Get the free Auditor's Report

Get, Create, Make and Sign auditors report

How to edit auditors report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out auditors report

How to fill out auditors report

Who needs auditors report?

Comprehensive Guide to Auditors Report Form

Understanding the auditors report

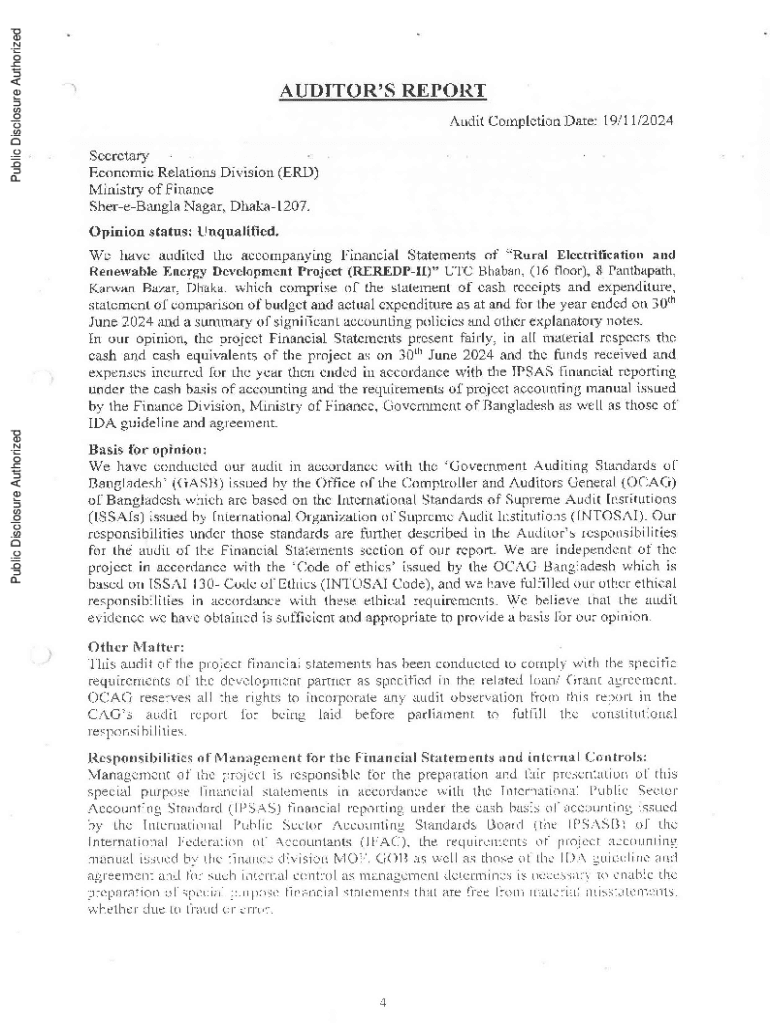

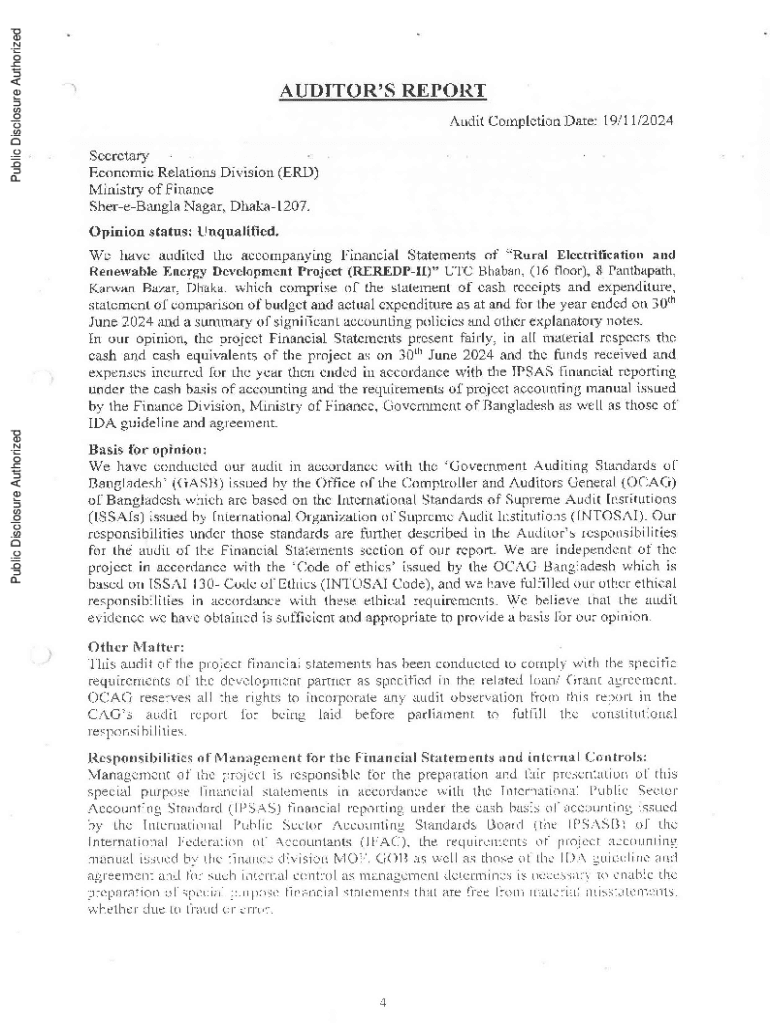

An auditor's report is a critical document that encapsulates an auditor's findings and opinions regarding an organization's financial statements. The primary purpose of this report is to express an opinion on whether the financial statements provide a true and fair view of the organization's financial position in accordance with the relevant accounting standards. These reports play a crucial role in ensuring financial transparency and accountability, particularly for stakeholders, investors, and regulatory bodies.

