Get the free Form 10-q

Get, Create, Make and Sign form 10-q

Editing form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

Understanding the Form 10-Q: A Comprehensive Guide

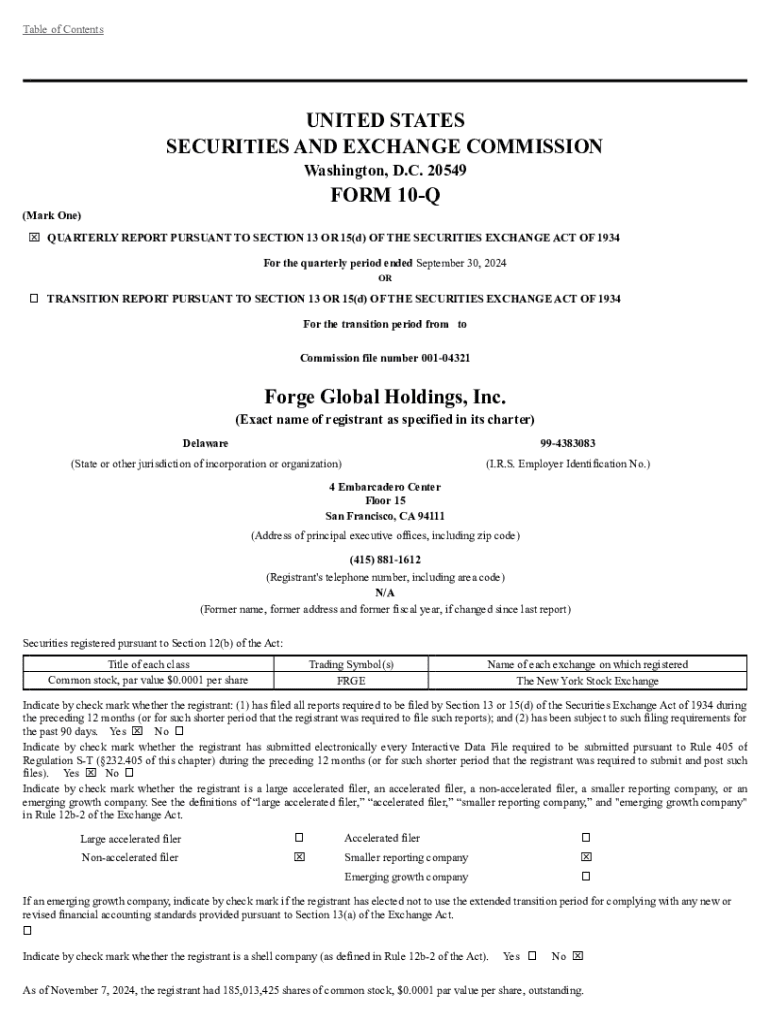

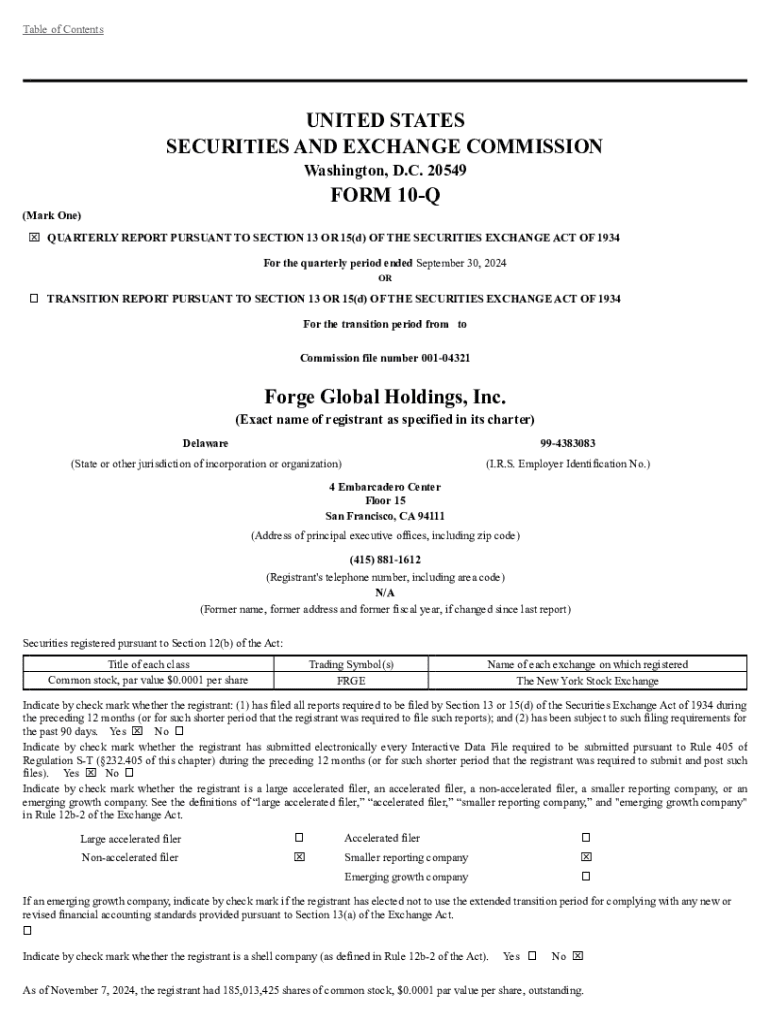

Understanding the Form 10-Q

The Form 10-Q is a pivotal document mandated by the Securities and Exchange Commission (SEC) that publicly traded companies must file quarterly. It serves not only as a financial update for shareholders but also ensures adherence to regulatory compliance. This form reveals crucial information about a company's financial health and operational status over the most recent fiscal quarter.

