Get the free Cdtfa-531-aa

Get, Create, Make and Sign cdtfa-531-aa

How to edit cdtfa-531-aa online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cdtfa-531-aa

How to fill out cdtfa-531-aa

Who needs cdtfa-531-aa?

CDTFA-531-AA Form: A Comprehensive How-to Guide

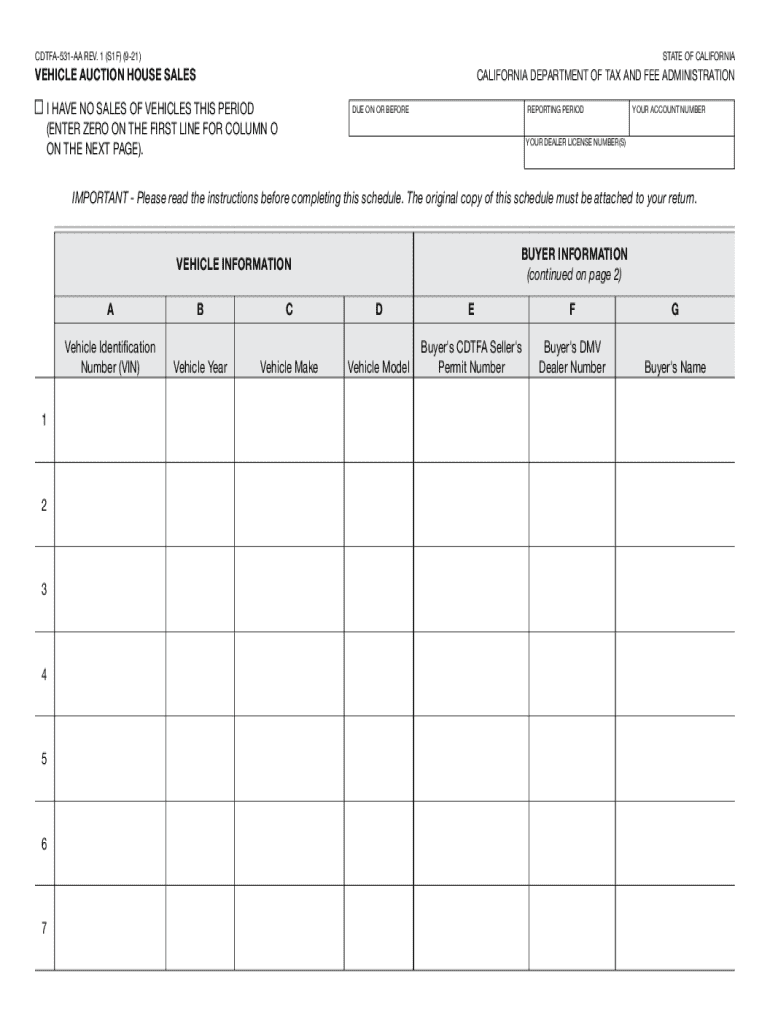

Understanding Form CDTFA-531-AA

Form CDTFA-531-AA is an essential document used in the vehicle auction industry in California. It serves as a declaration for the sale of vehicles at auctions, ensuring that proper sales tax is collected and reported. This form is especially important as it helps both buyers and sellers navigate the complexities of vehicle tax obligations and provides a clear record of the transaction.

The importance of this form cannot be overstated. By correctly utilizing the CDTFA-531-AA, auction houses and individual sellers can avoid potential penalties from tax authorities, ensuring compliance with California’s tax laws and regulations. Understanding the specific terminology associated with this form, such as ‘auction house’ and ‘vehicle sales,’ is crucial for anyone involved in selling or purchasing vehicles at auction.

Requirements for completing form CDTFA-531-AA

To ensure a smooth process when filling out the CDTFA-531-AA, it's important to understand the eligibility criteria and documentation required. This form is specifically designed for individuals or businesses involved in vehicle auctions.

