Get the free Ct-1096 Athen

Get, Create, Make and Sign ct-1096 aformn

How to edit ct-1096 aformn online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-1096 aformn

How to fill out ct-1096 aformn

Who needs ct-1096 aformn?

A comprehensive guide to CT-1096 AFORMN form

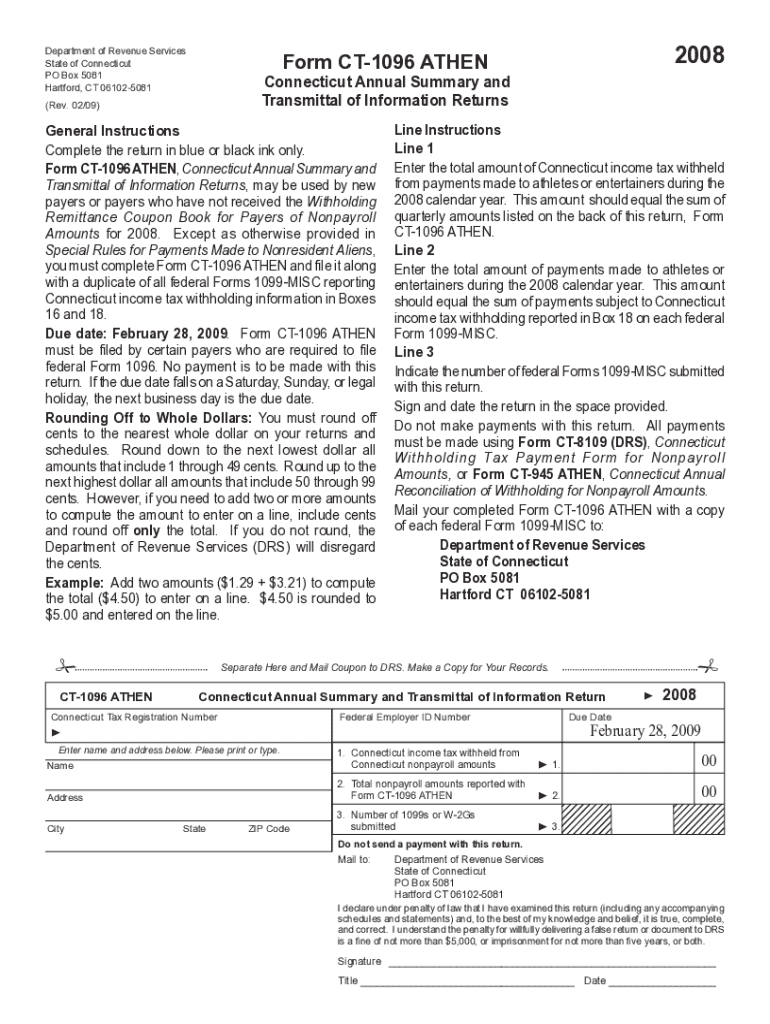

Overview of form CT-1096

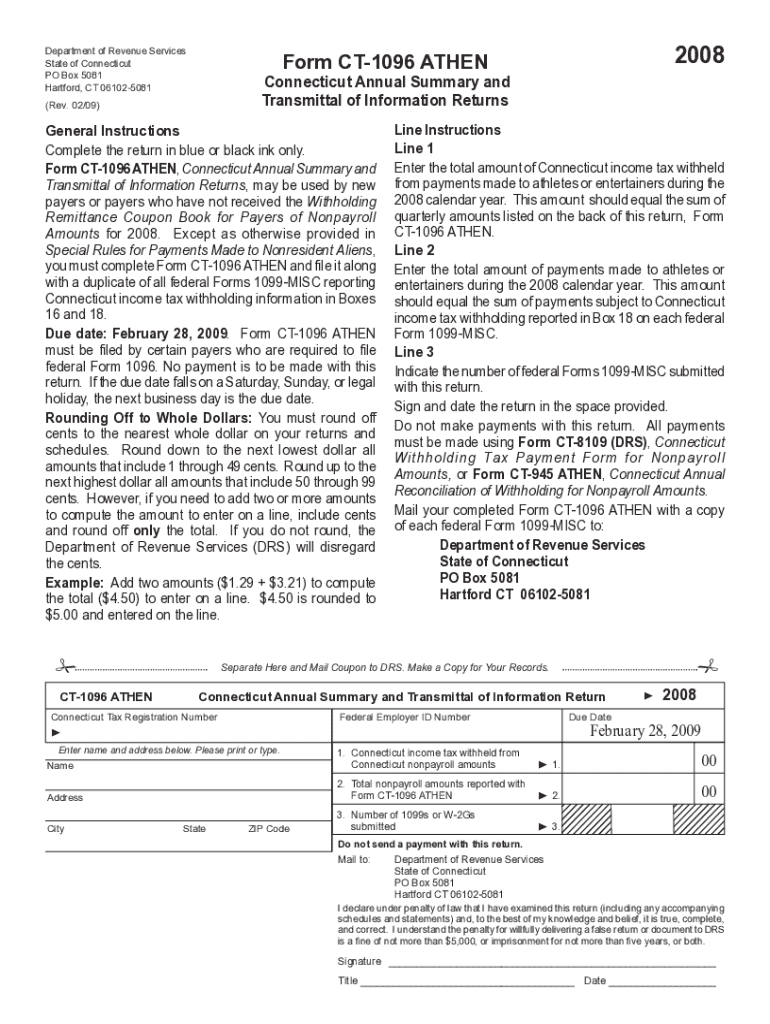

The CT-1096 AFORMN form is a critical document for businesses and entities that engage in transactions requiring reporting of payment information to the Connecticut Department of Revenue Services. The primary purpose of this form is to summarize amounts reported on various 1099 forms, ensuring that tax reporting responsibilities are met accurately and comprehensively.

Filing the CT-1096 is important because it consolidates information from multiple payee transactions into a single summary. This helps the state efficiently track income and enforce tax compliance for various entities, including independent contractors and service providers. Therefore, understanding the CT-1096's requirements is essential for all applicable individuals.

Who needs to file the CT-1096? Any business or individual who has made reportable payments for services rendered in the prior calendar year must complete this form. This includes payments reported on 1099-NEC for non-employee compensation and 1099-MISC for miscellaneous income. Filing deadlines typically align with federal requirements, offering a clear timeline for completion and submission.

Detailed instructions for filling out the CT-1096 form

Completing the CT-1096 form may appear daunting, but following a structured approach can simplify the process. Here’s a step-by-step guide aimed at facilitating a smooth completion.

Common mistakes to avoid when completing the CT-1096 include failing to double-check the accuracy of TINs, misreporting amounts from 1099 forms, and missing filing deadlines, all of which can lead to compliance issues.

Editing and managing your CT-1096

Utilizing pdfFiller to edit the CT-1096 form streamlines the entire process. pdfFiller offers a suite of tools designed to make document management and editing easy and efficient.

With interactive tools, users can easily fill out the CT-1096, ensuring each section is completed correctly. The platform also supports electronic signatures, enabling you to eSign documents directly within the interface, which is crucial for timely submissions.

Collaboration options allow teams to work together seamlessly. Shared access to the CT-1096 form ensures all team members can provide input and validate information prior to submission.

Filing your CT-1096 form: methods explained

Filing your CT-1096 can be done in two primary methods: e-filing and mail-in submission. Each method has its own benefits and considerations that can impact how quickly and effectively your submission is handled.

Regardless of the method chosen, ensure that all required documentation accompanies your form, as incomplete submissions can result in delays or penalties.

Compliance and regulations

