Get the free Cie Form 609a

Get, Create, Make and Sign cie form 609a

Editing cie form 609a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cie form 609a

How to fill out cie form 609a

Who needs cie form 609a?

A Comprehensive Guide to CIE Form 609A

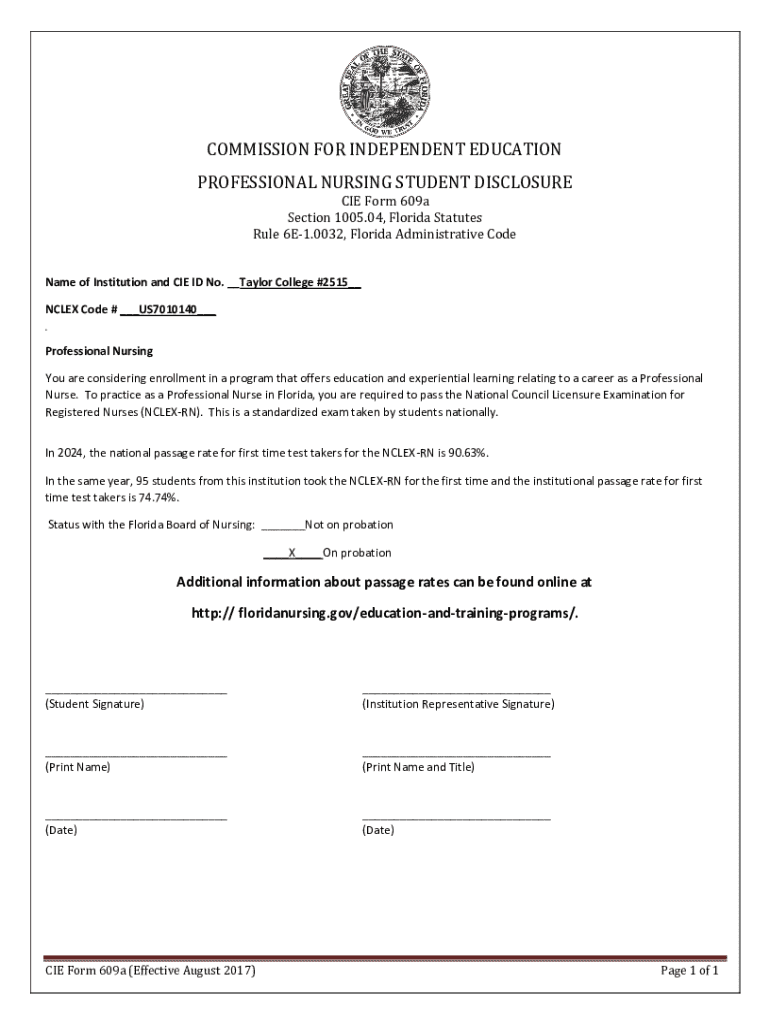

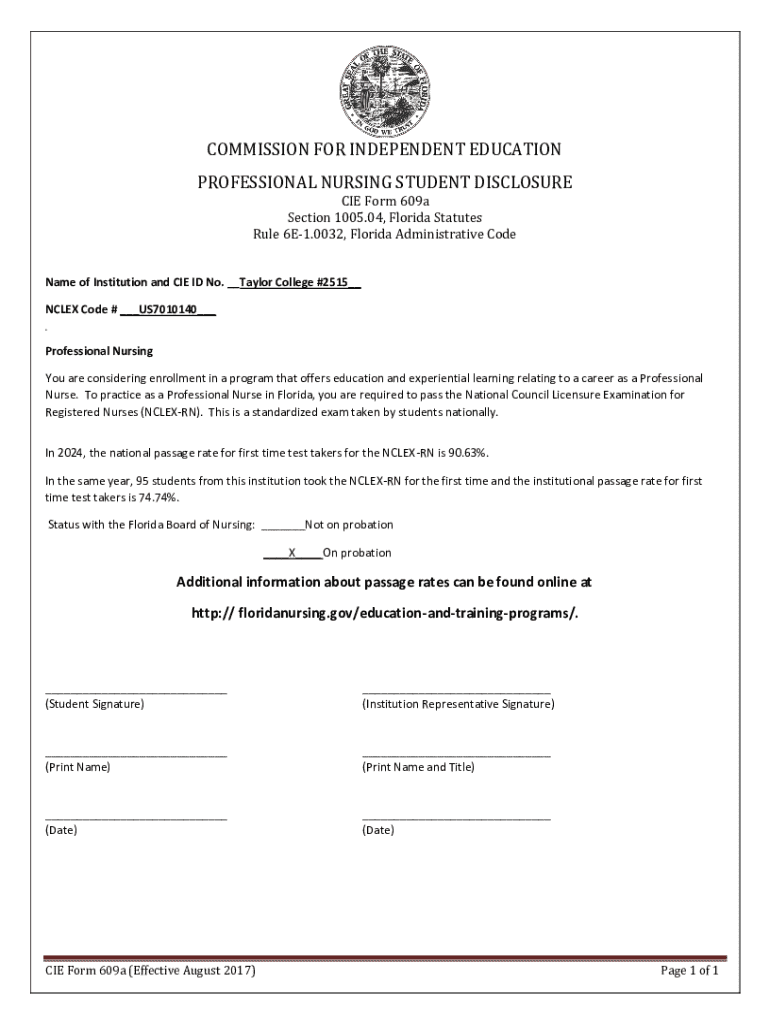

Understanding CIE Form 609A

CIE Form 609A is a specific document used primarily for employment verification purposes. This form is often required by employers and regulatory bodies to confirm an individual’s employment status, history, and sometimes their qualifications. It serves as a vital tool in maintaining workplace integrity and compliance with various employment laws.

