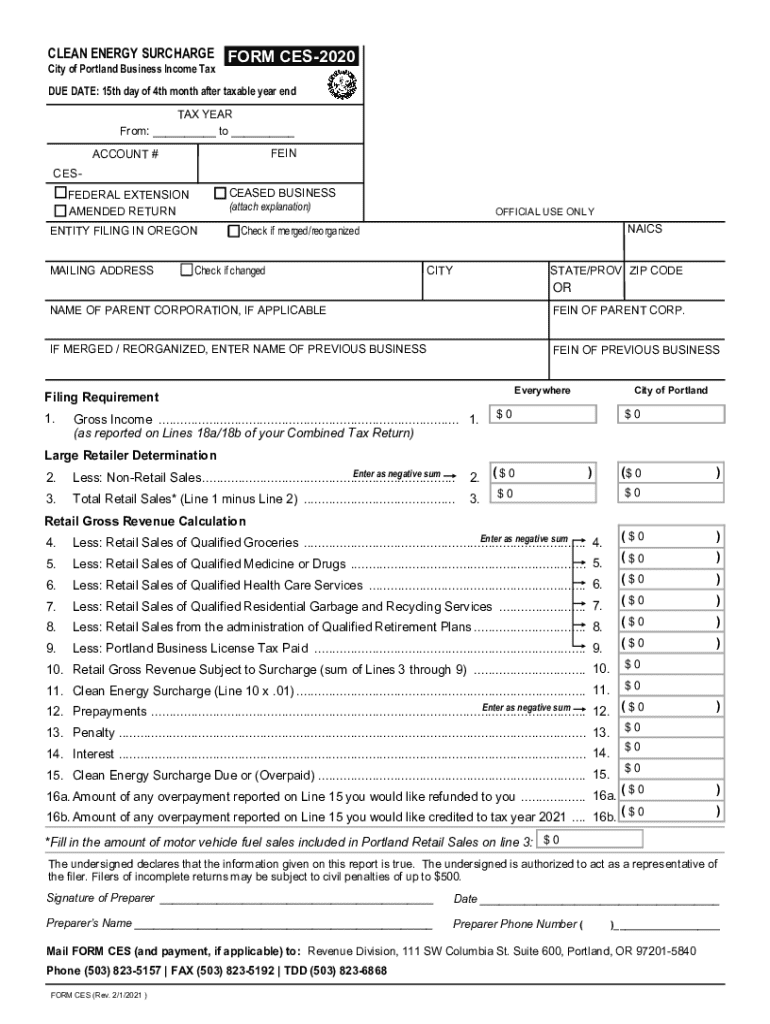

Get the free Clean Energy Surcharge Form Ces-2020

Get, Create, Make and Sign clean energy surcharge form

Editing clean energy surcharge form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out clean energy surcharge form

How to fill out clean energy surcharge form

Who needs clean energy surcharge form?

Comprehensive Guide to the Clean Energy Surcharge Form

Understanding the clean energy surcharge

The clean energy surcharge is a fee imposed on consumers and businesses to support the transition to renewable energy sources. It serves as a financial mechanism designed to fund clean energy projects and initiatives aimed at reducing carbon emissions and promoting sustainability across various sectors.

The purpose of the surcharge extends beyond mere funding; it incentivizes the adoption of renewable energy technologies, encourages energy-efficient practices, and ultimately bolsters the economic viability of clean energy solutions. As governments worldwide respond to climate change, these surcharges are becoming a commonplace aspect of energy pricing.

Historically, the clean energy surcharge has evolved from initial government incentives promoting greener energies to becoming a mandatory component in many jurisdictions. Legislative efforts to address climate change have led to the implementation of these surcharges, reflecting a growing commitment to sustainability.

Overview of regulations and eligibility

The clean energy surcharge applies to a broad spectrum of consumers, impacting both individuals and businesses. Understanding who is affected is crucial for compliance and financial planning.

Certain exemptions exist, often for low-income households or small businesses that consume below a specific threshold. Local laws and policies dictate these exemptions, necessitating a thorough understanding of the specific regulations in your area.

To navigate the clean energy surcharge effectively, individuals and businesses must be aware of relevant laws and policies in their locality, which can significantly differ by region.