Understanding Connecticut tax regulations is vital for anyone filing the CT-1096 form. The state has specific guidelines that dictate how and when the form should be filed, and failure to comply can result in serious penalties.

Penalties for late filing can add up quickly, encompassing both financial repercussions and potential legal action for persistent non-compliance. Taxpayers must stay informed about their obligations to avoid these outcomes.

Common questions regarding compliance include what to do if you’ve made errors on your CT-1096 and how to appeal for penalties incurred during late filings. Consulting with tax professionals or the Connecticut Department of Revenue Services can provide clarity regarding these issues.

Resources for CT-1096 users

For assistance with the CT-1096 form, accessing support is essential. The Connecticut Department of Revenue Services offers a range of contact options to help you navigate any challenges you encounter.

Additionally, understanding related forms and their requirements can simplify the process of filling out the CT-1096. Having relevant documentation and forms can ensure that all necessary information is reported accurately.

Utilizing pdfFiller’s knowledge base, which includes tutorials, webinars, and guides, can also enhance your understanding of form management and filing requirements.

Best practices for filing and managing tax forms

Maintaining accurate records throughout the year is a best practice for anyone who needs to complete the CT-1096. Using an organized system to track payments made to contractors or other payees can prevent last-minute rushes when tax season arrives.

Implementing these practices not only helps to ease the filing process but also enhances compliance with state regulations.

Final checklist before submitting your CT-1096

Before submitting your CT-1096, it’s crucial to conduct a final review to ensure accuracy and completeness. Following a checklist can be beneficial.

Completing this checklist can help mitigate errors that could delay processing and lead to compliance issues.

Additional considerations

Staying ahead of any upcoming changes to the CT-1096 form is crucial for users. The Connecticut Department of Revenue Services may alter requirements, deadlines, or regulations annually, impacting how forms should be filed.

Engaging with networking and community resources for tax preparation can provide beneficial insights from other taxpayers and professionals who navigate similar taxation environments.

Integrating pdfFiller into your tax documentation process offers robust solutions for all your form and document management needs, enhancing both usability and efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit ct-1096 aformn in Chrome?

Can I create an electronic signature for the ct-1096 aformn in Chrome?

Can I edit ct-1096 aformn on an Android device?

What is ct-1096 aformn?

Who is required to file ct-1096 aformn?

How to fill out ct-1096 aformn?

What is the purpose of ct-1096 aformn?

What information must be reported on ct-1096 aformn?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.