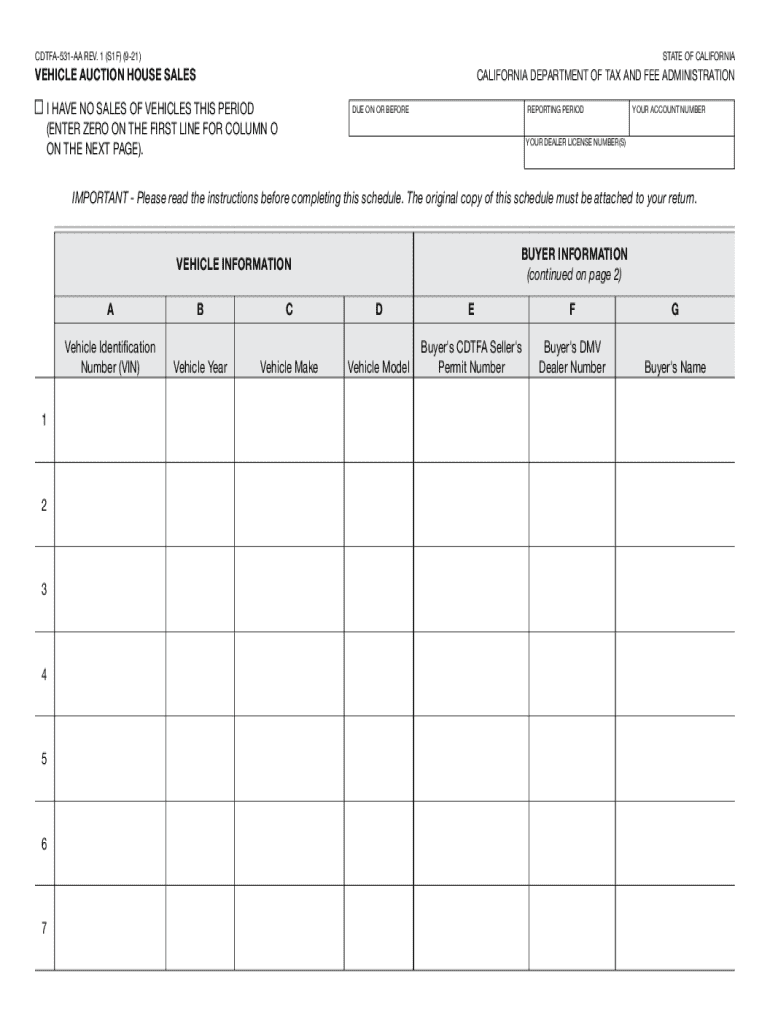

Eligible users include auction houses, individual sellers, and buyers participating in vehicle auctions. In order to fill this form correctly, users need specific documentation that includes the vehicle identification number (VIN), details about the seller and buyer, such as names, addresses, and contact information.

Step-by-step instructions for filling out form CDTFA-531-AA

Filling out the CDTFA-531-AA involves several steps, ensuring all necessary information is correctly entered. Here's a detailed breakdown of each section of the form:

Begin with the auction house details, followed by the vehicle identification and sale details. Ensure you accurately provide seller and buyer information without omissions. Double-check all entries for accuracy before advancing to the signature section.

Utilize tools like pdfFiller’s interactive features to receive instant feedback, enhancing the accuracy of your form entries.

Editing and customizing your form

After filling out your CDTFA-531-AA, you may need to edit or customize the document further. pdfFiller offers an easy-to-use platform for making these adjustments. To edit your form, simply upload it to pdfFiller, where you can access a range of editing features.

You have the option to add signatures, stamps, or additional notes to the form. One of the standout capabilities of pdfFiller is its collaboration features that allow you to share your document with team members, facilitating real-time feedback and adjustments.

Signing and submitting form CDTFA-531-AA

Once your CDTFA-531-AA form is completed, signing it correctly is crucial. pdfFiller provides various signing options, including electronic signatures, which streamline the process significantly. Understanding the validity of eSignatures within California is essential, as these are recognized as legally binding.

After signing your form, the next step is to submit it. Ensure you know where to send your completed CDTFA-531-AA. Typically, these forms are submitted to the California Department of Tax and Fee Administration. Lastly, be mindful of important deadlines associated with submission to avoid penalties.

Frequently asked questions (FAQ)

Addressing common inquiries associated with the CDTFA-531-AA can provide greater clarity for users. For instance, if you fill out the form incorrectly, immediate rectification steps include contacting the auction house or the buyer to amend details. Disputes during vehicle sales should also be handled according to specific guidelines outlined by tax authorities.

Feel free to consult the California Department of Tax and Fee Administration’s website or contact their support for further assistance if you encounter issues while completing or submitting your CDTFA-531-AA.

Downloading form CDTFA-531-AA

Accessing the CDTFA-531-AA form can be done easily through pdfFiller. Users can find a direct download link, making the form accessible for completion. The platform is designed to be compatible with various devices, ensuring that those looking to fill out the form can do so from computers, tablets, and smartphones.

Related forms and resources

Familiarizing yourself with related forms can enhance your overall understanding of vehicle auction processes. For example, Form TR-110 serves as an affidavit necessary for charitable organization vehicle auctions, while Form REG104 relates to notices regarding the removal of abandoned vehicles. These documents are vital for ensuring compliance and efficient operations in the auction landscape.

Best practices for managing auction house sales

To manage vehicle auction sales effectively, establishing clear processes is critical. Creating a checklist helps sellers and auction houses keep track of necessary documentation, ensuring transparency throughout the transaction. This not only helps in alleviating potential disputes but also makes the auction process smoother.

Utilizing cloud-based document management systems like pdfFiller can significantly streamline your operations. It allows auction businesses to securely store documents, ensuring access from anywhere, which is particularly important for remote cars and sales.

Conclusion on using pdfFiller for document management

In conclusion, the importance of using pdfFiller for managing the CDTFA-531-AA form is clear. The platform not only simplifies the document creation and management process but also ensures users have the tools they need to edit, sign, and collaborate seamlessly from the cloud. This unified approach reduces the risks of errors while maintaining compliance with California’s auction regulations.

Whether you are an individual seller or part of an auction house team, utilizing pdfFiller can enhance productivity and efficiency, setting you up for success in your vehicle sales endeavors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my cdtfa-531-aa in Gmail?

How do I execute cdtfa-531-aa online?

How do I fill out cdtfa-531-aa on an Android device?

What is cdtfa-531-aa?

Who is required to file cdtfa-531-aa?

How to fill out cdtfa-531-aa?

What is the purpose of cdtfa-531-aa?

What information must be reported on cdtfa-531-aa?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.