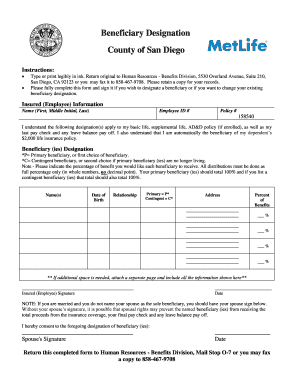

Get the free Form 40-f

Get, Create, Make and Sign form 40-f

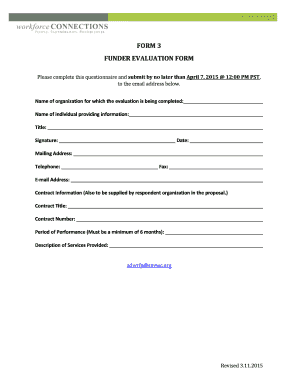

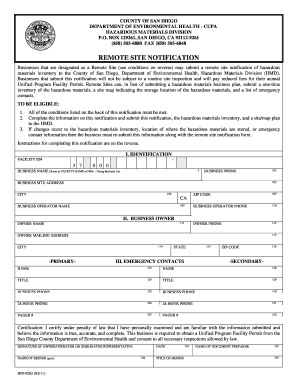

Editing form 40-f online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 40-f

How to fill out form 40-f

Who needs form 40-f?

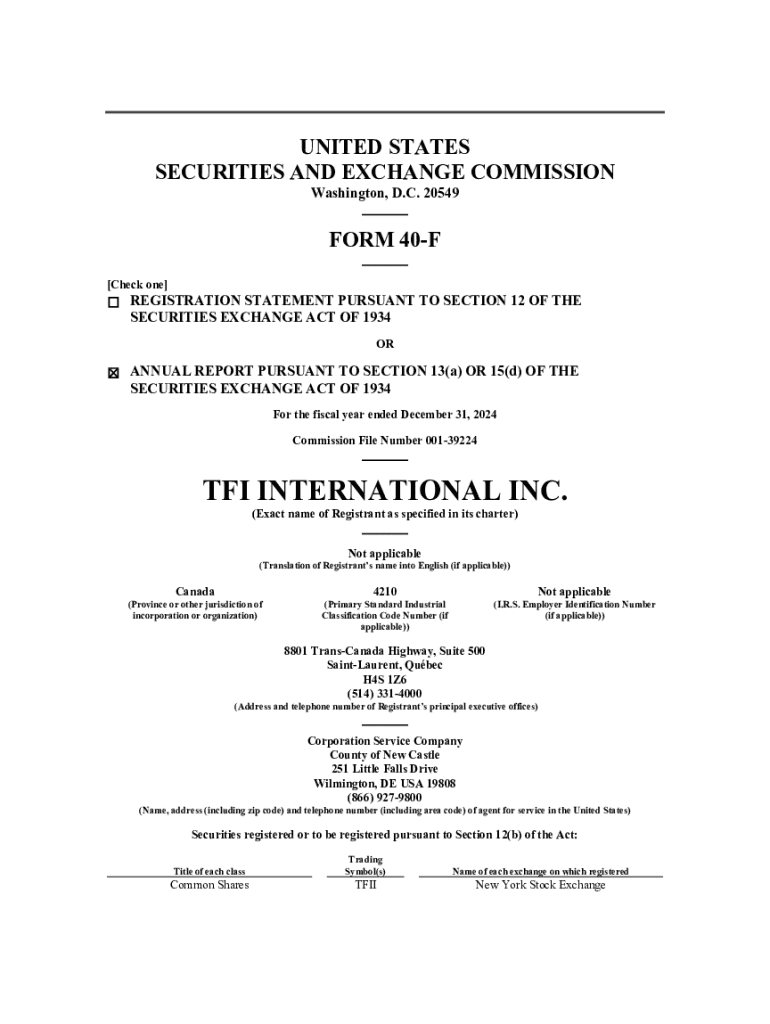

A Comprehensive Guide to Filling Out SEC Form 40-F

Understanding the SEC Form 40-F

SEC Form 40-F is a vital filing requirement for certain foreign companies that trade securities in the United States, primarily those established in Canada. The purpose of this form is to provide comprehensive information about the company's financial condition and operations, allowing investors to make informed decisions. It’s part of the U.S. Securities and Exchange Commission’s (SEC) broader regulatory framework aimed at maintaining transparency and investor protection.

