Get the free Roll-off Account Application

Get, Create, Make and Sign roll-off account application

How to edit roll-off account application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out roll-off account application

How to fill out roll-off account application

Who needs roll-off account application?

How to Fill Out a Roll-Off Account Application Form: A Comprehensive Guide

Understanding the roll-off account application form

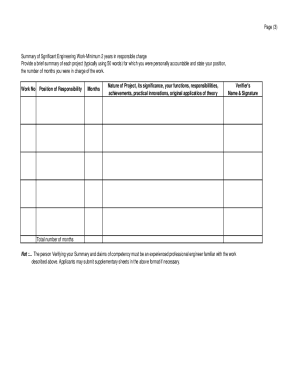

A roll-off account is a specialized account that allows users to effectively manage the cash flow and billing associated with large-scale projects, particularly in construction or risk management sectors. It serves as a separate ledger that simplifies accounting processes by allowing for precise tracking of project-related expenses. This is significant for teams working on roll-off contracts, enabling clear visibility into budget compliance and funding.

The roll-off account application form plays a crucial role as it initiates the process of opening such an account. By completing this form, individuals or teams can access the benefits, which include streamlined financial management, ease of tracking expenditures, and the ability to generate reports that aid in decision-making. Essentially, the roll-off account becomes a financial tool that enhances project accountability.

Key components of the roll-off account application form

Filling out the roll-off account application form requires specific information to ensure that it is processed efficiently. Essential elements include personal details of the applicant, financial information to verify eligibility, and company information if the application is being made on behalf of a team. Each component is designed to gather critical data that facilitates a thorough review by the financial institution.

Supplemental documentation is also required to reinforce the application. This typically includes proof of identity, such as a government-issued ID, along with income verification documents like pay stubs or tax returns. Providing accurate and up-to-date documents is vital to minimize delays during the approval process.

Step-by-step guide to filling out the roll-off account application form

The process of completing the roll-off account application form can seem daunting, but with a clear step-by-step approach, it becomes manageable. Begin by accessing the form available on pdfFiller, which provides an intuitive platform for filling out forms seamlessly.

Interactive tools available on pdfFiller

Utilizing interactive tools on pdfFiller can significantly ease the process of completing your roll-off account application. One of the primary features is the auto-fill capability that pre-populates fields based on previous entries, saving time and enhancing accuracy. This feature ensures that you don’t have to repetitively enter the same information, which can often lead to errors.

Additionally, for teams applying, real-time collaboration tools allow multiple users to work on the document simultaneously. This helps in brainstorming the best entries and validating information in a collaborative manner. Furthermore, pdfFiller offers eSigning options that facilitate prompt submission. With just a click, you can sign your form digitally, ensuring that the application is processed without unnecessary delays.

Common mistakes to avoid when completing the roll-off account application form

To ensure that your roll-off account application is successful, it's important to be aware of common pitfalls. One of the most common mistakes is submitting incomplete information. Leaving out required fields can lead to delays or outright denial of your application. Each piece of information is crucial, so double-check all sections before submission.

Handling these common errors proactively can increase the likelihood of a smoothly processed application.

Troubleshooting: What to do if your application is denied

If your application for a roll-off account is denied, it can be disheartening. However, understanding the reasons behind the denial and the steps to take next is crucial. Common reasons for denial include insufficient financial documentation, discrepancies in reported information, or failure to meet specific eligibility criteria.

Addressing the issues outlined in any denial notice and taking corrective actions can significantly enhance your chances in subsequent applications.

Frequently asked questions (FAQs)

After applying for a roll-off account, many questions may arise regarding the process and its implications. Clear answers to these can ease some of the concerns that applicants have.

Contact support for assistance

If you encounter challenges when filling out your roll-off account application form, reaching out to customer service can provide valuable assistance. pdfFiller's support team is available through various channels ensuring you have the help you need.

Be sure to check the hours of operation to ensure you reach support when they are available.

Popular links

Navigating through resources on pdfFiller can streamline your experience when applying for a roll-off account. Here are some useful links that can guide you further.

Additional tools for document management on pdfFiller

pdfFiller not only facilitates the completion of roll-off account application forms but also offers various tools for effective document management. An overview of other forms and templates can enhance flexibility in managing paperwork related to different projects.

Understanding your rights and responsibilities

It is imperative to understand your rights and responsibilities when handling a roll-off account. This includes being aware of how your personal information will be utilized and protected by the service provider. A thorough reading of the privacy policy is essential to ensure compliance with data protection regulations.

Furthermore, after creating a roll-off account, you have certain financial obligations, including timely payments and adherence to agreed-upon terms. Understanding these aspects will prepare you for a smooth experience while using the roll-off account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in roll-off account application?

Can I create an eSignature for the roll-off account application in Gmail?

How can I edit roll-off account application on a smartphone?

What is roll-off account application?

Who is required to file roll-off account application?

How to fill out roll-off account application?

What is the purpose of roll-off account application?

What information must be reported on roll-off account application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.