Get the free Public Auction of Tax Defaulted Property Terms and ...

Get, Create, Make and Sign public auction of tax

How to edit public auction of tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out public auction of tax

How to fill out public auction of tax

Who needs public auction of tax?

Understanding the Public Auction of Tax Form: A Comprehensive Guide

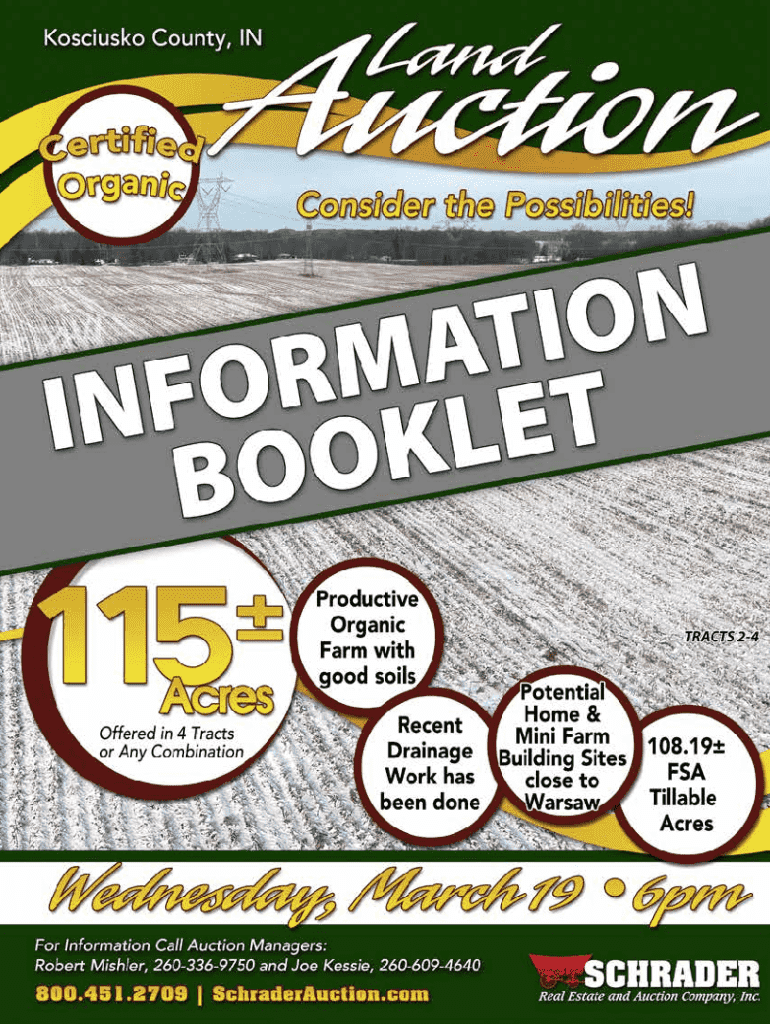

Understanding public auctions of tax-defaulted properties

Tax-defaulted properties are real estate properties for which the owner has failed to pay property taxes over a specified period. As a means of recovering lost tax revenue, local governments often sell these properties through public auctions. This process not only allows the government to recuperate taxes but also provides investors and homebuyers opportunities to purchase properties at reduced prices.

The public auction process generally involves the government listing these properties for sale after a specific period of delinquency. These properties then go under the hammer at an auction, where potential buyers bid against each other. The legal framework governing public auctions varies by location, but generally includes local regulations outlining how auctions are conducted and the rights of bidders.

The importance of the public auction of tax form

The tax form utilized during these auctions plays a critical role. It ensures potential buyers understand the financial obligations tied to the property and the bidding process. Without this form, buyers may find themselves unaware of crucial details, including existing liens and encumbrances.

Participating in public auctions offers several benefits. Potential buyers can acquire properties below market value, leading to significant returns on investment. Additionally, purchasing tax-defaulted properties can contribute to local revenue and community development, helping revitalize neighborhoods and restore properties to productive use.

