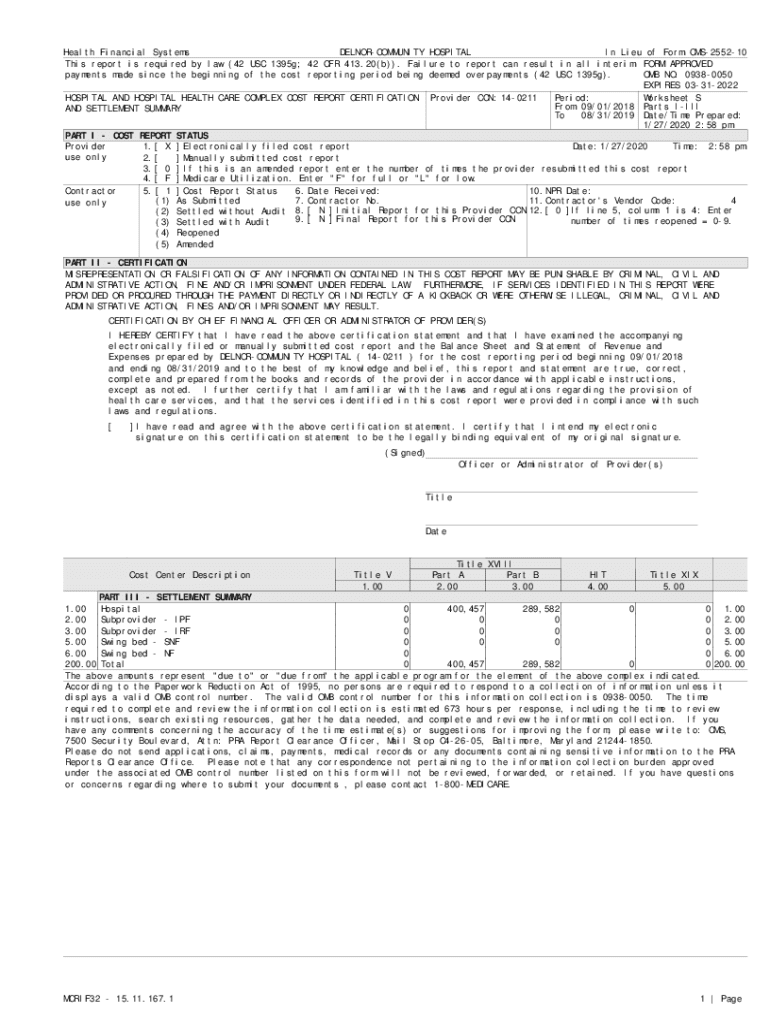

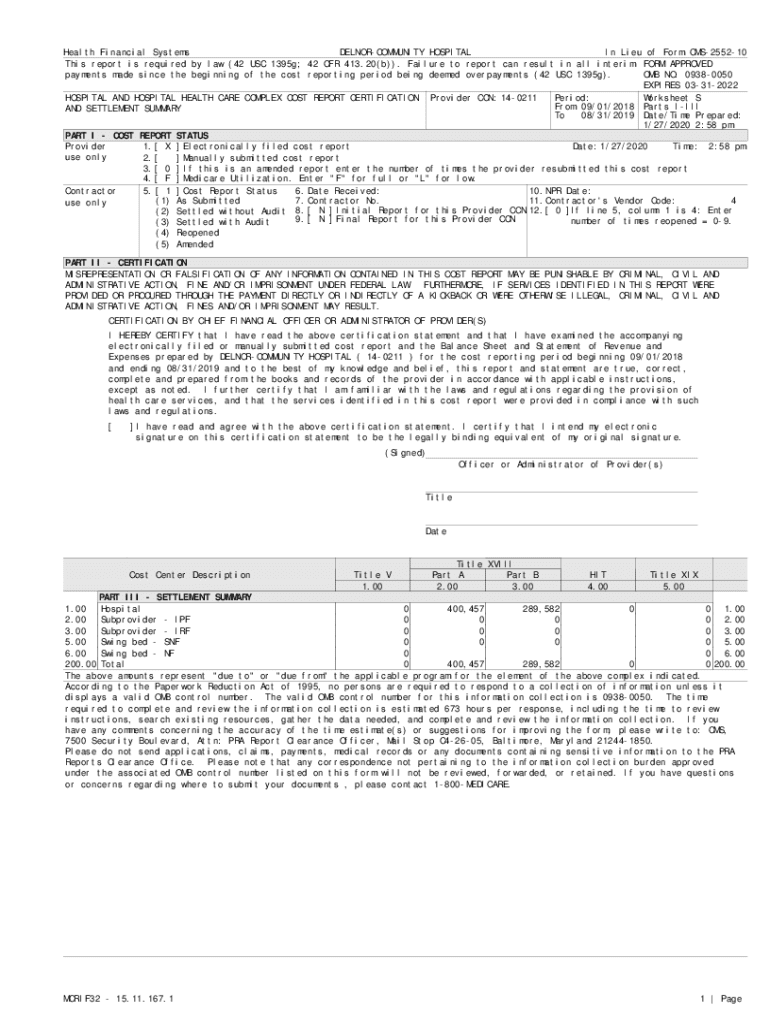

Get the free electronically filed or manually submitted cost report and the Balance Sheet and Sta...