Auditor's reports can significantly impact a company’s credibility and trustworthiness in the financial market, as they validate the accuracy of financial data presented by management. This is especially vital for public companies that rely on investor confidence. Without an auditor's report, stakeholders might hesitate before engaging with the organization, fearing poor financial management.

Types of auditor's reports

Key components of an auditors report

An auditor's report typically follows a structured format and includes several essential components that detail different aspects of the audit process and findings. One of the first sections is the auditor’s responsibility, which outlines the duties the auditor undertook during the audit. This includes assessing the financial statement's overall presentation and determining if they follow the relevant accounting frameworks.

Equally important is the management's responsibility section, where management acknowledges their role in preparing accurate financial statements and ensuring adherence to relevant laws and regulations. In addition, the opinion paragraph serves as the crux of the report, explaining the auditor's viewpoint regarding the accuracy of the financial statements. Other critical details include any emphasis of matter paragraphs, which highlight important issues that could influence understanding, and additional reporting responsibilities that may pertain to specific regulations.

Required information for completing an auditors report

Before filling out an auditor's report form, it is necessary to collect specific documents that serve as the foundation for the audit. The primary document is the set of financial statements being audited, which should encompass the balance sheet, income statement, cash flow statement, and notes to the accounts. Additionally, supporting documentation is often required to verify the information contained in these statements, such as ledgers, contracts, and previous audit reports.

It’s essential to follow standardized content specifications when completing the auditor's report. This includes adhering to formatting conventions, ensuring proper language and tone, and using common terminology that aligns with industry standards. A clear and precise writing style can enhance the report's readability and ensure that it is well-received by stakeholders.

Step-by-step guide to filling out an auditors report form

The process of filling out an auditor's report form can be broken down into several actionable steps. First, gather all necessary information, including financial statements and supporting documents, setting a solid foundation for accuracy.

Next, complete each section of the report carefully. Begin with the cover page, ensuring it includes all relevant details like the auditor's name, the entity being audited, and the date. The auditor's opinion must be articulated with precision, reflecting integrity in judgment. Following this, detail management's responsibility, encapsulating the expectations placed on them during the auditing process.

Step 3 involves a meticulous review and edit of the report. This is where quality assurance comes into play. Proofreading not only ensures the accuracy of the content but also enhances its professionalism. Finally, step 4 involves finalizing the report. This is where obtaining an eSignature through platforms like pdfFiller can streamline the process, enabling quick turnaround times and efficient document management.

Best practices for editing and managing auditors reports in pdfFiller

Utilizing pdfFiller can significantly enhance how auditors manage and edit their reports. The platform’s editing tools allow for easy manipulation of text, enabling users to highlight significant sections for collaboration with team members. This collaborative approach can lead to more refined and accurate reports through increased input and feedback.

Moreover, features like merging documents and adding comments can be invaluable during the review process. With comprehensive access control and security settings, users can confidently share their reports without compromising sensitive information. Tracking changes, aided by robust version control features, ensures that all amendments are logged and easily traceable, fostering a transparent modification history.

Common challenges and solutions in completing auditors reports

Completing an auditor's report does come with its fair share of challenges. One common hurdle is misinterpretation of terminology, which can lead to mistakes in judgment. Key terms such as 'material misstatement' or 'scope limitations' must be clearly understood to write an accurate report.

Additionally, compliance issues can arise when adhering to accounting standards like GAAP or IFRS. It's critical for auditors to stay updated on these standards to avoid pitfalls. To mitigate common errors, maintaining a checklist during the report writing process can be instrumental. This checklist can flag potential areas of concern and ensure thorough consideration of every aspect of the audit.

Interactive tools and features on pdfFiller for auditors report forms

pdfFiller offers a suite of interactive tools designed specifically for auditors report forms. Users have access to pre-designed templates that can significantly reduce the time spent on formatting. These templates provide a robust framework while ensuring compliance with regulatory standards.

Furthermore, the platform includes fillable fields and interactive functionalities that allow users to enter data seamlessly. For those requiring assistance, pdfFiller provides customer support with resources to guide them through any hurdles they may encounter while using the platform. This combination of user-friendly features and expert support makes pdfFiller an invaluable tool for any auditing team.

Real-life case studies: successful utilization of auditors reports

To illustrate the effectiveness of well-prepared auditors reports, let’s look at two case studies showcasing success stories. The first case involves a small business that utilized an auditors report to enhance its credibility with stakeholders. By ensuring their report reflected a clean unmodified opinion, they were able to attract investment and expand operations, significantly increasing their market competitiveness.

In another scenario, a large corporation faced compliance audits and relied heavily on their auditors report to address regulatory requirements. Through meticulous documentation and timely reporting, they not only achieved compliance but also instilled greater confidence in their investors, leading to increased stock prices. These examples demonstrate the profound impact that a well-structured auditors report can have on both small and large organizations alike.

Frequently asked questions (FAQ) about auditors reports

When faced with an unfavorable auditor's report, companies often wonder about the implications. An unfavorable opinion can lead to a loss of investor confidence and require the company to develop corrective action plans to address identified issues. Responding effectively to these opinions is crucial, usually requiring open communication between management and the audit team to remediate any flagged concerns.

Many people also inquire about the different formats available for auditor's reports. While the core components are generally consistent across reports, variations may exist depending on the jurisdiction or specific industry requirements. Therefore, it's vital for auditors to be adaptable and familiar with the nuances of the formats used in their respective fields.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send auditors report to be eSigned by others?

Where do I find auditors report?

How do I make changes in auditors report?

What is auditors report?

Who is required to file auditors report?

How to fill out auditors report?

What is the purpose of auditors report?

What information must be reported on auditors report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.