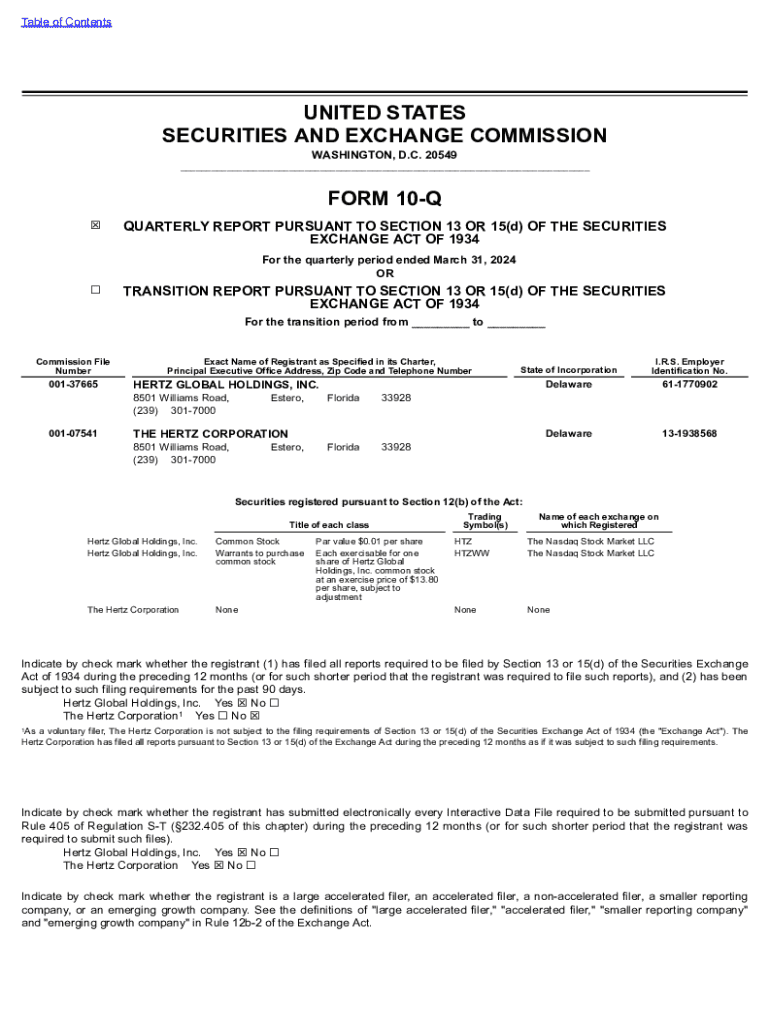

Get the free Form 10-q

Get, Create, Make and Sign form 10-q

Editing form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

Comprehensive Guide on Form 10-Q

Overview of Form 10-Q

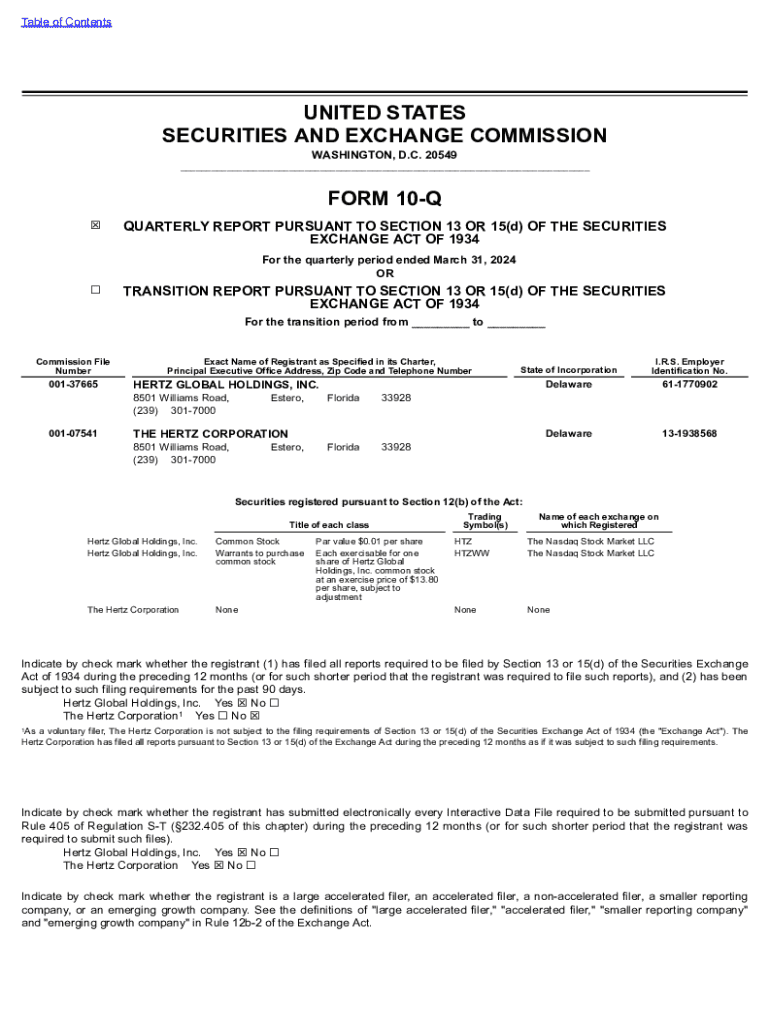

Form 10-Q is a mandatory report that publicly traded companies are required to submit to the U.S. Securities and Exchange Commission (SEC) on a quarterly basis. This form is essential for ongoing financial transparency, highlighting a company's financial performance and operations throughout the quarter. Unlike annual reports, Form 10-Q allows investors and analysts to monitor a company’s performance during the year and provides a more frequent update than annual reports.

