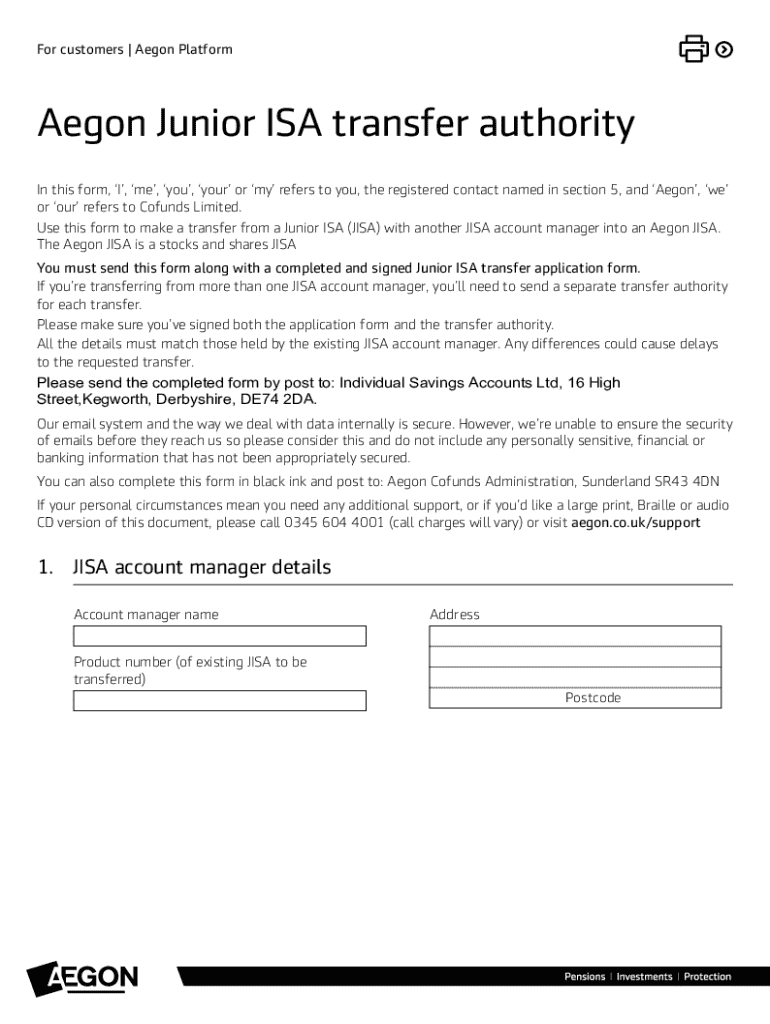

Get the free Aegon Junior Isa Transfer Authority

Get, Create, Make and Sign aegon junior isa transfer

Editing aegon junior isa transfer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out aegon junior isa transfer

How to fill out aegon junior isa transfer

Who needs aegon junior isa transfer?

Comprehensive Guide to Aegon Junior ISA Transfer Form

Understanding the Aegon Junior ISA

A Junior ISA (Individual Savings Account) is a tax-efficient way for parents and guardians to save and invest for their children’s futures. Under UK law, a child can have a Junior ISA from birth until their 18th birthday. Funds in this account cannot be accessed until the child turns 18, supporting long-term savings habits.

The significance of Junior ISAs lies in their ability to promote early saving, allowing money to grow free of tax. Aegon offers a variety of Junior ISA products, encompassing cash ISAs and investment ISAs, which enable parents to choose the most suitable option based on financial goals. Eligibility for these accounts typically requires the child to be under 18 and a resident in the UK.

Why transfer your Junior ISA to Aegon?

Considering a transfer of your Junior ISA to Aegon can unlock numerous benefits that enhance your savings strategy. First and foremost, Aegon offers competitive interest rates that could yield greater returns over time. Flexibility is another key benefit since Aegon provides varied investment options tailored to fit your financial strategies, from cash savings to investment funds.

Aegon also features a user-friendly online portal, making account management straightforward and accessible from anywhere. However, before proceeding with the transfer, it's essential to assess potential fees from your existing provider, which might affect your overall savings. Additionally, ensure that the transfer won’t disrupt the tax benefits previously accumulated in your Junior ISA.