Accurate completion of CIE Form 609A is crucial for all users, as any discrepancies can lead to delays in processing, potential legal ramifications, or even denial of employment opportunities. Individuals completing this form must be diligent in providing truthful and precise information to avoid complications later in the hiring or verification processes.

CIE Form 609A is typically used by job applicants or current employees undergoing background checks. It may also be required for loan applications or other situations needing proof of income or employment stability. Understanding when and how to use this form will streamline the documentation process for anyone involved.

Key features of CIE Form 609A

It’s essential to familiarize yourself with the structure of CIE Form 609A to ensure successful completion. The form is divided into several sections, each designed to collect specific information required for employment verification. Below is a detailed breakdown of form sections.

One common field that raises questions is the applicant’s Social Security number. This number is critical as it helps verify identity and assists in checking employment history against official records.

Preparing to fill out CIE Form 609A

Before tackling CIE Form 609A, being well-prepared is key to avoiding errors. Begin by gathering all required documentation. Personal identification, such as a government-issued ID, is often necessary. Additionally, supporting employment records may include recent pay stubs, tax forms, and letters of employment verification.

Understanding the terminology used in the form will enhance your ability to complete it accurately. Familiarize yourself with terms like 'employment verification,' 'full-time,' 'part-time,' and 'self-employed,' as these will clarify what information you need to provide.

Step-by-step instructions for completing CIE Form 609A

Completing CIE Form 609A can be straightforward if you follow these steps carefully.

Editing and managing CIE Form 609A on pdfFiller

pdfFiller offers a range of tools to manage CIE Form 609A efficiently. Start by importing the form to pdfFiller, where you can enjoy an array of editing options.

Utilizing editing tools is straightforward. Highlight sections that need emphasis, annotate important points, and add comments or revision notes to clarify any modifications you wish to discuss with another party. This functionality ensures all essential details are maintained.

How to eSign CIE Form 609A

Adding your signature digitally on CIE Form 609A through pdfFiller is a seamless process. You can draw your signature directly on the document, use a pre-saved signature, or type your name and select a suitable font style.

It’s important to recognize the legal validity of eSigned documents. According to various regulations, an eSignature holds the same weight as a handwritten signature, ensuring your document is legally binding. This provides security and legitimacy to the submissions made.

Collaboration and sharing

pdfFiller also allows users to share their CIE Form 609A with others for review or collaboration. Invite colleagues or supervisors by sending the document directly through the platform. Users can provide consent or revoke access based on their needs.

Managing permissions is critical. Ensure that only trusted parties have viewing or editing rights, as sensitive information will often be included in such forms. pdfFiller enables you to control who can access what, reducing risks around data privacy.

Common issues and troubleshooting

When dealing with CIE Form 609A, there can be common errors made during the submission phase. These can range from mistakenly providing incorrect personal information to omitting necessary documentation altogether. Carefully review your completed form to catch these errors.

If you encounter issues such as system glitches or form submission failures, check the pdfFiller support section for troubleshooting tips. Frequently asked questions can also clarify common concerns and assist users in resolving issues effectively.

Tips for efficiently managing your forms

Organization is key when managing multiple forms like CIE Form 609A. Implement a system that allows for easy access, such as categorizing forms by type, date, or relevant task. This will reduce time spent searching for documents.

To maintain a clutter-free digital workspace, regularly review and archive documents that are no longer in use. pdfFiller’s cloud storage solution not only allows for secure access but also makes it easy to retrieve any document when needed.

Additional tools and resources in pdfFiller

Apart from CIE Form 609A, pdfFiller provides an array of other templates available for various document needs. From tax forms to legal documents, users can benefit from a comprehensive library of customizable options.

Utilizing pdfFiller’s interactive tools enhances document management further. Users can add images, create forms from scratch, and even integrate workflows to streamline processes. The advantages of cloud-based solutions can’t be overstated, as they facilitate easy access and ensure all documents are secure.

Conclusion: simplifying your document management with pdfFiller

Mastering CIE Form 609A is essential for anyone navigating the complexities of employment verification. Understanding the process and leveraging tools available through pdfFiller enhances the efficiency of managing your documents.

By embracing the capabilities of pdfFiller, users can streamline their document handling tasks, ensuring quick access, secure storage, and a simplified workflow. This can ultimately lead to a more organized approach to managing essential documents, ensuring less stress in critical situations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the cie form 609a in Chrome?

How do I fill out cie form 609a using my mobile device?

How do I fill out cie form 609a on an Android device?

What is cie form 609a?

Who is required to file cie form 609a?

How to fill out cie form 609a?

What is the purpose of cie form 609a?

What information must be reported on cie form 609a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.