Get the free St-3

Get, Create, Make and Sign st-3

How to edit st-3 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out st-3

How to fill out st-3

Who needs st-3?

How to Fill Out and Manage the ST-3 Form: A Comprehensive Guide

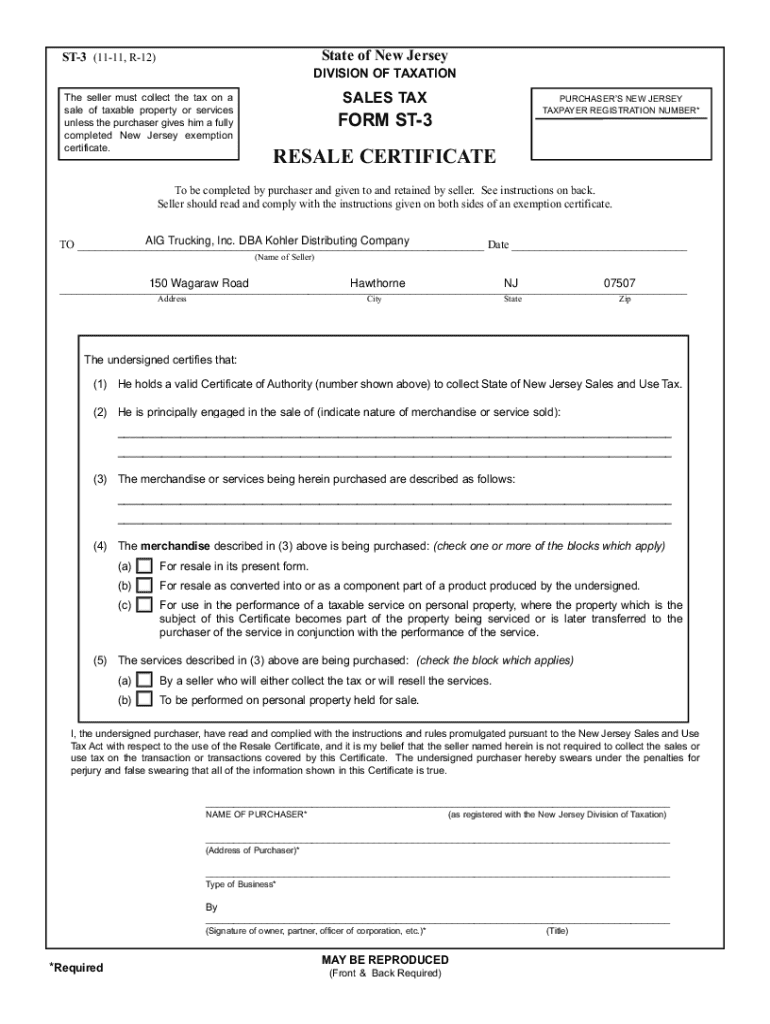

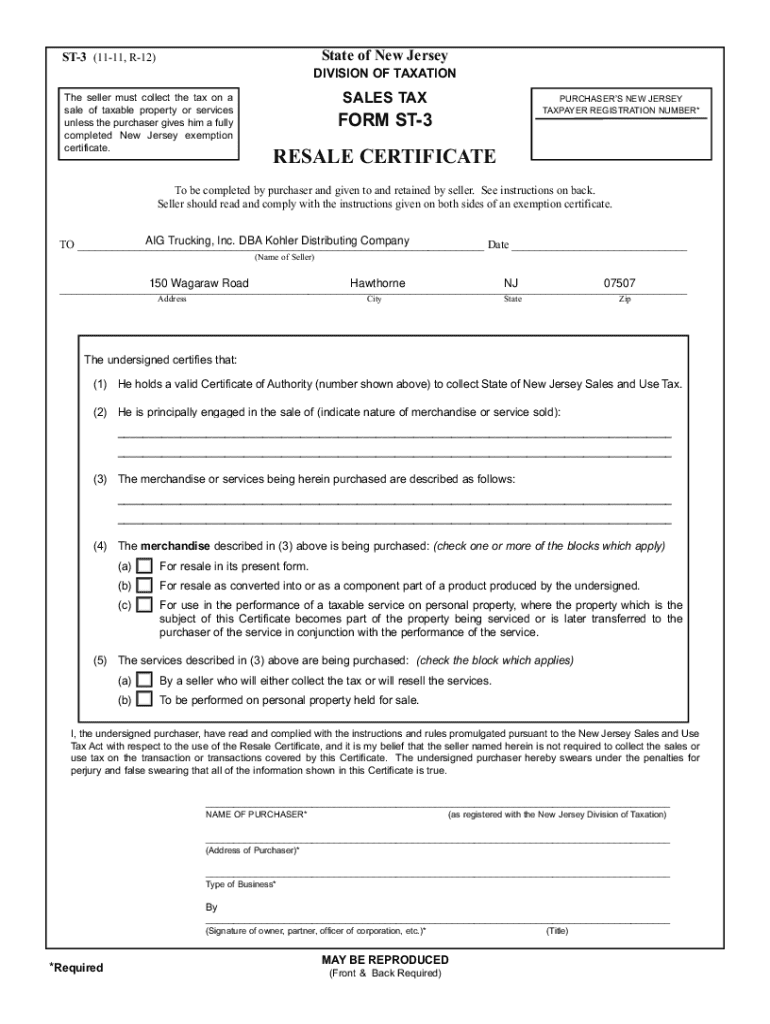

Understanding the ST-3 form

The ST-3 form plays a crucial role in tax reporting, particularly for businesses that need to report sales and use taxes. This form serves as a means to collect and remit the appropriate tax amounts to the state, ensuring compliance with tax regulations. Individuals and businesses utilizing this form help maintain transparency in their financial activities, reducing the likelihood of audits or penalties.

