Get the free Sample Leave and Earnings Statement (les)

Get, Create, Make and Sign sample leave and earnings

Editing sample leave and earnings online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sample leave and earnings

How to fill out sample leave and earnings

Who needs sample leave and earnings?

Sample Leave and Earnings Form: A Comprehensive Guide

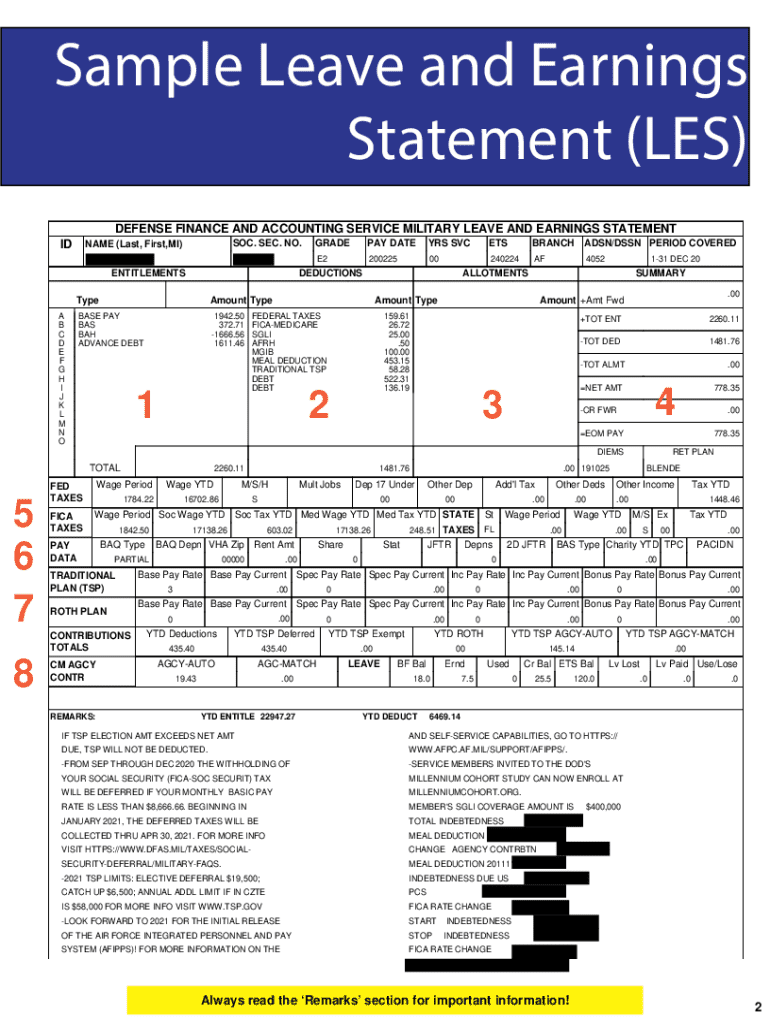

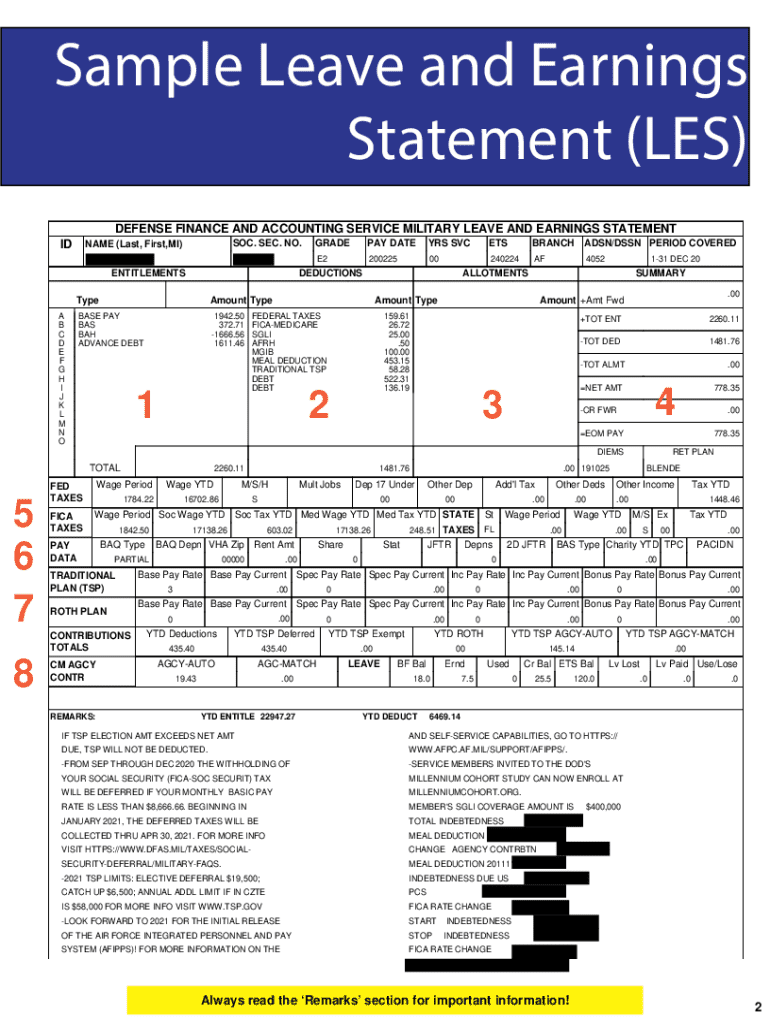

Understanding the leave and earnings form

The Leave and Earnings Form (LEF) is an essential document used predominantly in payroll management. It serves as a record of an employee's earnings, deductions, leave balances, and overall payroll information. Employers issue this form to provide employees with a summary of their compensation and any applicable leave that they may accrue over a set period. The importance of the Leave and Earnings Form lies in its dual functionality; it acts as a vital source of information for employees while allowing employers to maintain clear payroll records.

