Get the free Nearly 50 charged in Southern District of Texas as part ...

Get, Create, Make and Sign nearly 50 charged in

How to edit nearly 50 charged in online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nearly 50 charged in

How to fill out nearly 50 charged in

Who needs nearly 50 charged in?

Nearly 50 charged in form: What you need to know

Overview of recent charges related to the form

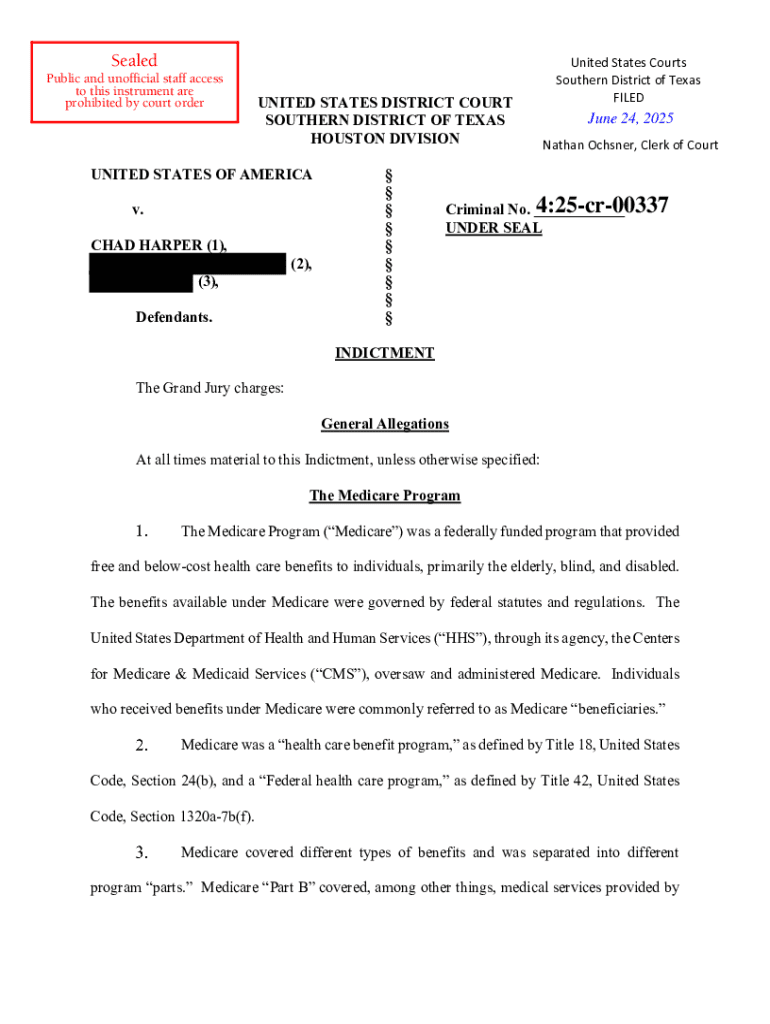

Recently, nearly 50 individuals were charged in connection with a particular form that reportedly facilitated fraudulent activities. This form is a crucial document typically used for various applications, such as governmental permits, business licenses, or grant applications, where accuracy and honesty are paramount. The nature of these charges emphasizes the critical importance of meticulousness when completing such forms.

The charges span a wide range, including fraud, forgery, and conspiracy. The individuals involved come from diverse backgrounds, including business owners, employees, and professional advisors, all of whom played a role in the misuse of the form. This situation serves as a sobering reminder to individuals and teams using similar forms about the potential legal repercussions of providing false information.

Detailed breakdown of charges

The nearly 50 charged include a mix of individuals, such as small business owners and industry professionals. Each individual’s background reveals a complex web of connections to the fraudulent use of the form. For instance, one of the charged individuals is a former compliance officer who was expected to ensure integrity in submissions, highlighting the breach of trust involved.

