Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Understanding Form 990: A Comprehensive Guide for Nonprofit Organizations

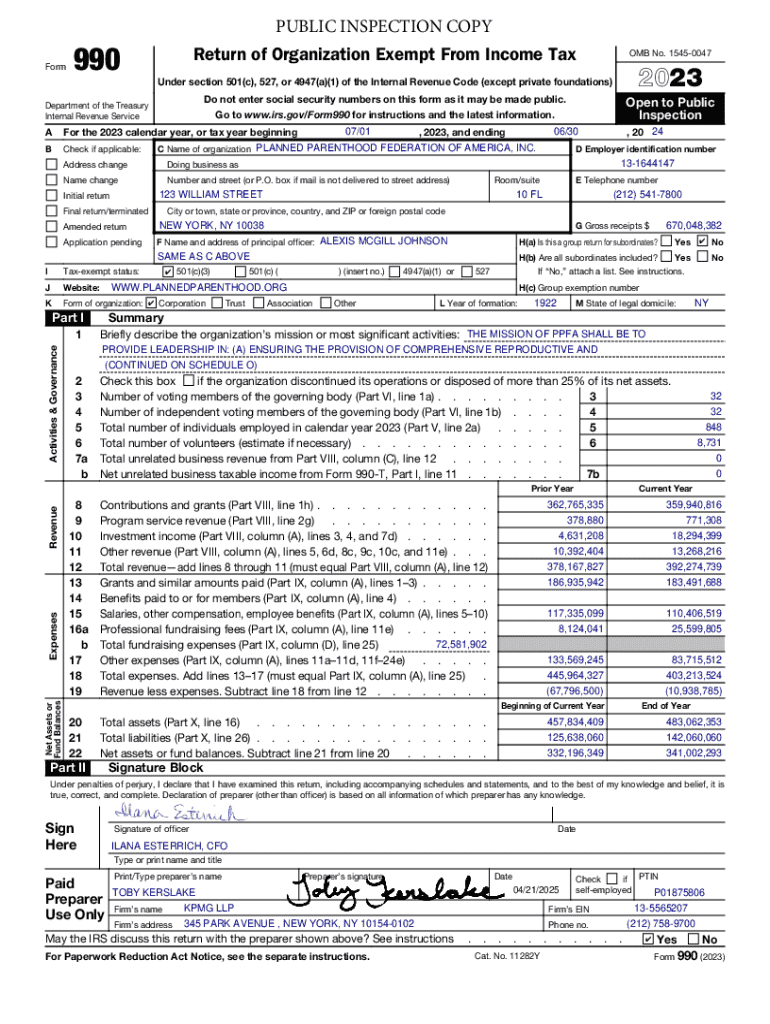

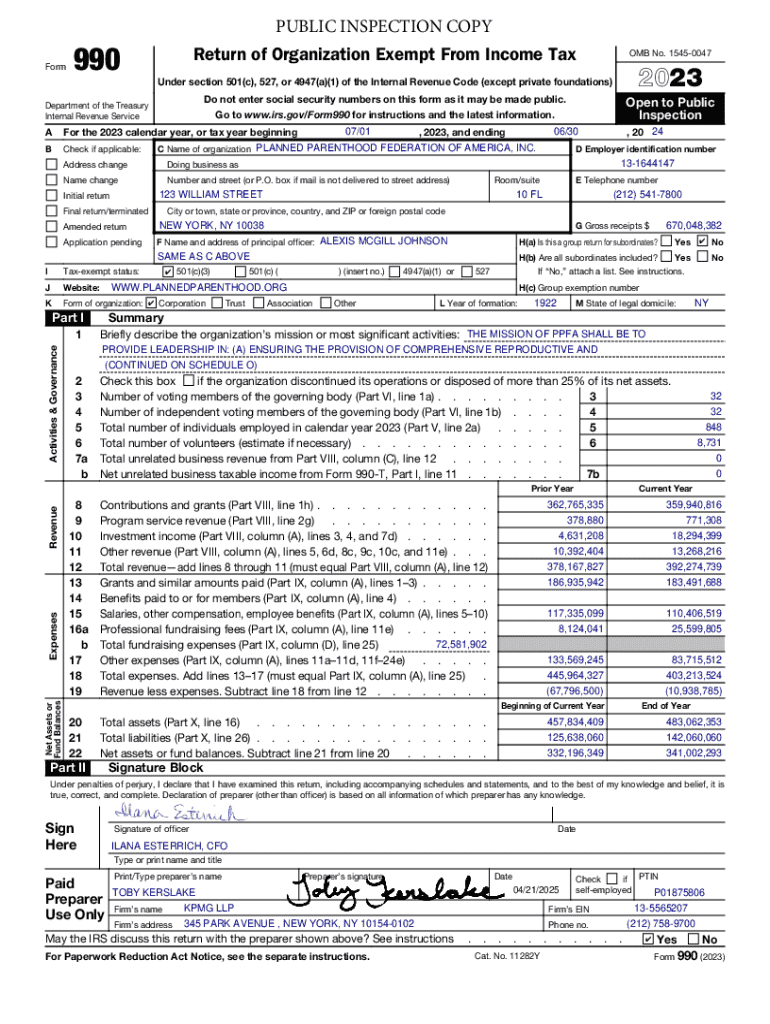

Understanding Form 990: An overview

Form 990 is a critical document required for most tax-exempt organizations in the United States. It serves as an annual information return, providing valuable insights into the organization’s financial and operational status. The primary purpose of the form is to ensure transparency and accountability, enabling government oversight and public access to essential financial data.

For nonprofit organizations, Form 990 is not just a filing requirement; it's an opportunity to highlight their mission, programs, and financial health. Unlike other tax forms, such as the standard IRS 1040 form used by individuals, Form 990 contains specific sections dedicated to charity operations, governance practices, and performance metrics, which distinguish it in terms of complexity and significance.

Who needs to file Form 990?

Not all organizations are required to file Form 990. Generally, charities and nonprofit organizations exempt from federal income tax under Section 501(c)(3) and other sections of the Internal Revenue Code must adhere to this requirement. However, the thresholds for filing can vary, creating a nuanced landscape of compliance obligations.

Entities that must file include larger nonprofits that generate more than $200,000 in gross receipts or have total assets exceeding $500,000. Smaller charities, often called 990-N filers or 'postcard' filers, must file if they gross less than $200,000 and have assets below $500,000, while other small organizations may qualify for a streamlined 990-EZ form.

Filing requirements for Form 990

Timeliness and accuracy are crucial when it comes to filing Form 990. Organizations must be aware of the specific deadlines to avoid penalties. Generally, Form 990 is due on the 15th day of the 5th month after the end of the organization's fiscal year. However, extensions can be requested to provide extra time for completion.

Filing requires various forms of documentation, including financial statements, governance policies, and descriptions of program accomplishments. These components provide a comprehensive overview of the organization's financial health, leadership, and community impact. Organizations can opt for e-filing through the IRS or file a paper form, each carrying its own set of advantages and challenges.

Understanding the sections of Form 990

