Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Your Comprehensive Guide to Form 990: Understanding, Filing, and Utilizing Nonprofit Reporting

Understanding Form 990: An overview

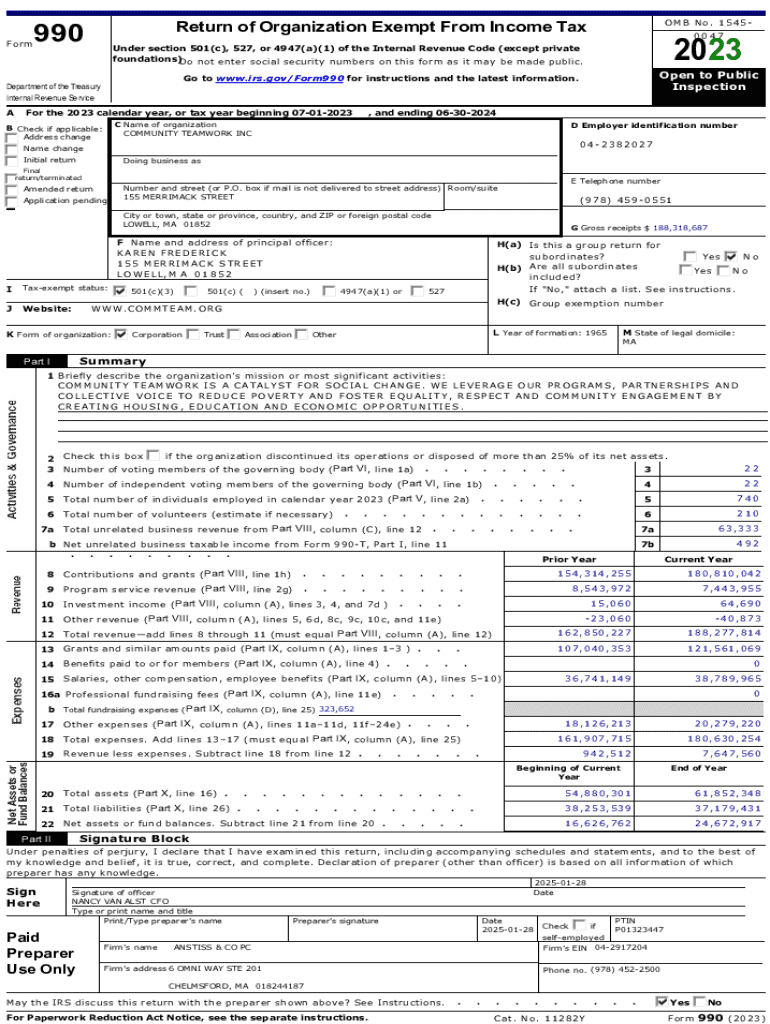

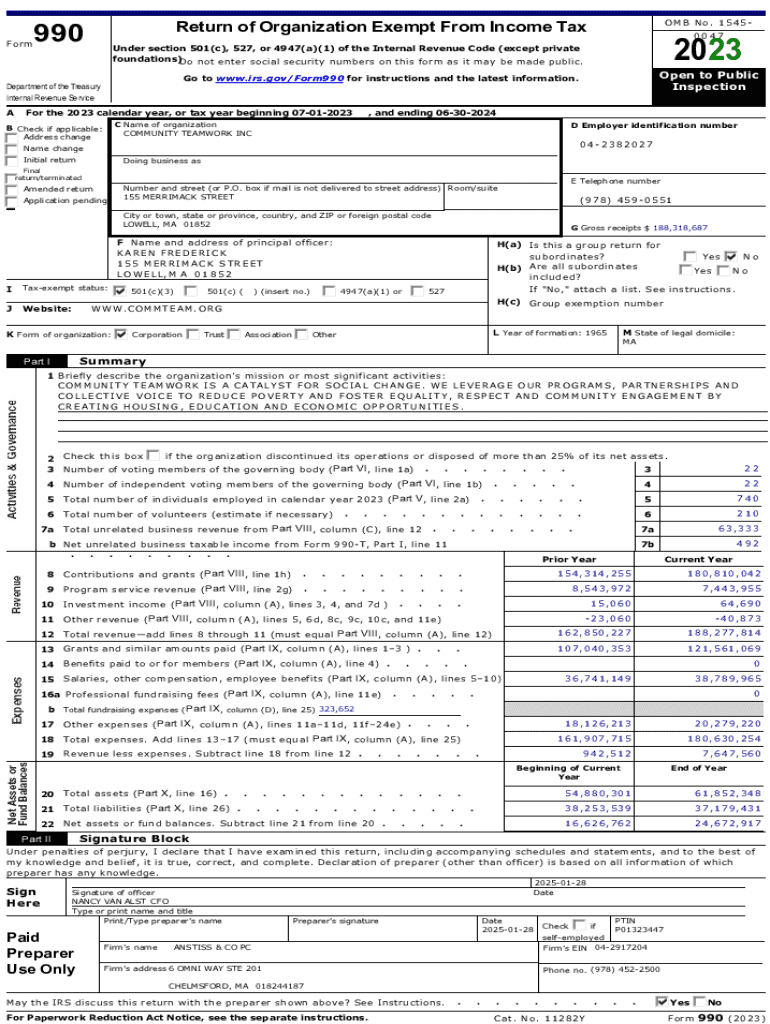

Form 990 serves as a critical resource for nonprofit organizations, detailing their financial information, governance, and alignment with their mission. The primary purpose of this form is to provide transparency and accountability to the public and IRS regarding how nonprofit dollars are spent. It's essential not only for tax compliance but also as a tool for stakeholders to assess the organization's operations and effectiveness.

Various types of organizations are required to file Form 990, including charitable nonprofits, private foundations, and social welfare organizations. While most of these entities must file annually, certain smaller organizations can file a simplified version, Form 990-N. Understanding your organization’s requirements and deadlines is crucial to remain compliant.

Contents of Form 990

Form 990 includes diverse sections, from essential summaries to in-depth financial statements. Below, we will break down the core parts of this form, giving an overview of each section's purpose and requirements. A proper understanding of these components will facilitate a complete and compliant filing.

Filing requirements for Form 990

Determining who must file Form 990 can be complex. Generally, organizations with annual gross receipts exceeding $200,000 are mandated to file the full Form 990, while others with receipts between $50,000 and $200,000 may still qualify to submit the shorter Form 990-EZ. Smaller organizations, often referred to as 'small nonprofits' with thresholds below $50,000, are eligible to use Form 990-N, also known as the e-Postcard.

File submissions can be done via eFiling or paper filing. eFiling is often recommended due to its speed and lower risk of errors. When selecting the appropriate form, understanding your organization’s size and complexity is crucial. For instance, Form 990-PF is specifically tailored for private foundations, including unique reporting that caters to their operational structures.

Consequences of non-compliance with Form 990

