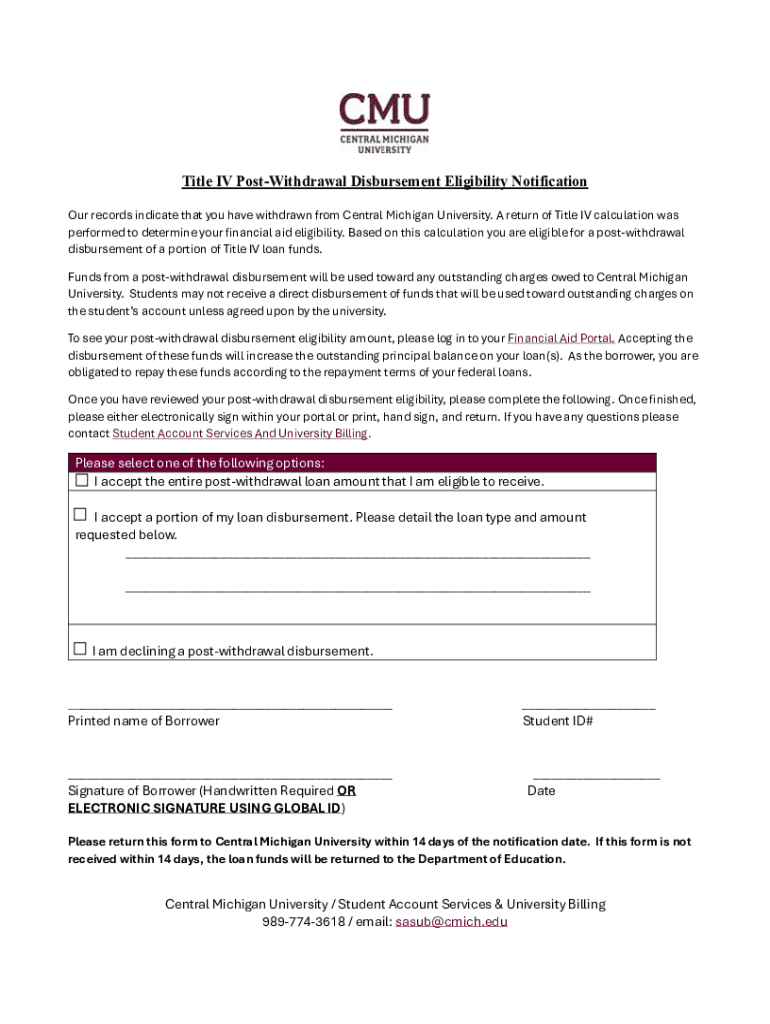

Get the free Title Iv Post-withdrawal Disbursement Eligibility Notification

Get, Create, Make and Sign title iv post-withdrawal disbursement

Editing title iv post-withdrawal disbursement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out title iv post-withdrawal disbursement

How to fill out title iv post-withdrawal disbursement

Who needs title iv post-withdrawal disbursement?

Understanding the Title Post-Withdrawal Disbursement Form: A Comprehensive Guide

Understanding Title and post-withdrawal disbursement

Title IV refers to a subset of the U.S. Higher Education Act that governs federal financial aid programs. These programs are vital as they provide students with access to education through grants, loans, and work-study opportunities. Understanding the Title IV financial aid system is crucial for college students, particularly when contemplating withdrawal from their programs. In situations where students withdraw from their courses, the post-withdrawal disbursement form becomes essential to ensure that they receive any money they have earned before their withdrawal.

The importance of post-withdrawal disbursement forms cannot be overstated. These forms allow students who have withdrawn to claim disbursements of their Title IV financial aid funds that they are entitled to, thereby ensuring they do not lose these valuable resources. It is imperative to grasp key terms and definitions associated with Title IV to navigate the financial aid process effectively.

Eligibility criteria for post-withdrawal disbursement

Qualifying for post-withdrawal disbursement requires understanding distinctions between official and unofficial withdrawals. An official withdrawal occurs when a student formally notifies the institution of their intention to withdraw, while an unofficial withdrawal typically involves less formal communication, such as ceasing attendance without notice. This distinction significantly affects eligibility for aid disbursements.

Timing and circumstances of withdrawal also play a crucial role. Students who withdraw early in the semester may not be entitled to as much aid as those who withdraw later, as they would have earned a smaller portion of their financial aid based on their attendance. Additionally, students must be assessed for financial aid eligibility to determine if they qualify for disbursement based on the remaining funds allocated to them.