Form 990 is composed of multiple sections, each serving a distinct purpose. The Summary (Part I) provides an overview of the organization, including its mission and achievements. The Governance section (Part II) elucidates the organization's board structure and policies, highlighting accountability and transparency.

Part III dives deep into the organization's program service accomplishments, showcasing the impact of its initiatives. The Checklist of Required Schedules (Part IV) assists organizations in identifying additional schedules they may need to complete based on their activities.

Editing and managing your Form 990

Completing Form 990 can be complex, but utilizing interactive tools can simplify the process significantly. At pdfFiller, users can access comprehensive templates and editing tools that facilitate the completion of Form 990 and its associated schedules efficiently. These tools also support collaboration among team members to ensure accuracy and adherence to deadlines.

Managing the document post-filing is critical. Retaining organized records and maintaining an audit trail for all changes strengthens compliance and visibility. Users can leverage pdfFiller for editing, eSigning, and sharing documents, providing a streamlined approach to document management that enhances overall operational effectiveness.

Penalties for non-compliance

Failure to file Form 990, or the filing of incorrect information, can lead to significant penalties. The IRS imposes fines that vary based on the size of the organization and the extent of the non-compliance. Organizations that consistently fail to file may risk losing their tax-exempt status altogether.

To avoid penalties, nonprofits should implement a robust compliance strategy, which includes keeping track of filing deadlines and conducting regular internal audits. Utilizing tools like pdfFiller can assist organizations in managing their records and ensuring they meet compliance requirements consistently.

Public inspection regulations

A unique feature of Form 990 is the requirement for public disclosure. Nonprofit organizations must make their Form 990 available for public inspection, which fosters transparency and accountability. This regulation not only protects the interests of stakeholders but also enhances trust among donors and the community.

Accessing Form 990 online is straightforward. Most organizations post the form on their websites, and numerous third-party platforms host these documents for public viewing. Best practices suggest that nonprofits not only comply with this requirement but also actively promote their filings to engage supporters and demonstrate their commitment to transparency.

