Get the free Form Adv

Get, Create, Make and Sign form adv

How to edit form adv online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form adv

How to fill out form adv

Who needs form adv?

Understanding Form ADV: A Comprehensive Guide for Investment Advisors

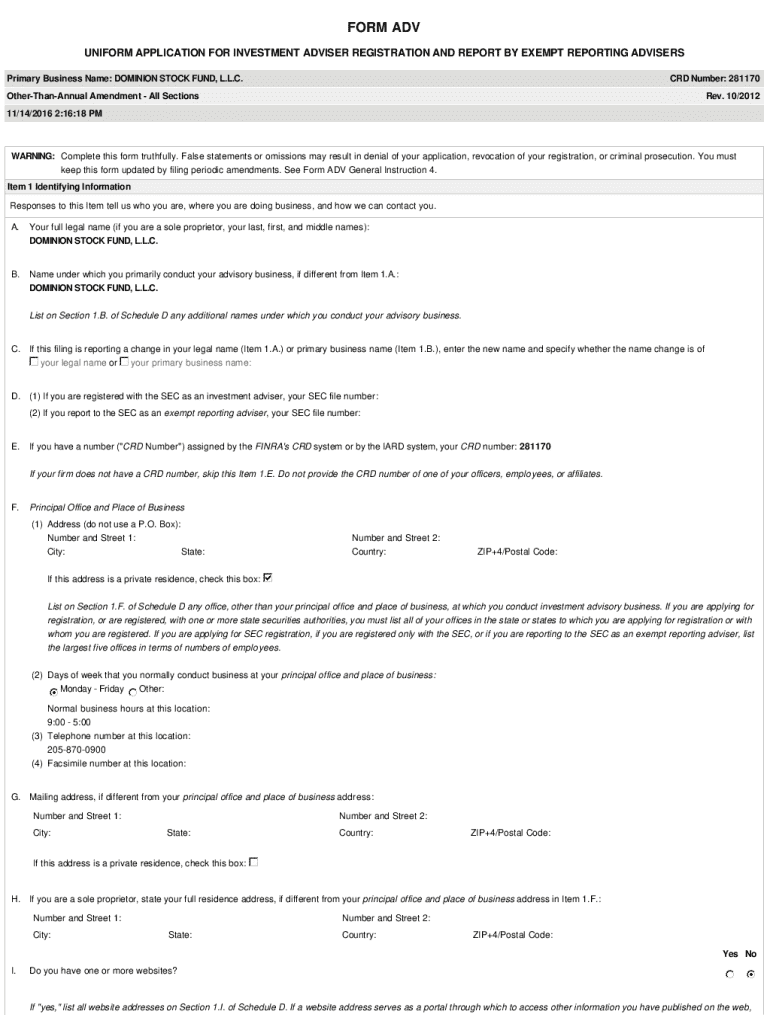

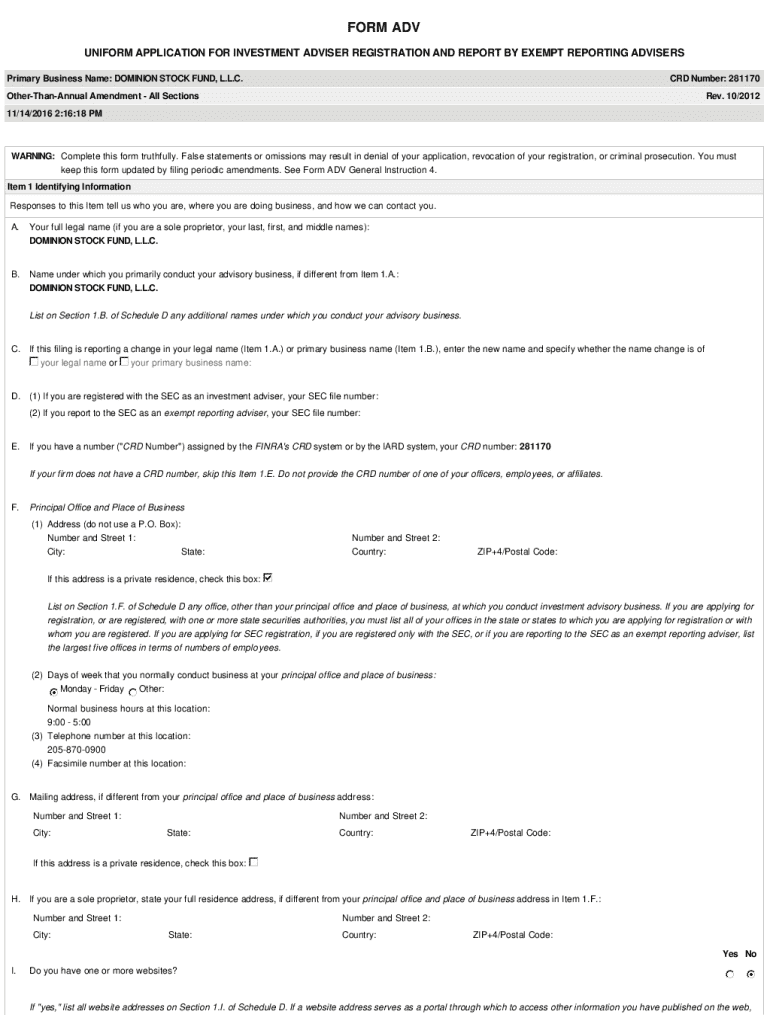

Understanding Form ADV

Form ADV is a crucial document in the investment advisory industry, serving as both a registration form and a disclosure document for investment advisers. This form plays an essential role in ensuring transparency within the financial markets and helps protect investors by providing them with critical information about the investment adviser's business practices, fees, and conflicts of interest. By requiring investment advisers to file Form ADV, regulators aim to promote accountability and enhance investor trust in the advisory industry.

What is Form ADV?

Form ADV is the form that investment advisers use to register with the Securities and Exchange Commission (SEC) or state regulators. It is mandatory for any investment adviser who is not exempt from registration requirements. The form serves as a comprehensive toolkit that discloses essential information about the adviser’s services, fees, and backgrounds to clients. It consists of several parts: Form ADV Part 1, Part 2, and Part 3, each designed for a specific purpose.

Purpose of Form ADV

The primary objective of Form ADV is to facilitate informed decision-making by potential clients. By mandating a clear presentation of an adviser’s business practices, fees, and conflicts of interest, the form equips investors with the knowledge necessary to ascertain whether an adviser aligns with their financial goals. The impact of Form ADV extends beyond compliance; it enriches the advisor-client relationship by building trust through transparency.

Regulatory requirements dictate that investment advisers must file Form ADV annually or whenever there are significant changes to their business. This necessitates that advisers stay vigilant in documenting their practices and maintaining current information. Consequently, effective compliance not only avoids potential legal repercussions but also enhances the professional reputation of the advisory firm.

Components of Form ADV