Steps for completing the title post-withdrawal disbursement form

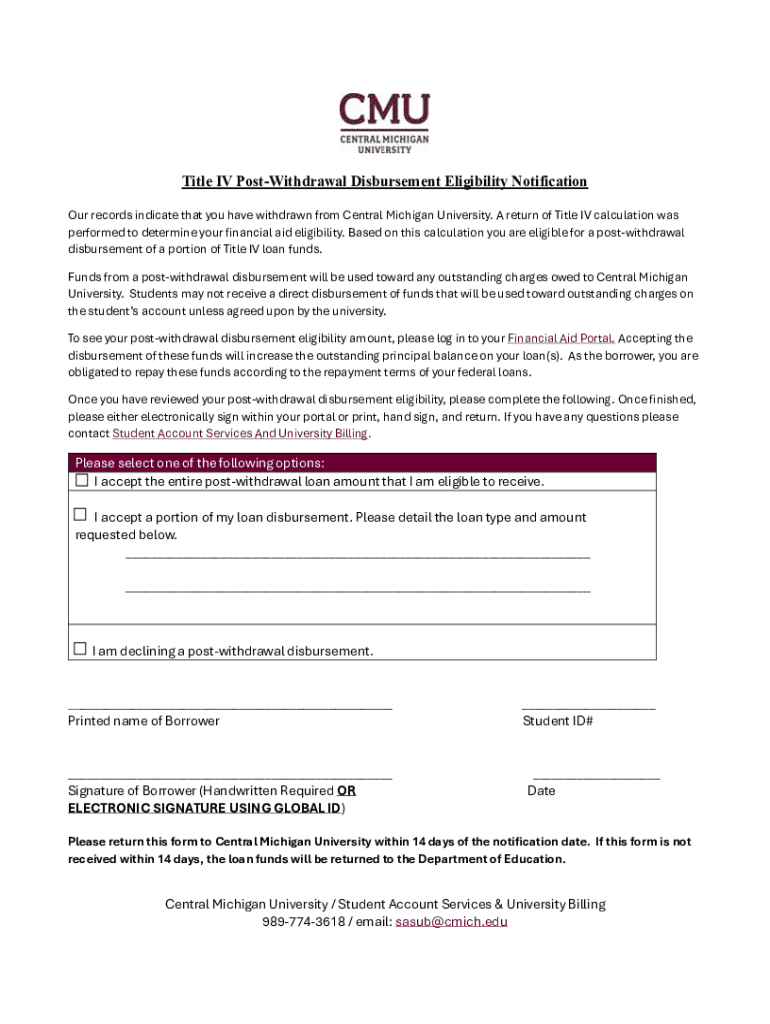

Completing the Title IV post-withdrawal disbursement form is a structured process. The initial step involves accessing the appropriate form, which is usually available on the financial aid section of your institution's website. Having this document at hand is crucial for the subsequent steps.

The form requires specific details. You'll need to provide your personal information, including your name and student ID, withdrawal details to clarify the circumstances leading to your withdrawal, and financial aid details that outline your existing aid awards. Additionally, documenting your attendance accurately is critical to support your request for disbursement.

How post-withdrawal disbursement is calculated

Understanding how post-withdrawal disbursement is calculated is pivotal. One must consider the R2T4 (Return of Title IV) responsibilities, which mandates determining how much financial aid a student has earned based on their attendance. The calculation distinguishes between earned and unearned aid with clear guidelines.

Students earn their Title IV aid proportionate to the period they attended. For example, if a student completed 60% of the semester, they would earn 60% of their aid. Conversely, any unearned aid must be returned to the federal government by the institution, typically within a specified time frame, ensuring compliance with financial regulations.

Key considerations for students

Withdrawing from a course can have implications beyond immediate financial concerns. Students must consider how their withdrawal may affect future financial aid eligibility. Many institutions have specific policies that may restrict future aid if withdrawals or poor academic performance occurs.

It’s also vital to understand the handling of credit balances post-withdrawal. In certain cases, unclaimed Title IV funds may be returned to the federal government unless students actively pursue these funds. Not adequately managing withdrawn aid can lead to complexities upon re-enrollment or transferring to another institution.

Communication with financial aid offices

Clear communication with financial aid offices is paramount for students navigating the post-withdrawal landscape. Financial aid representatives can provide insights specific to each student’s situation, clarify disbursement timelines, and guide them through any required paperwork.

Students should expect to receive notifications regarding their disbursement status. The responsiveness of financial aid offices can greatly impact students’ understanding and access to the funds they are entitled to. Questions regarding disbursement should be directed to financial specialists who can provide personalized assistance.

Institutional responsibilities

Educational institutions have specific obligations concerning Title IV funding and how they manage student financial aid processes. Compliance with federal regulations ensures that students receive their entitled aid and that institutions adhere to the legal requirements set forth by the Department of Education.

Furthermore, protecting student information is a significant institutional responsibility. Financial aid offices must ensure confidentiality and uphold the privacy standards installed by federal regulations to protect sensitive information while supporting students through their educational financial journeys.

Tools and resources available

To facilitate better understanding and management of financial resources and forms, various interactive tools are available. For instance, financial aid calculators can help students anticipate their financial needs based on their course load and withdrawal status.

Moreover, utilizing the pdfFiller platform for document management can streamline the completion and submission of the Title IV post-withdrawal disbursement form. Students can effortlessly edit, sign, and manage their documents from a single cloud-based platform, ensuring that their paperwork is always accessible, secure, and up-to-date.

Final thoughts on navigating post-withdrawal disbursement

Staying informed about financial aid processes is critical for navigating the complexities of Title IV funding. Understanding the intricacies of post-withdrawal disbursement forms and the related financial responsibilities can significantly affect students' future educational journeys.

Utilizing available resources to enhance financial literacy is also key. Proactively communicating with financial aid advisors can further clarify any uncertainties and empower students to make informed decisions regarding their educational financing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit title iv post-withdrawal disbursement from Google Drive?

How do I edit title iv post-withdrawal disbursement online?

How do I fill out the title iv post-withdrawal disbursement form on my smartphone?

What is title iv post-withdrawal disbursement?

Who is required to file title iv post-withdrawal disbursement?

How to fill out title iv post-withdrawal disbursement?

What is the purpose of title iv post-withdrawal disbursement?

What information must be reported on title iv post-withdrawal disbursement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.