing your loan application for part-time form, it's time to submit. Most lenders offer an online submission option, which is often the most efficient way to send your application. Ensure that all documents are attached and that you've followed their submission guidelines.

If online submission is not an option, check if the lender accepts mailed applications. In this case, make sure you follow the postal guidelines meticulously to prevent any loss of documents.

Processing timelines can vary widely. Understanding what communication to expect next can alleviate a lot of stress during this waiting phase.

Addressing missing information or evidence

It’s not uncommon for lenders to require additional documentation after your application is submitted. Should you receive a request for missing information, respond promptly and thoroughly to avoid any delays in processing your loan. Clarify any uncertainties by reaching out to the lender's support team.

Being proactive and timely with your responses can demonstrate your commitment and reliability, which lenders appreciate.

Managing changes in your application

Life circumstances can change unexpectedly, and it’s vital to ensure that any changes are reflected in your loan application promptly. This may include changes in your financial situation, such as new employment or shifts in income.

Being diligent about keeping your application updated not only shows responsibility but can also prevent issues later on during the loan processing.

Related forms and applications

In addition to loans, part-time students often encounter various forms of financial assistance. Scholarships and grants can be excellent alternatives to loans, offering funding without the burden of repayment. It's essential to explore these options thoroughly.

Having a thorough understanding of these additional forms can help in maximizing the available financial resources.

Resources and tools available via pdfFiller

pdfFiller offers a powerful suite of document management tools tailored to enhance your application process. Not only can you edit PDFs and fill out forms, but you also have the capability to eSign documents, ensuring a seamless experience from start to finish.

Utilizing pdfFiller's resources can significantly streamline your loan application for part-time form, helping you remain organized and efficient.

Special considerations for part-time students

Part-time students often face unique challenges, particularly in financial planning. It’s crucial to devise a budget that accounts for both coursework and part-time employment effectively. Several resources can provide guidance and support, especially for students with disabilities or learning challenges.

These considerations can significantly impact your educational experience, so accessing available resources is key.

Keeping track of your loan and repayment

Once your loan is approved, understanding your repayment obligations is crucial. Familiarize yourself with interest rates, repayment schedules, and the factors that may affect your total loan cost over time. Many loans offer grace periods that can ease your transition post-study.

Being vigilant about your loan and repayment options will help ensure that you remain financially secure throughout your studies and beyond.

Final reminders for a successful application

As you prepare to submit your loan application for part-time form, remember the critical importance of thoroughness and accuracy. Double-checking your submission can save you from unnecessary delays or complications.

By following this comprehensive guide, you're well on your way to successfully navigating the loan application for part-time form, ensuring that financial obstacles do not hinder your educational pursuits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get loan application for part-time?

How do I fill out loan application for part-time using my mobile device?

Can I edit loan application for part-time on an Android device?

What is loan application for part-time?

Who is required to file loan application for part-time?

How to fill out loan application for part-time?

What is the purpose of loan application for part-time?

What information must be reported on loan application for part-time?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.