Typically, businesses that make taxable sales in the jurisdiction must use the ST-3 form. This category includes retailers, wholesalers, and service providers. Understanding who is required to fill out this form is essential for ensuring tax compliance and avoiding potential fines.

Preparing to fill out the ST-3 form

Preparation is key when filling out the ST-3 form. Before starting, gather all necessary documentation that substantiates your sales transactions. This includes receipts, invoices, and any relevant sales records. Having these documents on hand will not only make the process smoother but also help in case of any discrepancies later.

Eligibility for using the ST-3 form typically includes businesses that have conducted taxable transactions or sales. Special considerations, such as specific exemptions related to varying business types, should also be reviewed to ensure accurate completion of the form.

Step-by-step instructions for completing the ST-3 form

Filling out the ST-3 form requires precision and attention to detail. The first section pertains to your identifying information, where you’ll need to provide personal and business details accurately. This includes your name, address, and any relevant tax identification numbers.

The second section focuses on calculating sales and use tax. Here, you will need to provide a detailed breakdown of your taxable sales, including total sales numbers and applicable tax rates, which can vary by jurisdiction. It’s crucial to stay updated on the current tax rates to ensure your calculations are accurate.

Interactive tools for filling the ST-3 form

pdfFiller offers an interactive PDF editor that simplifies filling out the ST-3 form. Users can easily access the tool and take advantage of features like pre-filled fields, making the process less daunting. A notable addition is the eSign feature, allowing you to add signatures electronically, which provides convenience and saves time.

Another significant benefit of using pdfFiller is its real-time collaboration tools. You can invite team members to review the document, ensuring all necessary stakeholders are involved in confirming the accuracy of the submitted form. The commenting and feedback features help facilitate communication and address any concerns promptly.

Editing and modifying your ST-3 form

Once the ST-3 form is filled out, it’s essential to have the flexibility to edit if changes or corrections are needed. Accessing previous versions of your ST-3 form is straightforward with pdfFiller's versioning system. This allows you to retrieve saved drafts and revert changes if necessary, ensuring your documentation stays accurate and up-to-date.

When approaching last-minute adjustments, efficiency is key. Utilize tools within pdfFiller that enable quick edits. Familiarize yourself with common issues that arise during last-minute changes to mitigate potential errors before final submission.

Filing the ST-3 form

After the ST-3 form is completed, the next step is filing it appropriately. Submission methods include both online and paper filing. Electronic filing tends to be more efficient and faster, with pdfFiller offering an easy pathway to submit your form. Simply follow the electronic filing directions provided by your state tax authority.

Deadlines are critical when it comes to submitting your ST-3 form. Annual filing dates vary by jurisdiction and missing these deadlines can result in penalties. Being aware of important dates helps in planning your tax responsibilities and managing submissions effectively.

Post-filing tips and document management

After filing the ST-3 form, it’s vital to track the status of your submission. You can usually confirm receipt through your tax authority’s website. In the case of any issues or discrepancies, knowing the right steps to take can help resolve them swiftly.

Organizing your tax documents also plays a pivotal role in managing your ST-3 form. Keeping these documents in an orderly fashion not only helps in future filings but also serves as a reference in case of audits.

FAQs: Common concerns regarding the ST-3 form

Addressing frequent questions can alleviate concerns when it comes to filling out the ST-3 form. Common questions often revolve around eligibility, deadlines, and how to handle errors during completion. Familiarizing yourself with these frequently asked questions can save time and reduce anxiety.

Mistakes such as misreporting sales or providing inaccurate business information are common missteps. Knowing how to avoid these pitfalls with accurate practices will help streamline your tax filing process.

Support and assistance options

When navigating tax-related queries, access to reliable assistance is key. Your state tax authority’s website often contains helpful resources and contact information for additional support. Additionally, utilizing pdfFiller's customer support can address specific issues faced during the form-filling process.

Having a support system in place enables you to focus on the core aspects of your business while ensuring compliance with necessary tax requirements.

Discover the power of pdfFiller for all your document needs

pdfFiller goes beyond simply providing tools for the ST-3 form. It offers robust capabilities for all types of document creation and management. With pdfFiller, users can seamlessly edit PDFs, eSign documents, collaborate with team members, and manage their documents from a single, cloud-based platform.

Embracing pdfFiller for your tax forms and beyond saves you time and reduces stress associated with document management. The platform is designed for individuals and teams who require easy access to document solutions, making it an invaluable resource in today’s digital landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send st-3 to be eSigned by others?

How do I edit st-3 online?

How do I fill out st-3 on an Android device?

What is st-3?

Who is required to file st-3?

How to fill out st-3?

What is the purpose of st-3?

What information must be reported on st-3?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.