Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990: Essential Guide for Nonprofits

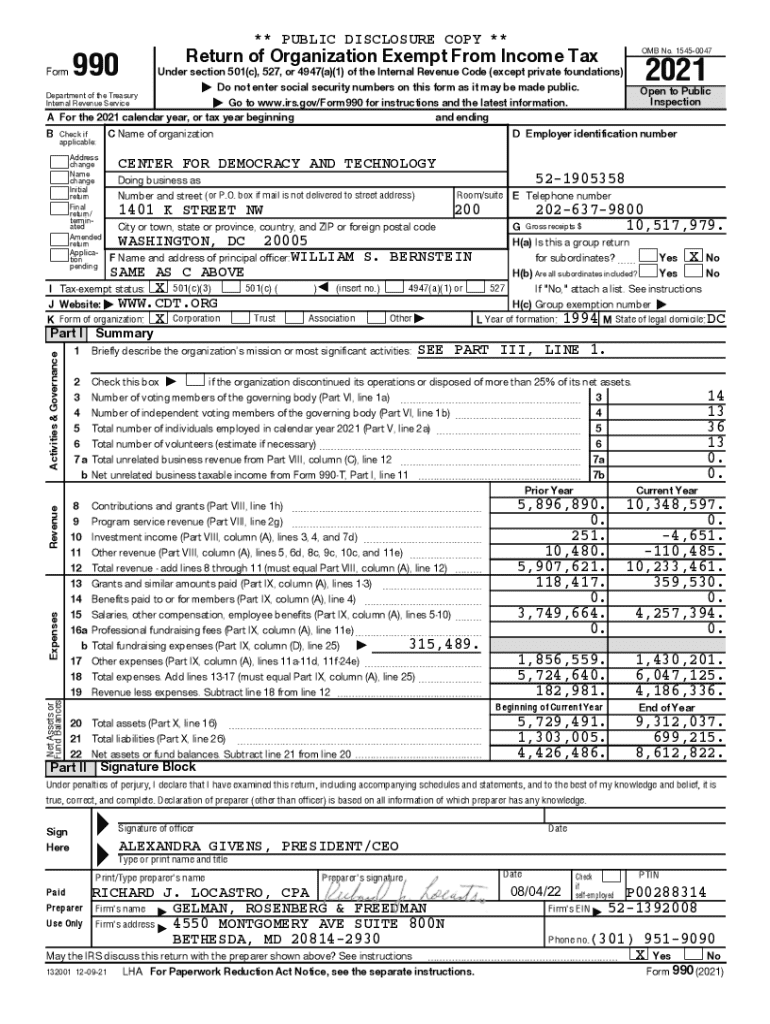

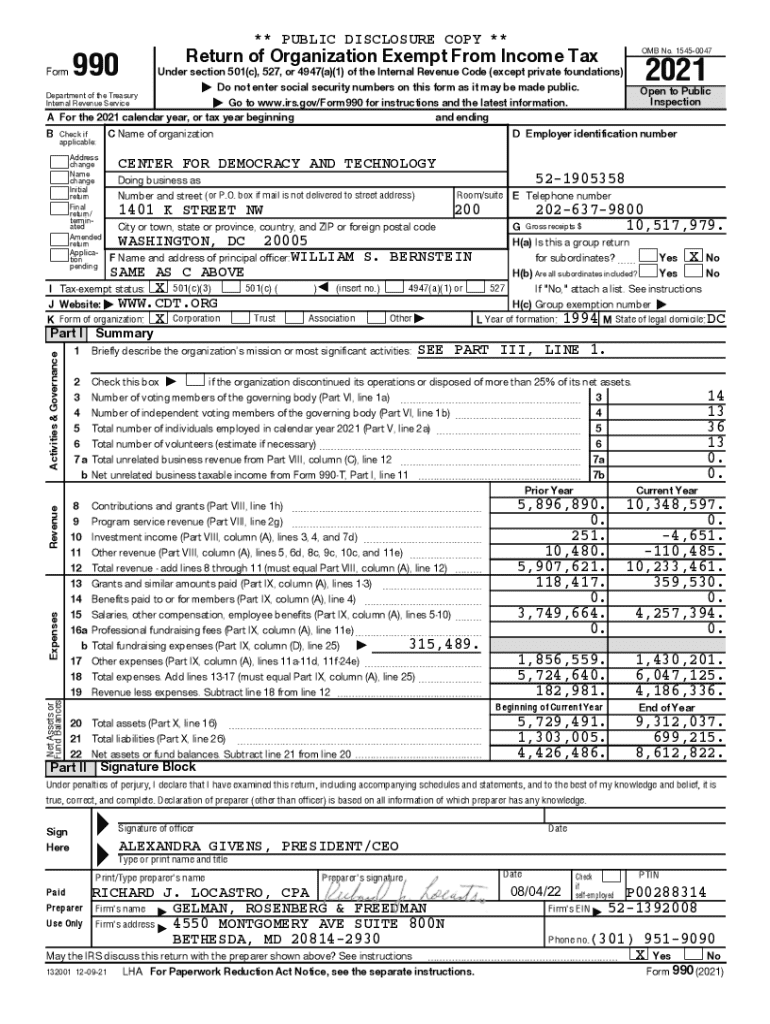

Understanding Form 990

Form 990 is an essential document that nonprofit organizations in the United States file annually with the Internal Revenue Service (IRS). This form provides a comprehensive overview of the organization's financial activities, governance, and operational details. Not only is it a tool for compliance, but it also serves as a vital resource for stakeholders such as donors, regulators, and the general public, offering insights into how nonprofits manage their resources.