The significance of Form 10-Q extends beyond mere compliance; it serves as a crucial tool for investors seeking insights into a company's ongoing financial health. By analyzing these quarterly reports, stakeholders can make informed decisions regarding their investments, assess the company’s operational trends, and identify potential risks.

What is a Form 10-Q?

As part of the SEC's regulatory framework, the Form 10-Q is designed to provide an overview of a company's financial condition and results of operations. The requirement for companies to file Form 10-Q stems from federal securities laws intended to protect investors and ensure they receive pertinent financial information on a timely basis. Companies must file this form within 40 days after the end of each fiscal quarter, offering current insights into their profitability and risks.

A key element in understanding Form 10-Q lies in differentiating it from Form 10-K, which is the annual report. While both forms provide vital information to investors, a Form 10-Q includes condensed financial statements and is less comprehensive than its annual counterpart. This means that while 10-Ks provide a holistic view of the company's annual performance and the intricacies of its operations, 10-Qs focus primarily on the most recent quarter.

Components of Form 10-Q

Form 10-Q consists of several key sections that provide a well-rounded picture of a company's financial status and performance. A detailed breakdown of these components includes:

Other required disclosures may include legal proceedings, controls and procedures regarding financial reporting, and risk factors that could affect the company's future performance.

How to find Form 10-Qs

Locating Form 10-Q filings is straightforward, thanks to the SEC's dedicated resources. To access these filings, investors can follow a simple step-by-step guide:

For efficient searching, use advanced search filters, including date ranges and specific form types, to narrow down results and find the information needed quickly.

Filing deadlines for Form 10-Q

Filing deadlines for Form 10-Q are dictated by the company's fiscal calendar. Companies must file their Form 10-Q reports within 40 days following the end of their fiscal quarter. Timely filing is crucial as it reflects on a company's commitment to transparency and investor communication.

Late filings can attract penalty fees and damage a company's reputation. Numerous case studies exist of firms facing repercussions due to delays, with some even resulting in investor lawsuits, reflecting the importance of adhering to filing schedules.

Navigating the 10-Q filing process

Preparing a Form 10-Q involves a structured filing process, starting with collecting necessary financial data. Begin with an internal audit of your financial records to ensure accuracy before filling out the form.

It’s important to avoid common mistakes during this process, such as providing outdated information or failing to disclose material events, as these can lead to further scrutiny from regulators and investors.

Key highlights in Form 10-Q reporting

Investors should pay close attention to material changes reported in each quarter's Form 10-Q. Significant developments – such as alterations in management, market expansion, or shifts in product lines – can greatly influence investor perceptions and stock performance.

Moreover, understanding a company's risk disclosures is vital. This section highlights the factors that can affect future performance and guide investment decisions. Companies are encouraged to provide transparent and clear reporting to foster trust with investors.

Best practices for analyzing Form 10-Q

Effective analysis of a Form 10-Q requires a strategic approach. Investors should focus on the financial statements to identify trends in revenue, profit margins, and cash flow oversights. Insights derived from this information can guide investment strategies.

By applying these techniques, investors can cultivate a more nuanced understanding of a company’s current standing and future potential.

Avoiding common pitfalls in Form 10-Q filings

Investors should remain vigilant about red flags when analyzing Form 10-Q filings. These may include inconsistencies between financial data and management commentary, overly optimistic forecasts, or lack of transparency regarding risks. Such issues can indicate deeper underlying problems within the company.

Incorporating these practices can help companies avoid pitfalls related to reporting and safeguard investor trust.

Frequently asked questions (FAQs) about Form 10-Q

Investors often have questions regarding the specifics of Form 10-Q. Common queries can revolve around the contents of the form, the importance of timely filings, and the implications of missing deadlines. Clarifying these concerns will empower both investors and reporting entities to effectively navigate the 10-Q landscape.

Providing clear answers enhances compliance understanding and reinforces the significance of diligent reporting practices.

Utilizing pdfFiller for Form 10-Q management

pdfFiller offers an innovative suite of tools tailored for Form 10-Q management, simplifying the complexity of preparing and filing. Users can efficiently edit and eSign Form 10-Q documents directly within the platform, streamlining collaboration across teams involved in the reporting process.

These functionalities position pdfFiller as an essential resource for companies navigating the complexities of Form 10-Q reporting.

Interactive tools for preparing and analyzing Form 10-Q

pdfFiller’s platform provides features that support the preparation and analysis of Form 10-Q filings. Users can take advantage of analytics tools that offer insights into submission trends, potential discrepancies, and areas needing further detail in disclosures.

These interactive tools ensure that both new and seasoned companies can effectively prepare their Form 10-Q reports, promoting accuracy and thoroughness.

Additional resources for in-depth understanding of Form 10-Q

For those looking to deepen their understanding of Form 10-Q, numerous educational resources are available. Financial analysts, investors, and corporate compliance teams can benefit from recommended texts, online courses, and webinars focused on SEC regulations and financial reporting.

These resources will empower users to navigate the complexities of Form 10-Q and maintain a competitive edge in the market.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 10-q directly from Gmail?

How do I edit form 10-q on an iOS device?

How do I edit form 10-q on an Android device?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.