Essentially, the Form 10-Q provides a detailed snapshot of a company's performance, aiding investors and analysts to make informed decisions. The frequency of these reports allows stakeholders to gauge a company's ongoing performance trends and any potential fluctuations in its financial stability.

Key components of Form 10-Q

Understanding the structure of Form 10-Q is crucial for both filing and analyzing the document. Key sections include:

What’s in a Form 10-Q?

The Form 10-Q must include specific disclosures as outlined by the SEC. Key features include quarterly financial statements that show the most recent performance metrics. Companies must also disclose material changes to financial positions and any legal proceedings affecting the business. Moreover, updates on risk factors or management's responses to these risks are essential for providing a complete financial picture.

Furthermore, companies are required to file updates if there are changes in internal controls over financial reporting. These periodic updates maintain transparency and help assure stakeholders of the company’s ongoing accountability to regulatory standards.

Comparison to other filings

A significant distinction exists between Form 10-Q and Form 10-K. While the Form 10-Q provides quarterly updates, Form 10-K presents a comprehensive overview of a company’s financial data on an annual basis, along with audited financial statements. This annual report is typically more detailed in scope and contains information such as market risks and competitive positions.

Unlike Form 10-K that requires extensive disclosures, Form 10-Q focuses on a more concise summary of financial health. However, the quarterly filings are crucial as they allow investors and analysts to monitor the business’s trajectory closely, revealing trends that may affect overall market performance.

Filing requirements for Form 10-Q

Not all businesses are required to file a Form 10-Q. Generally, companies that are publicly traded and registered with the SEC fall under this requirement. This encompasses larger entities like corporations and specific structured finance companies. Additionally, foreign companies following U.S. GAAP might also need to comply with similar requirements.

Failure to file Form 10-Q on time can lead to severe repercussions, including penalties from the SEC or potential delisting from exchanges, thereby damaging investor confidence. Companies must be diligent in meeting these necessary compliance guidelines to maintain transparency and trust.

10-Q filing deadlines

Timely filing of Form 10-Q is critical. Different types of companies face varying deadlines based on their classification:

Maintaining a calendar of key filing dates is crucial for compliance, helping companies avoid penalties and ensuring ongoing investor engagement.

How to find Form 10-Qs

Investors looking for filed Form 10-Q documents can access these through the SEC's EDGAR database. To locate specific filings:

Utilizing these steps ensures easy access to essential company filings, supporting informed investment decisions.

Common pitfalls in completing Form 10-Q

Completing the Form 10-Q may seem straightforward, but companies frequently encounter common mistakes. Errors can range from misreporting financial figures to failing to update risk factors or not providing adequate management discussions.

To avoid these pitfalls, companies should implement a thorough review process and ensure cross-departmental collaboration. Additionally, engaging experienced legal and financial advisors during the preparation phase can significantly reduce errors, ensuring compliance and accuracy.

Utilizing interactive tools for document management

Organizations like pdfFiller offer powerful tools for filling out and managing Form 10-Q. The ability to edit PDFs easily and incorporate electronic signatures fosters efficiency in the document preparation process. Cloud-based platforms streamline collaboration among team members, allowing for real-time editing and updates.

Transitioning to digital document management reduces the risk of errors associated with physical paperwork while enhancing overall workflow efficiency. By leveraging these interactive tools, companies can ensure their compliance documentation is accurate, timely, and accessible.

Importance of transparency and compliance

Regular filing of Form 10-Q communicates a commitment to transparency that fosters investor trust. Timely and accurate filings demonstrate a company's dedication to adhering to regulatory standards, which is vital in maintaining a robust shareholder base.

Conversely, inaccuracies or delays can lead to legal ramifications and erode investor confidence. Companies must prioritize compliance not only for regulatory reasons but also to build long-term relationships with their stakeholders.

Advanced considerations

The preparation of Form 10-Q is typically overseen by auditors who ensure the integrity of financial reporting. Given the importance placed on accurate disclosures, auditors play a crucial role in verifying the data presented in the filing.

Looking ahead, regulatory reporting and compliance are expected to evolve. Companies should stay informed about changes to reporting requirements and leverage technology to ensure they can respond promptly to these developments.

Real-life applications and case studies

Several companies have exemplified best practices in their Form 10-Q filings, demonstrating attention to detail and comprehensive analysis. For instance, a tech giant once provided an insightful MD&A section that thoroughly analyzed quarterly earnings in relation to shifting market trends, becoming a model for peers.

On the other hand, compliance failures have resulted in hefty fines and loss of market credibility. An infamous case involved a company that neglected to disclose significant risk factors, leading to legal actions and a sharp decline in share value. The contrasting outcomes highlight the importance of thorough and transparent Form 10-Q reporting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in form 10-q?

Can I create an electronic signature for the form 10-q in Chrome?

Can I create an eSignature for the form 10-q in Gmail?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.