Get the free Quarterly Tax and Wage Report for 2025 - dlt ri

Get, Create, Make and Sign quarterly tax and wage

How to edit quarterly tax and wage online

Uncompromising security for your PDF editing and eSignature needs

How to fill out quarterly tax and wage

How to fill out quarterly tax and wage

Who needs quarterly tax and wage?

Comprehensive Guide to Quarterly Tax and Wage Forms

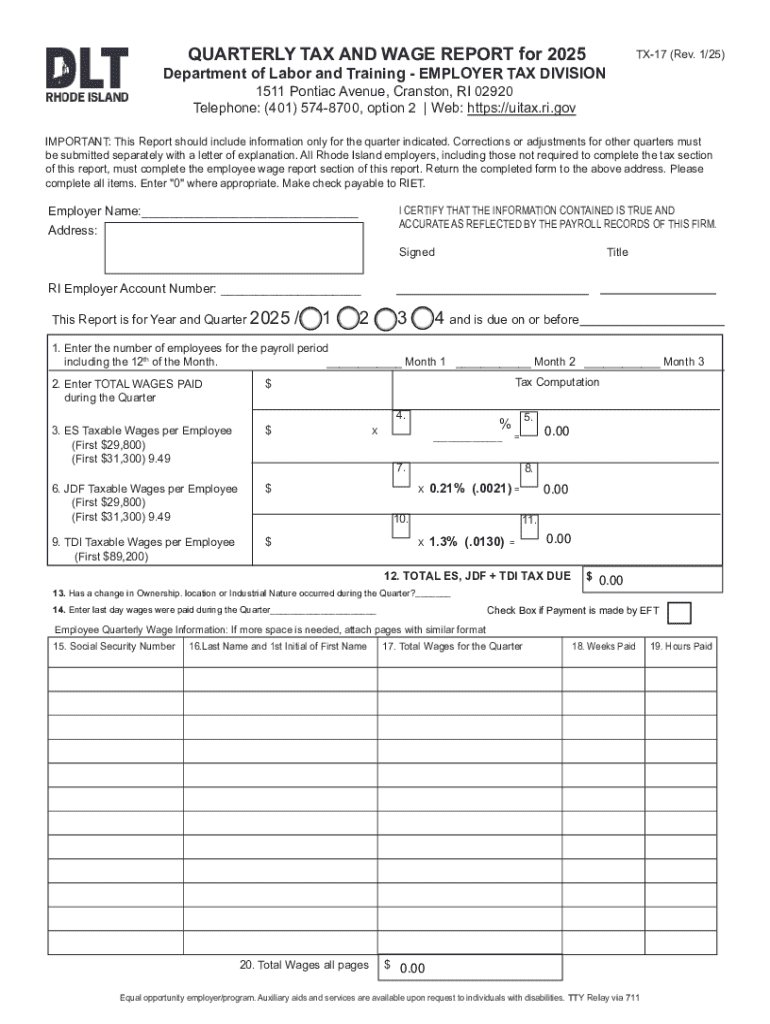

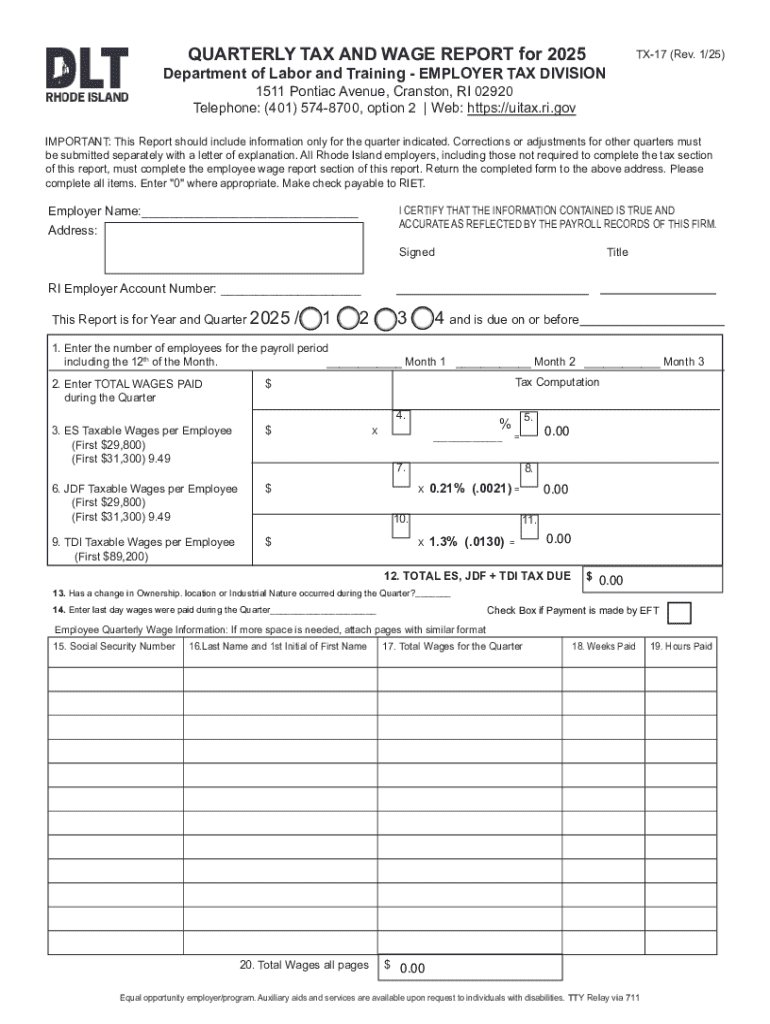

Overview of the quarterly tax and wage form

Quarterly tax and wage forms are essential documents that employers must file to report employee wages, withholdings, and payroll taxes every quarter. Accurate reporting is crucial for maintaining compliance with state and federal tax laws, ensuring that organizations avoid costly penalties and interest. Failing to file these forms on time can lead to serious financial repercussions, including fines and audits.

Every quarter has specific deadlines for filing. Employers generally must submit their quarterly tax forms on the last day of the month following the end of the quarter. For example, forms for Q1 (January-March) are due by April 30. To stay organized, employers should create a calendar or set reminders to ensure compliance.

Understanding the different forms

Employers should familiarize themselves with the different forms related to quarterly tax and wage reporting. These forms have distinct purposes and submission requirements, which can vary by state. While the exact names and numbers may differ, the following are the most commonly used forms.

As tax rules and regulations frequently evolve, it’s vital to check for any updates or changes for the current tax year to ensure compliance. Employers should verify requirements specific to their states, as some state forms may differ significantly.

Step-by-step guide to filling out the quarterly tax and wage form

Completing Form C-3 is a critical task for employers, requiring attention to detail. When filling out this form, certain information is mandatory, like employee names, Social Security numbers, wages earned, and taxes withheld. Employers should maintain accurate and timely records to facilitate smooth submissions.

To avoid common errors, employers should double-check entries for accuracy, such as spelling employee names correctly and cross-referencing Social Security numbers. Missing or incorrect information can lead to delays or penalties.

Filing methods

Employers have several options for filing their quarterly tax and wage forms, with online methods becoming increasingly popular for their convenience. One recommended platform is pdfFiller, offering a user-friendly interface for document submission.

To file online through pdfFiller, users can create an account, select the appropriate form, and easily input information. Forms can be filled, edited, and e-signed directly within the platform, which enhances efficiency.

Tools for effective document management

