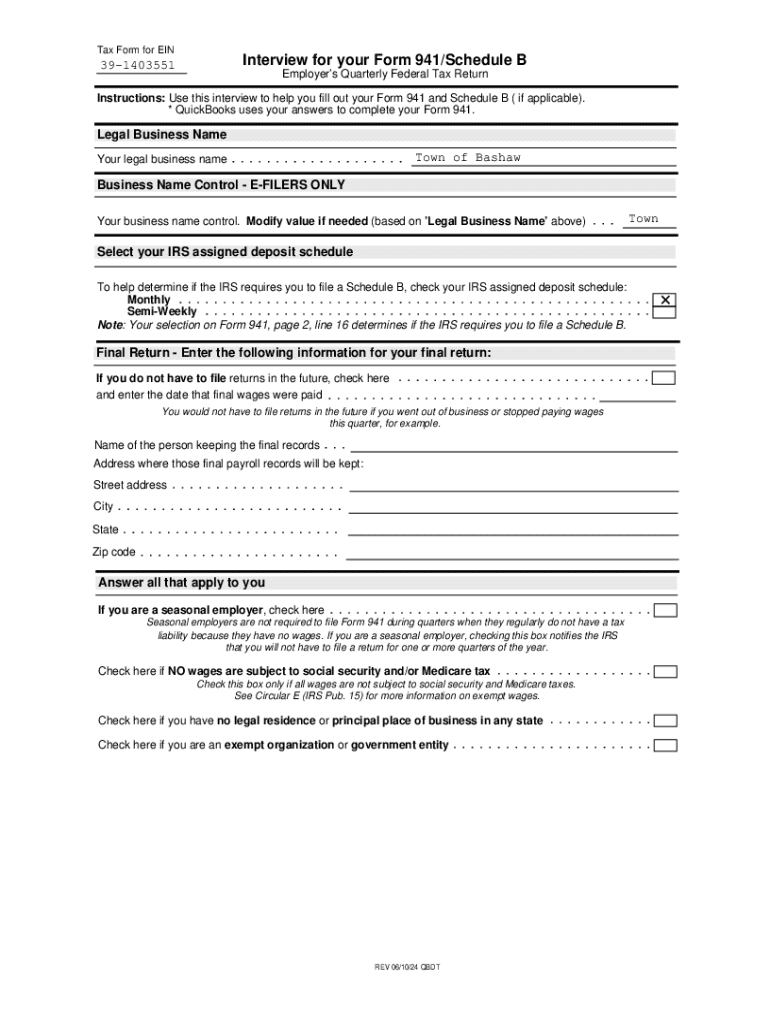

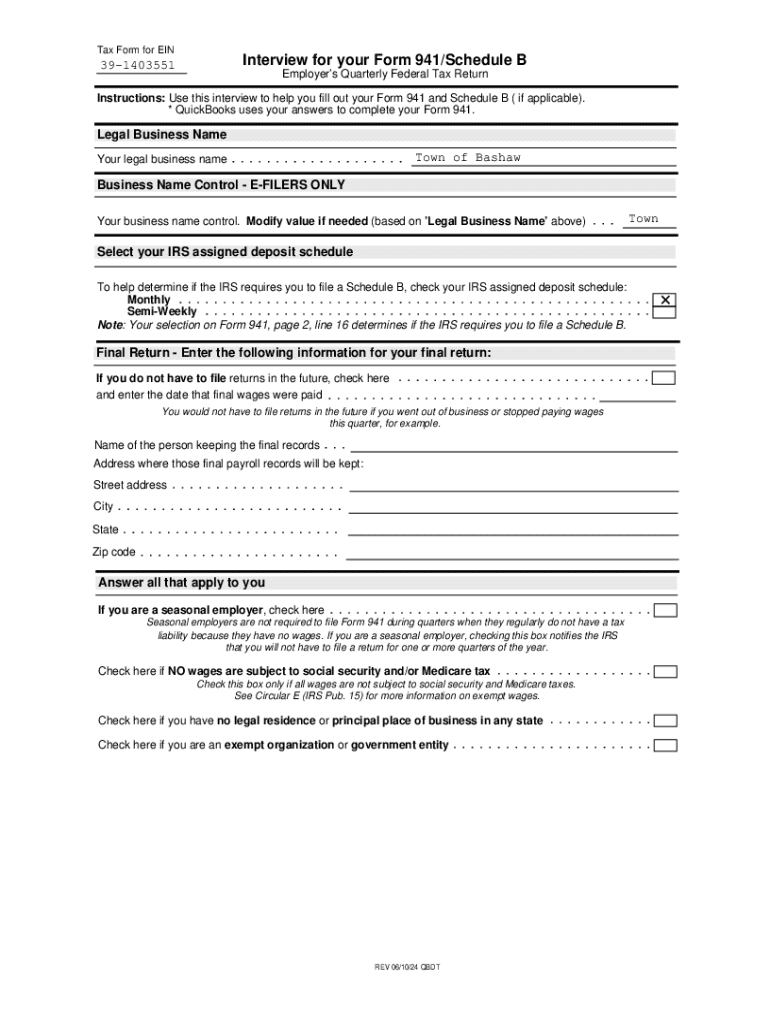

Get the free Tax Form for Ein

Get, Create, Make and Sign tax form for ein

How to edit tax form for ein online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax form for ein

How to fill out tax form for ein

Who needs tax form for ein?

Tax Form for EIN Form: A Comprehensive How-to Guide

Understanding the EIN and tax form SS-4

An Employer Identification Number (EIN) is a unique identifier assigned by the IRS to businesses for tax purposes. It's akin to a social security number for a business entity, facilitating the reporting of income and other tax-related activities. For new businesses or those seeking to turn a hobby into a legitimate venture, obtaining an EIN is crucial. Not only does it help in establishing business identity, but it also streamlines tax filing processes.

Confusion often arises between the EIN and the IRS Form SS-4. The SS-4 is the application form used to obtain the EIN. While the EIN is the end goal, understanding the SS-4 is essential for successful application, requiring accurate information and a clear understanding of the business structure.

Who needs to apply for an EIN?

Various business entities must apply for an EIN to comply with federal tax regulations. Each type of entity has its own requirements and implications for applying. Here are the primary categories:

Overview of IRS Form SS-4

The IRS Form SS-4 is specifically designed to help businesses apply for their EIN. This form holds significant weight as it encompasses important information about the business and its owners. Understanding Form SS-4 is vital for ensuring that the EIN is issued correctly and in a timely manner.

The form requires key information, including the legal name of the business, its address, the type of entity applying, and specific details about the business operations. Completing it accurately is crucial to avoid delays or rejections.

Preparing to fill out EIN form SS-4

Before tackling the SS-4, preparation is key. It's best to gather essential information to streamline the process and ensure accuracy.

Understanding the SS-4 sections ahead of time will further aid in seamless completion. Ensuring all areas are filled correctly can save unnecessary complications later.

Step-by-step guide to filling out form SS-4

The SS-4 form consists of several distinct sections, each with specific requirements. Here’s a breakdown of what to expect.

