Get the free Form 425

Get, Create, Make and Sign form 425

How to edit form 425 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 425

How to fill out form 425

Who needs form 425?

Comprehensive Guide to Form 425: Federal Financial Report Using pdfFiller

Understanding Form 425: Federal Financial Report

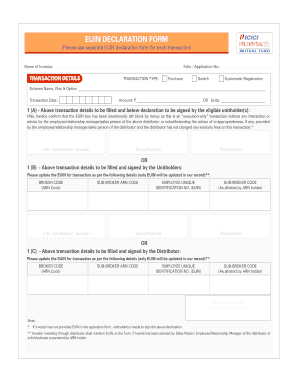

Form 425, also known as the Federal Financial Report, is a critical document required for financial reporting by various federal grantees and contractors. This form plays a significant role in ensuring transparency and accountability in the use of federal funds. By providing a standardized method for reporting financial data, Form 425 allows federal agencies to assess how well grantees meet their financial obligations.

The necessity to use Form 425 extends to all organizations receiving federal funding or grants. This includes nonprofits, educational institutions, and state or local governments. Understanding the nuances of this form can help organizations accurately report their financial status, thus facilitating compliance and potentially leading to future funding opportunities.

Reporting requirements involve several key aspects, including total expenditures, program income, and unobligated balances. Accurate completion of each section enhances the credibility of an organization, making it imperative to approach this form with diligence and accuracy.

Key sections of Form 425: A detailed breakdown

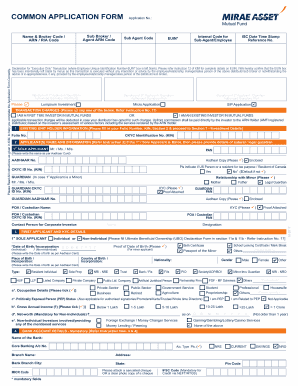

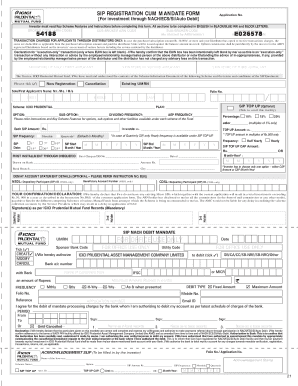

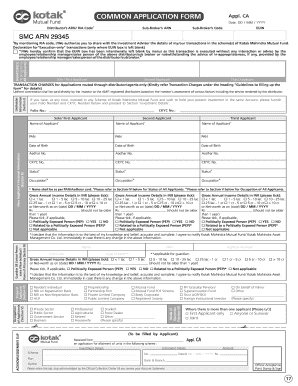

Form 425 is divided into several sections, each serving a unique purpose in capturing essential financial data. Understanding these sections is crucial for proper completion.

Step-by-step instructions for completing Form 425

Completing Form 425 effectively requires careful preparation and systematic execution. Below are the detailed steps to guide you through the process.

Common mistakes include misreporting financial data or failing to include program income. Double-checking entries and consulting resources can help mitigate these issues.

Using pdfFiller to edit and complete Form 425

pdfFiller provides a robust platform for editing and completing Form 425 easily and efficiently. Its features cater specifically to help users navigate the complexity of this federal form.

Accessing Form 425 on pdfFiller is simple. The template library offers a direct search functionality, and existing PDFs can be uploaded effortlessly.

Editing tools within pdfFiller are extensive, allowing users to add text, insert signatures, and adjust financial figures as necessary.

eSigning and sharing your completed Form 425

Once Form 425 is completed, pdfFiller’s eSignature features facilitate easy signing. Users can sign documents securely without the need for printing or scanning.

Managing submitted Form 425

After submitting Form 425, it’s vital to manage the submission effectively to ensure proper tracking and compliance. pdfFiller helps users in this regard by offering a seamless experience.

Additional tips for a successful reporting process

Setting up reminders for future reporting deadlines is essential to maintaining compliance with federal regulations. Utilizing tools to track these dates can simplify the process.

Frequently asked questions about Form 425

Many users have questions regarding Form 425, its processing time, and amendment procedures. Here are some common inquiries answered for clarity.

Real-life examples of submitters’ experiences with Form 425

Understanding how other organizations handle Form 425 can provide valuable insights. Several case studies demonstrate best practices regarding the completion and submission of the form.

How pdfFiller enhances your document management experience

pdfFiller stands out as a cloud-based solution that revolutionizes how users manage their Form 425 submissions. The streamlined document workflow allows for seamless transitions between editing, signing, and sharing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 425 on an iOS device?

How do I complete form 425 on an iOS device?

Can I edit form 425 on an Android device?

What is form 425?

Who is required to file form 425?

How to fill out form 425?

What is the purpose of form 425?

What information must be reported on form 425?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.