Get, Create, Make and Sign electronically filed or manually

Editing electronically filed or manually online

Uncompromising security for your PDF editing and eSignature needs

How to fill out electronically filed or manually

How to fill out electronically filed or manually

Who needs electronically filed or manually?

Electronically filed or manually form: Which is best for you?

Understanding the basics of document filing

Document filing is a crucial process within various sectors, including legal, administrative, and business environments. It refers to the systematic organization, storage, and retrieval of documents and forms, both physical and digital. The methods of filing can be primarily categorized into two approaches: electronic filing and manual filing. Understanding these two methods helps individuals and teams make informed decisions about their filing processes.

When we talk about electronic filing, it refers to the use of digital platforms to submit, store, and manage documents, often involving forms completed online. Manual filing, on the other hand, involves completing forms on paper and submitting them physically through the mail or in person. Both methods have unique advantages and drawbacks, often influenced by factors such as accessibility to technology, types of documents, and regulatory requirements.

Common forms and documents for filing can include tax returns, legal briefs, permits, and grant applications. Knowing the specific requirements and rules associated with these forms is essential for ensuring compliance and avoiding rejections.

Advantages of electronically filing

Electronically filing documents offers several compelling advantages over the traditional manual method. One significant benefit is speed and efficiency. Instant submission and acknowledgment can drastically reduce the turnaround time for receiving confirmations from regulatory bodies or clients. In contrast, manual filing can often involve unnecessary delays due to mailing times or processing.

Another advantage is accuracy and reduced errors. Electronic filing platforms frequently incorporate automated error checks, ensuring that key information is filled out correctly before submission. Additionally, many users find that using a PDF format in electronic filing helps maintain the document's integrity, preserving formatting and display across various devices.

Step-by-step guide to electronically filing documents

To ensure a smooth electronic filing process, it’s essential to follow a structured approach. Let’s break it down into specific steps.

Step 1: Prepare your forms

Choose a reliable tool like pdfFiller for document creation. Ensure that all necessary information is correct and complete before moving to the next step. An incomplete form can lead to delays and potential rejections.

Step 2: Choose the right platform

pdfFiller provides many benefits over traditional methods, including user-friendly editing, eSigning capabilities, and collaborative options. Features such as real-time editing and comments make it ideal for teams working together.

Step 3: Submit your documents

Once your documents are prepared, utilize the pdfFiller platform to submit them electronically. After submission, you’ll receive a confirmation to ensure your documents were received successfully.

Step 4: Track your submission

Many electronic filing platforms, including pdfFiller, offer tools to track the status of your submissions, so you can easily check for any updates or issues that need addressing.

When to choose manual filing

While electronically filing is advantageous, there are instances where manual filing might be a better choice. Certain situations, like lack of access to technology or familiarity with digital processes, may necessitate a traditional approach. Additionally, some specific forms may not be eligible for electronic submission due to regulatory constraints.

To effectively complete the manual filing process, gather all necessary documents and information before starting. This preparation can significantly minimize stress and ensure that the process goes smoothly.

Frequently asked questions

With many people transitioning to electronic filing, several questions arise regarding the process. Here are some frequently asked questions.

Electronic filing best practices

To ensure successful electronic filing, adopting best practices is essential. Maintaining data security is paramount. Choose platforms known for their robust security features and encryption methods, such as pdfFiller.

Keeping records organized also contributes to a smoother filing process. pdfFiller helps with document management, allowing users to categorize forms efficiently and access them easily whenever needed.

Lastly, staying current with filing requirements can save time and effort. Regularly check for updates on tax and legal filing needs to avoid any compliance issues and ensure your forms are always up to date.

Resources for further assistance

As you explore the world of electronic filing, having the right resources can simplify the process. Reach out to customer support at pdfFiller for personalized assistance. Additionally, online tutorials and FAQs offer invaluable guidance for navigating electronic filing.

Community forums can also be beneficial, allowing you to connect with other users for shared advice and experiences. For ongoing learning, consider following blogs and websites that specialize in document management and electronic filing solutions.

Exploring advanced features of pdfFiller

The capabilities of pdfFiller extend beyond basic filing processes. Advanced features include collaboration tools that allow teams to work together on documents seamlessly. With capabilities for creating templates, users can streamline repetitive forms, making the filing process more efficient.

Utilizing e-signatures introduces additional speed and professionalism in document approvals. Businesses and individuals alike can harness these features to improve workflow efficiency. Integrating pdfFiller with other software solutions enhances the overall experience and enables broader functionality.

Conclusion

In summary, understanding the nuances of electronically filed or manually submitted forms empowers users to choose the optimal approach for their filing needs. The speed, efficiency, and accuracy associated with electronic filing through platforms like pdfFiller make it an attractive alternative for many.

As you consider transitioning to electronic filing, remember the advantages it offers, such as collaborative features and the accessibility of documents from anywhere. Embracing modern filing solutions can save time, enhance professionalism, and contribute to an organized document management approach.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my electronically filed or manually in Gmail?

How can I modify electronically filed or manually without leaving Google Drive?

Can I create an electronic signature for signing my electronically filed or manually in Gmail?

What is electronically filed or manually?

Who is required to file electronically filed or manually?

How to fill out electronically filed or manually?

What is the purpose of electronically filed or manually?

What information must be reported on electronically filed or manually?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.