Form ADV comprises various sections, each designed to elicit specific information relevant to the advisory practice. Understanding these components is crucial for both advisers and clients. Here's a detailed overview:

Accessing Form ADV

Accessing Form ADV is straightforward, thanks to the SEC's Investment Adviser Public Disclosure (IAPD) website. This platform allows clients and prospective investors to search for registered investment advisers and review their Form ADV filings. Here’s a step-by-step guide:

Interpreting the information on Form ADV can initially seem daunting, but key sections like the fee structures, services, and disciplinary history are vital for making informed decisions.

Filling out Form ADV

When filling out Form ADV, financial advisors must adhere to several guidelines to ensure compliance. Accuracy is paramount, as any misrepresentation could lead to serious repercussions, including penalties or loss of credibility. Advisers should take the following steps during the filing process:

By focusing on accuracy and timeliness, advisers can mitigate potential risks and enhance their trustworthiness in the eyes of clients.

Editing and managing Form ADV

Managing Form ADV documents effectively is essential for maintaining accurate and compliant records. pdfFiller offers powerful features for editing, signing, and storing Forms ADV securely in the cloud. Here are some key functionalities:

By leveraging pdfFiller's tools, investment advisers can streamline their Form ADV management, allowing them to focus more on client relations and less on paperwork.

Frequently asked questions about Form ADV

Understanding Form ADV can raise questions among both clients and advisers. Here are some common queries, along with their answers:

More resources and tools

To navigate the complexities of Form ADV, advisors should utilize various resources. The following are recommended:

Utilizing these resources not only enhances understanding but also fortifies compliance efforts, ensuring a successful advisory practice.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form adv from Google Drive?

Can I create an electronic signature for signing my form adv in Gmail?

How can I edit form adv on a smartphone?

What is form adv?

Who is required to file form adv?

How to fill out form adv?

What is the purpose of form adv?

What information must be reported on form adv?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.