Within the context of SEC filings, Form 40-F exists alongside forms like 10-K but is specifically tailored for foreign companies, bridging any gaps in information transfer between jurisdictions.

Who is required to file?

Any Canadian company whose securities are publicly traded in the U.S. must file SEC Form 40-F if it qualifies as a well-known seasoned issuer (WKSI) or meets other specific criteria set forth by the SEC. This includes companies listed on recognized exchanges and those that exceed certain asset and revenue thresholds. Importantly, stakeholders such as investors, analysts, and regulatory bodies rely on this filing for insights into the company's performance.

Components of the Form 40-F

Form 40-F includes several key sections that cover essential aspects of a company's operations and governance. These sections are designed to provide a holistic view of the company, starting with financial statements that reflect operational health.

Moreover, the required documentation for the form includes the company’s latest audited financial statements, management discussion and analysis (MD&A), and any reports from independent auditors. Ensuring accuracy in these reports is crucial, as they anchor the overall compliance of the filing.

The filing process

Filing SEC Form 40-F can seem daunting, but breaking it down into clear steps makes the process manageable. Here is a step-by-step guide to filing the form accurately.

Common pitfalls include neglecting to gather complete documentation or misinterpreting sections of the form. It’s crucial to avoid such mistakes as they can lead to compliance issues.

Implications of filing Form 40-F

Filing Form 40-F is not merely a regulatory obligation; it plays a significant role in ensuring investor transparency. By providing a clear view of a company's operations and financial health, it fosters an environment of trust among investors. Companies that are diligent in meeting their filing requirements typically enjoy a stronger reputation and greater confidence from stakeholders.

On the flip side, non-compliance can have serious ramifications. Companies may face fines, penalties, or even legal action. Consistently delayed filings can damage trust and affect the market perception of the company.

Tools and resources for filers

Utilizing interactive tools can greatly streamline the process of filling out Form 40-F. Platforms like pdfFiller offer features specifically designed for document management, including collaborative tools for teams. These tools allow seamless editing, eSigning capabilities, and the ease of accessing documents anytime, anywhere.

Efficient document management is crucial for maintaining accuracy, especially in the context of SEC filings. Ensuring that all team members can easily access the most recent version of a document reduces the likelihood of errors.

Enhancing your filing experience

To make the filing process as smooth and efficient as possible, consider adopting some best practices. Begin with planning ahead; a well-organized approach to gathering data and documentation will reduce stress significantly.

Frequently asked questions often delve into specifics about deadlines, required documentation, and the nuances of each filing. Staying informed and seeking clarity on these topics can significantly alleviate any concerns about the filing process.

Staying up-to-date with filing requirements

The regulatory landscape around SEC filings is continually evolving. Keeping abreast of any changes or amendments is crucial for maintaining compliance. To stay informed, companies should regularly check the SEC’s website and follow relevant regulatory news outlets.

Utilizing tools that track changes and provide reminders for upcoming deadlines can also ensure that filings are made timely and accurately.

Support and assistance

For those navigating the complexities of Form 40-F filing, reaching out to experts can be a proactive approach to ensuring compliance. It’s wise to consult legal or financial experts specializing in securities regulations when uncertainties arise.

Additionally, engaging with the pdfFiller community can provide valuable insights and tips from other users. Sharing experiences can enhance understanding of best practices and problem-solving strategies in the filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the form 40-f in Gmail?

How do I edit form 40-f straight from my smartphone?

How do I fill out the form 40-f form on my smartphone?

What is form 40-f?

Who is required to file form 40-f?

How to fill out form 40-f?

What is the purpose of form 40-f?

What information must be reported on form 40-f?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.