The components of the LEF are significant as they contribute to an employee's financial health. Each section of the form provides critical details, including personal information, income sources, tax withholdings, and leave entitlements. By understanding the breakdown of this form, employees can make informed decisions regarding their finances, leave usage, and overall employment status.

How to access your sample leave and earnings form

Accessing your sample leave and earnings form is straightforward, and employees are encouraged to familiarize themselves with the options available. The form can usually be obtained through electronic systems utilized by employers or directly from payroll systems. Most large organizations will provide access to the LEF through online portals that employees can log into securely and retrieve their documentation whenever needed.

For those who prefer printed versions, it's possible to request hard copies directly from the HR or payroll department. If you’re utilizing pdfFiller, the process is even simpler. Here is a step-by-step guide on how to navigate pdfFiller to find your Leave and Earnings Form online.

Interactive features of the sample leave and earnings form

One of the highlights of the sample leave and earnings form within pdfFiller is its interactive features that allow users to modify the document easily. Editing the form is made intuitive with pdfFiller’s suite of editing tools. Users can change text, add new sections, and even upload supporting documents that need to accompany the LEF, making it a flexible tool for managing payroll information.

Additionally, signing the form electronically is hassle-free. Employees can take advantage of the eSigning functionality to add their signature, which enhances the efficiency of the submission process and ensures compliance with legal standards. Furthermore, pdfFiller ensures that any form submitted is secure and keeps user information confidential, making it an ideal solution for document management.

Filling out the sample leave and earnings form

Filling out the sample leave and earnings form can be straightforward when you know what each section entails. It is essential to approach this task methodically, ensuring that all required information is correctly entered. Here’s a detailed breakdown of the main sections you’ll encounter on the form.

Common mistakes to avoid

When filling out the sample leave and earnings form, certain common mistakes can often lead to inaccuracies that can complicate payroll processing. Below is a checklist of common errors to be mindful of during completion. By understanding these pitfalls, individuals can enhance the accuracy of their submissions and ensure smooth processing on their behalf.

Double-checking the form prior to submission is critical. Review the information to ensure accuracy not only in filling out the sections, but also in reconciling the earnings with the listed deductions. Creating a systematic approach for verification can prevent future complications.

How to interpret your sample leave and earnings form

Interpreting your sample leave and earnings form is essential for understanding your overall financial health as an employee. Several key terms and data points are listed on your LEF, and grasping their meanings will aid in making informed financial decisions. Pay attention to the pay periods and payment schedules as they indicate the frequency of your earnings and the buildup of leave balances.

Important terms like gross pay, net pay, and deductions become clearer once the definition of each is established. These components allow employees to assess their total earnings against expenses and savings goals. Evaluating this data will enable employees to plan their finances more effectively.

Handling nonreceipt of your leave and earnings form

In rare instances, you may find that you do not receive your Leave and Earnings Form. If this happens, it's vital to take immediate action to safeguard your financial standing. Start by reaching out to your payroll or HR department as soon as possible to inquire about your form’s status. They should be able to provide the document promptly or explain the reasoning behind the oversight.

Additionally, understanding your rights as an employee can help you navigate such situations. Employers are legally obligated to provide timely pay statements under various labor regulations, and knowing these rights can empower you to escalate your concerns appropriately.

Payroll customer support and resources

Accessing customer support for payroll issues can be essential for resolving inquiries related to your Leave and Earnings Form. Most companies provide dedicated payroll customer support to assist employees in navigating any complications that may arise. Make sure to have relevant information at hand, such as your employee ID and work details, as this can expedite the resolution process.

In addition to customer support, there are numerous resources available that can provide assistance and guidance on payroll regulations and policies. Utilizing these links can further inform you about your rights and responsibilities as an employee in relation to payroll documentation.

Real-world samples and templates

Accessing sample leave and earnings forms is useful for those looking to understand how to fill out their own. pdfFiller offers a range of templates that can serve as valuable references, showcasing how various employers structure their Leave and Earnings Forms. Reviewing these samples can provide insight into what to expect in your own documentation and help you fill out your form accurately.

Utilizing templates can also yield significant time-saving benefits. Pre-designed forms enable users to fill out necessary information seamlessly, as they typically require less customization than creating a form from scratch.

Best practices for document management

Effectively managing your Leave and Earnings Forms is crucial in maintaining organized payroll records. One of the best practices involves digitizing these forms through pdfFiller, allowing you to keep a clear record of payroll documents in one accessible location. This method ensures that you can retrieve your forms easily while minimizing the risk of misplacement or loss.

Collaboration is another important aspect of document management. If you work within a team, having shared access to these forms can foster transparency and ensure that all team members have the necessary documentation on hand when needed. Cloud-based solutions, such as those provided by pdfFiller, greatly enhance collaboration efforts, making it easier to work together on payroll and HR documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sample leave and earnings to be eSigned by others?

Can I edit sample leave and earnings on an iOS device?

How do I fill out sample leave and earnings on an Android device?

What is sample leave and earnings?

Who is required to file sample leave and earnings?

How to fill out sample leave and earnings?

What is the purpose of sample leave and earnings?

What information must be reported on sample leave and earnings?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.