Get the free Fiscal Agent Information

Get, Create, Make and Sign fiscal agent information

How to edit fiscal agent information online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fiscal agent information

How to fill out fiscal agent information

Who needs fiscal agent information?

A comprehensive guide to the fiscal agent information form

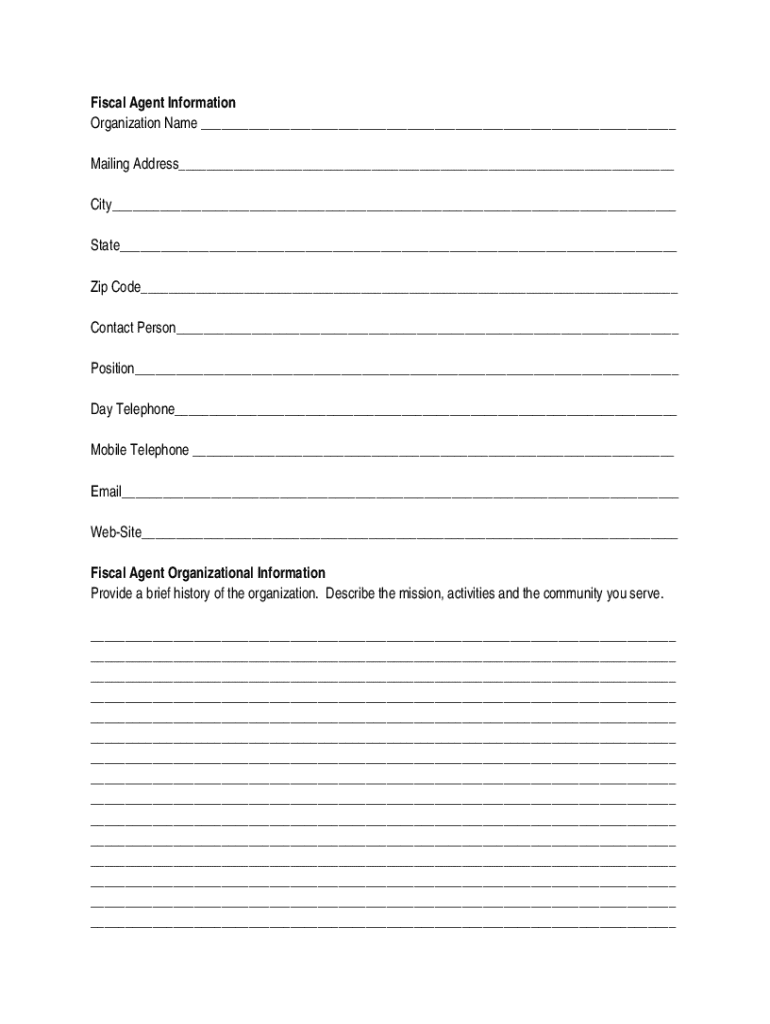

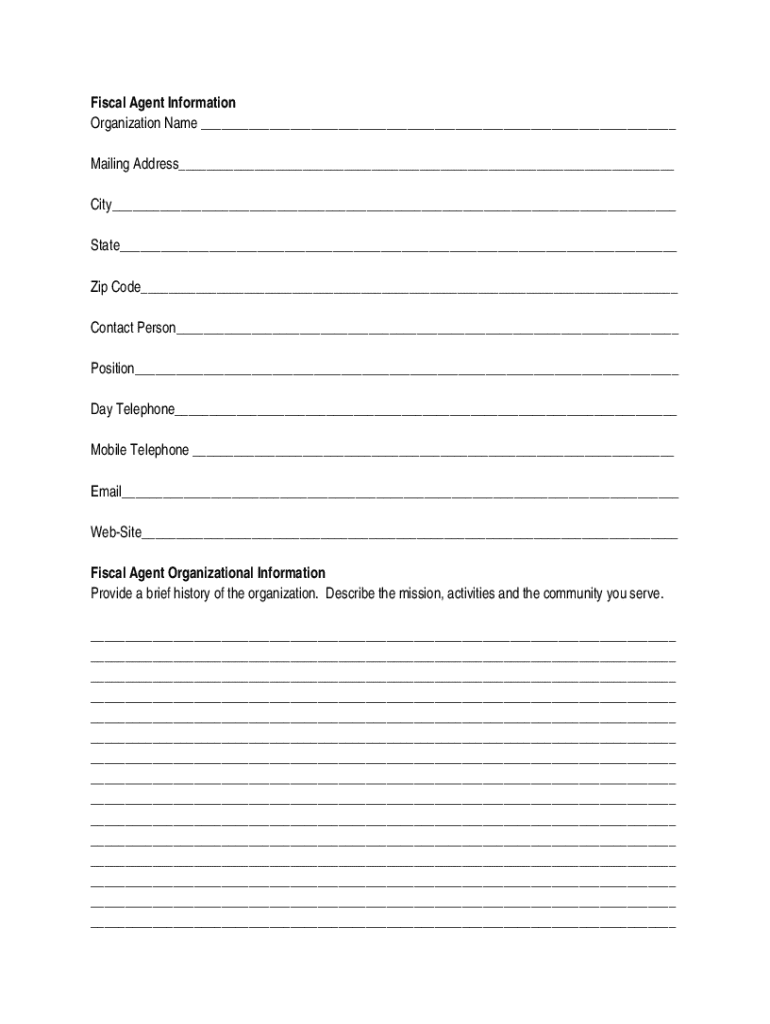

Overview of fiscal agent information forms

A fiscal agent information form is a key document used to streamline the process of managing funds on behalf of individuals or organizations. This form serves the purpose of collecting essential details about the fiscal agent appointed to manage finances, thereby ensuring transparency and accountability. Proper completion of the fiscal agent information form is crucial as it not only aids in adherence to legal requirements but also enhances operational efficiency by providing accurate data that can significantly reduce administrative errors.