On the legal side, the charges filed include: 1. Fraud - Misrepresentation of facts to gain an unfair advantage. 2. Forgery - Unauthorized alterations or duplicates of documents. 3. Conspiracy - Planning with others to commit unlawful acts. The potential penalties for these offenses can range from fines to several years of imprisonment, making it crucial for anyone involved with such forms to remain vigilant.

Understanding the implications of the charges

The legal ramifications of these offenses are severe and could include considerable jail time, steep fines, and a permanent criminal record, all of which impact not only the charged individuals but also their affiliated organizations. Furthermore, this case emphasizes the need for stringent oversight and proper management of form submissions to prevent similar situations in the future.

For organizations using similar forms, this incident underscores the necessity of compliance and thorough due diligence. Failing to adhere to best practices when managing forms can result in reputational damage and loss of business opportunities. It’s crucial for individuals and teams to review their procedures and establish safeguards to ensure accurate and lawful submissions.

Steps to properly fill out and manage the form

Filling out the form correctly is paramount in avoiding the pitfalls highlighted by the recent charges. Here’s a comprehensive guide to assist you in proper form management:

It's also beneficial to have a checklist of documents and evidence that can support your submission. Ensuring that every piece of required information is included will bolster the integrity of your application.

Interactive tools for form management

pdfFiller offers a suite of unique tools that enhance the form management process. These tools streamline document transactions and foster collaboration among teams, making it easier to maintain accurate documentation.

Utilizing these interactive features on pdfFiller can enhance efficiency and minimize errors, thus reducing the risk of issues like those seen with the nearly 50 charged individuals.

Best practices for compliance and risk management

To mitigate risks associated with filling out and managing forms, organizations should adopt robust compliance protocols. Key strategies include regular training on form requirements, conducting audits of submissions, and encouraging a culture of transparency.

Furthermore, protecting the confidentiality and security of submitted information is imperative. Teams should implement necessary security measures such as encryption and secure access controls to ensure data integrity.

Frequently asked questions (FAQs)

Many individuals may have concerns about submitting forms. Here are answers to some common queries regarding incorrect submissions and contesting charges.

Expanding knowledge: related legal and regulatory topics

Being aware of other related forms and documentation is essential for staying compliant. Understanding key regulations that govern the use of similar forms can help organizations avoid pitfalls.

Staying abreast of current trends and future developments in form regulations is crucial, especially as digital documentation becomes increasingly scrutinized. Engaging in continuous education regarding updates in law and best practices is vital for teams.

Testimonials and case studies

Positive outcomes from proper form usage stress the importance of sound practices. Many individuals and teams have succeeded through complete and accurate submissions using pdfFiller’s capabilities.

Conversely, there are valuable lessons learned from individuals who faced repercussions due to improper management of forms. These cases underline the significance of adhering to best practices.

Glossary of terms related to the form and charges

Understanding legal jargon is important for those engaged with form submissions. Below are definitions of key terminologies relevant to such contexts.

About pdfFiller

pdfFiller specializes in document management, providing users with sophisticated tools that address form management issues, including legal compliance and ease of document editing. Their cloud-based platform revolutionizes how documents are handled, ensuring users have the resources needed to create, edit, sign, and manage all types of documents.

With a commitment to user satisfaction and comprehensive document solutions, pdfFiller empowers individuals and teams to streamline their documentation processes, thereby minimizing risks related to document submission.

Contact us

For further inquiries related to form issues, pdfFiller provides user-friendly contact options. Users can reach out through their website for support, ensuring that assistance is readily available when navigating the intricacies of form management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my nearly 50 charged in directly from Gmail?

How do I complete nearly 50 charged in online?

How do I fill out the nearly 50 charged in form on my smartphone?

What is nearly 50 charged in?

Who is required to file nearly 50 charged in?

How to fill out nearly 50 charged in?

What is the purpose of nearly 50 charged in?

What information must be reported on nearly 50 charged in?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.