It's essential to provide precise information. Common mistakes include misinterpreting the questions or providing incorrect Social Security numbers. Taking the time to review each entry can greatly enhance the likelihood of approval.

Submitting your EIN form

Once your SS-4 form is completed, submitting it correctly is the next step. The IRS provides various methods for submission, each with its own requirements.

Processing times vary based on the method of application. Generally, online applications are processed immediately, whereas mailed applications can take several weeks. If urgent, review expedited processing options.

After you submit your EIN form

Once submitted, you'll receive confirmation of your EIN. This confirmation is crucial for your business tasks moving forward.

Additionally, keeping your EIN information current is necessary. If your business details change, you must notify the IRS to maintain compliance.

Common issues and solutions

Managing an EIN application can lead to challenges. Knowing how to address these common issues can save time and frustration.

Related documents and forms

Understanding other documents related to the EIN application can further enhance your tax preparedness. Several forms intersect with the EIN process.

Familiarizing yourself with these documents ensures a smoother tax process and compliance across various levels.

Enhancing your document management process

As you navigate the EIN application process, consider utilizing advanced document management solutions such as pdfFiller. This cloud-based platform offers a range of features specifically designed for form management.

Using pdfFiller can not only expedite your EIN application process but also enhance your overall business document strategy.

Useful tools and features

In today's fast-paced business environment, having the right tools at your disposal makes all the difference. pdfFiller offers a suite of interactive tools tailored to enhancing your form-filling experience.

Leveraging these tools can greatly simplify the process of obtaining your EIN and managing your business documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the tax form for ein in Chrome?

How do I fill out the tax form for ein form on my smartphone?

Can I edit tax form for ein on an iOS device?

What is tax form for ein?

Who is required to file tax form for ein?

How to fill out tax form for ein?

What is the purpose of tax form for ein?

What information must be reported on tax form for ein?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.