Utilizing pdfFiller's interactive document features can significantly simplify the management of quarterly tax and wage forms. The platform offers a range of editing capabilities, allowing employers to adjust and update forms with ease.

Additionally, pdfFiller supports e-signature options, facilitating quick approvals. Storing forms securely in the cloud also provides peace of mind, ensuring that documents are easily accessible and protected against loss.

Post-submission actions

After submitting your quarterly tax and wage form, it’s crucial to track the submission status. Employers should keep records of confirmations or receipts issued by the tax authority. This step safeguards against future discrepancies.

Understanding potential audit triggers can prepare employers for unexpected scrutiny. Common triggers include discrepancies in filed wages or employment numbers compared to previous filings. If corrections are needed, the process typically involves filing an amended form to rectify errors.

Frequently asked questions

Employers often have queries surrounding quarterly tax and wage submissions. Addressing these questions can demystify the process.

Additional resources for employers

Employers should routinely consult official government websites relevant to their locations for specific guidelines. Direct resources from tax or employment agencies can provide up-to-date information.

Furthermore, best practices such as conducting regular payroll audits and providing training for employees on documentation requirements can enhance compliance. Engaging in webinars and tutorials can also aid in staying informed.

Support and contact information

Should issues arise while completing tax forms, pdfFiller support offers various contact methods. Users can reach out through email or live chat for prompt assistance, ensuring they receive quality help when needed.

Response times can vary, but the support staff is dedicated to resolving user queries efficiently.

Importance of staying informed

Tax regulations are subject to change, making it essential for employers to stay informed about new laws affecting quarterly reporting. Subscribing to newsletters or updates from tax and unemployment agencies can be instrumental.

Staying ahead of changes can assist businesses in maintaining compliance and avoiding unnecessary penalties or legal issues.

Best practices for employers

Adhering to best practices can streamline the filing process and enhance reporting accuracy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my quarterly tax and wage directly from Gmail?

How do I complete quarterly tax and wage online?

Can I edit quarterly tax and wage on an Android device?

What is quarterly tax and wage?

Who is required to file quarterly tax and wage?

How to fill out quarterly tax and wage?

What is the purpose of quarterly tax and wage?

What information must be reported on quarterly tax and wage?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.