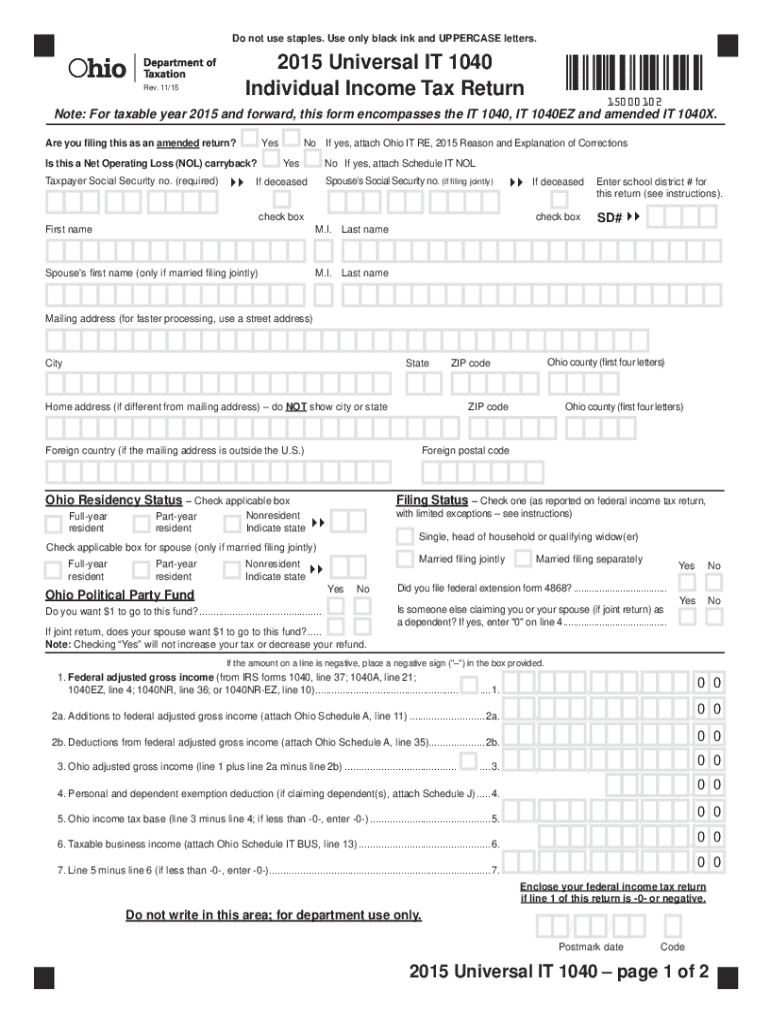

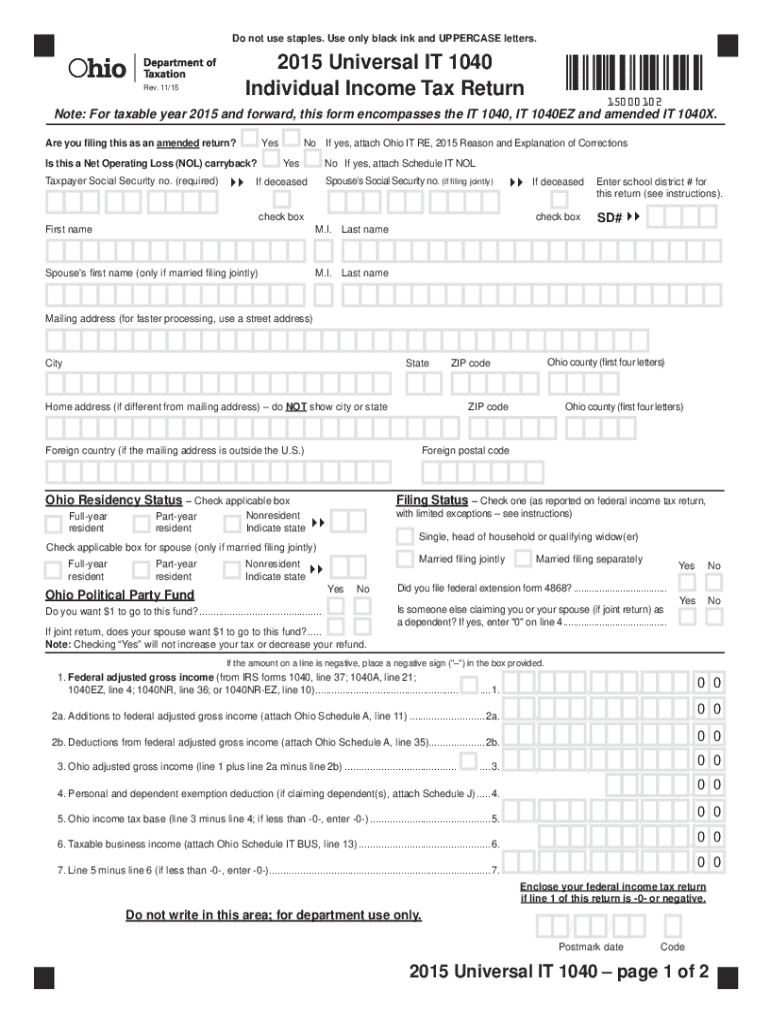

Get the free 2015 Universal It 1040

Get, Create, Make and Sign 2015 universal it 1040

How to edit 2015 universal it 1040 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2015 universal it 1040

How to fill out 2015 universal it 1040

Who needs 2015 universal it 1040?