Understanding the role of fiscal agents

Fiscal agents play a pivotal role in financial management, especially for those who require assistance in handling their funding. These agents are typically organizations or individuals that receive and manage funds on behalf of others, ensuring that financial resources are utilized efficiently and in accordance with agreed-upon guidelines. The responsibilities of fiscal agents range from financial reporting and compliance to fund disbursement and budgeting.

In managing funds, fiscal agents not only handle the technical aspects of financial transactions but also act as liaisons between funders and recipients. Their ability to maintain accurate records, ensure compliance with relevant regulations, and provide transparency to stakeholders makes them indispensable in the financial landscape.

Accessing the fiscal agent information form

Finding and accessing the fiscal agent information form is straightforward. The form can usually be downloaded directly from official organizational websites or platforms that specialize in document management, such as pdfFiller. For your convenience, pdfFiller offers a user-friendly template that simplifies the process of obtaining this form.

You can choose between digital access or downloading a physical copy, depending on your preference for filling out the form. For an enhanced experience, tools like pdfFiller allow you to edit and sign the form digitally, saving time and streamlining the process.

Step-by-step guide to filling out the fiscal agent information form

To ensure clarity and accuracy, the process of completing the fiscal agent information form can be broken down into manageable steps:

Editing and customizing the fiscal agent information form

Once you have downloaded the fiscal agent information form, you may want to edit or customize it to better meet your needs. pdfFiller provides robust editing tools that make this process simple. You can add or remove fields as necessary, ensuring the form captures all relevant information.

Saving different versions or drafts is also crucial. It allows you to keep track of changes and maintain a clear record of your submissions. Moreover, collaboration with team members is seamless on pdfFiller, enabling multiple users to contribute to the form from various locations.

Submitting the fiscal agent information form

After filling out the fiscal agent information form, the next step is submission. Depending on the requirements set by the agency or organization involved, you may submit the form electronically or via physical mail.

Expect confirmation of your submission within a designated timeframe. Keeping an eye out for this confirmation will help you ensure that your form has been successfully processed and received.

Managing your fiscal agent information form after submission

Once you’ve submitted your fiscal agent information form, it’s important to monitor its status. Many organizations provide online portals where you can check the progress of your submission. Knowing the status can help you be proactive, particularly if follow-ups become necessary.

Updating your information post-submission should also be prioritized. If there are changes in your circumstances or in the details provided in the form, communicate these changes promptly to avoid conflicts in record-keeping. Keeping accurate and thorough records of your submissions is vital for all future transactions and communications.

Frequently asked questions about fiscal agent information forms

Common issues and troubleshooting

Completing a fiscal agent information form can sometimes present issues, such as misplaced files, technical difficulties, or misunderstanding of required fields. Diagnosing these issues early is critical for smooth processing.

If difficulties persist, reaching out to technical support or consulting with knowledgeable colleagues can expedite the resolution process.

Additional tools and resources on pdfFiller

pdfFiller not only provides the fiscal agent information form but also a wide array of related forms and templates that cater to various document management needs. Users can easily integrate their fiscal forms with other document management tools, enhancing workflow efficiency.

Testimonials from satisfied users highlight the platform's ability to simplify compliance, improve collaboration, and streamline the entire document creation process, making it an indispensable resource for individuals and teams alike.

Exploring more about fiscal agents

For those interested in understanding the broader implications of fiscal agents, exploring articles about their impact on funding and support systems can be beneficial. The role of fiscal agents extends beyond mere fund management; they facilitate trust and accountability between parties and contribute significantly to financial stability in various sectors.

Additionally, insights into the future of fiscal management suggest an increasing reliance on technology to enhance financial processes, paving the way for innovative solutions and improved frameworks.

Stay updated with current fiscal agent policies

Staying informed on the latest updates regarding fiscal agent practices and regulations is crucial for anyone involved in financial management. Subscribing to newsletters, following relevant organizations on social media, or attending workshops can help enhance your knowledge and keep you abreast of changes in policies.

By utilizing available education and support channels, you can ensure that you remain compliant and informed, thereby maximizing the effectiveness of your fiscal management practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute fiscal agent information online?

How do I fill out the fiscal agent information form on my smartphone?

Can I edit fiscal agent information on an iOS device?

What is fiscal agent information?

Who is required to file fiscal agent information?

How to fill out fiscal agent information?

What is the purpose of fiscal agent information?

What information must be reported on fiscal agent information?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.