Preparing for the transfer process

To ensure a smooth transfer process to Aegon, gather all necessary documents beforehand. Essential items include identification details, such as the National Insurance number for the account holder, and current Junior ISA account information detailing your existing provider. Having these documents ready will facilitate the completion of the transfer form and speed up the overall process.

Understanding the transfer timeline is crucial too. Typically, a Junior ISA transfer can take anywhere from a few days to several weeks, depending on your current provider's efficiency. Should you face any delays, reaching out to customer service can often provide clarity and assurance regarding your application status.

Step-by-step guide to completing the Aegon Junior ISA transfer form

Accessing the Aegon Junior ISA transfer form is the first step in the transfer process. You can conveniently find the form on pdfFiller’s platform. Here's a systematic breakdown of how to fill out the transfer form, ensuring all required information is accurately captured.

Utilizing pdfFiller tools for an efficient filling process

pdfFiller enhances the experience of filling out the Aegon Junior ISA transfer form through its array of user-friendly tools. Editing the PDF form is made easy with fillable fields and text boxes that allow for clear and legible inputs. You can add signatures, dates, and comments to ensure that the form meets all requirements before submission.

The platform also allows for seamless collaboration, which is perfect for family members or financial advisors who may want to discuss or verify the details provided within the form. With options for sharing and real-time feedback, your transfer process can become even more efficient.

Submitting your Aegon Junior ISA transfer form

Once you've completed your Aegon Junior ISA transfer form, it’s time to submit it. You have the option to submit the form online via the Aegon portal, ensuring a fast and efficient transfer process. Alternatively, for those who prefer traditional methods, you may mail a physical copy of the form to Aegon’s designated address.

Tracking your transfer progress

Monitoring the progress of your Junior ISA transfer is straightforward with Aegon. Through the user-friendly Aegon online portal, you can check the status of your application at any time. Additionally, should any uncertainties arise, contacting Aegon's customer support team can provide further assistance and clarity regarding the transfer process.

If any issues occur during the transfer, it's crucial to remain proactive. Most hurdles can be resolved with direct communication with both Aegon's support and your current Junior ISA provider.

FAQs about Aegon Junior ISA transfers

Many parents have questions when it comes to transferring their Junior ISA to Aegon. Common concerns include delays in the transfer process. It's essential to note that while transfers can take time, delays can be addressed effectively by maintaining communication with your current provider and Aegon.

Another important consideration is whether you can transfer from multiple providers. Aegon permits transferring Junior ISAs from several institutions, offering flexibility to consolidate your child's savings under one care.

Additional considerations for managing Junior ISAs with Aegon

After successfully transferring to Aegon, understanding how to manage your Junior ISA efficiently is crucial. Consider future contributions, as Aegon allows you to add funds to the Junior ISA up to the annual allowance limits set by the government. Strategic planning for these contributions can maximize the growth of your child's savings.

Moreover, transitioning the Junior ISA to an adult ISA comes into play once your child reaches 18. This transition should be planned in advance to maintain the tax benefits and seamless access to funds as they begin to manage their finances.

Feedback and testimonials from users

Users consistently express satisfaction with the efficiencies gained from the Aegon Junior ISA transfer process. Many testimonials highlight how Aegon's clear instructions and supportive customer service made their experience seamless. Notably, pdfFiller is frequently mentioned for its capacity to simplify the transfer form filling process, ensuring that users can edit, sign, and submit documents from the ease of their digital devices.

These positive experiences not only reflect the effectiveness of Aegon's services but also underscore the importance of utilizing tools like pdfFiller that promote document efficiency and user satisfaction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send aegon junior isa transfer for eSignature?

How do I edit aegon junior isa transfer straight from my smartphone?

How do I fill out aegon junior isa transfer on an Android device?

What is aegon junior isa transfer?

Who is required to file aegon junior isa transfer?

How to fill out aegon junior isa transfer?

What is the purpose of aegon junior isa transfer?

What information must be reported on aegon junior isa transfer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.