Get the free Cafeteria Plan

Get, Create, Make and Sign cafeteria plan

How to edit cafeteria plan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cafeteria plan

How to fill out cafeteria plan

Who needs cafeteria plan?

Cafeteria Plan Form - How-to Guide Long-Read

Understanding the cafeteria plan

A cafeteria plan, also known as a Section 125 plan, allows employees to select from a variety of pre-tax benefit options. This flexible approach empowers individuals to choose which benefits best fit their personal needs—ranging from health insurance to child care subsidies. The primary advantage of cafeteria plans is the potential for reduced taxable income, which can lead to significant savings for employees.

Cafeteria plans stand apart from traditional benefit structures, where employees are often limited to a one-size-fits-all package. Instead, these plans allow customized selections, ensuring that employees can prioritize benefits most relevant to them. This enhanced flexibility often translates to higher employee satisfaction and engagement as well.

Key components of a cafeteria plan

Cafeteria plans are multifaceted, comprising an array of benefits designed to meet diverse employee needs. Common components include health benefits, dependent care assistance, and flexible spending accounts (FSAs). These options allow employees to allocate their benefits based on what they value most, enhancing the overall utility of their compensation package.

While the variety is appealing, certain benefits are excluded from cafeteria plans. For instance, long-term disability insurance and life insurance often don’t fall under the cafeteria plan umbrella, as these benefits typically must adhere to different regulatory standards.

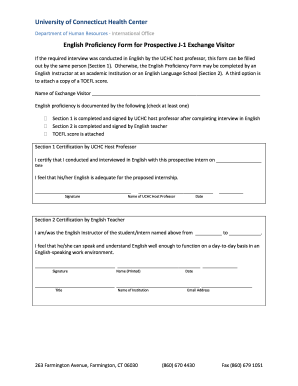

The cafeteria plan form

The cafeteria plan form is a critical document in the benefits selection process. Its primary purpose is to allow employees to officially elect their benefit choices. Completing this form accurately is essential as it dictates the benefits the employee will receive for the year.

Key sections of the cafeteria plan form typically include personal information, details of the chosen benefit options, and necessary signatures. Each section must be filled out with care to prevent issues during benefits administration.

Steps for completing the cafeteria plan form

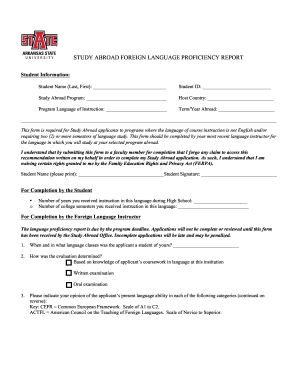

Step 1: Gather required information

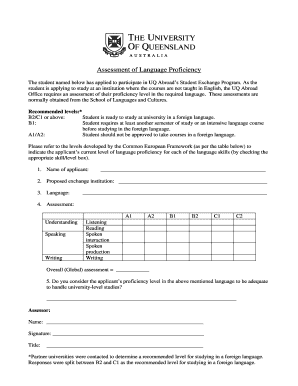

Before starting, employees must compile necessary personal documentation. This includes identification, information regarding dependents, and details regarding prior health insurance coverage. Having this information at hand ensures a smooth completion of the form.

Step 2: Review each benefit option

Careful evaluation of each benefit option is crucial. Consider external factors such as family needs, health status, and financial goals. Each selection should align with both current needs and future plans.

Step 3: Fill out the form

When filling out the cafeteria plan form, ensure accuracy in each section. Common pitfalls include incorrect numbers in benefit contribution fields or missing required signatures. Taking time to double-check entries will save hassle later.

Step 4: Final review and submission

Before submission, conduct a thorough review of the form. Ensure all sections are filled correctly and all required documents are attached. Utilizing platforms like pdfFiller allows for seamless electronic submission, simplifying the process even further.

Interactive tools available on pdfFiller

pdfFiller offers a suite of tools designed to enhance the experience of completing cafeteria plan forms. Whether you need to edit, sign, or manage your documents, this cloud-based platform enables efficient workflows and collaboration.

The significant benefits of using pdfFiller for cafeteria plan forms include real-time collaboration features, ensuring your team can work together efficiently, and cloud storage, providing effortless access to your documents anytime, anywhere.

Frequently asked questions about cafeteria plans

Best practices for employers offering cafeteria plans

For employers, effective communication during open enrollment is crucial. Clear explanations regarding available benefits, eligibility criteria, and enrollment deadlines ensure employees make informed decisions. Utilization of tools like pdfFiller can facilitate smoother communication and document management.

Moreover, regularly gathering employee feedback on benefits can provide insights into areas for improvement. Employers should remain agile, ready to adjust offerings based on employee needs and preferences, fostering an environment of responsive and adaptive management.

Additional considerations

Understanding the tax implications of cafeteria plans is vital for both employers and employees. Generally, contributions made towards pre-tax benefits reduce taxable income, providing financial flexibility. However, there are different regulations governing these plans, so it's essential to stay compliant with IRS regulations and guidelines.

Transitioning from traditional benefits to cafeteria plans may present challenges. Companies must consider employee communication strategies and offer training sessions to explain the new benefit structure. Keeping compliance and legal advisories in mind will safeguard the organization from possible legal ramifications.

Conclusion: Ready to get started?

Leveraging tools like pdfFiller for your cafeteria plan needs simplifies the complexities involved in managing employee benefits. Efficient document management not only increases productivity but ensures accuracy and compliance throughout the process. As your organization explores cafeteria plans, make informed decisions to optimize your offerings and enhance employee satisfaction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit cafeteria plan online?

How do I edit cafeteria plan in Chrome?

Can I create an electronic signature for the cafeteria plan in Chrome?

What is cafeteria plan?

Who is required to file cafeteria plan?

How to fill out cafeteria plan?

What is the purpose of cafeteria plan?

What information must be reported on cafeteria plan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.