Failure to comply with Form 990 filing requirements can lead to various repercussions for nonprofits. Not only can late filings incur steep penalties – ranging from $20 per day up to $10,000, depending on organization size – but organizations may also face scrutiny and loss of tax-exempt status if they consistently neglect their filing obligations. Misreporting, whether intentional or accidental, can bring further legal challenges and financial liabilities.

Not filing Form 990 can also diminish donor confidence. As stakeholders seek transparency in financial operations, being unable to provide valid Form 990 filings can hinder fundraising efforts and ruin credibility. It’s crucial for organizations to prioritize compliance not only to avoid penalties but also to foster trust with the public and potential funders.

Public inspection regulations and their importance

Form 990 plays a significant role in promoting transparency within the nonprofit sector. Once filed, this form is accessible to the public, providing valuable insights into a nonprofit’s financial status, governance practices, and program performance. People can access these filings online through various platforms, including the IRS website and nonprofit analysis sites, fostering an awareness of how donor funds are utilized.

Understanding what information is publicly available is vital for organizations to navigate privacy concerns effectively. While financial details are disclosed, sensitive personal information about donors and beneficiaries is kept confidential to protect against misuse. Organizations must ensure that their Form 990s accurately reflect their operations while adhering to these privacy regulations.

Historical context and evolution of Form 990

Since its inception, Form 990 has evolved significantly, adapting to changing regulations and the increasing need for transparency. Originally introduced in the 1940s, its purpose was to serve as a tax reporting form for charitable organizations. Over time, it has undergone numerous revisions to ensure it meets both the IRS's compliance requirements and the public's demand for clarity.

Important revisions have included the implementation of the Schedule B, detailing major contributors, and enhanced sections focusing on governance and accountability strategies. Each update represents an effort by regulators to create more robust transparency and accountability frameworks for nonprofits. Understanding the historical context of Form 990 can aid organizations in appreciating their responsibilities under current laws.