The significance of Form 990 cannot be overstated, as it plays a crucial role in ensuring transparency and accountability in the nonprofit sector. By compiling intricate financial data and organizational narratives, Form 990 allows stakeholders to evaluate the nonprofit's fiscal health and operational efficacy. Furthermore, the information disclosed is accessible to the public, reinforcing the importance of ethical standards in fundraising and program execution.

Variants of Form 990

Form 990 is not a one-size-fits-all document; instead, it comes in several variants designed for different types of organizations. The main versions include Form 990, Form 990-EZ, and Form 990-PF. Each has unique requirements and is tailored to varying levels of complexity and income thresholds.

For instance, Form 990 is typically used by larger nonprofits with gross receipts exceeding $200,000 or total assets over $500,000. Conversely, Form 990-EZ is a streamlined version for organizations with gross receipts between $50,000 and $200,000. Form 990-PF is specifically for private foundations, outlining their financial activities, grants, and distributions.

Filing requirements and deadlines

The requirement to file Form 990 varies based on the type of nonprofit organization. Most tax-exempt organizations, such as charities and private foundations, are mandated to file annually. The general deadline for filing is the 15th day of the 5th month following the end of the organization's fiscal year. This means, for organizations operating on a calendar year, the due date would be May 15.

Extensions for filing are available, allowing organizations to move their deadline to November 15. However, it's crucial to remember that an extension to file is not an extension to pay any taxes owed, which highlights the importance of fiscal planning well in advance of the deadline.

Penalties for non-compliance

Failure to file Form 990 can lead to serious repercussions. Nonprofits may incur financial penalties if they miss the filing deadline or submit an incomplete form. The IRS typically imposes a penalty that starts at $20 per day, up to a maximum of $10,000 for small organizations. For large organizations, this penalty can rise to $100 per day, capped at $50,000.

Persistent non-filing could also jeopardize an organization’s tax-exempt status, leading to further complications in operations and fundraising efforts. It’s vital for nonprofits to prioritize compliance with Form 990 submissions to avoid these ramifications.

Navigating the form: a step-by-step guide

Completing Form 990 can appear daunting, but breaking it down into manageable sections can simplify the process. The form is divided into numerous parts that require detailed reporting on income, expenses, compensation of key employees, and governance information. Each section serves a specific purpose, ensuring a complete financial picture of the organization.

To aid in the completion of Form 990, using interactive tools on pdfFiller can enhance the user experience significantly. These digital platforms provide features for filling out, signing, and managing the document remotely. When reporting financials, accuracy is paramount, and organizations should be meticulous about reconciling all figures from their accounting systems.

Public inspection regulations

Organizations that file Form 990 must comply with public inspection regulations set forth by the IRS. These regulations require that Form 990 be made available for public inspection on request. This requirement underscores the notion of transparency within the nonprofit sector, enabling donors and the public to access critical financial information about organizations operating in the community.

To ensure compliance with these public inspection rules, nonprofits should maintain copies of their filed forms in a readily accessible place, whether digitally or physically. Organizations are also encouraged to proactively make this information available on their websites, fostering a culture of openness and accountability.

Historical context of Form 990

Since its introduction in the early 20th century, Form 990 has evolved significantly. Originally designed as a straightforward reporting tool, it has undergone numerous revisions to enhance transparency and accountability in the nonprofit sector. The Tax Reform Act of 1969 marked a pivotal change, leading to more rigorous reporting requirements that compelled organizations to disclose greater financial details.

This evolution continued with legislative changes over the years, culminating in the formulation of specialized versions like Form 990-PF for private foundations. The ongoing refinement of Form 990 reflects broader trends in nonprofit regulation, responding to calls for greater transparency from the public and regulators alike.

Using Form 990 for charity evaluation

Form 990 is an invaluable resource for evaluating nonprofit organizations. By analyzing the data presented in Form 990, stakeholders can assess an organization’s financial health, efficiency in fund utilization, and overall operational efficacy. For potential donors, understanding how funds are allocated can be a determining factor in supporting a cause.

Furthermore, using metrics derived from Form 990, researchers can offer valuable insights into trends within the nonprofit sector. Such analyses contribute to a more informed philanthropic landscape, ultimately guiding donors in making better decisions based on organizational performance rather than superficial advertising.