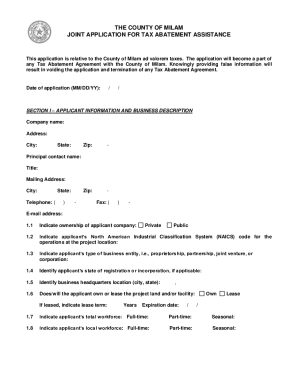

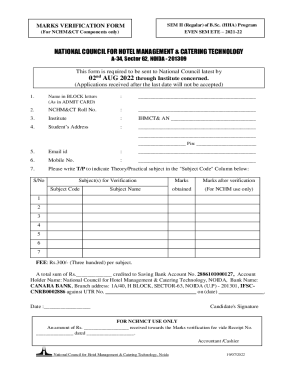

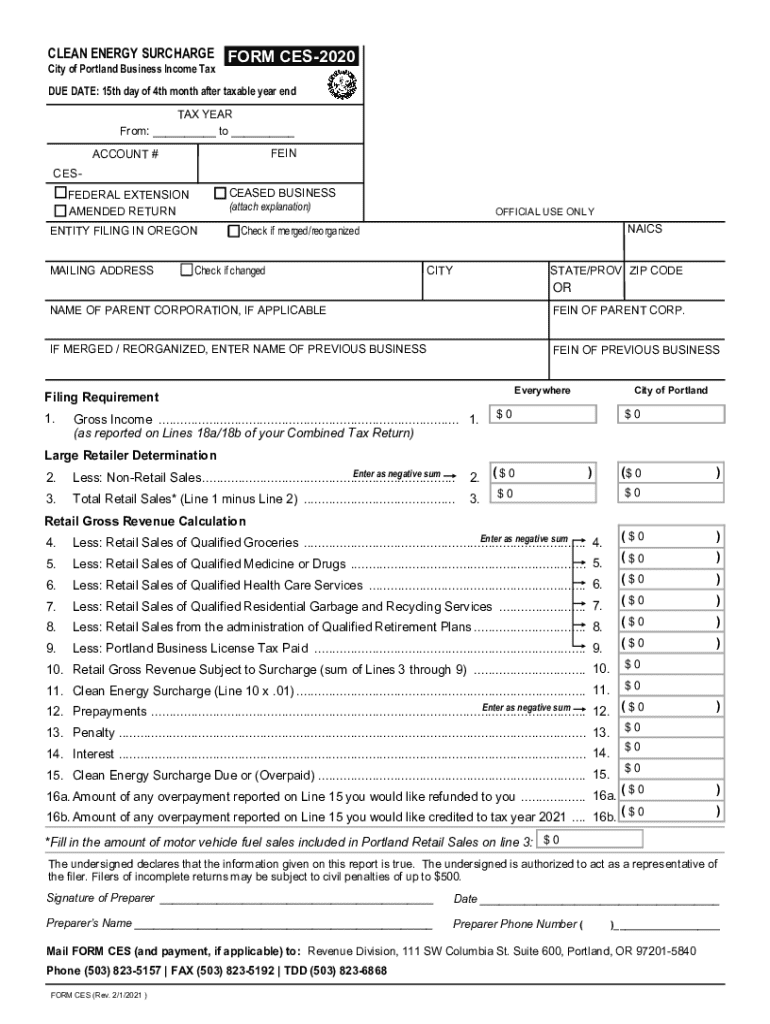

Detailed breakdown of the clean energy surcharge form

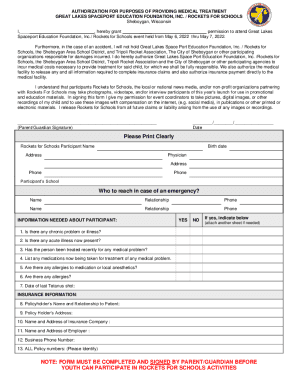

Two main types of forms are associated with the clean energy surcharge: the initial registration form and annual renewal forms. Understanding these forms is essential for compliance and accurate surcharge calculation.

Each form typically requires specific documentation and details about energy consumption patterns. Providing accurate and comprehensive information is crucial to avoid delays and ensure compliance with applicable regulations.

Step-by-step instructions for completing the clean energy surcharge form

Before filling out the clean energy surcharge form, it's essential to prepare adequately. Start by gathering all necessary information, including personal identification, energy consumption data, and any documentation required by local regulations.

Common pitfalls when filling out the form include inaccuracies in data reporting or incomplete sections, which may delay processing. Take time to double-check all information before submission.

How to submit the clean energy surcharge form

Submission methods for the clean energy surcharge form vary based on local regulations and technological capabilities. Generally, two main methods exist for submission: online submissions and mail-in options.

It's crucial to adhere to submission deadlines to avoid penalties. Tracking your submission status can often be done through the same portal or service used for submission.

Paying the clean energy surcharge

Once the clean energy surcharge form is submitted, the next step involves payment. Several payment options are available to ease the process for individuals and businesses alike.

Understanding payment deadlines is crucial: late payments may incur penalties. Ensure to check for any FAQs regarding specific payment issues to avoid common problems.

Managing and maintaining compliance

Staying compliant with clean energy surcharge regulations involves diligent record-keeping. Participants must track all submitted forms and payment receipts meticulously.

Ongoing management of your compliance status is critical to ensure participation in clean energy initiatives remains seamless and beneficial.

Contact and support for clean energy surcharge queries

When navigating the clean energy surcharge form, questions may arise. It's essential to know where to seek help as regulations can be complex.

pdfFiller can also support users in managing their forms through tools that simplify document management, eSigning, and collaboration. This can enhance the completion and submission process of your clean energy surcharge form.

Navigating future changes in clean energy regulations

The landscape of clean energy regulations is ever-evolving, and staying informed is key for individuals and businesses relying on energy-intensive practices.

By proactively engaging with new information and developing strategies to adapt to changes, one can ensure that compliance and participation in clean energy initiatives remain effective.

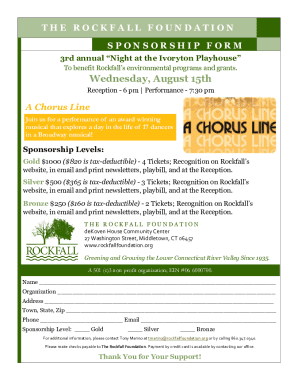

Related forms and additional resources

Beyond the clean energy surcharge form, several related programs may exist in your jurisdiction, providing additional benefits for adopting renewable energy practices.

Accessing links to further information about these initiatives can provide valuable insights into maximizing the benefits associated with clean energy practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in clean energy surcharge form?

How do I fill out clean energy surcharge form using my mobile device?

Can I edit clean energy surcharge form on an Android device?

What is clean energy surcharge form?

Who is required to file clean energy surcharge form?

How to fill out clean energy surcharge form?

What is the purpose of clean energy surcharge form?

What information must be reported on clean energy surcharge form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.