Utilizing Form 990 for charity evaluation

Form 990 serves a dual purpose: it's essential for compliance, and it can function as a powerful tool for prospective donors and supporters to evaluate a nonprofit’s health and mission effectiveness. By examining key sections, individuals and organizations can gain insights into not only the financial stability of a nonprofit but also how efficiently they are using their resources to achieve their goals.

Specific metrics derived from Form 990 allow for comparisons among similar organizations, revealing program effectiveness and operational efficiencies. Platforms like pdfFiller can help collect and manage these forms, making analysis easier and more accessible for stakeholders aiming to make informed donation decisions.

Tips for successfully completing Form 990

Completing Form 990 doesn’t have to be daunting; adopting a systematic approach can streamline the process. Start by gathering essential documents such as financial statements, donor lists, and governance policies. Breaking down the form into its constituent parts, focusing on one section at a time ensures thorough completion. Utilizing resources such as online guides can facilitate understanding of specific requirements for each part.

Common challenges include ensuring accurate reporting and understanding complex IRS guidelines. Engaging with knowledgeable peers or consultants can provide guidance and alleviate errors. Additionally, utilizing interactive tools available on pdfFiller can enhance the document management process, ensuring smooth collaboration among team members.

Third-party resources for assistance

Several trusted organizations and websites offer guidance on completing Form 990. Resources such as the National Council of Nonprofits and the Foundation Center provide educational materials and tools to facilitate understanding and compliance. Furthermore, the IRS itself offers a wealth of information, including instructional guides and FAQs tailored to Form 990.

In addition, forums and community networks exist where nonprofit professionals can share insights and seek advice. These platforms provide informal but valuable support systems that can enhance collective knowledge regarding best practices for completing Form 990 and managing related obligations. Leveraging these resources can significantly improve the filing experience.

How to read and interpret Form 990 data

Interpreting Form 990 data effectively can empower stakeholders to make informed decisions about supporting nonprofits. Key financial indicators to focus on include total revenue, total expenses, and changes in net assets over time. By examining trends, donors and evaluators can understand how an organization manages its finances and the impacts on its mission.

Evaluators should pay particular attention to program service accomplishments and the allocation of expenses. Understanding how much an organization spends on administrative versus programmatic costs can indicate operational efficiency and effectiveness. pdfFiller's interactive features can enhance the analysis process, allowing users to draw comparisons across sectors or years seamlessly.

Fiduciary reporting responsibilities

The responsibility of filing Form 990 rests heavily on the shoulders of a nonprofit's board members and executive staff. Ensuring accurate and timely submissions is not merely about compliance; it's vital for maintaining public trust and organizational integrity. Board members, in particular, play a crucial role in overseeing the governance of the organization, safeguarding that the fiduciary duty is upheld.

Promoting transparency and accountability should be central to your organization’s culture. Best practices include regular training for boards on compliance matters, involving key staff in the preparation process, and conducting periodic reviews of financial and governance practices. By establishing strong internal procedures, an organization can enhance its sustainability and reputation.

Frequently asked questions on Form 990

Form 990 raises many questions, especially for new nonprofit leaders or volunteers involved in filing. One of the most common inquiries is, 'What forms do I need to file?' Organizations must evaluate their annual gross receipts to determine if they should complete the full Form 990, use the shortened 990-EZ, or opt for the e-postcard version, Form 990-N.

Another frequent question centers on timeline: 'When is Form 990 due?' As addressed earlier, this is typically the 15th day of the 5th month following the end of the organization's fiscal year. Understanding these timelines is essential for smooth filing and planning. Overall, many considerations involved in Form 990 are made simpler through dedicated resources such as pdfFiller.

Next steps after filing Form 990

Once Form 990 has been filed, organizations should focus on record retention and future compliance. Keeping organized records of your Form 990 submissions and any related financial documentation is crucial for future filings. Establishing a well-structured digital filing system can facilitate data retrieval for audits or further evaluations.

Preparing for future filings should also involve staying informed about any changes in IRS regulations and updating internal practices as needed. Regular communication among board members and staff about compliance responsibilities can help maintain accountability and ensure smooth transitions into subsequent filing periods.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the form 990 in Gmail?

How can I edit form 990 on a smartphone?

How do I complete form 990 on an iOS device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.