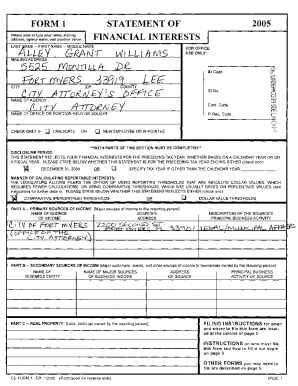

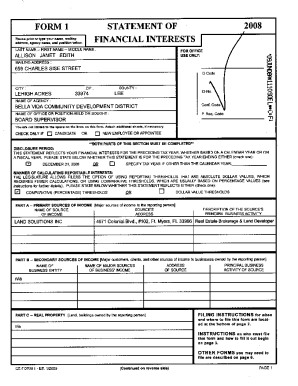

Understanding fiduciary reporting

Fiduciaries within nonprofit organizations have a critical responsibility to ensure that Form 990 accurately reflects the organization’s financial activities and governance structures. These individuals, often board members or officers, are entrusted with maintaining robust financial oversight and ensuring that all information reported is truthful and complete. Their understanding of fiduciary duties extends to compliance with both state and federal regulations.

It's imperative for fiduciaries to be aware of their roles in reporting, as inaccuracies or omissions can have severe repercussions for the organization, including fines or loss of tax-exempt status. Proper training and internal controls can help fiduciaries fulfill their obligations effectively, ensuring that Form 990 is filed accurately and timely.

Filing modalities for Form 990

When it comes to filing Form 990, organizations may choose between electronic filing and traditional paper submissions. Electronic filing through platforms like pdfFiller provides several advantages, including immediate submission confirmation, enhanced convenience, and reduced chances of clerical errors. Many organizations now favor electronic processes due to these benefits.

For those opting for paper filing, it is crucial to ensure the form is mailed to the correct IRS address and to allow sufficient time for delivery. Regardless of the method chosen, tracking the filing status can mitigate headaches and ensure compliance is maintained.

Form 990 data from the IRS

The IRS provides a wealth of data from Form 990 filings, which can be invaluable for research and analysis within the nonprofit sector. Understanding how the IRS shares this data can enhance the ability of organizations and stakeholders to glean insights related to industry trends, funding sources, and allocation efficiencies.

Accurate and organized data reporting in Form 990 is crucial, as the IRS uses this information for its publications and databases. With reliable data, nonprofits can benchmark their own performances against industry standards and utilize findings in strategic planning.

Third-party sources for Form 990

Accessing Form 990 filings can be facilitated through various reputable third-party platforms. These resources not only provide copies of filed forms but also offer analysis tools that can help individuals and organizations interpret the data effectively. Utilizing these platforms enhances the user’s ability to draw comparisons between nonprofits and gauge performance metrics.

However, users must approach third-party information with caution. Ensuring the credibility of the source and the context in which information is presented is essential to avoid misinterpretation or biased analysis.

The nonprofit sector in the U.S.: a resource guide

According to data derived from Form 990, the nonprofit sector significantly impacts American communities, with over 1.5 million registered nonprofits in the country. These organizations contribute vast economic resources, operate in diverse sectors, and provide crucial services. Understanding the dynamics of this sector can inspire potential donors and volunteers, informing them about the essential roles nonprofits play.

Key statistics, like the billions in charitable contributions reported annually, underscore the sector's importance. They also highlight the various issues nonprofits tackle, from education and healthcare to arts and community development. Interested parties can explore this landscape through resources like the National Council of Nonprofits and IRS publications, which provide further insights into regulation and sector dynamics.

How to read Form 990

Interpreting Form 990 can be challenging, given the complexity and volume of data presented within it. Breaking it down into sections, however, can significantly enhance comprehension. Key areas to focus on include revenue streams, expenses, program services, and net assets. By actively engaging with each section, users can discern the financial health and operational effectiveness of any nonprofit.

Tools such as pdfFiller can assist in reading and filling out Form 990 efficiently. For those unfamiliar with financial terminology, employing glossaries or guides can demystify complex terms and figures, enabling a more fruitful analysis of the data provided.

Locating a text of Form 990

Finding the latest version of Form 990 is easy, with resources like the IRS website and platforms like pdfFiller offering accessible options to view and download the form. Staying updated with the most recent version is crucial, as regulations and requirements can shift from year to year. Nonprofits should regularly check official sources to ensure compliance.

It is advisable to familiarize oneself with any changes between versions to avoid errors when filing. pdfFiller provides users with an easy interface to navigate and access the required forms efficiently, further streamlining the filing process.

Interactive features and support on pdfFiller

pdfFiller stands out as an excellent resource for users needing to complete and manage Form 990. The platform features interactive functionalities that guide users through the filling process, ensuring all sections are completed accurately and efficiently. Moreover, pdfFiller's support options, including live chat, provide immediate assistance for users encountering difficulties.

Community forums also enable users to share their experiences and insights, creating an environment of collaboration and knowledge exchange. With these features, pdfFiller empowers organizations to manage their Form 990 filings seamlessly and ensures compliance with ease.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form 990?

How do I make edits in form 990 without leaving Chrome?

Can I create an electronic signature for signing my form 990 in Gmail?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.