Get the free Fdd Fundmarket

Get, Create, Make and Sign fdd fundmarket

How to edit fdd fundmarket online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fdd fundmarket

How to fill out fdd fundmarket

Who needs fdd fundmarket?

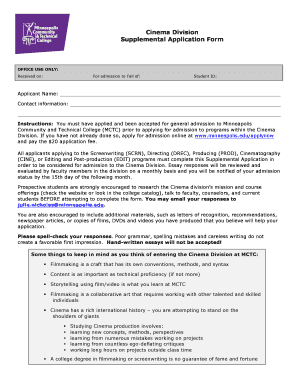

A comprehensive guide to the FDD Fundmarket Form

Understanding the FDD Fundmarket Form

The FDD Fundmarket Form is a crucial document designed for the financial sector, serving as a comprehensive application for investment management purposes. It encapsulates a variety of essential financial disclosures, risk assessments, and asset management details. The primary purpose of this form is to provide a standardized method for reporting, which can improve transparency in investment dealings across different stakeholders, including individual investors, financial institutions, and regulatory bodies.

Understanding the significance of the FDD Fundmarket Form is critical for anyone involved in investment activities. It not only assists in compliance with regulatory requirements but also supports informed decision-making by offering insights into the financial health and risk exposure of a given investment vehicle.

Overview of key features and components

The FDD Fundmarket Form consists of specific sections that play a crucial role in delivering a holistic view of an investment. Key features include an executive summary, which presents an overview of the investment strategy; financial disclosures that detail the financial metrics essential for evaluation; and risk assessments that highlight potential challenges investors might face. Each of these components provides transparency and clarity, crucial for making informed investment choices.

The standard layout of the FDD Fundmarket Form is designed for ease of navigation. Mandatory fields are clearly marked, ensuring that essential information is not overlooked. Optional fields, while not compulsory, allow for the inclusion of additional insights that could be pertinent for specific stakeholder interests.

Step-by-step guide to filling out the FDD Fundmarket Form

Filling out the FDD Fundmarket Form requires careful preparation to ensure accuracy. Start by gathering all necessary documentation, including prior financial statements, performance reports, and risk management plans. Having these documents at hand will facilitate a smoother completion of the form.

Once you’re prepared, fill out each section methodically. Begin with the executive summary, where you’ll articulate your investment approach succinctly. Follow this by detailing your financial disclosures, where precise metrics are essential. Next, provide comprehensive asset management details and finally, outline your risk assessment alongside mitigation strategies. It’s crucial to also be aware of common mistakes, such as incomplete fields or miscalculations, which can compromise the integrity of your submission.

Editing and customizing the FDD Fundmarket Form

Utilizing pdfFiller for form editing makes the process far more efficient. pdfFiller offers a user-friendly interface with robust editing tools that allow users to modify existing forms seamlessly. This includes features that enable you to insert data, annotate sections, or customize fields to suit specific needs.

Custom fields can also be added to address unique investment strategies or specifics that may not be covered by the standard form. This customization not only enhances the form’s relevance for your specific application but also aids in meeting regulatory requirements tailored to your particular investment context.

Electronically signing and sharing the FDD Fundmarket Form

Electronic signatures provide a secure and convenient solution for signing the FDD Fundmarket Form. Compared to traditional methods, eSigning eliminates delays associated with physical signatures, allows for instant verification, and is legally valid in many jurisdictions for financial documentation.

Using pdfFiller, signing the FDD Fundmarket Form is straightforward. Users can follow a step-by-step process to electronically sign the document and share it with stakeholders seamlessly. This capability supports collaborative efforts, enabling multiple parties to engage in the review and approval process effectively.

Managing and storing your FDD Fundmarket Form

Effective document management practices are vital for the proper storage and retrieval of your FDD Fundmarket Form. Organizing forms logically, maintaining version control, and implementing collaborative features can significantly enhance access and reduce the chance of errors. Employing a systematic approach to document management ensures that all parties involved can easily find and refer to the most current version.

Safety is also a paramount concern. pdfFiller employs data encryption to protect sensitive financial information against unauthorized access. Understanding regulatory compliance aspects concerning document security is crucial to ensure your organization adheres to best practices in handling financial disclosures.

Interactive tools for enhanced user experience

pdfFiller offers interactive features that can significantly improve the user experience while working on the FDD Fundmarket Form. Real-time collaboration tools allow multiple users to edit and comment simultaneously, fostering a cooperative environment. This capability is especially beneficial for teams working on investment strategies, where insights from multiple perspectives can lead to more informed decision-making.

Templates are also available, delivering pre-structured formats that can save you time during form completion. Using a template accelerates the filling process, ensuring that nothing crucial is missed and that investment reports are both comprehensive and compliant.

Advanced considerations and risk management

Engaging with the FDD Fundmarket Form necessitates a clear understanding of the risks involved in fund market transactions. Investors need to recognize specific risk factors that could impact financial performance, including market volatility, economic fluctuations, and regulatory changes. A thorough assessment of these risks is crucial for developing effective investment strategies.

Scenario planning is an integral part of utilizing the FDD Fundmarket Form. By modeling various scenarios, investors can proactively address potential challenges and refine their investment strategies accordingly. Assessing the impact of different market conditions on the expected return can lead to more robust financial planning and enhanced risk appetite management.

Case studies and practical applications

Analyzing real-world examples of successful utilization of the FDD Fundmarket Form can provide invaluable insights. Case studies reveal how different organizations have leveraged the form to enhance their investment strategies, improve compliance, and effectively manage risks. Notable examples highlight diverse applications—from startups securing funding to established firms optimizing their portfolios by utilizing thorough financial disclosures.

Insights drawn from these case studies illustrate best practices, such as the importance of thorough financial analysis, diligence in risk assessments, and the crucial impact of collaborative efforts among team members when working on investment documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit fdd fundmarket from Google Drive?

How do I make edits in fdd fundmarket without leaving Chrome?

How do I fill out the fdd fundmarket form on my smartphone?

What is fdd fundmarket?

Who is required to file fdd fundmarket?

How to fill out fdd fundmarket?

What is the purpose of fdd fundmarket?

What information must be reported on fdd fundmarket?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.