Get the free 2022 Form in-111 Instructions

Get, Create, Make and Sign 2022 form in-111 instructions

Editing 2022 form in-111 instructions online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2022 form in-111 instructions

How to fill out 2022 form in-111 instructions

Who needs 2022 form in-111 instructions?

2022 Form IN-111 Instructions Form: A Comprehensive Guide

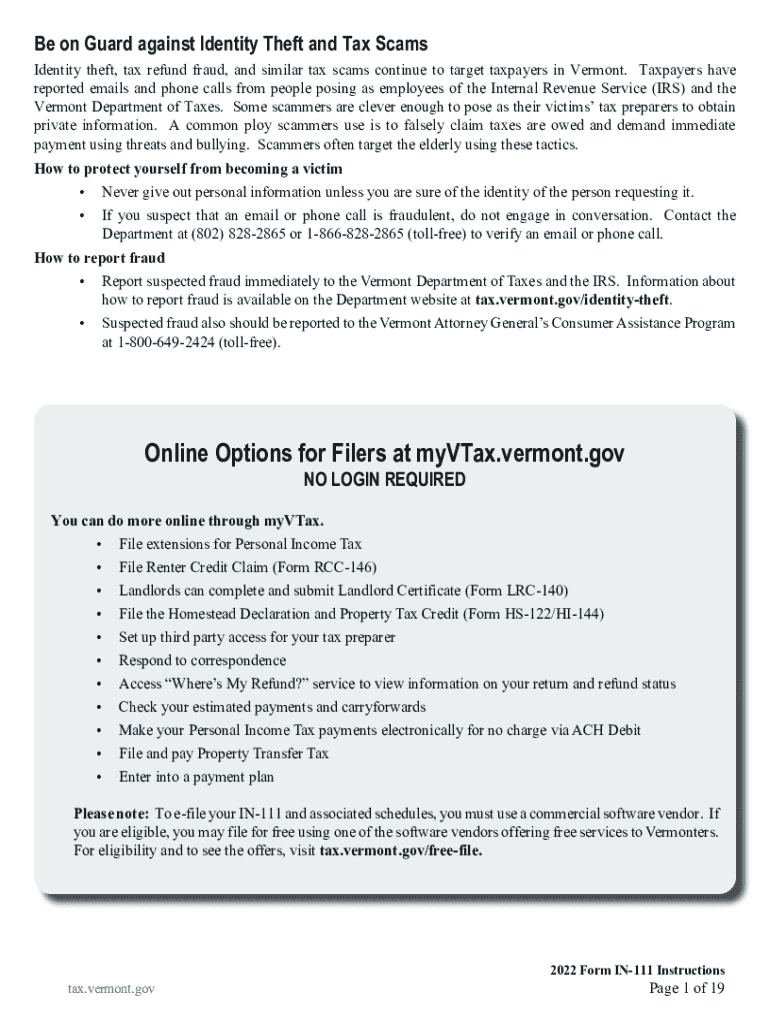

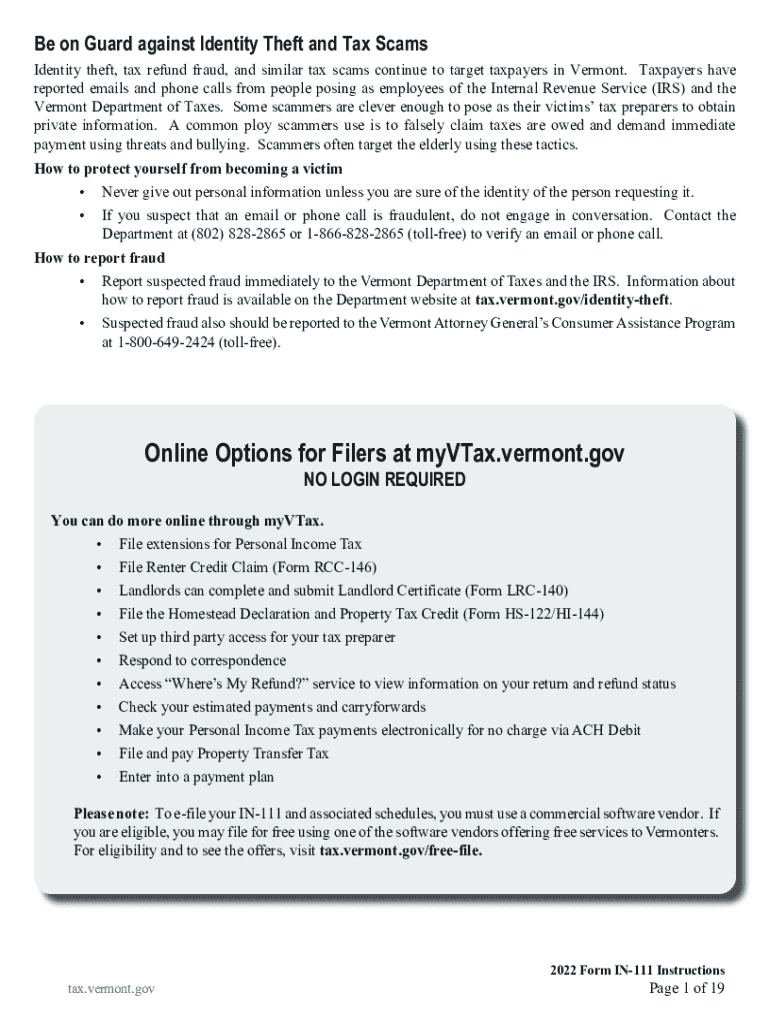

Overview of Form IN-111

Form IN-111 serves as a critical document for individuals managing their tax obligations at the state level. Particularly relevant for residents who exceed certain income thresholds or claim specific deductions, understanding this form is essential for accurate tax compliance. The importance of submitting a correctly completed Form IN-111 cannot be overstated, as it plays a significant role in calculating state tax liabilities or obtaining potential refunds.

Key reasons for completing this tax form include reporting income accurately, claiming applicable deductions and tax credits, and ultimately determining the final tax liability or an expected refund. Adhering to submission deadlines is crucial; typically, the filing deadline aligns with the federal tax filing deadline, providing enough window to gather necessary documentation efficiently.

Individuals required to complete Form IN-111 typically include those earning above the income thresholds specified by the state and individuals wishing to claim specific deductions or credits. Additionally, eligibility criteria often include residency status and income level, which must be reviewed carefully to ascertain the need for this form.