Preparing for the auction

Before participating in an auction, thorough research is essential. Begin by researching available properties, which can often be found through various online resources, local government databases, and auction sites dedicated to tax-defaulted properties. These listings provide detailed information about each property, including location, size, and any underlying issues.

Understanding the requirements for bidders is equally crucial. Eligibility criteria typically include being of legal age and sometimes requiring a valid form of ID. Before the auction day, ensure you have all necessary documentation completed, as failing to meet these requirements can result in disqualification.

The public auction process

On auction day, expect a structured procedure ranging from sign-ins to bid collections. Arrive early to secure registration and receive any material required to participate. Ensure you're familiar with the auction format and the properties being sold to avoid rushing and missing out on key details.

Employing effective bidding strategies can mean the difference between leaving with a property or watching it slip away. Setting a budget beforehand and sticking to it is critical. Additionally, assess property values and potential bidding increments to ensure you're making informed decisions.

Post-auction procedures

Winning an auction comes with immediate responsibilities. After securing a bid, familiarize yourself with the necessary next steps, including any upfront fees and additional costs. These may include auction fees, taxes, and renovation costs if the property requires repairs.

The closing process is another crucial step. Complete all forms and necessary documentation to transfer ownership legally. During this phase, understanding the deed transfer process is essential to ensure no complications arise post-purchase.

Common challenges and considerations

While public auctions of tax-defaulted properties can offer lucrative opportunities, they come with inherent risks. Liens and encumbrances attached to a property might go unnoticed without thorough due diligence. Existing challenges related to property conditions also need careful evaluation before making a bid.

Legal protections for buyers in such auctions can be limited. Often, properties are sold 'as is' without warranties. It is vital to understand the implications of this phrase, reinforcing the 'buyer beware' principle intrinsic to these transactions.

Frequently asked questions about public auction of tax form

When navigating public auctions, specific questions frequently arise. Interested participants often wonder how to find properties available for auction. Local government websites or designated auction sites are excellent starting points. They provide updated listings of properties that have fallen victim to tax delinquency.

Bidders also frequently ask about prerequisites for participation. Generally, being of legal age and providing valid identification is essential, alongside registration for the auction. If a bid is won but payment cannot be completed, the auction house typically has stringent policies, including the potential for losing a deposit.

Using pdfFiller to navigate public auctions

pdfFiller streamlines the process of participating in public auctions, especially when it comes to filling out necessary tax forms. Users can easily complete forms online through an intuitive interface that guides them through the required information, ensuring nothing is overlooked.

Collaboration tools available on pdfFiller enhance team efforts in preparing for auctions. Sharing documents and insights within teams enables effective coordination, while e-signature features allow for timely document finalization and submission. This efficiency can be crucial when timelines are tight, making pdfFiller an invaluable resource for auction participants.

Final tips for successful public auction participation

Successfully navigating public auctions requires building a network of professionals, including attorneys familiar with real estate law, local real estate agents, and authorities responsible for tax collections. Establishing these connections can provide valuable insights and present opportunities that may not be widely known.

Leveraging interactive tools available in pdfFiller for document management can further ensure your bidding process is organized. Track auction schedules and stay updated with changes seamlessly, enhancing your overall strategy when participating in public auctions.

Upcoming public auctions and events

For those interested in participating in upcoming public auctions, keeping abreast of the auction schedules is crucial. Local county websites typically announce future auction dates, complete with property listings and registration information. Staying proactive is key for anyone eager to capitalize on these opportunities.

Mark your calendars for important auction events and make sure to gather all required documentation ahead of time. Doing so puts you in the best position to succeed when engaging in the competitive environment of public auctions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify public auction of tax without leaving Google Drive?

How do I complete public auction of tax online?

How can I fill out public auction of tax on an iOS device?

What is public auction of tax?

Who is required to file public auction of tax?

How to fill out public auction of tax?

What is the purpose of public auction of tax?

What information must be reported on public auction of tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.