How to read and analyze Form 990

Understanding how to read Form 990 can offer valuable insights into an organization's financial integrity and operational effectiveness. Key metrics such as revenue, expenditures, and program accomplishments provide a snapshot of how resources are managed. Stakeholders, including donors and board members, rely on this information to make informed decisions.

Utilizing Form 990 for charity evaluation research can also guide potential donors in assessing an organization’s impact and performance over time. By comparing metrics against peers, funders can identify high-performing nonprofits worthy of investment. Case studies illustrate how effective interpretation of Form 990 can lead to more empowered decision-making in the charitable sector.

Alternatives and variants of Form 990

While Form 990 is the standard for most nonprofits, it's important to know that different variants exist, catering to the specific needs of smaller organizations. Form 990-EZ is a shorter version available for smaller nonprofits with simpler financials, while Form 990-N, also known as the e-Postcard, is designed for organizations with minimal activity. Understanding which form to use is crucial, as filing the wrong version could lead to compliance issues.

Choosing the right form isn't merely a matter of preference but rather reflects the organization's financial complexity and revenue size. Selecting the appropriate variant can streamline the filing process, making it more manageable for smaller organizations. Comparative analyses of when to use each form help ensure nonprofits remain compliant while meeting their operational needs.

Third-party resources for Form 990 assistance

Navigating the complexities of Form 990 doesn’t have to be a solitary endeavor. A wealth of third-party resources exists, including tools and platforms that offer guidance throughout the filing process. Services that specialize in nonprofit compliance can provide tailored assistance and ensure that organizations meet all regulatory requirements effectively.

Community support is also invaluable. Nonprofit forums and networks offer platforms where organizations can share experiences and resources related to Form 990. For more complex scenarios or for organizations with limited in-house expertise, seeking professional assistance can significantly ease the filing burden.

Navigating fiduciary reporting with Form 990

Fiduciary responsibility is a vital aspect of nonprofit governance, and organizations must adhere to this duty while preparing Form 990. Board members and leaders must ensure accuracy and truthfulness in reporting to uphold the organization’s integrity and trustworthiness in the eyes of donors, stakeholders, and the public.

Best practices in fiduciary reporting include regular training for board members on compliance regulations, establishing protocols for collective decision-making, and maintaining open lines of communication regarding the organization’s financial practices. Integrating fiduciary responsibilities into the Form 990 preparation process can help ensure that all aspects of governance and management are aligned toward the organization’s mission.

The evolution and history of Form 990

Form 990 has evolved over the years, reflecting changes in regulations and societal expectations for transparency in the nonprofit sector. Originally introduced by the IRS in the early 20th century, it has undergone numerous revisions and updates to adapt to the growing complexity of nonprofit organizations and the need for more detailed reporting.

Key milestones in the history of Form 990 include important regulatory changes that prioritize greater disclosure and accountability. These shifts have shaped how nonprofits report their activities and financial standings, significantly impacting fundraising efforts and public trust.

Additional considerations for special filers

Certain categories of nonprofits, such as grantmaking foundations and churches, face unique considerations when filing Form 990. Grantmakers often have detailed reporting requirements, while many religious organizations may be exempt from filing altogether, depending on their operations and financial thresholds.

Organizations with complex structures, such as controlling subsidiaries or those involved in multiple services, must pay special attention to their reporting practices to ensure transparency and compliance. These nuances require tailored filing strategies that align with their specific mission, ensuring they uphold all regulatory obligations.

Frequently asked questions about Form 990

Nonprofit leaders frequently encounter questions about filing Form 990, ranging from understanding requirements to addressing complexities in e-filing. Common inquiries include clarifications on filing exemptions and how to accurately report financial figures. Addressing these FAQs can empower organizations to navigate the filing process more effectively.

Myths can also complicate the understanding of Form 990. For example, some leaders believe that filing Form 990 guarantees tax-exempt status, while in reality, consistent compliance is necessary. Insights from experienced nonprofit leaders can further illuminate the dos and don’ts of Form 990 filing, fostering a culture of compliance and transparency.

Best practices for preparing Form 990

Preparing Form 990 can be a daunting task, but implementing best practices can streamline the process and elevate the quality of submissions. Organizations should develop a step-by-step checklist that outlines required data, making it easier to gather necessary financial documents and program details comprehensively.

Effective collaboration is key. Encouraging input from various teams within the organization—such as finance, program management, and governance—can enrich the final form. Additionally, maintaining accurate records throughout the year rather than in a last-minute rush can ensure that all needed information is available, making the filing process smoother and more efficient.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 990 from Google Drive?

How do I edit form 990 in Chrome?

How do I fill out form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.