Step-by-step instructions for completing Form IN-111

Filling out Form IN-111 necessitates gathering a range of personal and financial information. First, ensure you have your personal details, including your name, address, and Social Security number. Next, compile details concerning your financial situation, such as income sources, possible deductions, and applicable credits that might affect your total tax calculations.

Now, let’s walk through each section of the form in detail:

Section 1: Taxpayer Information

Start by accurately entering your personal details. Make sure the information mirrors the documentation available to the IRS. Any discrepancies can lead to delays or complications in processing your return.

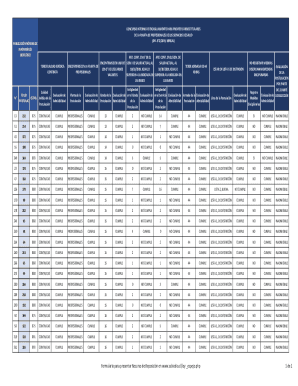

Section 2: Income Reporting

In this section, you’ll need to provide a comprehensive account of all income earned during the tax year. This includes wages from multiple employers, any freelance or contractual earnings, as well as investment income. To calculate total income, sum all earnings and ensure you include any untaxed income sources.

Section 3: Deductions

Eligible taxpayers can claim various deductions, such as those for mortgage interest or property taxes. It's crucial to document these properly, as they can significantly reduce taxable income. When claiming deductions, provide the necessary receipts and proof, as required.

Section 4: Tax Credits

This section addresses claiming available tax credits. Familiarize yourself with the credits relevant to your situation, as they directly reduce your tax liability on a dollar-for-dollar basis. Check eligibility for each credit and follow the stipulated steps to ensure proper claim.