A comprehensive how-to guide for the 2015 Universal IT 1040 Form

Understanding the 2015 Universal IT 1040 Form

The 2015 Universal IT 1040 Form serves as a crucial document for individuals and teams filing their federal taxes. This form is the standard tax return used by most taxpayers, consolidating personal income, deductions, and credits into one streamlined document. Its significance lies in its ability to accurately report earnings, ensuring compliance with tax regulations while maximizing potential refunds. For 2015, the IRS introduced several changes to streamline the process, including updates to certain forms and enhanced online filing options.

Notably, the 2015 Universal IT 1040 Form reflects tax law adjustments from previous years, like modifications to standard deduction rates and personal exemption limits. These changes can significantly affect tax liabilities. For instance, taxpayers must be aware of enhancements in the Affordable Care Act that can influence reporting of health insurance coverage.

Who should use the 2015 Universal IT 1040 Form?

Generally, any individual with a taxable income must consider using the 2015 Universal IT 1040 Form. This includes employees receiving W-2 forms, freelancers earning 1099 income, and anyone with additional forms of income like interest or dividends. Exemptions do exist; for example, certain low-income individuals or those whose only income comes from Social Security may not need to file.

It's important to note the differences between the IT 1040 and other forms like the IT 1040-EZ or IT 1040-A. The 1040-EZ is designed for simple tax situations, offering limited options for deductions. Conversely, the IT 1040 allows for a fuller slate of deductions and credits, making it suitable for more complex financial scenarios.

Preparing to fill out the 2015 Universal IT 1040 Form

Before diving into the completion of the 2015 Universal IT 1040 Form, it's vital to gather all necessary documents. Key documents include your W-2 forms, which report wages earned and withholdings, as well as 1099 statements for independent contractors and miscellaneous income. Keeping receipts for deductible expenses is critical, particularly for those who itemize their deductions. Finally, having your previous year’s tax return can provide insight and help ensure efficiency as you complete this year's form.

Additionally, setting up your working environment can enhance accuracy and efficiency. Consider using reliable tax preparation software that aligns with the 2015 Universal IT 1040 Form requirements. Many users find benefits in digital formats that facilitate electronic filing and automatic calculations. Alternatively, if you prefer a traditional approach, ensure you have quality printing supplies if you opt to fill out the form by hand.

Step-by-step instructions for completing the form

First, accurately fill in your personal information on the 2015 Universal IT 1040 Form. This includes your name, address, and Social Security number. Ensuring accuracy here is imperative as errors can delay processing or trigger audits. Double-check that you've entered the correct filing status, whether it's single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

Next, you need to report your income. This encompasses wages from your employer, interest from banks, and any freelance income. Each income category should be carefully summed up. Moving to deductions, familiarize yourself with the opportunities available for 2015. Common deductions can include mortgage interest, student loan interest, and educational expenses. When it comes to credits, ensure you claim any eligible ones, as these can directly reduce your tax bill, such as the Child Tax Credit or education credits.

Calculating your tax liability involves understanding tax brackets for 2015—these define what percentage of your income is taxable. Use a tax table to determine how much tax you owe based on your total taxable income. Finally, finalize the form by signing it and ensuring all sections are complete. Failing to review for common errors such as incorrect Social Security numbers, mismatched names or initials, or omitted signatures can lead to complications.

Utilizing pdfFiller for your IT 1040 form

Using pdfFiller provides an advantageous way to edit and fill out the 2015 Universal IT 1040 Form. With a simple and user-friendly interface, you can easily enter text, adjust fields, and even add your signature directly onto the form. This ease of access is particularly beneficial for users who might otherwise feel overwhelmed by traditional forms. pdfFiller's tools also allow users to save their progress, ensuring that work can be revisited without the risk of losing vital information.

Additionally, the collaboration features of pdfFiller let you invite team members to review and edit the form together. This is particularly useful in family or joint filing situations, where more than one person needs to contribute. You can manage permissions for each team member to control what changes they can make. Moreover, utilizing pdfFiller's secure eSigning options ensures that your digital signatures are legally valid and accepted by the IRS, adding both security and convenience to your filing process.

Finally, pdfFiller provides cloud storage solutions, making it easy to organize your forms for effortless future retrieval. You can categorize forms by year, type, or status, simplifying your tax preparation in the following years while maintaining essential records.

Common FAQs and troubleshooting tips

Many users encounter issues when completing the 2015 Universal IT 1040 Form, which raises several common questions. For instance, 'What if I make a mistake on my form?' If you make an error after submission, you have the option to amend your tax return using Form 1040X. This allows you to correct any inaccuracies, adding details or altering calculations as necessary.

Moreover, if you experience technical issues while using pdfFiller, troubleshooting is usually straightforward. Most problems can be resolved through quick checks, like confirming your internet connection or updating your browser. If these solutions don't work, pdfFiller offers dedicated support to assist with any personalized help needed. Ensuring that you have access to expert guidance can make your tax-filing experience much smoother.

Future considerations

With each tax year, changes to tax laws and forms occur, necessitating a solid understanding of upcoming modifications to ensure compliance. As you transition to future tax forms, keeping abreast of changes is crucial. pdfFiller can facilitate this transition through its updated templates and forms, allowing users to stay current while simplifying the filing process.

Additionally, maintaining an organized digital workspace year-round aids in future tax preparation. Keeping records and receipts in a systematic manner will ease your workload come tax season, leading to an easier experience in filling out forms, like the 2015 Universal IT 1040 Form, or any future iterations that you may need to complete. Adopting best practices for document management can save both time and frustration in the long run.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute 2015 universal it 1040 online?

How do I make changes in 2015 universal it 1040?

Can I create an electronic signature for signing my 2015 universal it 1040 in Gmail?

What is universal it 1040?

Who is required to file universal it 1040?

How to fill out universal it 1040?

What is the purpose of universal it 1040?

What information must be reported on universal it 1040?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.