Section 5: Final Calculation

This final section is crucial as it provides the formula for calculating the total tax obligation or potential refund. Double-check your calculations to avoid errors that may lead to issues with the state tax authorities.

Tips for accurate completion of Form IN-111

Avoiding common mistakes is key to a successful filing. Watch for specific line items that are easy to overlook, such as additional income or tax credits for which you may be eligible. Incorrect calculations often occur, so take your time through the math portions of the form.

Using technology can significantly aid in filling out forms accurately. Platforms like pdfFiller allow for easy editing, ensuring that adjustments can be made quickly. These tools help maintain clarity and organization, reducing the probability of human error during data input.

How to file Form IN-111

There are various options for submitting the Form IN-111, allowing taxpayers to select the method they find most convenient. Electronic filing via online platforms typically speeds up the process and reduces paperwork. Many tax software solutions can also handle Form IN-111, leading to a more streamlined experience.

Tracking your submission provides peace of mind. Most states offer confirmation services for electronic submissions, allowing you to verify that your Form IN-111 has been received and is being processed.

Sharing and collaborating on Form IN-111

Utilizing tools like pdfFiller enhances collaboration among team members managing tax documentation. It allows users to edit and share the form easily, ensuring everyone involved can contribute effectively.

Setting permissions for collaborative edits is straightforward—partners can comment or make direct edits based on how you configure access. This feature mitigates confusion and ensures clarity on who entered what information.

Integrating electronic signatures not only expedites approval processes but also adds security to document transactions. Ensuring that all stakeholders can approve quickly contributes to maintaining accountability during tax season.

Managing your answered Form IN-111

Once you’ve completed the Form IN-111, proper storage and organization become paramount. It’s recommended to digitize completed forms for convenient access and safe backup. Cloud-based services like pdfFiller offer secure storage solutions that enable retrieval from anywhere at any time.

Handling amendments post-submission is another significant aspect. Should you discover errors after submission, understanding your state’s protocol for amendments is critical to avoid penalties. Most states allow for a straightforward correction process, but timely action is essential to rectify mistakes efficiently.

Additional support with pdfFiller

pdfFiller is equipped with a variety of interactive tools tailored specifically for users needing assistance with Form IN-111. The platform offers customizable templates that can streamline the process, providing users with a framework to fill out the form without missing critical information.

For those facing complexities or uncertainties, contacting customer support is a straightforward solution. pdfFiller's support team is available to address queries and provide guidance, ensuring users feel supported throughout their filing journey. Additionally, accessing FAQs on their website can clarify common concerns and enhance user experience.

Keeping up-to-date with tax changes

Staying informed about current tax laws is a vital practice for all taxpayers. This includes monitoring updates to Form IN-111, which may change annually based on legislative alterations. Following reliable sources and subscribing to pertinent newsletters or tax alert services is an excellent way to remain ahead of changes that could affect your tax filing.

Awareness of potential shifts in credits, deductions, and filing requirements can prove beneficial in optimizing your filings and ensuring compliance. Platforms like pdfFiller often provide updates and resources to guide users through these modifications.

Real-life case studies

Providing context can be beneficial when discussing Form IN-111. Case studies illustrate how various individuals successfully navigated the complexities of this form, allowing them to maximize deductions or credits beneficial for their unique financial situations. For instance, one filer incorporated a blend of retirement income and freelance earnings, effectively reducing tax obligations through proper deductions and credits.

Analysis of previous submissions highlights common pitfalls as well as successful strategies, granting insight into how thoughtful preparation and utilizing available tools like pdfFiller can simplify the process. Lessons learned through these experiences reinforce the value of following a systematic approach to tax submission.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2022 form in-111 instructions without leaving Google Drive?

Where do I find 2022 form in-111 instructions?

How do I edit 2022 form in-111 instructions in Chrome?

What is form in-111 instructions?

Who is required to file form in-111 instructions?

How to fill out form in-111 instructions?

What is the purpose of form in-111 instructions?

What information must be reported on form in-111 instructions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.